5 Lesser-Known (but Valuable!) AMEX Platinum Perks for Big Travel With Small Money

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The AMEX Platinum cards have terrific benefits, including the flexibility to use your AMEX Membership Rewards points to buy travel, or transfer them to airline programs.

You’ll get a $200 annual airline incidental fee credit on your selected airline. Plus $200 per year to spend on Uber or UberEats, access to Centurion Lounges and 1,000+ Priority Pass Lounges, and free Hilton, Starwood, and Marriott Gold elite status.

But there are lesser-known, yet valuable, AMEX Platinum benefits too.

Let’s check out the AMEX Platinum benefits you might not be familiar with!

Lesser-Known AMEX Platinum Benefits

Link: The Platinum Card® from American Express

Link: The Platinum Card® from American Express Exclusively for Mercedes-Benz

These AMEX Platinum benefits can help you save lots of money, time, and aggravation! And making the most of these perks can help off-set the $550 annual fee. (See Rates & Fees)

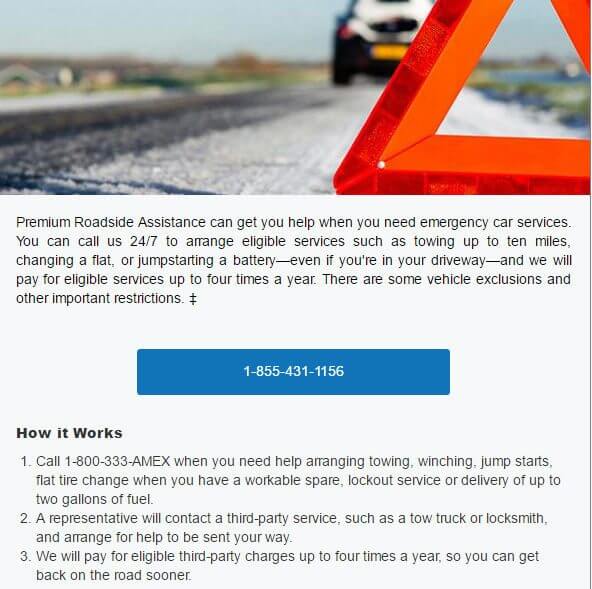

1. Cancel Your AAA Membership and Save ~$60

Link: AMEX Premium Roadside Assistance

Million Mile Secrets team member Andy recently locked his car keys in the trunk.

Andy: After calling myself all kinds of names (because, really, no one can be that stupid!) I remembered that my AMEX Platinum comes with free Premium Roadside Assistance.

I didn’t even have the card with me, so I called my wife and wrote down the card and telephone numbers. The guy arrived within 30 minutes, and his truck had an AAA emblem on it. So, I think AMEX uses the same shops, at least in my area.

AMEX Premium Roadside Assistance covers towing or other emergency services for up to 4 occurrences a year, just like AAA. My whole experience was cordial and painless, and saved a ton of money.

2. Save on Luxury Stays and Get VIP Status

Link: AMEX Fine Hotels & Resorts

Link: How to Get Big Travel With Small Money Using the AMEX Fine Hotels & Resorts Program

If you book paid hotel stays, you can save hundreds of dollars and get exclusive perks when you book through AMEX Fine Hotels & Resorts.

When you book any Fine Hotels & Resorts stay with your AMEX Platinum card, you’ll get:

- 12:00 pm check-in (when available)

- Room upgrade upon arrival (when available)

- Daily breakfast for 2 people

- Guaranteed 4:00 pm late check-out

- Complimentary Wi-Fi

- Unique hotel amenity (which could include a complimentary night, resort credits, or spa services)

Fine Hotels & Resorts prices are sometimes slightly more expensive than booking directly with the hotel or through an online travel agency. But this is NOT always the case.

Plus, hotel breakfast alone can cost $50+ for 2, and the unique hotel amenity could be a 3rd or 4th night free, or a $100 resort credit. And if you get an upgrade, you’ll do even better!

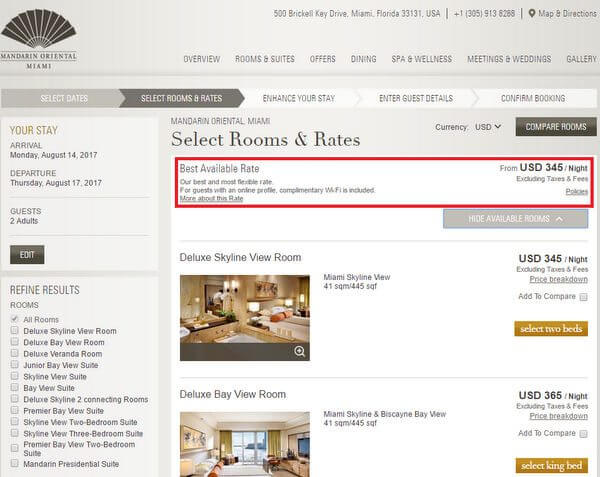

For example, a sample room at the Mandarin Oriental in Miami costs ~$345.

The price is the same on the Fine Hotels & Resorts website, but the rate includes a possible upgrade, breakfast for 2 every morning, early check-in and late check-out, and a 3rd free night.

