Amex Hilton Surpass review: Improved weekend night certificate and more

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Hilton is a favorite among Million Mile Secrets readers and staff because it’s so easy to earn Hilton Honors points and use points at Hilton hotels. You can choose a luxury hotel, like Waldorf Astoria, or a family-friendly Hampton Inn, which offers free hot breakfast for all hotel guests.

The refreshed Hilton Honors American Express Surpass® Card is an excellent option for travelers who book Hilton hotels. The card is offering a welcome bonus of 125,000 Hilton Honors points after you meet minimum spending requirements.

Because Amex limits welcome bonuses to once per person per lifetime on a particular card, if you’ve had the Amex Hilton Surpass (even under its previous name, the Amex Hilton Ascend), you’re not eligible for this bonus.

You can replenish points quickly by earning lots of bonus points on paid Hilton stays and other useful bonus spending categories, including U.S. restaurants and U.S. supermarkets — and because the novel coronavirus has severely hindered travel, these Hilton cards will give you the opportunity to earn hotel points and elite status much faster. I’ll explain!

Here’s our Amex Hilton Surpass review.

The information for the Hilton Surpass card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Hilton Surpass review

Current bonus

New Hilton Honors Surpass cardholders, will earn 125,000 Hilton Honors points after spending $2,000 on purchases within the first three months of account opening.

A free standard night at Hilton hotels generally costs between 10,000 and 95,000 Hilton Honors points per night, so the bonus points are more than enough for a night at any top Hilton hotel, or for multiple nights at less expensive locations.

Hilton is one of the biggest hotel chains, so there’s likely a Hilton hotel no matter where you travel. Hilton hotel brands include:

- Conrad

- Canopy

- Curio

- DoubleTree

- Embassy Suites

- Hampton Inn

- Hilton

- Hilton Garden Inn

- Hilton Grand Vacations

- Home2 Suites

- Homewood Suites

- Tapestry Collection

- Tru

- Waldorf Astoria

Hilton points are generally worth at least 0.5 cents each. For most people, the 125,000-point Amex Hilton Surpass bonus is worth at least $625 in stays. However, it’s possible to get more value from your Hilton points, depending on where you use them.

Unlike other hotel chains, Hilton does not have an award chart The number of points required to book an award stay vary depending on your travel dates. Travel during peak periods generally costs more points than during the off-season. The Hilton Points Explorer tool gives you an idea of the minimum and maximum number of points you’ll pay at a specific property.

Most folks prefer to pay cash for lower-cost stays (less than $125 per night), and conserve points to book free nights or a weekend-night certificate at expensive top-tier hotels. For example, during peak travel dates, you could pay more than $1,000 for a night at the Conrad Maldives Rangali Island, or you could book an award stay for 95,000 Hilton points per night or by redeeming a certificate.

You can use the Amex Hilton Surpass welcome bonus to save big on other adventures, like a ski trip to Utah. Rather than spending $900+ to stay at the luxurious Waldorf Astoria Park City, which has direct access to the slopes, use your welcome bonus or a weekend-night certificate.

In more moderate accommodations, you can stretch your Amex Hilton Surpass bonus points and still get terrific value at brands like DoubleTree and Hilton Garden Inn.

Benefits and perks

Earning rates

With the Amex Hilton Surpass, you’ll earn:

- 12 Hilton points per dollar spent on eligible purchases at Hilton hotels and resorts

- 6 Hilton points per dollar spent on eligible purchases at U.S. restaurants, U.S. supermarkets and U.S. gas stations

- 3 Hilton points per dollar spent on all other eligible purchases

- Terms Apply

For example, if your monthly grocery bill is $500, you can earn 36,000 Hilton points per year just by using the Amex Hilton Surpass card for those purchases.

COVID-19 benefit enhancement: From May to July 2020, you’ll now earn 12 Hilton points per dollar at U.S. supermarkets. Plus, any bonus points you earn through eligible purchases that post between May 1 and December 31, 2020, will be considered “base points,” and will count towards elite tier qualification and Lifetime Diamond Status.

Complimentary Hilton Gold elite status

You get Hilton Gold status just for having the Amex Hilton Surpass, which earns you an 80% bonus on points at Hilton hotels. That’s on top of the 10x Hilton points per dollar you get as a Hilton Honors member if you book your room directly with the hotel (5x points per dollar at Home2 Suites and Tru). You earn 12x points per dollar if you use this card for the reservation. Altogether, you can expect to earn 30x Hilton points per dollar at most Hilton hotels.

