Amex Hilton Credit Card review: A top no annual fee hotel credit card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Hilton brand hotels include more than 5,200 locations all over the world, ranging from affordable family destinations to five-star luxury resorts. Hilton’s rewards program, Hilton Honors, is a valuable way to earn free nights regardless of where your travels take you.

The no-annual-fee Hilton Honors American Express Card (see rates and fees) comes with an 80,000 Hilton Honors bonus points after you spend $1,000 in purchases on the card in the first three months of card membership. Plus, you can earn an additional 50,000 Hilton Honors Bonus Points after you spend a total of $5,000 in purchases on the card in the first six months.

We’ll show you some ideas for redeeming that welcome offer, from a weekend on the strip in Las Vegas to multiple nights at a budget-friendly Hampton Inn. And remind you of the ways Hilton is helping travelers through the coronavirus pandemic. Here’s our Hilton Honors Amex credit card review.

Who is the Hilton Amex card for?

With a big welcome offer and no annual fee, this card is perfect if you stay at Hilton hotels now and then. But if you’re looking for premium perks you’ll have to look to the other Hilton cards.

Current welcome bonus

With the increased offer on the Hilton Honors American Express Card, you’ll earn 80,000 Hilton Honors bonus points after you spend $1,000 in purchases on the card in the first three months of card membership. Plus, you can earn an additional 50,000 Hilton Honors Bonus Points after you spend a total of $5,000 in purchases on the card in the first six months.

A conservative estimated value of that welcome offer is at least $400. That’s because the value of Hilton points is usually 0.5 cents each or more (80,000 points x 0.005 cents per point). However, if you use Hilton points for stays at expensive properties, it’s easy to receive far more value than that.

Award prices can vary depending on the location, brand and season, and there’s no longer a Hilton award chart. The Hilton Points Explorer tool can give you an idea of the minimum and maximum number of points you’ll pay at a specific location. Team member Joseph likes to use Hilton Honors points at low category hotels because he finds it’s the easiest to get a good value for his points. He uses other points for ultra-luxury hotel stays.

Benefits and perks

Hilton status

You’ll receive complimentary Silver Hilton status just for having the Hilton Honors Amex card, which gets you a 20% bonus on top of the base points you’ll earn at Hilton hotels. That’s on top of the 10 Hilton points per dollar you get as a Hilton Honors member by booking your room directly with the hotel (5 points per dollar at Home2 Suites and Tru), and 7 points per dollar you earn by using this card for the reservation. Altogether, you can expect to earn 19 Hilton points per dollar at most Hilton hotels.

You’ll earn Hilton Gold status if you spend $20,000 on eligible purchases with your card in a calendar year (valid through the end of the next calendar year after it’s earned). That comes with all the Silver Status benefits, but you’ll get additional perks, like an 80% bonus on base points for staying at Hilton, as well as free breakfast at Hilton hotels and room upgrades when available. Enrollment required for select benefits.

If it’s Gold status you’re after, though, you’re better off with a card like the Hilton Honors American Express Surpass® Card, which comes with automatic Gold status. Here’s our review of the Hilton Surpass.

Enrollment required for select benefits below.

The information for the Hilton Surpass has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Car rental loss and damage insurance

Pay for your eligible car rental with the Amex Hilton Honors card and decline the rental company’s collision damage waiver, and you’ll receive secondary coverage for damage due to collision or theft. You can check out important restrictions here.

Extended warranty

Pay for an eligible item with your Amex Hilton Honors card and you could be covered up to an additional year on eligible warranties of five years or less. Some items don’t qualify, so read the important exclusions.

Purchase protection

It’s the worst when you’ve just bought an expensive item and you break it. When you buy an eligible item with your Amex Hilton Honors card you’ll get purchase protection for up to 90 days for accidental damage or theft. You can be reimbursed up to the amount you charged to your card or a maximum of $1,000 per occurrence and $50,000 per account per calendar year. Find out more about what’s covered here.

Free ShopRunner membership

Cardholders get a complimentary ShopRunner membership. ShopRunner is a third-party service that gives you free two-day shipping and free returns at more than 140 (and growing) online stores. ShopRunner is normally a $79 per year membership, but is yours complimentary with this card.

Don’t forget to enroll for ShopRunner after you apply for and receive your card.

Access to Amex Offers

You can add Amex Offers to the card, which are statement credits or bonus points you’ll receive when you enroll your card for targeted offers at merchants. Many Million Mile Secrets team members save hundreds each year just from this one perk.

Is the Hilton card worth the annual fee?

The Amex Hilton card has no annual fee.

I wouldn’t recommend applying for the Amex Hilton Card (or any of the best travel credit cards) unless your credit score is at least 700.

Note that you can’t receive the welcome offer on this card if you’ve already had it, because Amex only allows folks to earn a bonus once per card per lifetime. However, if you’ve already had a different Hilton card (like the Hilton Honors American Express Surpass® Card) you’re still eligible for the welcome offer on this one.

