How to get $200 in food with your Amex Platinum card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It’s no secret that The Platinum Card® from American Express offers some fantastic benefits, including perks like up to $200 annual Amex Platinum airline credit for incidental expenses on your selected airline and up to $100 in credit for Saks Fifth Avenue. But one of the most useful perks, especially in a time like this — during a pandemic, is the up to $200 in Uber Cash per calendar year (for use in the U.S.). This may sound counterintuitive, given most people likely aren’t using rideshares a lot, but the good news is, the Uber Cash can be used for UberEATS, too!

UberEATS and the Amex Platinum

The annual Uber Cash that comes with The Platinum Card® from American Express is split into monthly $15 increments, except for December, when you receive $35 in credit.

If you have The Platinum Card® from American Express, you’ll get up to $15 per month ($35 in December) in Uber credit. To redeem the credit, you must add your Amex Platinum card as a method of payment in your Uber account and select to use the credit before completing your Uber ride or ordering through UberEATS.

How to Use the Amex Platinum credit with UberEATS

You can download the UberEATS app for iOS and Android devices. Once you’ve installed it, log-in to your account and add your Amex Platinum card as a method of payment.

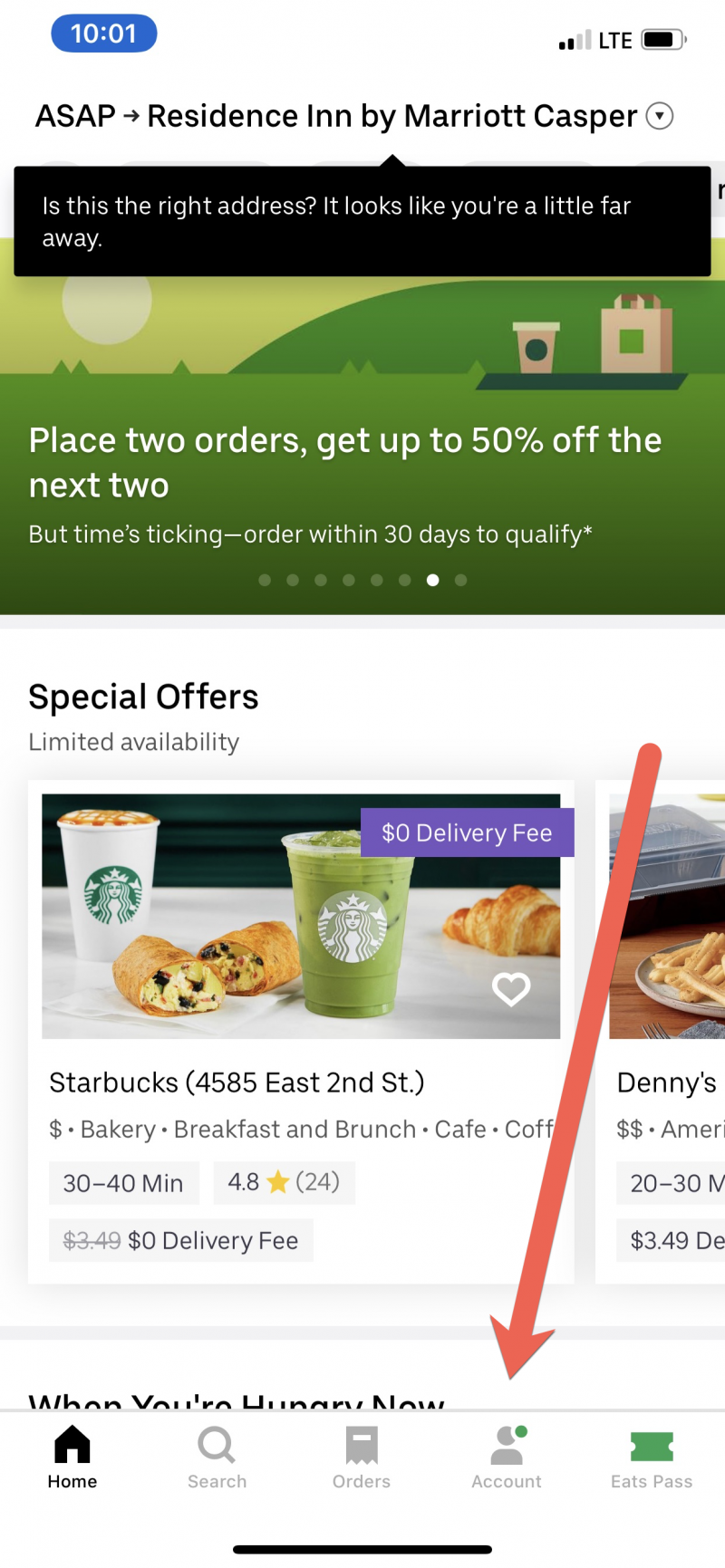

Start by navigating to your account settings.

