How to take advantage of Chase Pay Yourself Back redemptions

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Chase recently extended its Pay Yourself Back program, which is an alternative way to redeem Chase Ultimate Rewards points. It originally became available during the height of the pandemic, and it allows holders of certain cards to redeem points for statement credits toward purchases at grocery stores, restaurants, home improvement stores, and select charities.

With Pay Yourself Back, you can receive up to 1.5 cents per point (depending on which Chase credit card you have). It’s exciting because it’s always good when a credit card issuer or loyalty program gives us another way to redeem points.

This feature was set to expire at the end of April 2021, but it has been extended between two and eight months, depending on the card and specific categories. I’ll show you exactly how to use Chase Pay Yourself Back, who should use it, and why it makes the Chase Travel Portal obsolete.

What is Chase Pay Yourself Back?

With Chase’s Pay Yourself Back feature, you can redeem points for a statement credit to offset spending on certain categories. The value you get and the eligible categories depend on the Chase card you have.

This return rate is substantially higher than just cashing your points out, in which case you’ll get a value of 1 cent per point. You have 90 days from the time each eligible transaction posts to erase it with your Chase points.

Eligible categories added and offer extended

The Chase Pay Yourself Back feature allows you to redeem Chase Ultimate Rewards points for a statement credit to offset spending on certain categories. You’ll get a value of at least 1.25 cents per point when you use your Chase points in this way.

This was meant to be a fleeting benefit, presumably to give your Chase points more value during this extended period of reduced travel spurred by the coronavirus. Chase has now extended this benefit for up to eight more months. After launching the program, Chase added another exciting aspect to the Pay Yourself Back perk: While only Chase Sapphire cards previously qualified for this benefit, Ink and Freedom cardholders can now use it, too, when it comes to select categories. Below are the details for each card.

Chase Sapphire Preferred® Card:

- Points worth 1.25 cents each when redeemed for purchases made at grocery stores, restaurants (including take out and delivery), home improvement stores and eligible charities

- Feature ends Sept. 30, 2021 (except the charitable donations aspect, which ends Dec. 31, 2021)

- For example, you could redeem 10,000 Chase Points with the Sapphire Preferred to cover a $125 grocery bill

Chase Sapphire Reserve®:

- Points worth 1.5 cents each when redeemed for purchases made at grocery stores, restaurants (including take out and delivery), home improvement stores and eligible charities

- Feature ends Sept. 30, 2021 (except the charitable donations aspect, which ends Dec. 31, 2021)

- For example, you could redeem 10,000 Chase Points with the Sapphire Reserve to cover a $150 grocery bill

- What’s more, this card’s $300 travel credit can now be redeemed at grocery stores and gas stations through Dec. 31, 2021. (That had been set to end on June 30, 2021.) Many a loyal user of this card appreciates how that $300 credit helps offset the $550 annual fee.

Ink Business Preferred® Credit Card:

- Points worth 1.25 cents each

- Can redeem points for select online advertising, shipping expenses, and eligible charities

- Feature will end on June 30, 2021

Chase Freedom Flex, Chase Freedom Unlimited®, Ink Business Cash® Credit Card, and Ink Business Unlimited® Credit Card :

- Points worth 1.25 cents each, only when redeemed for donations to eligible charities

- Feature ends Dec. 31, 2021

- For example, you could redeem 10,000 Chase Points with the Freedom Flex to cover a $125 charitable donation

The charities you can use with the Pay Yourself Back feature are:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- Habitat for Humanity

- International Medical Corporation

- Leadership Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Thurgood Marshall College Fund

