Chase Sapphire Reserve review

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Chase Sapphire Reserve continues to be one of the most enticing credit cards on the market. We think this is one of the best credit cards for travel.

The Chase Sapphire Reserve sign-up bonus is worth at least $900 in travel when redeemed through Chase Ultimate Rewards. You also get a $300 annual credit for travel purchases every cardmember anniversary. That’s $1,200 in value in the first year, which doesn’t include other money-saving perks. Folks looking to unlock travel benefits can do really well with the Chase Sapphire Reserve. Here’s our full review of the card, so you can decide if it’s a good fit for your wallet.

Chase Sapphire Reserve review

Current bonus

When you sign up for the Chase Sapphire Reserve card, you’ll earn 60,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening (and meeting minimum spend is easier than you might think).

Chase points are worth 1.5 cents each with the Chase Sapphire Reserve when you use them to pay for travel booked through the Chase Travel Portal. Because of this, the 60,000-point bonus is worth at least $900 in travel.

But these points are worth potentially much more when you redeem them through Chase transfer partners. For example, you can book a round-trip coach flight from West Coast cities to Hawaii on Alaska Airlines by transferring 24,000 points to Singapore Airlines. That means this bonus is enough to get you two round-trip tickets to Hawaii, which could easily cost $1,000+ otherwise.

You can also book stunning premium cabins, like Singapore Airlines first-class suites, by transferring your points to Singapore Airlines.

Benefits and perks of the Chase Sapphire Reserve

Earning rates

Spending with the Chase Sapphire Reserve will earn you the following:

- 3 Chase points per dollar on dining, which includes dining out, takeout, and eligible delivery services

- 3 Chase points per dollar on travel worldwide, which takes effect immediately after you earn the $300 annual travel credit

- 1 Chase point for everything else.

Note that Chase considers a wide range of purchases to be travel, from airfare to hotels to passenger trains to limousines to timeshares to parking lots and garages.

Chase Pay Yourself Back

Chase Sapphire Reserve card members can redeem earned points for cash where each point is worth 1 cent — and in turn, 100 points are worth $1. However, Chase currently also offers a more lucrative Pay Yourself Back option in which you can redeem your earned points in the form of a statement credit to offset purchases you have already made in sets of rotating categories.

Points redeemed through this Pay Yourself Back option are redeemed at a rate of 1.5 cents each. As such, 100 points equals $1.50 in redemption value, so ultimately these are worth 50% more than if redeemed for cash.

With Pay Yourself Back, you have 90 days from the time each eligible transaction posts to erase it with your Chase points. Read our full guide on Chase Pay Yourself Back to learn how to use it, as well as its benefits and downfalls.

Annual $300 travel credit

One of the best perks of the Chase Sapphire Reserve is the annual $300 travel credit. Every cardmember year, you’ll get the first $300 spent on travel automatically reimbursed as a statement credit. Chase has a broad definition of travel that triggers this statement credit:

- Hotels

- Airfare

- Rental cars

- Cruises

- Tolls

- Parking

- Uber

- Timeshares

- Campgrounds

- Trains

- Buses

- Ferries

There are two things to note about the travel credit. The first is that although you normally earn 3 Chase Ultimate Rewards points per dollar on travel purchases, the $300 in travel that is reimbursed as part of the credit won’t earn any points.

The second is that some charges which seem to be travel-related might not qualify for the travel credit. Some vacation rentals fall into this category because they might code as a real estate transaction instead of travel. Many people report that Airbnb stays do count as travel, but sometimes rentals through VBRO or HomeAway don’t end up coding that way.

If you spend at least $300 per year on travel (most people I know certainly do), this travel credit effectively lowers the annual fee to $250 per year. And this doesn’t include the card’s other perks.

DoorDash credits

Through the end of 2021, Sapphire Reserve cardholders can receive up to $60 in statement credits on qualifying DoorDash purchases made with the card. The statement credit will be posted to your account the same day a qualifying DoorDash purchase posts to your account, and it will appear on your credit card statement within one to two billing cycles.

You’ll also get at least 12 months free of DoorDash’s subscription service called DashPass, which provides free delivery and reduced service fees from thousands of restaurants.

Peloton membership credits

As a Chase Sapphire Reserve card member, you can get up to $120 back on an eligible Peloton Digital or All-Access membership through December 2021. Peloton provides you with cardio, running, strength, yoga, and other classes that you can view using a phone, a tablet, or a TV.

Lyft Pink membership

Cardholders will receive a complimentary Lyft Pink membership. Lyft Pink is a membership that normally costs $19.99/month and comes with perks, like:

- 15% off all rides

- Three free cancellations a month (if you rebook within 15 minutes)

- Three free bike/scooter rides per month

- Priority airport pickups

- Waived lost and found fees

- “Surprise offers” — including seasonal discounts and exclusive savings

Normally the membership costs $240. So that’s a great perk if you can actually utilize the service.

