Here’s How Seasoned Travelers Accomplish Many Travel Goals at Once With Flexible Points!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Points and miles can be confusing. If you don’t know where you want to go, you can get lost in all the great deals. So what can you do to zero in on the best strategy for YOU?

Reader Keith emailed:

I prefer Delta, so I have stayed away from diving into the fray of other point cards. It seems difficult to transfer points to Delta. And another kick to myself is we don’t use our AMEX Delta Gold card regularly to maximize points.

I take long motorcycle trips several times a year, and a couple of flights annually (with an occasional United Airlines flight). For hotel points I have Hilton and IHG accounts (no credit cards) with a fair amount of points in each. I do have a Starwood Preferred Guest card but rarely use it.

What would be your suggestion for me to maximize my Delta miles, United Airlines miles, and hotel points?”

Lots of folks are in the same situation, Keith! But, because you have clear travel goals, it will be easier to figure out the best strategy for you.

Flexible Points Can Help You Accomplish Many Travel Goals

Trying to earn and redeem points in multiple loyalty programs at the same time can be overwhelming. But, Keith can simplify his strategy with the power of transferable points. And, there are flexible points programs that can help meet ALL of his travel goals!

I suggest Keith consider earning Chase Ultimate Rewards points or AMEX Membership Rewards points.

Travel With Chase Ultimate Rewards Points

Link: Why Chase Ultimate Rewards Is My Favorite Points Program

Link: Chase Sapphire Preferred Card

I love using Chase Ultimate Rewards points because of their great travel transfer partners. With Chase’s “5/24” rule it can be tougher for some miles and points enthusiasts to get their cards. But, there are some exceptions to this rule.

If you are under the “5/24” rule, you could get the Chase Sapphire Preferred card. It earns 2 Chase Ultimate Rewards points per $1 spent on dining and travel. And currently comes with a 50,000 point bonus you spend $4,000 on purchases in the first 3 months from account opening.

Here’s what Keith could do with Chase Ultimate Rewards points to help his travel goals!

1. Book Flights on Delta

Chase Ultimate Rewards points transfer to 2 Delta partners:

- Flying Blue (the loyalty program for KLM & Air France)

- Korean Air

Booking Delta award flights to Hawaii with Korean Air miles is one of the cheapest ways to get there! Just remember, when you are booking partner award flights you can only book the low-level award seats.

2. Transfer Points Directly to United Airlines and IHG

You can transfer Chase Ultimate Rewards points to both United Airlines and IHG at a 1:1 ratio. But, sometimes transferring points directly to United Airlines is NOT the best way to book United Airlines awards!

That’s OK, because Chase Ultimate Rewards points also transfer to United Airlines’ partner Singapore Air. Which can save you points on flights to Hawaii!

3. Pay With Points Through the Chase Travel Portal (And Book Hilton Stays!)

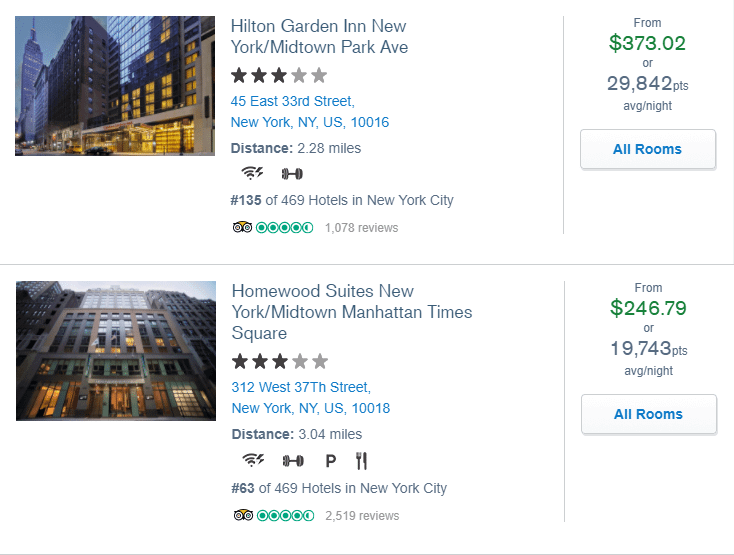

You can pay for almost any flight or hotel stay with Chase Ultimate Rewards points when you book with the Chase travel portal. The redemption rate you get for your points varies depending on which Chase Ultimate Rewards card you have.

When you redeem points for travel this way, you’ll also earn frequent flyer miles on flights at the same time! But you likely will NOT earn hotel rewards.

