IHG Premier credit card review: Easily earn 125,000 points and a reward night

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you like the convenience of staying at a Holiday Inn Express, but want to the option to stay at luxury InterContinental hotels, then the IHG® Rewards Club Premier Credit Card is the right hotel credit card for you. Right now, it comes with 125,000 IHG points and one Reward Night (worth up to 40,000 points) after meeting minimum spending requirements.

125,000 points is one of the higher bonuses we’ve seen for this card. We’ve seen higher, but the IHG Premier has previously offered a bonus as low as 80,000 points. This award amount could decrease again in the future, so now is an excellent time to apply.

The Chase IHG Premier also has solid perks beyond the intro bonus, like the card’s fourth night reward benefit, which we’ll talk about more in a bit. Let’s review this card so you can decide if it’s the best travel credit card for your situation.

IHG Premier credit card review

Who is the IHG Credit Card for?

There are 5,900+ IHG hotels around the world, so there’s a good chance that there is an IHG hotel where you want to travel to next. You can use your IHG points to book nights at these brands:

- avid

- Atwell Suites

- Candlewood Suites

- Crowne Plaza

- EVEN Hotels

- Holiday Inn

- Holiday Inn Club Vacations

- Holiday Inn Express

- Holiday Inn Resorts

- Hotel Indigo

- HUALUXE® Hotels and Resorts

- InterContinental Hotels & Resorts

- Kimpton Hotels & Restaurants

- Regent Hotels & Resorts

- Six Senses Hotels & Resorts

- Staybridge Suites

- voco

With this card, you can earn IHG points that can be used just about anywhere in the world. But this is a Chase credit card, which means it is subject to the Chase 5/24 rule (you won’t be approved if you’ve opened five or more credit cards from any bank in the past 24 months, excluding most business credit cards). You’ll want to balance your choice to apply for this card with the other rewards credit cards you might be limiting yourself from opening.

Current bonus

With the Chase IHG Premier, you can earn 125,000 bonus IHG points after spending $3,000 on purchases within the first three months of account opening. We estimate an IHG point’s value to average 0.5 cents each, meaning you should have little trouble receiving $625 from this bonus. The card has an $89 annual fee that you can recoup if you spend several nights per year at IHG hotels.

The other component of the welcome bonus is a Reward Night (worth up to 40,000 points). You should be able to save more than the card’s $89 annual fee when you redeem this perk, since 40,000 points are valued around $200, by our calculations.

Factoring in the bonus points and bonus reward night, you should be able to get $736 in value from this card above and beyond the annual fee in your first year of cardmembership!

Benefits and perks

This is the best cards for earning IHG points, and with it you’ll earn points at the following rates:

- 10 points per dollar at IHG hotels

- Two points per dollar at restaurants, gas stations and grocery stores

- One point on all other purchases

Below are some other solid card benefits.

Elite Status

Chase IHG Premier cardholders receive automatic Platinum IHG status, which comes with:

- Late checkout, subject to availability

- No expiration date on points

- Priority check-in

- 50% points bonus on paid stays

- Welcome amenity (typically bonus points or a food/drink voucher)

- Guaranteed availability on paid rooms with 72 hours of notice (conditions apply)

- Complimentary room upgrades (conditions apply)

The most valuable perk of Platinum Elite Status is complimentary room upgrades. There are a few exceptions (they aren’t available on award night stays and exclude suites), but anyone who frequently stays at IHG properties can save quite a bit of money with this perk throughout the year. Cardholders who make the most of their Platinum Elite status each year can make up for the $89 annual fee with this benefit alone.

Fourth night reward

If you frequently book longer hotel stays, this benefit could potentially be worth thousands of dollars. IHG Premier cardholders get a Reward Night when redeeming points for any stay of four or more nights. The process for booking is simple — a points discount is automatically applied during the reservation process.

Let’s say you book a six-night stay at the Hotel Indigo Hong Kong Island, which starts at 25,000 points for a standard room. You’ll end up saving 25,000 points, which is worth $125 according to our estimate of IHG points value.