- United Negro College Fund

- United Way

- World Central Kitchen

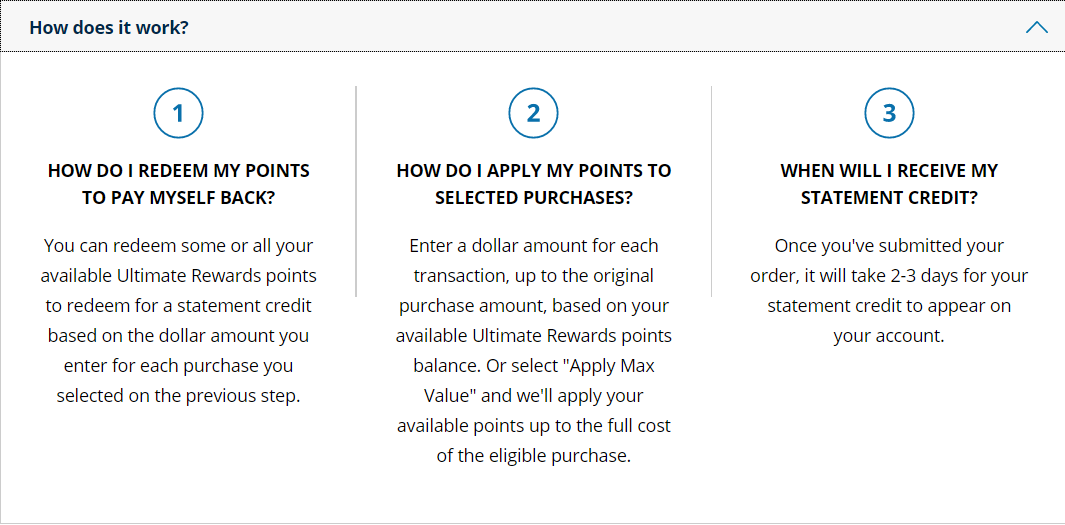

How to use Chase Pay Yourself Back

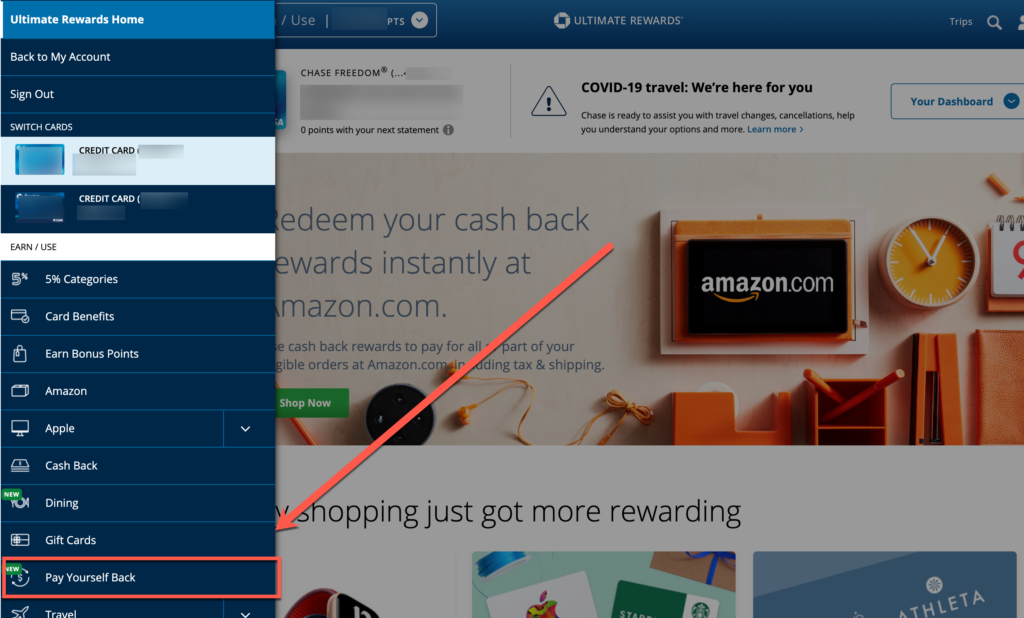

Step 1. Navigate to the Chase Ultimate Rewards website

Head to the Chase Ultimate Rewards website and choose which Chase card you want to view.

Step 2. Click the Pay Yourself Back button

At the top of the page is a drop-down menu showing you all the possible ways to redeem your Chase points. This is where you’ll find the Pay Yourself Back feature, and it’s extra easy to find because it’s tagged as NEW. Click it.

Step 3. Enter the amount you’d like to be credited

You’ll be taken to a screen that shows all your recent eligible transactions (groceries, home improvement stores, and dining). With each purchase, you can stipulate the number of points you’d like to cash out. Below, I’ve decided to be reimbursed for $1 of my $45 order.

I have the Chase Sapphire Preferred, which means my points are worth 1.25 cents each through this method. I’ll have to spend 80 points to get $1 off my order.

Step 4. Confirm and submit

Click the Confirm & Submit button, and you’re done! Your statement credit will post within three business days. Note that with each transaction, you’ve got one opportunity to reimburse yourself. In other words, if you decide to only reimburse half of a purchase, you won’t be able to reimburse yourself for the other half later — the purchase will disappear from your list of eligible transactions.