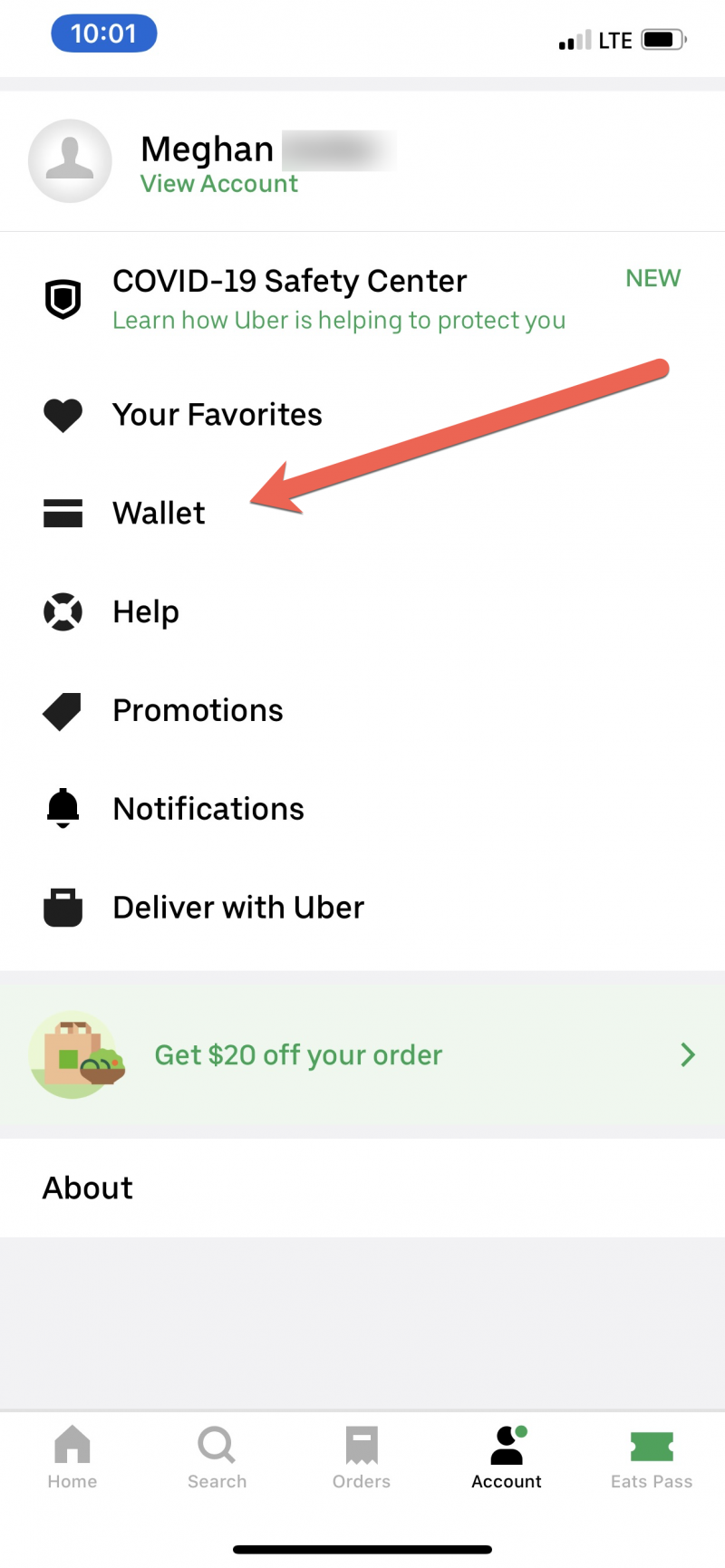

From there, click through to your “wallet.”