This is another perk that makes up for the card’s annual fee all on its own. Note that you’ll get the biggest value when booking exactly four-night reward stays.

Anniversary Reward Night certificate

Each year when you renew your card, you’ll earn an Anniversary Reward Night certificate valid at any participating IHG property costing 40,000 or fewer points per night. Unfortunately, some of IHG’s top hotels are excluded from eligibility. However, you can still find a lot of great locations to redeem your night at, such as the InterContinental Budapest.

Bonus points earning opportunity

Cardholders earn 10,000 bonus points after spending $20,000 (and making an additional purchase) on the card each year. This is still a nice perk for anyone who spends regularly on hotel stays with the IHG card each year.

Global Entry or TSA PreCheck application fee credit

You’ll receive a statement credit up to $100 every four to five years when you use your card to pay for your TSA PreCheck or Global Entry application fee (up to $100). It’s rare for a card with such a low annual fee to offer this benefit to cardholders, which makes it an excellent perk.

How to redeem IHG points

You can book any available award night through the IHG website. IHG advertises that there are no blackout dates on award nights, but in my personal experience this isn’t always the case.

IHG has announced plans to introduce variable pricing for award nights and since then the most expensive award nights have gone up to 100,000 points per night. However, right now only a small handful of hotels located outside the U.S. are actually charging that much. Almost all locations cost 10,000-70,000 points.