You’ll also receive free breakfast at Hilton hotels, and room upgrades when available.

You can even earn Hilton Diamond status if you spend $40,000 on eligible purchases with your card in a calendar year (valid through the end of the next calendar year after it’s earned). That comes with all the Gold status benefits plus things like executive lounge access, an elite-status gift and a 100% bonus on points earned at Hilton hotels.

Weekend-night certificate when you hit a spending threshold

You’ll earn a weekend night after you spend $15,000 on purchases in a calendar year with your Amex Hilton Surpass card. You can use this weekend night at nearly any Hilton hotel, including expensive resorts like the Hilton Moorea Lagoon Resort and Spa, where rates often exceed $600 per night.

COVID-19 benefit enhancement: As its name suggests, a weekend night can only be redeemed for a free night on Friday, Saturday or Sunday. However, Hilton is relaxing this policy due to restricted travel from the coronavirus. Weekend night certificates issued on or before December 31, 2020, can now be used for any night, not just weekend nights. That’s a hugely positive change!

Priority Pass airport lounge access

This card gives you 10 free airport lounge visits each year once you enroll in a complimentary Priority Pass Select membership. Priority Pass has more than 1,200 airport lounges worldwide, so it shouldn’t be hard to use these annual passes.(Enrollment required).

These visits do not come with guest privileges, so if you’re traveling with a friend, you’ll have to use two of your free visits to get lounge access for yourself and a guest.

Access to Amex Offers

Add Amex Offers to the card. These targeted offers are awarded as statement credits or bonus points after you enroll with merchants like Hilton hotels. I recently got $550 back by stacking Amex Offers in Hawaii at the Grand Wailea resort and have saved hundreds of dollars over the years with other offers.

Car rental insurance

The Hilton Surpass comes with secondary rental car insurance that covers damage due to theft or collision on eligible rentals of 30 days or less. Check these important restrictions because some types of vehicles and countries are excluded.

Global Assist Hotline

When you travel 100 miles or more from home, you can call a 24-hour hotline to assist with urgent needs including translation services, passport replacement, missing luggage or medical clinics or services. You’ll be responsible for any fees. Here’s more about the Global Assist Hotline.

Extended warranty

When you make an eligible purchase with the Hilton Surpass card, Amex extends the original manufacturer’s warranty up to one year on eligible warranties of five years or less. Here’s more about limitations and exclusions with the card’s extended warranty coverage.

Purchase protection

When you use your Amex Hilton Honors Surpass for an eligible purchase, you’re covered for 90 days if the item is accidentally damaged or stolen. Coverage is limited up to $1,000 per occurrence or $50,000 per account per calendar year. Check out the terms for purchase protection here.

Is the annual fee worth it?

I don’t recommend applying for the Amex Hilton Surpass (or any of the best travel credit cards) unless your credit score is at least 700.

The Amex Hilton Surpass $95 annual fee is not waived the first year (See rates and fees), but the card’s benefits and perks easily offset the annual fee. For example, when you spend $15,000+ with the card in a calendar year you’ll earn a free weekend-night certificate. Spending $15,000 in a calendar year to earn the weekend-night certificate could be worth $1,000 or more depending on where you redeem it. Here’s a list of exclusions.

The 10 free Priority Pass lounge visits help you avoid paying for overpriced airport food. (Enrollment required).

If you frequently stay at Hilton hotels, Gold elite status perks like free breakfast, upgrades when available, and bonus points offer huge value.

Team member Jasmin stayed at the Conrad Tokyo and was able to get a $140 breakfast for free thanks to her Hilton Honors Gold status. (enrollment required).

If you spend $40,000 or more in a calendar year and stay at Hilton hotels even a handful of times throughout the year, you could also get great value from the Hilton Surpass card because you’ll earn Hilton Honors Diamond status. Diamond status comes with the same perks as Hilton Gold plus a 48-hour room guarantee, executive-floor lounge access and a welcome amenity unique to each hotel.

