Over “5/24”? We Rank the Best Chase Travel Cards You Can Still Actually Get

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.| Card Name | Sign-Up Bonus |

|---|---|

| Marriott Rewards Premier Business Credit Card | 75,000 Marriott points after you spend $3,000 on purchases in the first 3 months from account opening |

| The Hyatt Credit Card | 40,000 Hyatt points after you spend $2,000 on purchases in the first 3 months from account opening. Plus, a $50 statement credit after your first purchase. |

| British Airways Visa Signature® Card | Up to 75,000 British Airways Avios points after you spend $10,000 on purchases in the first year of account opening |

| Ritz-Carlton Rewards® Credit Card | 2 complimentary nights at any Tier 1-4 Ritz-Carlton hotel after you spend $4,000 on purchases in the first 3 months from account opening |

| Disney® Premier Visa® Card | $200 statement credit after you spend $500 on purchases in the first 3 months from account opening |

Chase has some of the best travel rewards cards, including the Chase Sapphire Reserve, Chase Sapphire Preferred Card, and Chase Ink Business Preferred Credit Card. And Chase Ultimate Rewards is my favorite transferable points program!

But if you’ve opened 5+ cards from any bank (NOT counting Chase business cards and these other business cards) in the past 24 months, your credit card application is likely to be declined.

If you are over “5/24,” not all is lost. There are still Chase cards you can get.

Here’s my ranking of the Chase cards that aren’t restricted by the “5/24” rule.

1. Chase Marriott Rewards Premier Business Card

Link: Chase Marriott Rewards Premier Business Card

The Chase Marriott Business card is my favorite Chase card not affected by the “5/24 rule.” It currently comes with an 75,000 Marriott point bonus after spending $3,000 on purchases within 3 months of account opening.

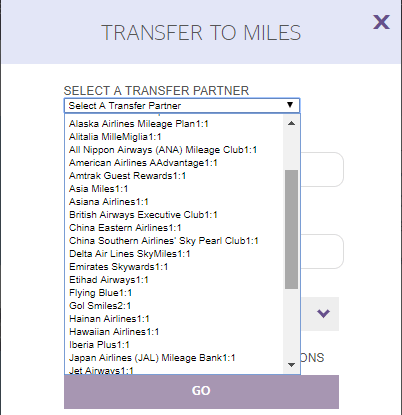

This card is a good pick even if you don’t stay at Marriott hotels. Because you can transfer Marriott points to Starwood at a 3:1 ratio, then transfer Starwood points to over 30 airlines. This includes Alaska Airlines, Delta, American Airlines, and British Airways.

The $99 annual fee is NOT waived the first year. But these benefits will offset the cost:

- Free night at a category 1 to 5 hotel annually

- 15 elite night credits annually (good for silver status, earn gold status by spending $50,000 a year)

- 1 elite night credit for every $3,000 in spending

- 6 Marriott points per $1 spent at Marriott and Starwood hotels

- 4 Marriott points per $1 spent on gas station, restaurant, shipping, internet, cable and phone service purchases

- 2 Marriott points per $1 spent on all other purchases

Not sure if you’re eligible for a small business card? Check out my post on how you might qualify.

2. Chase IHG Rewards Club Select Credit Card

Link: Chase IHG Rewards Club Select Card

Link: My Review of the Improved Chase IHG Card Offer

With the Chase IHG card, you can earn 60,000 IHG points after spending $1,000 on purchases in the first 3 months. Plus, a $50 statement credit after your first purchase. The bonus is worth 6 nights at a category 1 IHG hotel, or enough for a night at expensive resorts, like the InterContinental Bora Bora Resort and Thalasso Spa where Emily and I stayed.

Or redeem the bonus 16 nights at IHG Point Breaks hotels which are only 5,000 points a night!

I keep this card year after year because of the annual free night certificate at any IHG hotel. You could use it to book a $400+ a night room at the Intercontinental New York Times Square. That’s well worth the $49 annual fee (waived the first year).

Other benefits include:

- 5 points per $1 spent at IHG hotels

- 2 points per $1 spent at restaurants, gas stations, and grocery stores

- Automatic IHG Platinum status, which gets you perks like upgrades (when available) and late check-out

- 5,000 bonus IHG points for adding an authorized user and making a purchase within the first 3 months

Getting automatic elite status is also helpful because you can sometimes match status with other hotel chains, like this status match opportunity from Choice Hotels.

3. Chase Hyatt Credit Card

Link: Chase Hyatt Credit Card

Link: My Review of the Chase Hyatt Card

With the Chase Hyatt card, you’ll earn 40,000 Hyatt points after spending $2,000 on purchases within the first 3 months of account opening.

Hyatt is my favorite hotel chain, because their locations and service are top-notch. Award nights start at 5,000 Hyatt points, so you could stay 8 nights at the brand new Hyatt House Chicago / Oak Park (opening soon).

Other card benefits include:

- Discoverist status (free internet, late check-out)

- A free category 1 to 4 night every card anniversary

- 5,000 Hyatt points for adding an authorized user and making a purchase within the first 3 months

- 3 points per $1 spent at Hyatt hotels

Million Mile Secrets team member Jasmin recently used her Chase Hyatt anniversary free night at the Hyatt Regency Calgary, and saved ~$225!