Bonus points on Lyft rides

Chase Sapphire Reserve cardholders will earn 10x Chase Ultimate Rewards points on Lyft rides. A bonus like this can really add up quickly if you use rideshare services for a majority of your transportation.

Airport lounge access

The Chase Sapphire Reserve makes your airport experience beyond the security line more tolerable as well. It’s one of the best credit cards with lounge access, providing you a premium Priority Pass membership more valuable than even the most expensive Priority Pass membership you can purchase. Lounges often come with complimentary alcohol and food, as well as plenty of outlets and fast Wi-Fi.

The best Priority Pass membership you can buy costs $429 per year and gives you unlimited access to the 1,000+ lounges in the network. But you’ll need to pay $32 for each guest you bring along. With the Chase Sapphire Reserve’s Priority Pass membership, you get the same unlimited lounge access for yourself and two guests. If you need to bring a third person, it’s only $27 extra. If you travel with a partner and child, that’s an easy $64 in savings per visit over purchasing a membership.

There are a growing number of airport restaurants that accept your Priority Pass membership. Right now, there are about 30 in the U.S. alone. The rules vary slightly with the location, but in general, you show a same-day boarding pass and proof of your Priority Pass membership and you’ll get between $28 and $32 off your bill per person for up to two people. That’s an easy $56 to $64 free meal.

TSA PreCheck or Global Entry credit

Being stuck in the airport security line can really muck up a trip. Instead of dreading the airport experience, enroll in TSA PreCheck or Global Entry (which comes with TSA PreCheck). Once you’re approved, you can use an expedited security line (if your airport has one) when you’re flying with any of the 60+ participating airlines. Plus, you won’t have to remove your shoes, belt or laptop. It makes airport security a breeze.

It saved me from missing a flight and having to purchase a ticket for almost $600 for another flight. You can’t beat that.

Normally, TSA PreCheck costs $85 and Global Entry costs $100, but if you pay either of those fees with your Chase Sapphire Reserve, the fee will be reimbursed up to $100. Both are valid for five years.

You can use this credit once every four years. Every time you need to renew your TSA PreCheck or Global Entry, you’ll receive the up to $100 statement credit as long as you keep your Chase Sapphire Reserve.

No foreign transaction fees

The Chase Sapphire Reserve is great to use while traveling because it doesn’t incur absurd foreign transaction fees. Some credit cards will charge you 3% just for swiping outside the U.S.

Primary rental car insurance

The rental car insurance that comes with Chase Sapphire Reserve is primary coverage. That means you can decline the rental company’s collision damage waiver and the card will cover you for theft or damage. That’s a savings of easily $15+ per day.

Trip delay insurance

Trip delay insurance is one of those perks that’s easy to overlook until you need it. Just last year, I was reimbursed for more than $500 in expenses from two separate trip delay insurance claims with my Chase Sapphire Preferred Card.

The trip delay insurance for both of these cards covers expenses you incur as the result of an eligible trip delay, including:

- Ground transportation (rental, taxi, etc.)

- Lodging

- Food

- Incidentals (toiletries, clothing, medications, etc.)

Read our post on how to file Chase trip delay insurance claims.

How to redeem points

With the Sapphire Reserve, you earn what we consider to be the most useful credit card points (read our Chase Ultimate Rewards review). Chase points are flexible, which means you can use them for travel or redeem them for cash back. As mentioned before, the most effective use of Chase points is to transfer them directly to Chase’s terrific travel partners. For those with other Chase Ultimate Rewards points-earning credit cards, you can combine points to your Sapphire Reserve account before transferring them directly to an airline or hotel partner.

Below are a couple of ways to redeem 60,000 Chase Ultimate Rewards points — and be sure to check out our post of the best ways to use Chase points.

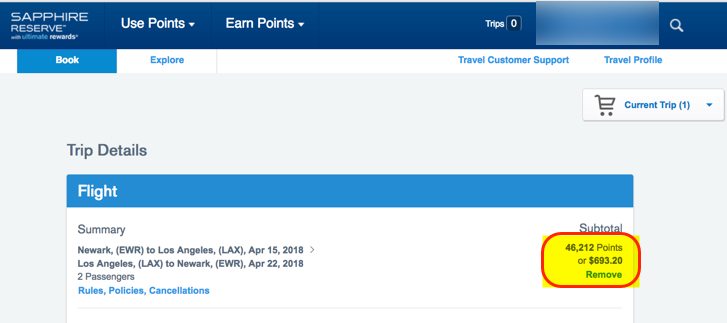

Book airfare, hotels and rental cars at the Chase Travel Portal ($900 worth of travel)

Booking through Chase Travel Portal, you can reserve flights, hotels and rental cars for less with points linked to your Chase Sapphire Reserve. That’s because they’re worth 1.5 cents each when you redeem for travel through the Chase Travel Portal. You’ll get $900 worth of travel with the 60,000-point Chase Sapphire Reserve sign-up bonus (60,000 points x 1.5 cents each).