How to use points

It’s relatively easy to search the Hilton website to figure out the number of Hilton points you need for a free stay on your travel dates. Here’s how:

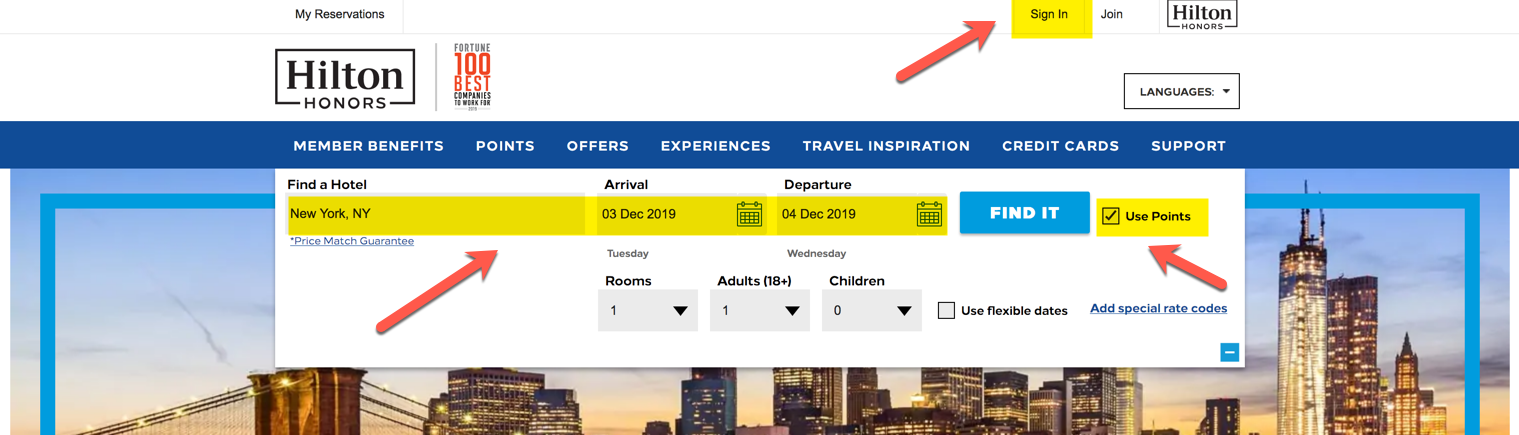

Step 1: Enter search criteria — login not required

Suppose you want to stay in New York City using your Hilton points.

Navigate to Hilton’s homepage and click “Sign In.” You don’t need to log in to see points values, but you’ll need to sign in to book. Enter your destination, travel dates, number of rooms and number of guests.

Choose “Use Points” to search for award nights. There’s also an option to select flexible dates if your travel plans aren’t firm.

Then, click “Find It” to get the search going.

Step 2: Pick your hotel

From there, you’ll see a list of Hilton hotels at your destination, along with the nightly points rate of each hotel (unless it’s sold out).

To choose a hotel, click the “Select” button under the nightly rate.

