The best cards to earn IHG points in 2020 (Plus a couple of bonus strategies)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

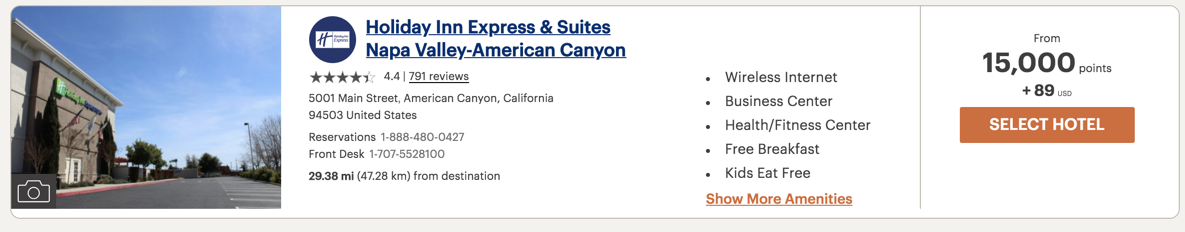

With a presence in 100 countries, InterContinental Hotels Group (IHG) offers opportunities for award-night stays at more than 5,000 hotels across the globe. And a current 150,000-point welcome bonus on the IHG® Rewards Club Premier Credit Card is a good incentive to start planning your 2020 travels. Award nights at IHG hotels start at 10,000 points, so after meeting minimum spending requirements, you could easily book a week of hotels with this offer.

In addition, there are other ways to boost your IHG points balance. Here’s a look at the best cards to earn IHG points.

Earn IHG points with the Chase IHG Premier credit card

Chase IHG Premier Credit Card

With the Chase IHG Premier hotel credit card, you can earn 150,000 bonus points after spending $3,000 on purchases within the first three months of account opening . The card has an $89 annual fee is waived for the first year.

If you frequently stay at IHG hotels, the IHG Premier credit card is your best option for earning IHG points. You’ll earn:

- 10x points at IHG hotels

- 2x points at restaurants, gas stations and grocery stores

- 1x points on all other purchases

To learn more, check out our story on IHG credit card benefits and perks. Every year upon renewal of your card, you’ll get a reward night certificate which is valid for any IHG hotel that costs 40,000 IHG points per night or less. You’ll also get Platinum IHG status as long as you have the card, and a TSA PreCheck/Global Entry fee credit worth up to $100.

The card also has a fourth-night-reward perk, which applies to any points stay of four or more nights. This is a useful perk and if you have the old IHG Select card (no longer available to new applicants) you can stack it with that card’s 10% points redemption rebate. To learn more, read our full review of the IHG Premier card.

Transfer Chase Ultimate Rewards to your IHG account

You can also earn IHG points indirectly by transferring Chase Ultimate Rewards to your IHG account. While we rarely recommend this over earning IHG points directly, this could be a useful way to top off your account for a specific award stay. These cards allow you to transfer Chase points.

Chase Sapphire Preferred Card

Many of us on the Million Mile Secrets team got started with the Sapphire Preferred. In fact, this is the best first credit card for beginners to miles and points. With the Chase Sapphire Preferred, you’ll earn 60,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening.

You’ll also earn:

- 2x Chase points on travel purchases

- 2x Chase points on dining

- 5x Chase points on Lyft rides (through March 2022)

- One Chase point per dollar on everything else

When you have the Chase Sapphire Preferred, you can redeem your points through the Chase travel portal at a value of 1.25 cents per point. That offers a better value than if you transfer your points to IHG, and it’s why we usually suggest not transferring your points to IHG.

Check out our review of the Chase Sapphire Preferred here.

Chase Sapphire Reserve

The Chase Sapphire Reserve is one of the top premium travel cards. The card has a $550 annual fee and comes with benefits to help offset that fee. The card has an intro bonus of 50,000 Chase points after spending $4,000 in the first three months from opening your account. The card also comes with a Priority Pass Select membership, which gets the cardholder and up to two guests unlimited access to 1,200+ Priority Pass airport lounges. And every year, you’ll get up to $300 in travel credits, which effectively brings your out of pocket costs down to a more manageable $250.

The Reserve earns:

- 10x Chase points on Lyft rides (through March 2022)

- 3x Chase points on travel and dining

- One Chase points per dollar on all other purchases

The Sapphire Reserve also comes with a free year of Lyft Pink membership (active by Mar. 31, 2022), which normally costs $19.99/month and gets you 15% off Lyft rides. And you’ll get $60 in DoorDash credit in 2020 and another $60 in credit in 2021.

Ink Business Preferred Credit Card

The Chase Ink Business Preferred currently has the highest bonus of any card that earns Chase Ultimate Rewards points. Because of the incredible bonus and outstanding money-saving perks, this is our #1 pick for the best business credit card.

With the Chase Ink Business Preferred, you’ll earn 100,000 Chase Ultimate Rewards points (worth over $1,250 in travel when redeemed through Chase Ultimate Rewards) after you spend $15,000 on purchases in the first three months after opening your account. And you’ll also get:

- 3x Chase points on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year)

- 5x Chase points on Lyft rides (through March 2022)

- One Chase point per dollar spent on all other purchases

Again, you’re likely better off using your points in ways other than by transferring to IHG, but it could be a useful way to top off your account.

Here’s our review of the Chase Ink Business Preferred.

Bonus ways to earn IHG points

Earn IHG points with IHG Points + Cash

Using the IHG Points + Cash trick is a great way to save money, especially if you don’t want to open up another credit card. You essentially buy IHG points for as little as ~0.6 cents per point.

This IHG payment method allows you to book award nights using a combination of points and cash. If you don’t have enough points for an award night (or don’t want to use them all), you can buy the points you need to make up the balance.

When you select the Points + Cash method of payment you will need fewer points to book the hotel. So you’re essentially buying IHG points (at what is often a big discount). If you cancel your reservation before the deadline, however, IHG will not refund your money. Instead, it will refund the points you purchased. Always double-check the cancellation deadline.

IHG promotions

Another fantastic way to earn IHG points is with an IHG promotion.

One of the most popular is called IHG Accelerate. It’s a way to earn thousands of extra points by completing different tasks unique to your account. For example, team member Jason was targeted in the past with:

- Stay at two different IHG brands and earn 12,600 IHG points

- Stay two weekends, including a Saturday night and another night, and earn 8,400 IHG points

- Stay at two IHG hotels and earn 5,600 IHG points

- Complete all three tasks above and earn 26,600 IHG points

Game promos like these are fun and can coincide with your upcoming travels. And you can book award nights for much less with the PointBreaks list, which is a rotating quarterly list of IHG hotels that are discounted to 5,000, 10,000 or 15,000 points per night.

Bottom line

There are some great ways to earn IHG points using credit cards. Most notably, you can earn a healthy 150,000-point bonus after meeting minimum spending requirements with the IHG Rewards Club Premier Credit Card.

You can also earn Chase Ultimate Rewards and transfer points to your IHG account. Finally, don’t forget the IHG Points + Cash trick if you don’t want to open another credit card. IHG points are easy to earn and are extremely useful because the hotel chain has more than 5,000 properties in 100 countries.

Let me know your favorite way to collect IHG points.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!