How to maximize Chase’s Pay Yourself Back

If you’ve collected Chase points for a while now, you may notice something familiar about the above statement credit redemption rates: They’re exactly the same as if you were to redeem your points for travel through the Chase Travel Portal. This means that if you tend to use your points to book travel through the Chase Portal, you should stop doing that — at least while you can still redeem your points for between 1.25 and 1.5 cents each for statement credits.

So why does switching your points redemptions from travel to groceries, dining, and home improvement stores make sense? First, understand that you’re getting the same value from your points. If you want to offset your $600 hotel stay this month with Chase points, you could just as easily use points to offset $600 in groceries and dining purchases. You’ll still effectively get your $600 hotel room for “free” by using the same amount of points. HOWEVER, redeeming for those non-travel related purchases is smarter for two reasons.

1. You won’t earn Chase points on your card when redeeming through the Chase Travel Portal

When you reserve travel through the Chase Travel Portal, your card is not charged the amount for which you’re redeeming points.

For example, if you have the Chase Sapphire Reserve, your points are worth 1.5 cents through the Chase Portal. If you simply use 13,334 Chase points to book the flight, your card won’t be charged, and therefore you’ll earn ZERO points.

Instead, you could use Pay Yourself Back to reimburse $200 in groceries. Then you could SPEND $200 for your flight, which will earn 3x points with your Chase Sapphire Reserve. This way, you’ll earn 600 points you otherwise would not have. 600 points is worth $9 in groceries, dining, or home improvement stores (or travel, of course).

2. You won’t earn hotel points or elite status when redeeming through the Chase Travel Portal

When you reserve travel through the Chase Travel Portal, you’re actually booking through Expedia, which is an “online travel agency.”

When you book hotels through an online travel agency, you won’t get the benefits that come with booking direct with the hotel, namely:

- You won’t earn hotel points for your stay

- You won’t earn elite night credits for your stay

- Your elite status will not be recognized, and you won’t get any perks that come with it (like room upgrades, free breakfast, spa credits, etc.)

Instead of using points to book through the Chase Portal, you can use your card to book directly with your desired hotel, receive all of the above perks, and reimburse yourself for the cost by using Chase Pay Yourself Back for groceries, dining, and home improvement stores.

You could even book a hotel through an online portal and earn bonus cash back or points. You can read about how to do that here.

What other options should you consider?

This is a great new feature for Ultimate Rewards points earning cards, but Chase transfer partners are still the best option if you’re looking to maximize your rewards.

Sure, you can get up to 1.5 cents per point by redeeming with Pay Yourself Back. But we estimate Chase points value to be around 2 cents each. That’s because you can get vastly outsized value for your points by converting your points to airline miles or hotel points with valuable Chase transfer partners, and then redeeming them for luxury hotels or business/first-class flights.

For example, I transferred 25,000 Chase points to Hyatt for a stay at the Hyatt Zilara Cancun. The hotel was selling for around $550, meaning I received a value of 2.2 cents each. That’s $175 more value than even the best return you’ll get with Pay Yourself Back. By redeeming 25,000 points via Pay Yourself Back, you’d get:

- $375 if you hold the Chase Sapphire Reserve

- $312.50 if you hold the Chase Sapphire Preferred

Read our post about how to transfer Chase Ultimate Rewards points for more details and ideas to getting huge value from your points.

Bottom line

While Chase has extended the Pay Yourself Back feature, we don’t know what it will look like long-term. That said, it’s a solid option for redeeming your points right now, given fewer people are traveling.

For example, you can redeem your points for eligible categories including groceries, home improvement stores, select charities and dining at the following rates with two of Chase’s most popular cards:

- Chase Sapphire Preferred – 1.25 cents each

- Chase Sapphire Reserve – 1.5 cents each

You can also transfer the points you earn from other Chase Ultimate Rewards cards to these two above cards to unlock the biggest return for your spending.

Just remember, we usually recommend using Chase transfer partners to get the biggest bang for your point. We estimate that Chase points are worth 2 cents on average when using your points this way. However, if you want money now, this is as good as time as ever to cash out.

To learn more about how to best use Chase points, you can subscribe to our newsletter!

Featured image by By Daxiao Productions/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!