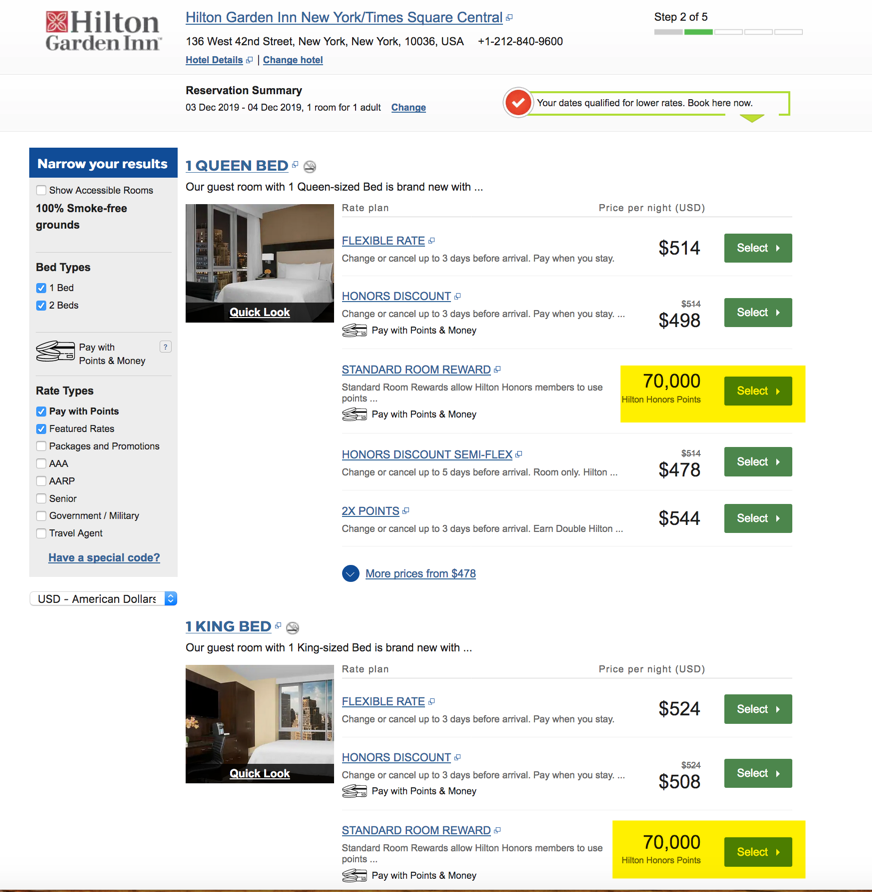

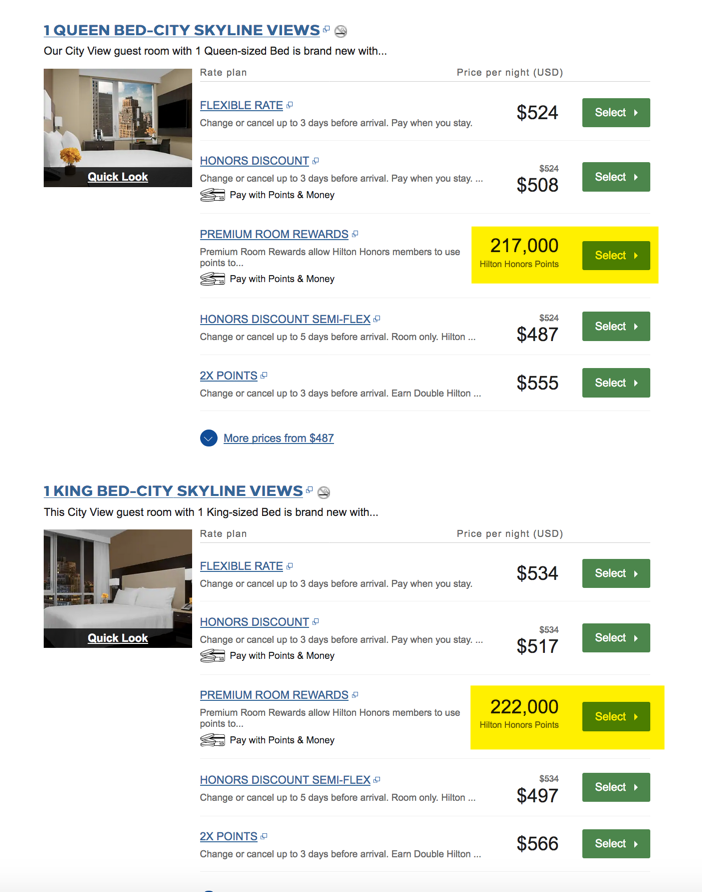

Step 3: Choose your room type

Next, select the room you want. Standard rooms will cost the fewest points compared to upgraded rooms, like those with better views or more space.

For example, standard room nights (one king or queen) on a sample date in December at the Hilton Garden Inn New York/Times Square Central go for 70,000 Hilton points per night.

But “premium” rooms with views of the New York City skyline cost 217,000-222,000 Hilton points per night.

If you see an asterisk next to the nightly rate, it means the rate changes during your stay.

Once you’ve decided on the room, click the “Select” button.