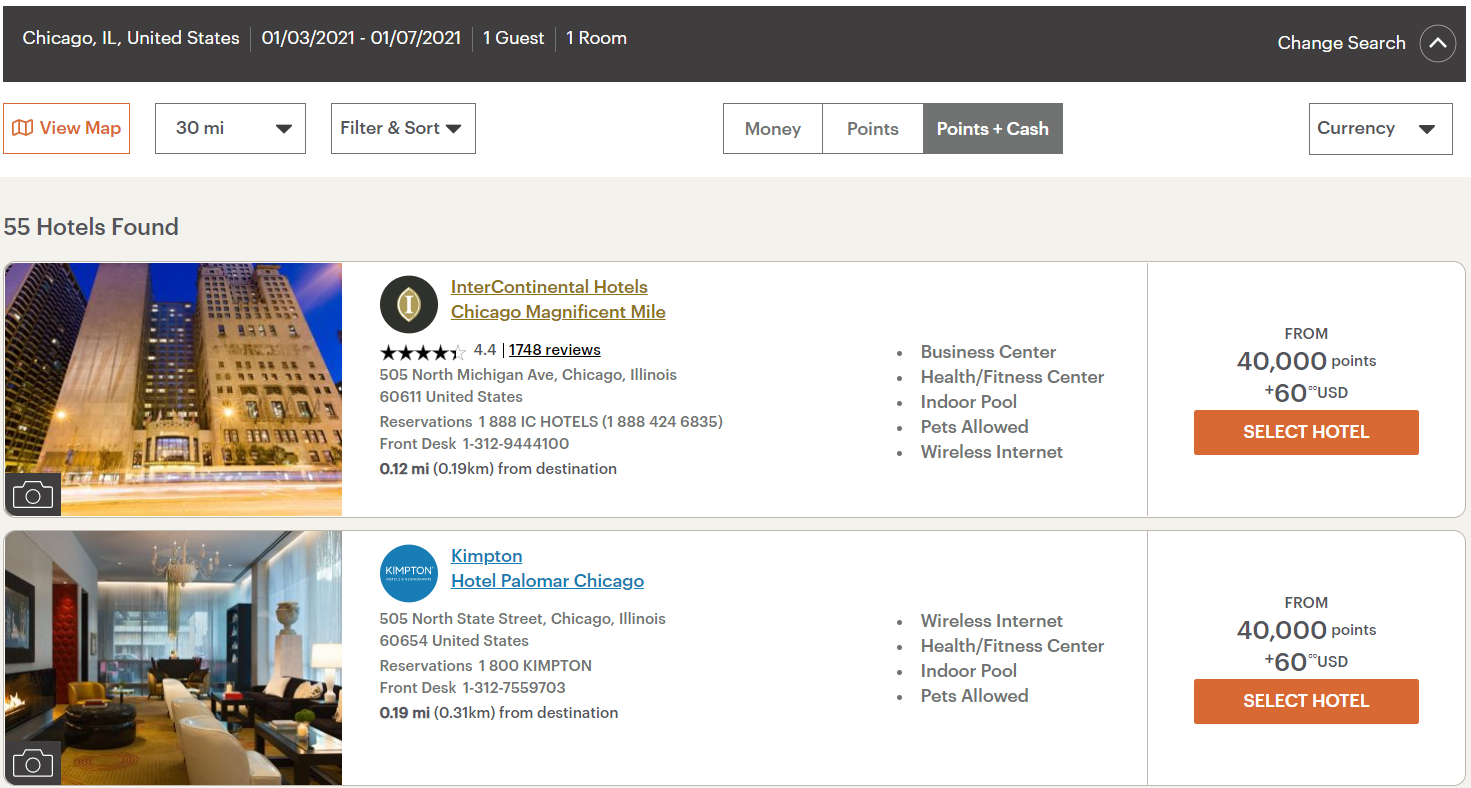

You can also stretch your points by booking Points & Cash nights. But if you want to go this route, be sure to compare the cash price of the hotel to the Points & Cash rate to make sure you’re getting a good deal for your points.

You can also use IHG points for a variety of other rewards, like gift cards, digital downloads or you can convert them into airline miles. But the value you can get from these other options is not good compared to booking a free night.

The unofficial IHG award chart starts at 10,000 IHG points for a free night at the lowest category hotels and up to 100,000 IHG points for a top-tier property. You could use the bonus to splurge on (nearly) two free nights at the InterContinental Le Moana Bora Bora, which can easily cost $650+ per night — or you can get multiple free nights in France at the Holiday Inn Lyon-Vaise, which can cost $100+ a night during peak season. No matter what your travel style is, you can receive great value from this bonus.

Is the annual fee worth it?

For most people, the annual Reward Night certificate alone is worth the card’s annual fee. Most of these hotel stays are worth more than the $89 annual fee, making it an easy choice to keep paying the annual fee and taking all the other card benefits as the cherry on top.

Don’t let the 40,000 IHG point limit bother you, because there are plenty of great IHG hotels that are within this limit. I stayed at the InterContinental Hotel Saigon, which is a five-star hotel in downtown Ho Chi Minh City, Vietnam, complimentary with an anniversary Reward Night certificate (incidentally, the hotel sells for 22,000 IHG points per night).

Also, just for keeping this card open you will earn automatic Platinum IHG status. There is no minimum spending to achieve this perk.

Insider tips

You are not eligible for this card if you currently have it or you have earned the bonus on it in the past 24 months. But if you have the old Chase IHG Rewards Club Select card (no longer open to new applicants), you can still qualify for the Chase IHG Premier card because it is considered a different product. And both cards come with an anniversary Reward Night certificate valid at hotels costing up to 40,000 points per night.

Bottom line

The current offer for the Chase IHG Premier card is a great opportunity to stock up on IHG points. Once you’re approved for the card, you can earn 125,000 IHG points after meeting minimum spending requirements. That’s more than enough points for a complimentary night at an insanely expensive resort. Or you could use those points to cover your hotel stay for a week or more of vacation at cheaper IHG hotels.

You’ll also enjoy a Reward Night once you meet the welcome bonus’ spending requirements. This gives you a one-night hotel stay and has a redemption value of up to 40,000 points (potentially a five-star hotel).

The card carries an $89 annual fee, but with perks like the Global Entry or TSA PreCheck application fee reimbursement, cardmember anniversary Reward Night, and a Reward Night when you redeem points for any stay of four or more nights, it’s worth keeping year after year.

Let us know what you think of the card! And subscribe to our newsletter for more hotel credit card reviews and travel news sent to your inbox once per day.

Featured photo by Patrick Cooper/Shutterstock

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!