How to avoid JetBlue baggage fees

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Once upon a time, JetBlue wouldn’t charge you for your first checked bag.

Airline baggage policies since those days have become much worse. You’ll now be charged up to $35 for your first bag, unless you buy a qualifying (more expensive) ticket that exempts you from the fee.

There are still lots to love about JetBlue, like free in-flight entertainment & Wi-Fi, more legroom, desirable snacks, and cheap fares. There are a few ways to take the sting out of JetBlue baggage fees (including simply holding certain airline credit cards). You’ll want to fly the airline for its other perks, so let’s take a look.

Avoiding JetBlue baggage fees

On the majority of JetBlue’s routes, you have a choice of five fare levels when you buy a ticket:

- Blue Basic

- Blue

- Blue Plus

- Blue Extra

- Mint (business class)

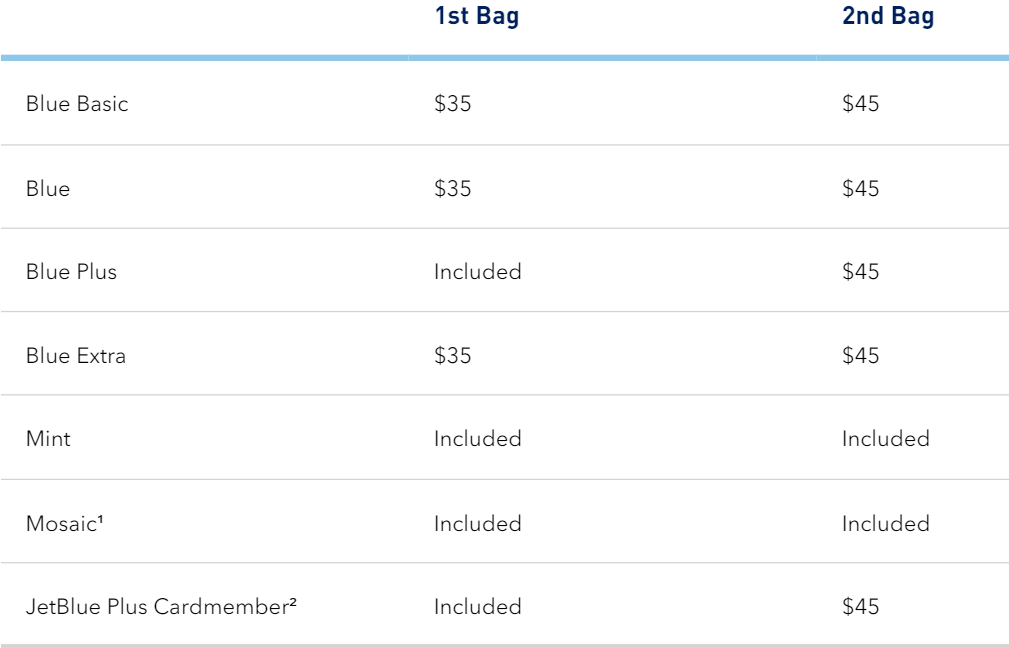

To get a free checked bag (or two), you’ll have to pay the more expensive Blue Plus or Mint fares. If you purchase any other fare type, you’ll be stuck with a fee:

- $30 each way to check your first bag, $40 to check your second bag if purchasing your checked baggage online more than 24 hours before departure

- $35 each way to check your first bag at the airport within 24 hours of departure, $45 to check your second bag

- Third bag costs $150

Note: Mint fares offer the first two bags free.

Choose the right fare

If you know you’ll be checking a bag, you’re sometimes a little better off purchasing a mid-range Blue Plus fare instead of paying for a bag separately. That’s because for some flights, the difference in fare between the cheapest Blue ticket and Blue Plus is less than $30.

All JetBlue fares include a carry-on bag and personal item, so if you can pack light, you won’t have to pay extra at all.

Use the right credit card

On all JetBlue flights, those with the JetBlue Plus and JetBlue Business cards get a free first checked bag for themselves and up to three companions on the same reservation when using the card to pay for the tickets.

If you must pay for a checked bag separately, use a card that reimburses airline incidental fees, like:

- The Platinum Card® from American Express (up to $200 annual airline fee credit per calendar year, but you must choose JetBlue as your qualifying airline). Enrollment required.

- The Business Platinum Card® from American Express (up to $200 annual airline fee credit per calendar year, but you must choose JetBlue as your qualifying airline). Enrollment required.

Just remember, you’ll only be reimbursed if you pay the bag fee separately — paid airfare does not qualify for the credit.

Elite status

If you qualify for TrueBlue Mosaic status, you and those on your itinerary get the first and second checked bags for free. You’ll qualify Mosaic when you earn 15,000 base flight points within a calendar year OR by flying 30 segments plus 12,000 base flight points within a calendar year.

You’ll earn between one and three base points per dollar you spend on the base fare of JetBlue-operated flights (depending on which fare level you buy):

- Blue Basic – 1 point per dollar

- Blue, Blue Plus, Blue Extra, and Mint – 3 points per dollar

Bottom line

On JetBlue’s lowest fares (Blue fares), you’ll pay $30 for your first checked bag when purchasing online ahead of time — but you’ll pay an extra $5 if you wait to do it at the airport.

Often, you’ll save money by paying the next most expensive fare (Blue Plus), which includes a free checked bag and sometimes costs less than $30. But if the fare difference is $30+, you’re better off paying for for a bag separately. Instead of paying for a Blue Plus or Blue Flex fare to have a checked bag included.

Those with select JetBlue cards get a free first checked bag. You could also consider using a card that reimburses airline incidental fees to pay separately for your checked bag. Check out our post on all the ways to avoid checked baggage fees for more details.

Subscribe to our newsletter for more easy and common sense tactics to saving while you travel.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!