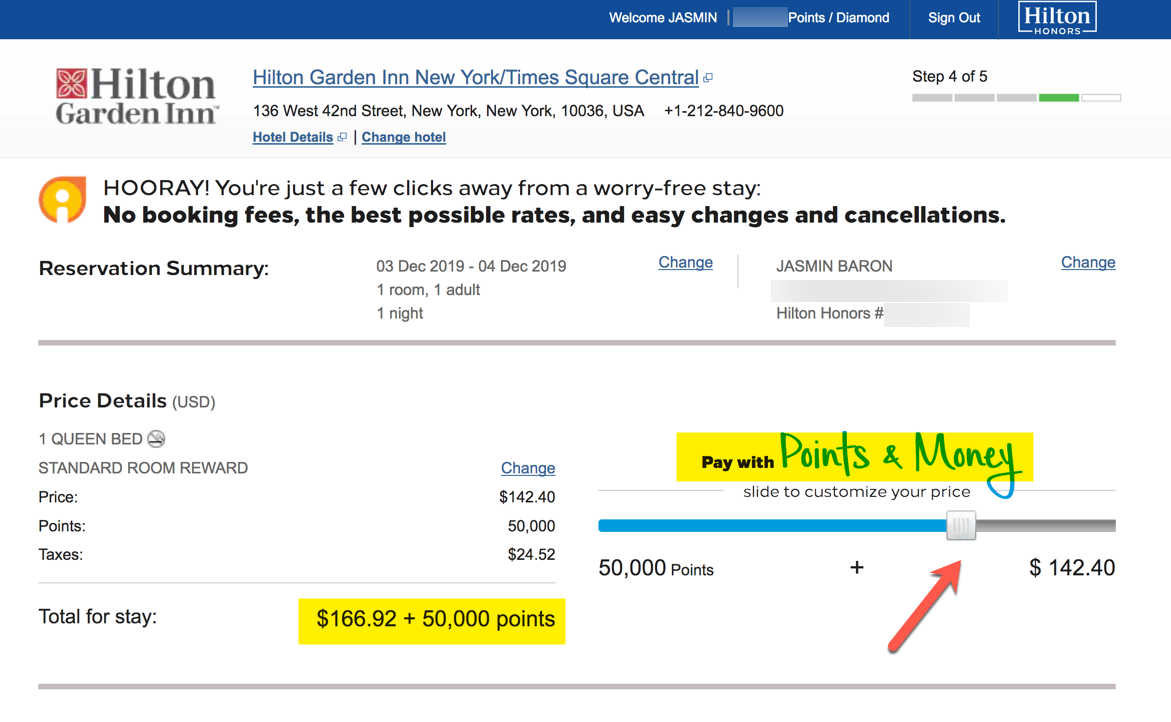

Step 4: Book your room

If you aren’t logged into your account, you’ll be prompted to do so. From there, continue booking as usual. Add names of additional guests or any special requests. You’ll then see your reservation details and your Hilton loyalty account information.

You can also customize your payment with a combination of points and money by moving the slider on the booking screen.

Remember, the rate could change depending on the day of the week or season. Here’s more about how to use Hilton Honors points in general and the best uses of Hilton points.

Insider tip

There have been multiple data points of Amex Hilton Surpass cardholders receiving targeted offers to upgrade their cards to the Hilton Honors Aspire Card from American Express with the opportunity to earn its full welcome bonus. While this is in no way guaranteed to happen to you, I recommend opening the Amex Hilton Surpass before opening the Hilton Aspire — the opportunity to earn two bonuses with one hard credit pull is hard to beat.

Cards similar to the Hilton Surpass

If the Hilton Surpass doesn’t sound like the perfect fit for you, there are other Hilton cards to choose from:

- Hilton Honors American Express Card – Earn 80,000 Hilton Honors bonus points after you spend $1,000 in purchases on the card in the first three months of card membership. Plus, you can earn an additional 50,000 Hilton Honors Bonus Points after you spend a total of $5,000 in purchases on the card in the first six months.

- Hilton Honors American Express Business Card – 130,000 Hilton points after you spend $3,000 on purchases within the first three months of account opening

- Hilton Honors Aspire Card from American Express – 150,000 Hilton points after you spend $4,000 on purchases within the first three months of account opening

These are all considered different card products, which means it’s possible to earn the welcome bonus on more than one version. I’m a big fan of the Hilton Aspire card because it comes with incredible benefits that make it worth much more than the $450 annual fee (see rates and fees) for frequent Hilton guests. (Here’s our review of the Hilton Aspire.)

The information for the Hilton Aspire Amex card has been collected independently by Million Mile Secretes. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

The Hilton Honors American Express Surpass Card is offering a welcome bonus of 125,000 Hilton Honors points after meeting minimum spending requirements.

You’ll also receive money-saving perks like complimentary Hilton Gold elite status (free breakfast) and Priority Pass airport lounge passes. (Enrollment required).

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

For rates and fees of the Hilton Surpass Card, please click here

For rates and fees of the Hilton Aspire Card, please click here

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!