How to earn points with the Hilton card

The Amex Hilton Honors Card also earns:

- 7 Hilton points per dollar spent at any Hilton portfolio hotel or resort

- 5 Hilton points per dollar at U.S. restaurants, U.S. supermarkets and U.S. gas stations

- 3 Hilton points per dollar spent on all other eligible purchases

- Terms Apply

The 5 Hilton points you’ll earn per dollar on U.S. restaurants, U.S. supermarkets and U.S. gas stations can help you get your next vacation sooner by racking up large amounts of points. It’s an easy way to work towards your next trip. And using the card (or any Hilton card for that matter!) will keep your Hilton points from expiring.

How to use your Hilton Honors points

You can use points across all 14 of the Hilton hotel brands:

- Conrad

- Canopy

- Curio

- DoubleTree

- Embassy Suites

- Hampton Inn

- Hilton

- Hilton Garden Inn

- Hilton Grand Vacations

- Home2 Suites

- Homewood Suites

- Tapestry Collection

- Tru

- Waldorf Astoria

These brands give you a range of options, no matter where you go or your travel style. I like to stop at Hampton Inn or DoubleTree during road trips when I need a comfortable bed to crash on for the night, and I really love the Elara by Hilton Grand Vacations during the ~10 weeks a year I spend in Las Vegas.

Hilton also offers a cool program that allows you to pool your Hilton points together with up to 10 friends or family members each year. You can transfer up to 500,000 points every year to them for free, allowing them to vacation for longer or stay at a more upscale hotel. Another option is to use points to pay for part of an award stay and pay cash for the rest to lower the cost of a luxury hotel.

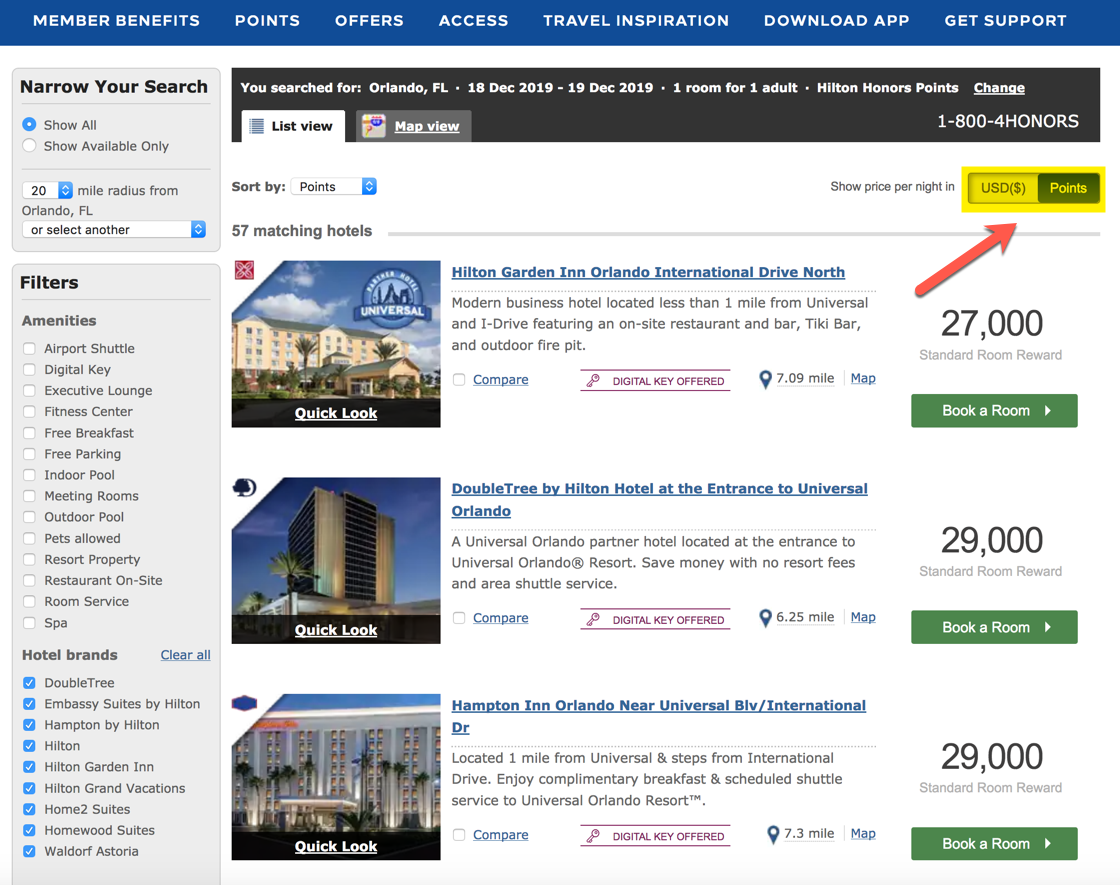

Because Hilton doesn’t publish an award chart like other hotel chains do, you will need to search for your travel dates and destination to find the best deals.