As a result, your nightly rate will drop to $279. And you’ll also receive $100 in spa credit as a special amenity!

Keep in mind, you’ll receive the discount at the checkout. And upgrades and early check-in are always subject to availability.

If you’re planning a paid stay at a luxurious hotel anywhere in the world, check if Fine Hotels & Resorts has a better deal for you first.

You’ll also want to compare rates and perks to other benefits you may have:

- If you’re are a Citi Prestige cardholder, you already have the 4th night free benefit

- If you have hotel elite status, check which perks you’re already entitled to – although you may not receive your benefits when you book through Fine Hotels & Resorts

3. Skip the Car Rental Line and Get Free Upgrades

Link: AMEX Platinum Car Rental Privileges

AMEX Platinum cardholders can get Preferred status with Avis, Executive status with National Car Rental, and Gold Plus Rewards with Hertz.

Folks with National’s Executive Status receive a free upgrade from mid-size class to Executive (at airports) or from full-size to premium. The Hertz Gold Plus Rewards gets you a one-class upgrade at Gold locations. And Avis Preferred lets you skip the counter and get straight to your car.

I do NOT recommend using your AMEX Platinum to pay for your car rental if you have another card that includes primary rental insurance, like the Chase Sapphire Preferred Card or Chase Sapphire Reserve.

Check out my series on how to get the best prices on rental cars, including through Costco Travel.

4. Protection If You Become Sick or Injured

Link: AMEX Premium Global Assist

No one plans for things to go wrong, but if you become sick or injured when you’re traveling, the AMEX Platinum is a terrific card to have. You’ll be covered for medical evacuation costs that can run into tens of thousands of dollars.

The AMEX Platinum is not the only card that covers medical evacuation. Other premium cards, like the Chase Sapphire Reserve and Citi Prestige, cover it too.

But AMEX Platinum’s Medical Evacuation coverage does NOT have a coverage limit. And it doesn’t exclude any countries or high-risk activities like scuba diving or rock climbing, among others. In addition, you don’t have to pay for the trip with your AMEX Platinum card.

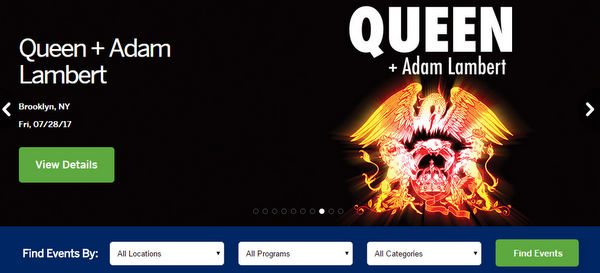

5. Access Exclusive Entertainment, Dining, and More

Link: AMEX Dining and Entertainment

By Invitation Only

Want to rub shoulders with celebrities? By Invitation Only gets you exclusive access to events and experiences not available to general public. Past events include Hamilton (including meet and greet with the cast), the Kentucky Derby, Wimbledon, New York Fashion Shows, and many more exclusive events around the world.

Membership Experiences

Folks who love shows, concerts, theater, or sports can get access to special events with Membership Experiences when they pay for the ticket with their eligible American Express card.

You can check for events taking place in your city, or sign-up to receive future email alerts.

For example, AMEX Platinum cardholders recently had the chance to buy pre-sale Hamilton – An American Musical tickets in Los Angeles.

AMEX Platinum Concierge

The AMEX Platinum Concierge can do a lot of things for you, and you can use the service for almost any request except things that are illegal or unethical.

The service itself doesn’t cost anything, but you must pay for items or services you receive. You can pre-authorize them to make the purchase or pay for the service you want, and they they will put the charge on your credit card. Or you can ask them to contact you first and give you the options.

To contact the AMEX Platinum Concierge, call 800-525-3355 and have your AMEX Platinum card number ready.

Platinum Dining Program

Link: AMEX Global Dining Collection

The AMEX Global Dining Collection can help get you a reservation to some of the most acclaimed restaurants in the world, such as Per Se and Le Bernadin in New York, or Benu and The French Laundry in California.

There is no guarantee that you’ll get your table. So if you’re looking for a popular restaurant, the earlier you book, the better your chances are. And you do NOT have to pay with your AMEX card.

And sometimes there are special menu tasting events and exclusive kitchen tours.

Bottom Line

The AMEX Platinum has benefits that can save you money, give you peace of mind, and make your life easier:

- Premium Roadside Assistance: Cardholders can cancel their AAA membership, because AMEX Platinum provides the same benefits.

- Fine Hotels & Resorts Program: Perks include a room upgrade, daily breakfast for 2, early check-in and late check-out, and special amenity.

- Car Rental Status: Get free upgrades with National and easy car pick-ups with Hertz and Avis.

- Medical Evacuation: One of the most valuable benefits if your medical emergency requires your evacuation home or to the closest medical facility.

- Dining and Entertainment programs: Get an invitation to an exclusive event, a ticket to a sold-out show, or a reservation at a hard to-get-into restaurant.

- Platinum Concierge: Use Platinum Concierge for many tasks, including tickets, restaurants, travel reservations, finding a perfect gift, or for travel research.

If you’ve had experiences using these perks, I’d love to hear about them!

For rates and fees of the Amex Platinum card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!