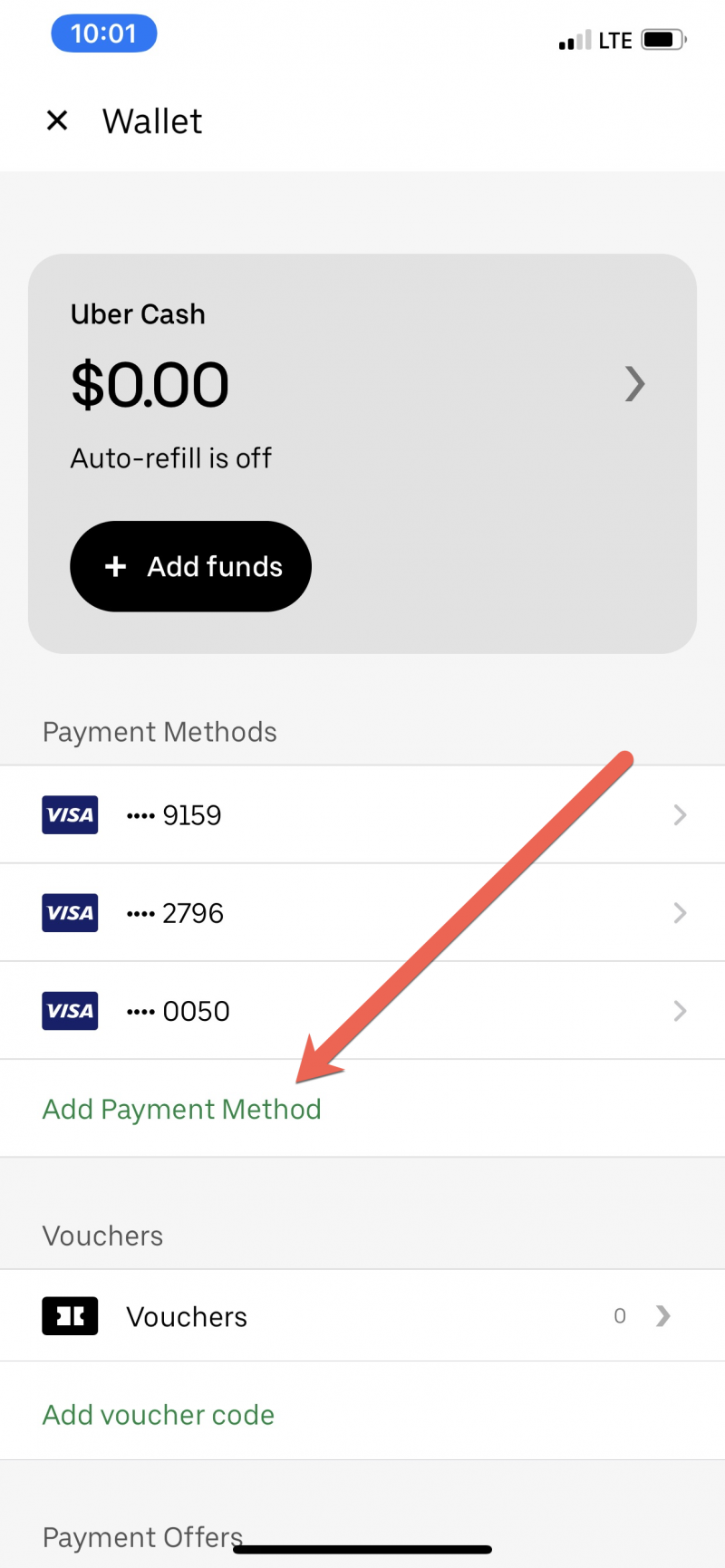

Then click “Add Payment Method,” and from there, you’ll be asked to input your Amex Platinum card info, including account number, expiration date, and so on.

You should get an email confirming you’ve added your Amex Platinum card to your account, including details of the Uber/UberEATS credit.

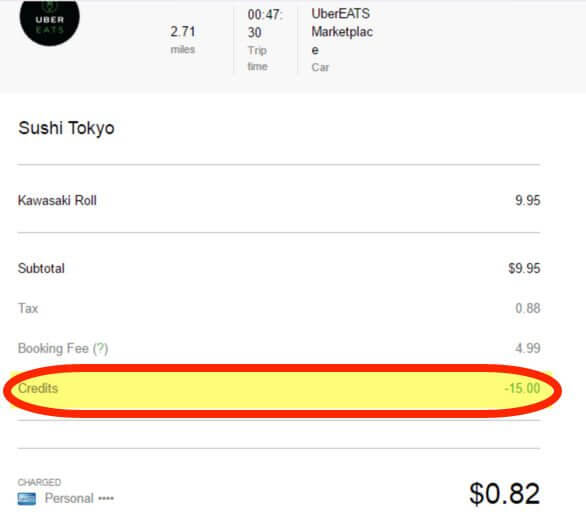

When you receive your invoice later by email, the Amex Platinum Uber Cash should appear. In this case, the credit covered almost the entire bill. Whatever is left over will be charged to your Amex Platinum card.

Is the Uber Credit Worth the Annual Fee?

If you can take advantage of the up to $200 Amex Platinum Uber Cash, in addition to other card perks like the up to $200 annual airline incidental fee credit and airport lounge access (enrollment required), the $695 annual fee (see rates and fees) might be worth it for you. But keep in mind:

- Uber and UberEATS are not in every area, or might have limited participation. So if you can’t use the service (or don’t travel often to cities that have it) the Uber credit is useless

- Depending on where you live, Uber might be more expensive than a cab, which lowers the value of the credit

And remember to factor in the ~$5 booking fee with UberEATS. You’ll be able to stretch the credit further if you use it for Uber rides instead.

Bottom line

You can still take advantage of the Amex Platinum up to $200 yearly Uber Cash if you don’t take Uber rides. Instead, use the credit through the UberEATS app to order food delivery in participating cities.

To redeem your Uber Cash, download the UberEATS app, then add your Amex Platinum card as a method of payment. The Cash will be applied to your bill shortly after purchase.

You’ll get up to $15 per month ($35 in December) in credit. But keep in mind, UberEATS adds a ~$5 booking fee to orders, so factor it into your savings.

For rates and fees of the Amex Platinum Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!