Here’s our complete guide to how to use Hilton Honors points for more details.

To find award pricing, visit Hilton’s website and search for a hotel room like you normally would. By default, it will show you cash pricing (remember to log in to see Hilton Honors member pricing). To change prices to award points pricing, flip the toggle on the top right side of the page. This makes it easy to compare value.

I’ve found rooms in Las Vegas for as little as 26,000 Hilton points per night. Those who are looking for a bit more culture and style can enjoy a room in Paris at the Hampton by Hilton Paris Clichy starting at 40,000 Hilton points per night. Or consider the Hilton Paris Charles De Gaulle Airport for only 36,000 Hilton points per night when flying in or out of the city.

Because the Amex Hilton card earns you complimentary Silver Hilton status, you are eligible for your fifth night free when you book five or more consecutive award nights. This is effectively a 20% discount in point cost.

Folks who are willing to search around can find amazing deals that are hard to match elsewhere. Here’s our rundown of the best ways to use Hilton points.

Cards similar to the Hilton Amex card

While the Amex Hilton Honors Card is the only Hilton American Express card with no annual fee, there are other options that offer larger welcome offers and more bonus points on spending.

For example, you can open:

- Hilton Honors American Express Surpass® Card

- Read our review of the Hilton Surpass

- Welcome bonus: 130,000 Hilton Honors bonus points after you spend $2,000 in eligible purchases within the first 3 months of card membership. Terms apply.

- The Hilton Honors American Express Aspire Card

- Read our review of the Hilton Aspire

- Welcome bonus: 150,000 Hilton points after you spend $4,000 on purchases within the first three months of account opening. Terms apply.

- Hilton Honors American Express Business Card

- Read our review of the Hilton Business Credit Card

- Welcome bonus: Earn up to 180,000 bonus points. Earn 130,000 bonus points after you spend $2,000 in purchases on the card in the first three months of card membership. Plus, you can earn an additional 50,000 Hilton Honors bonus points after you spend a total of $10,000 in purchases on the card in the first six months.

The Amex Hilton Honors Card requires you to spend $20,000 in a calendar year to earn Hilton Gold status. If you stay with Hilton a lot, consider the Hilton Honors Surpass Card with its higher welcome offer, complimentary Hilton Gold status, higher bonus point earning rates, airport lounge access with Priority Pass Select and a free weekend night when you spend $15,000 or more in a calendar year.

Hilton Gold status will earn you 80% bonus points during hotel stays, complimentary breakfast for you and a guest and space-available room upgrades.

You can get these benefits for only a $95 annual fee (see rates and fees), which is probably a better deal for most people.

You could also consider The Hilton Honors American Express Aspire Card, which comes with complimentary Hilton Diamond status, higher bonus point earning rates, credits for airline incidental fees each calendar year, statement credits each year on eligible purchases at participating Hilton Resorts, airport lounge access with Priority Pass Select, a weekend night reward when you receive the card and more.

The Hilton Diamond status will earn you 100% bonus points during hotel stays, complimentary breakfast for you and a guest, executive lounge access, a 48-hour room guarantee and space-available room upgrades. This card has a $450 annual fee (see rates and fees), but you can achieve many of the same benefits with the Amex Hilton Surpass if you’re a big spender. Team member Jasmin has already gotten over $750 in value from having the card in less than a year. Enrollment required for select benefits.

The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

The Hilton Honors Card from American Express comes with an intro offer of 80,000 Hilton Honors bonus points after you spend $1,000 in purchases on the card in the first three months of card membership. Plus, you can earn an additional 50,000 Hilton Honors Bonus Points after you spend a total of $5,000 in purchases on the card in the first six months.

The Amex Hilton Honors card will earn you complimentary Silver Hilton status and 7 Hilton points per dollar spent at Hilton hotels. You can also earn additional Hilton points from everyday purchases like 5 Hilton points per dollar at U.S. restaurants, U.S. supermarkets and U.S. gas stations, plus 3 Hilton points on other eligible purchases.

This is a terrific card to consider if you prefer no annual fee and don’t stay at Hilton hotels often. But if you frequently stay with Hilton, you might instead consider a card like the Hilton Honors American Express Surpass. It includes complimentary Gold Elite Status (which comes with perks like an 80% points bonus on Hilton stays, free breakfast, space-available room upgrades and more), a weekend night after spending $15,000 in a calendar year, and 10 complimentary Priority Pass airport lounge visits. These additional benefits make it worth the $95 annual fee for that card.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets email newsletter.

For rates and fees of the Hilton Surpass Card, please click here.

For rates and fees of the Hilton Amex Card, please click here.

For rates and fees of the Hilton Honors Aspire Card from American Express, click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!