American Airlines AAdvantage MileUp℠ Card review: Earn 10,000 miles and a $50 credit

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Citi is an MMS advertising partner.

The American Airlines AAdvantage MileUp℠ Card is the only American Airlines credit card with no annual fee, making it a no-risk way to earn American Airlines miles. One of the best parts about this card is you’ll earn bonus miles when you spend on groceries, a big expense for most of us. Not even the American Airlines cards with annual fees have that bonus category.

You can apply for the American Airlines MileUp card here.

Plus, current Citi American Airlines cardholders will be relieved to know that the MileUp card is exempt from the sign-up bonus restrictions on other American Airlines Citibank credit cards. This means that you are more likely to be eligible for this offer.

American Airlines MileUp card review

Current bonus

With the American Airlines AAdvantage MileUp card, you’ll earn 10,000 American Airlines miles and a $50 statement credit after spending $500 on purchases in the first three months of account opening. There are certainly higher intro offers on other Airline credit cards but this is a decent bonus for a no-annual-fee credit card.

Benefits and perks

The AA MileUp card earns 2x miles on eligible American Airlines purchases and at grocery stores, including eligible grocery delivery services. All other purchases will earn one mile per dollar.

25% savings for inflight snacks

When you fly American Airlines, you’ll save 25% on inflight purchases of drinks or snacks when you pay with your card.

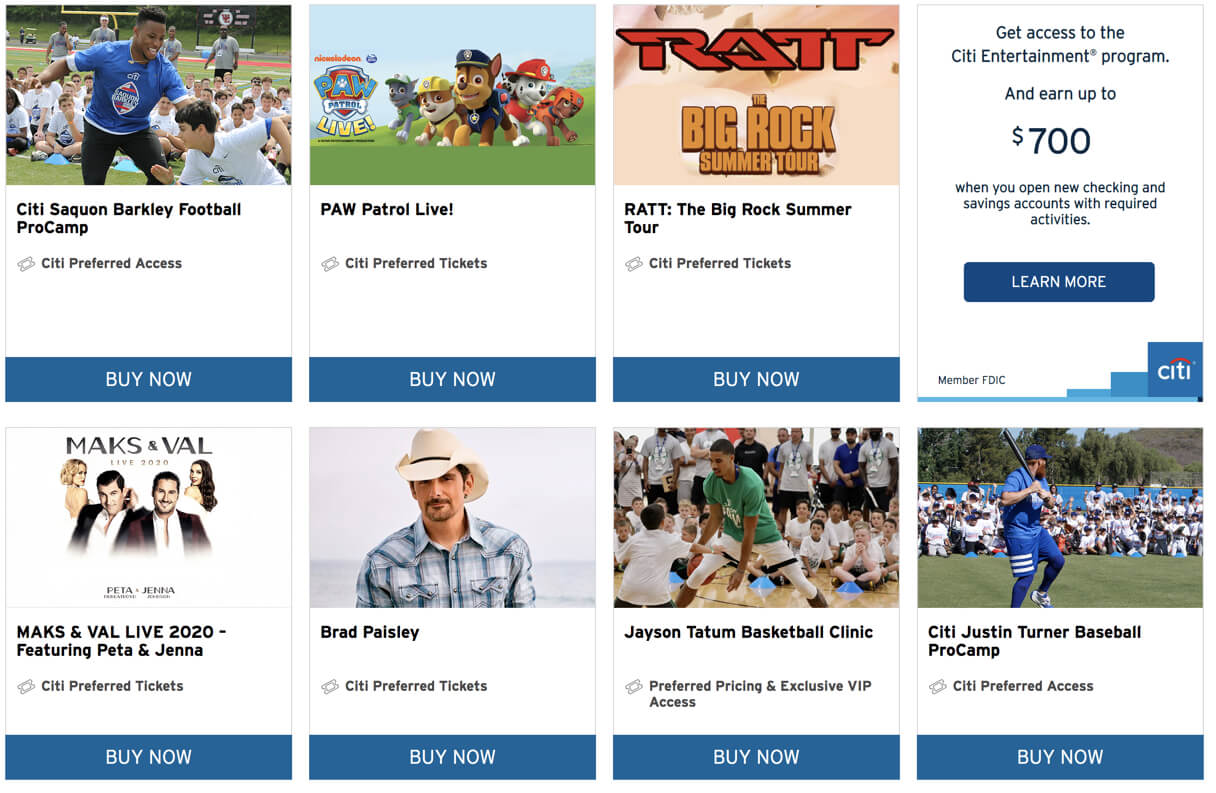

Citi Entertainment

Citi Entertainment gives Citi customers early access to concerts, sports events, theater performances and more. You’ll also get preferred access for better seats or invitations to special events.