Or, Use AMEX Membership Rewards Points

Link: My Guide to AMEX Membership Rewards

Link: Book United Airlines Flights With AMEX Membership Rewards Points

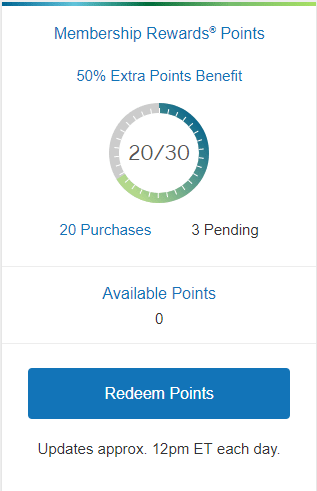

AMEX Membership Rewards points transfer directly to 20 different airline and hotel partners. This includes Delta, Hilton, and several United Airlines partners, like Air Canada and Singapore Air!The AMEX Everyday Preferred card would be a good card for Keith to consider. Because it earns 3 AMEX Membership Rewards points per $1 spent at supermarkets, and 2 points per $1 spent gas stations. Plus, if you make 30+ purchases within a billing cycle, you will earn a 50% points bonus on your purchases!

It currently comes with 15,000 AMEX Membership Rewards points after spending $1,000 on purchases within the first 3 months. We don’t earn a commission on this card, but we’ll always tell you about the best deals!

With Amex Membership Rewards points Keith could:

1. Transfer Points Directly to Delta and Hilton

AMEX Membership Rewards points transfer directly to Delta at a 1:1 ratio. And they transfer to Hilton at a 2:3 ratio. Transfers are typically instant, so once you make the transfer you can book your award right away! Note: When you transfer AMEX Membership Rewards points to any US based airline AMEX charges a .06 cents per point excise fee. The fee is capped at $99. And you will not pay this fee when transferring points to hotel programs or airlines base outside of the US.2. Book United Airlines Flights

You can NOT transfer AMEX Membership Rewards points directly to United Airlines. But, you can book United Airlines award flights by transferring your points to their partner airlines.

Your points will transfer at a 1:1 ratio to these United Airlines Partners:

- Air Canada Aeroplan

- ANA

- Singapore Air

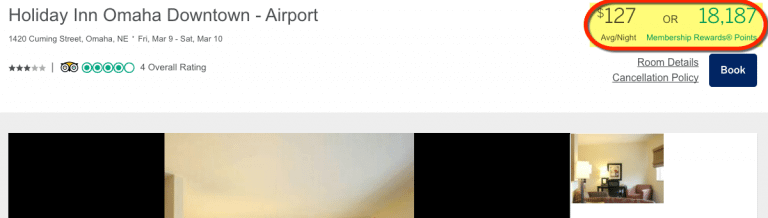

4. Use the AMEX Travel Center to Pay With Points (And Book IHG Stays!)

You can pay for flights and hotels with your AMEX Membership Rewards points directly through the AMEX Travel Center.

This is not always the best use of your points since you’ll only get 1 cent per point towards airfare, and even less towards hotels. 🙁 However, if you have the Business Platinum® Card from American Express you can get 35% of your points back on certain flights.

Other Points Card Options

Keith could use the cards he already has to earn points and miles. The Starwood Preferred Guest® Credit Card from American Express is a good option, because for every 20,000 Starwood points you transfer, you get a 5,000 mile bonus! And Starwood points transfer directly to Delta. With the transfer bonus, you essentially earn 1.25 Delta miles per $1 spent on the card – even better than the Delta credit card Keith already has!

But, if he wants to earn points directly with his favorite loyalty programs there are some great sign-up bonuses on these cards:

- United MileagePlus Club Card

- AMEX Hilton Surpass Card

- IHG Rewards Club Select Credit Card

Beyond the sign-up bonuses, these cards have other great benefits. You could get instant elite status with the AMEX Hilton Surpass and Chase IHG cards. And the United MileagePlus Club card comes with a United Club membership, and free checked bags!

Bottom Line

Flexible points are the key to having a simple points and miles strategy. When you have transferable points you can get free flights AND hotels with 1 credit card!And transferable points give you the option to not only transfer points directly to the airlines you want to fly, but to also transfer to your favorite airline’s partners. This is useful because sometimes you can get a better deal when you book an award through a partner airline.

If there is a specific loyalty program you like, you might consider getting their program credit card. Not only will you earn a potentially lucrative bonus, but you’ll get great perks like elite status or free checked bags, too!

Have fun on your motorcycle trips, Keith!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!