Perhaps the best part about redeeming your points this way is that you never have to worry about blackout dates or finding award seats. And you’ll still earn miles for your flight. Prices are usually the same as what you’ll find through online travel agencies.

When redeeming points through the Chase Travel Portal, you can book hotel stays at boutique hotels or airfare on budget airlines.

Hyatt award stay ($900+ in value)

We at MMS love transferring Chase Ultimate Rewards points to Hyatt to book fantastic hotel stays.

You can book an award night for as few as 5,000 Hyatt points. This means the Chase Sapphire Reserve could get you up to 10 nights at Hyatt hotels around the world. Or you can splurge for a special occasion and use more points to stay at a higher category Hyatt hotel, which might be very expensive if you paid cash.

Hyatt has a no-blackout-date policy, which makes it easier to use points to book award stays. You can even use points to stay at top-rated all-inclusive Hyatt hotels, like Hyatt Zilara Cancun, which several of us on the team recommend. Rooms at this hotel can cost $450+ per night, but you can book the same room for 25,000 Hyatt points. The Chase Sapphire Reserve sign-up bonus is enough for two nights at this hotel.

Is the annual fee worth it?

This is a fair question because the Chase Sapphire Reserve comes with a $550 annual fee, which can be intimidating. The card has some of the best travel credit card perks of any premium rewards credit card, beginning with the annual $300 travel credit.

As long as you get $250 in value each year from the card’s other perks, the Chase Sapphire Reserve is worth it. As you can see from the above benefits, that’s not hard to do for some. Especially if you regularly use rideshare and meal delivery services.

Who is this card for?

The Chase Sapphire Reserve is best for those who travel relatively frequently. With protection against canceled and delayed flights, access to 1,000+ airport lounges and a $100 Global Entry credit, those who travel internationally each year will enjoy this card. There are some important rules to consider first.

If you’ve opened five or more cards in the past 24 months from any bank (excluding Chase business cards and certain other small-business cards), you will not be approved for Chase Sapphire Reserve. If you’re just over the “5/24 limit,” it might be worth waiting to apply for other cards until after you’re eligible to get the Sapphire Reserve.

Also note that Chase has restrictions for their Sapphire-branded credit cards:

- You no longer can have more than one Sapphire-branded credit card. For example, if you currently have the Chase Sapphire Preferred card, you won’t be eligible for the Chase Sapphire Reserve card.

- If you close a Chase Sapphire card account, you won’t be eligible for any Sapphire-branded credit cards if you’ve earned the sign-up bonus on a Sapphire-branded product within the last 48 months.

Insider secrets

This card has a superpower unique among Chase cards, making it the best Chase credit card available.

As mentioned before, the points you earn with this card are worth 1.5 cents each through the Chase Travel Portal. However, if you have other Chase Ultimate Rewards points-earning cards, you can transfer the Chase points you earn from those cards to the Chase Sapphire Reserve and they are instantly worth 1.5 cents each through the Chase Portal.

For example, if you have the Ink Business Preferred® Credit Card, you can redeem your Chase points through the Chase Portal for 1.25 cents each. But if you open the Chase Sapphire Reserve, you can transfer all the points you accrue with the Ink Business Preferred to your new card and they’ll instantly be worth 1.5 cents each.

This applies to no-annual-fee credit cards as well, like the Ink Business Cash® Credit Card or Ink Business Unlimited® Credit Card. That’s a huge deal.

Bottom line

There are lots of reasons the Chase Sapphire Reserve is such a popular premium travel rewards credit card.

When you open the Chase Sapphire Reserve, you’ll earn 60,000 Chase Ultimate Rewards points after meeting minimum spending requirements. You can use the sign-up bonus points to get $900 worth of travel by booking airfare, hotels or rental cars through the Chase Travel Portal. But you can potentially get much more value by transferring points to Chase travel partners, like Hyatt or Singapore Airlines.

The Chase Sapphire Reserve card comes with a $300 annual credit for travel purchases every cardmember anniversary, which effectively reduces the annual fee to $250 ($550 annual fee minus $300 annual travel credit). It’s easy to accumulate points with this card because you earn 3 points per dollar for travel and dining purchases.

Let me know which of the Chase Sapphire Reserve benefits are your favorite. And subscribe to our newsletter for more credit card reviews like this delivered to your inbox once per day!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!