4. Chase British Airways Visa Signature CardLink: British Airways Visa Signature Card

With the Chase British Airways card, you can earn up to 75,000 British Airways Avios points, after meeting tiered minimum spending requirements.

You’ll get:

- 50,000 British Airways Avios points after spending $3,000 on purchases in the first 3 months of account opening

- 25,000 additional British Airways Avios points after spending $10,000 on purchases in the first year of account opening

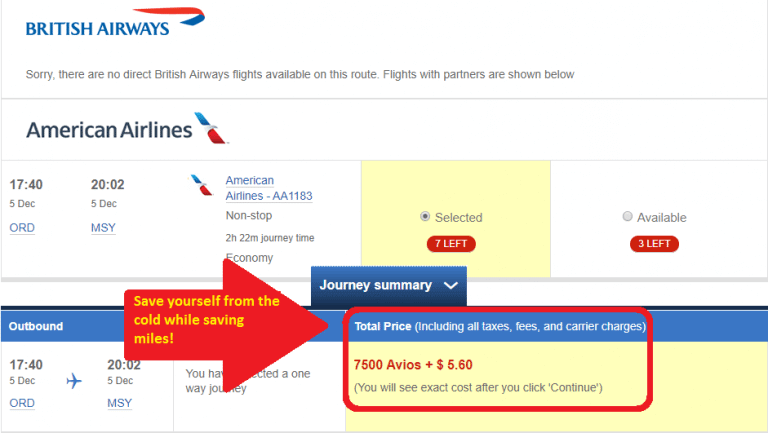

Because British Airways uses a distance-based award chart, you can book any flight in North America under 1,149 miles for only 7,500 British Airways Avios points one-way. If you fly on American Airlines, that’s a 5,000 point savings per one-way flight.

For example, you could escape the Chicago winter in New Orleans on American Airlines for 10,000 less miles round-trip!

You’ll also get:

- No foreign transaction fees

- 3 British Airways Avios points per $1 on British Airways purchases

- 1 British Airways Avios point per $1 on all other purchases

- Travel Together Ticket every year that you spend $30,000 (A Travel Together Ticket grants you a second seat on a reward flight, taxes and fees apply. More details here)

Check out my series on how to earn and use British Airways Avios points for more ideas on how to use the sign-up bonus!

Team member Harlan is considering the Chase British Airways card and should be able to meet the spending to earn the full sign-up bonus, because he has a small business. He’ll likely use the points for short partner award flights on airlines like Qantas or American Airlines.

5. Chase Ritz-Carlton Rewards® Credit Card

Link: Ritz-Carlton Rewards® Credit Card

If you’re looking to pamper yourself, the sign-up bonus on the Ritz-Carlton Rewards® Credit Card gets you 2 free nights at any Ritz-Carlton tier 1 to 4 hotel after meeting the minimum spending requirements!

You could stay 2 nights at the Ritz-Carlton Montreal, which would normally cost 120,000 Ritz-Carlton points or $1,000+ per night depending on the season.

The $450 annual fee is high, and isn’t waived the first year. But if you make the most of the $300 travel credit for airline incidentals, and use the other available benefits ($100 Global Entry fee reimbursement, $100 hotel credit, $100 airline ticket discount (on multi-passenger itineraries), you can more than make up for the fee.

You also get:

- Priority Pass Select Lounge membership

- Gold Elite Status your first year, and every year after if you spend $10,000 (Platinum Elite Status if you spend $75,000 per year)

- 10,000 Ritz-Carlton points for adding an authorized user and making a purchase within the first 3 months

- An annual 10% bonus on all points earned with the card

- 5x points per $1 at Ritz-Carlton, Marriott, and SPG hotels

- 2x points per $1 at restaurants and travel (direct airline ticket purchases, and car rentals)

- 1 point per $1 on all other purchases

Team member Keith recently visited the Ritz-Carlton Marina del Rey, which can cost over $500 per night!

6. Chase Disney Visa Credit Card

Link: Chase Disney Visa Card

The Chase Disney Visa Card comes with a $200 statement credit after spending $500 on purchases in the first 3 months of opening your account. The $49 annual fee is not waived the first year.

You’ll also earn 2% in Disney reward dollars per $1 you spend at restaurants, supermarkets, gas stations, and most Disney locations. You can redeem Disney reward dollars as a statement credit towards airfare, or as a Disney Rewards Redemption Card which can be used at Disney theme parks, hotels, and golf courses.

I don’t normally recommend this card because Chase has so many other more valuable travel cards. But if you’re a Disney fanatic it might make sense for you.

Bottom Line

If you are over the “5/24 rule” there are still Chase credit card options for Big Travel with Small Money.

You could get away for a week with IHG and Hyatt, or have a luxury weekend with Ritz-Carlton. And you can still earn LOTS of miles for airfare with the British Airways Visa Signature Card, or by transferring the Marriott points to Starwood and then to airlines partners from the Chase Marriott Business card.

Do you agree with my ranking? Which Chase credit card not affected by the “5/24 rule” is your favorite?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!