There are lots of events listed on the website and they’re always changing. It’s worth a look to see what’s coming to your area or somewhere you’re headed, so you can score better tickets.

Concierge access for help with the details

You can call Citi Concierge to help with:

- Travel plans

- Shopping or finding a specific item

- Dining reservations

- Entertainment tickets or arrangement

- Everyday needs

If you can’t get a reservation at a restaurant, for example, you can ring the concierge to see if they can work their magic. It’s a free service.

How to redeem miles

American Airlines is moving to dynamic pricing, but it’s still possible to get a good idea of what award tickets should cost by referring to the American Airlines award chart.

Domestic coach flights on American Airlines, for example, can cost as few as 5,000 miles each way. So with this super-easy bonus, I could fly from my home airport of Cincinnati to Chicago and still have miles to spare.

Here’s a guide to the best ways to use American Airlines miles.

Is the American Airlines AAdvantage MileUp worth it?

This card is absolutely worth it for some, because the AAdvantage MileUp has no annual fee. Keeping no-annual-fee cards for the long term can increase your average account age and possibly boost your credit score.

Because this card is exempt from Citi’s tougher credit card application rules, you are eligible for the Citi American Airlines MileUp card even if you have another Citi American Airlines card like the Citi® / AAdvantage® Executive World Elite Mastercard®.

However, it’s likely not worth it if you fly American Airlines regularly and could use the perks of other cards, like preferred boarding, free checked bags on American Airlines domestic flights or are trying to stay under 5/24 to qualify for the best Chase cards. This card will count toward your Chase 5/24 limit.

Who is the MileUp card for?

If you’re looking for a great way to earn American Airlines miles without an annual fee, the American Airlines MileUp is your best option. That’s especially true if you want to earn American Airlines miles for groceries; this card offers two American Airlines miles per dollar at grocery stores, including eligible grocery delivery services. You won’t find that bonus category with any other American Airlines miles-earning card.

Insider secret

If you have other Citi American Airlines personal cards and paying the annual fee is no longer worth it for you, you can downgrade to the Citi AA MileUp card. If you do this you won’t earn a welcome bonus on the card, but you will be able to keep the account open. This will help to increase your age of account and can improve your credit score.

Cards similar to the American Airlines AAdvantage MileUp

The welcome bonuses on other Citi cards can get you a business-class flight to Asia on partner Cathay Pacific. But be prepared for higher costs. If you can qualify for a business credit card, the 65,000 American Airlines mile bonus from the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® (after spending $4,000 in purchases within the first four months of account opening) comes with a $99 annual fee, waived for the first 12 months. Here’s our CitiBusiness AAdvantage Platinum Select review if you want to learn more about the card.

For a bigger travel card bonus on a personal card, check out the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. The Citi AAdvantage Platinum Select card has a $99 annual fee (waived for the first 12 months) and a 50,000 mile bonus after spending $2,500 on purchases in the first three months of account opening.

The information for the Citi AAdvantage Platinum and CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Or you can earn a bonus of 50,000 American Airlines miles from the Citi® / AAdvantage® Executive World Elite Mastercard® but you’ll have to spend $5,000 on purchases in the first three months of account opening and pay a $450 annual fee. That’s a much bigger annual fee, but the card does come with premium benefits, like airport lounge access. Check out our review of the Citi AAdvantage Executive to learn more.

Bottom line

The American Airlines AAdvantage MileUp℠ Card is a great choice for anyone who want an easy and inexpensive way to earn American Airlines miles. This card has no annual fee and earns 2x American Airlines miles on eligible American Airlines purchases and for groceries. It currently offers a bonus of 10,000 American Airlines miles, plus a $50 statement credit, after you spend $500 on purchases within the first three months of account opening. You’re eligible for the MileUp card even if you already have other Citi American Airlines cards.

For a no-annual-fee card, the Citi AAdvantage MileUp card offers a generous intro bonus in exchange for a very low spending requirement. There are alternative Citi cards with larger sign-up bonuses but be prepared for annual fees and higher spending requirements. If you’re interested in carrying a simple American Airlines mile-earning card with no annual fee, the American Airlines AAdvantage MileUp℠ Card is a good one to consider, especially if you’ve already earned the welcome bonus on other, more valuable Citi American Airlines cards.

You can apply for the American Airlines AAdvantage MileUp℠ Card here.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!