Opening new credit cards can actually improve your credit score

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Do you have a long and healthy credit history? Do you always pay your bills on time? Do you avoid carrying a credit card balance month-to-month? You’ve likely got a credit score in the high 700s (at least!). But that score isn’t bullet proof.

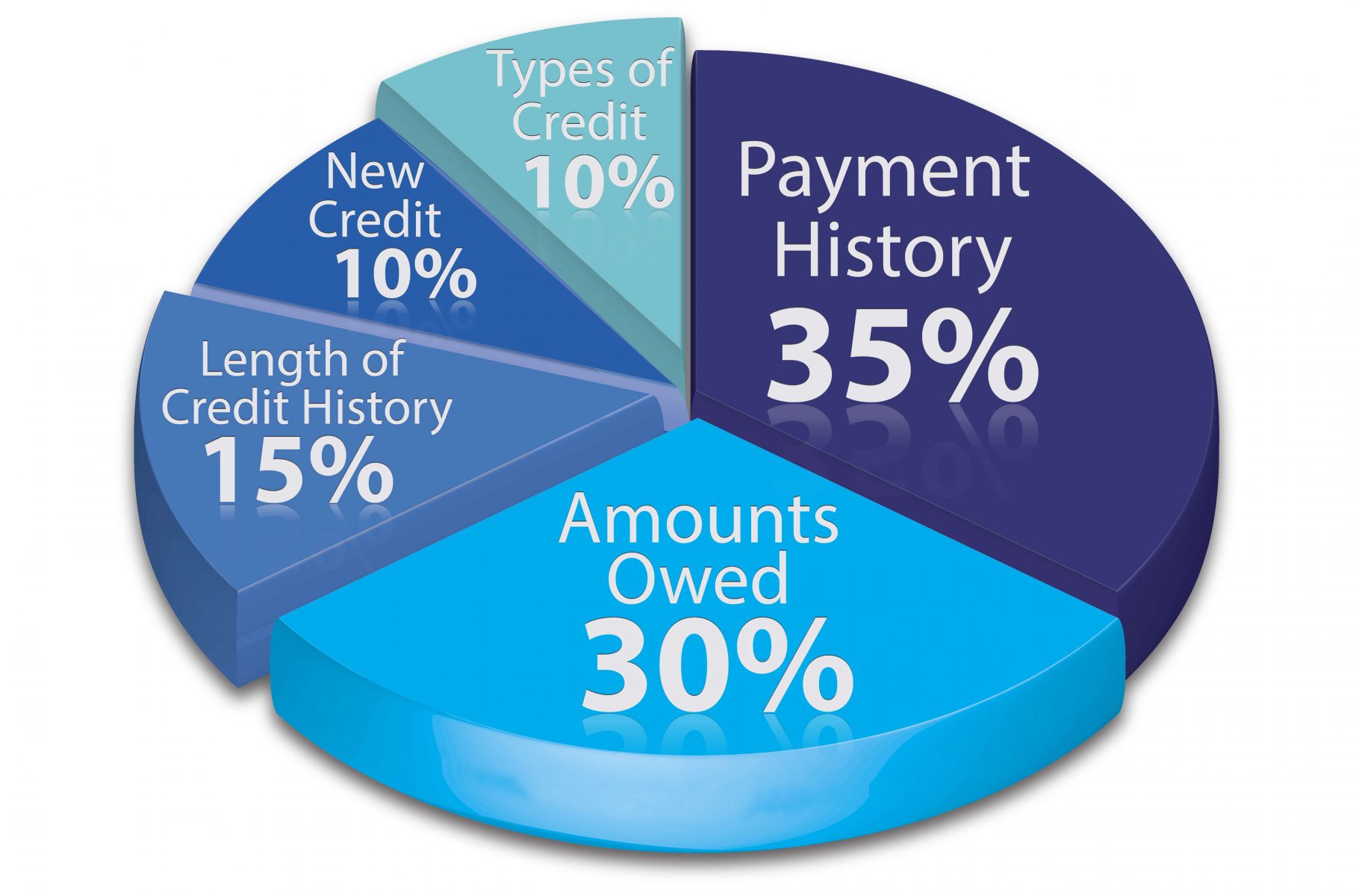

In fact, the one thing you might think will harm your credit score can be the very thing to preserve it. A huge credit misconception is that as long as you pay your balances and never make a late payment, your credit score will dwell with the angels among the loftiest cloud. Most don’t understand one important factor that goes into your credit — and it accounts for a whopping 30% of your score.

Credit Utilization Makes up 30% of Your Credit Score!

30% of your credit score is based on balances owed, which is also known as your credit utilization. Even if you pay your entire balance off each month, your credit report might show balances that count toward your credit utilization. That’s because most banks report your balance after the statement close date. Some banks (like Chase) even report your balance a few days after you make a purchase.

The longer you wait to pay your credit card bill, the more time your outstanding balance will appear on your credit report. This has the potential to negatively impact your credit score — even if you pay the full balance before the statement due date.

If you’ve only got one or two cards with low credit limits, your credit utilization will skyrocket if you make any kind of significant purchase. For example, if you’ve got a total of $5,000 in credit and you book a $2,500 family getaway, your credit utilization will be 50%. Credit bureaus will not like that. You could see your credit score drop by 30 points or more, despite the fact that you pay the balance before it’s due.

One trick to avoid having a high credit utilization ratio is to pay credit card bills more than once per month, or before the statement close date. We sometimes pay the total balance on certain cards four or five times in a month.

Paying before the due date is an especially good idea if you make a large purchase during the month. You can pay it off right away to avoid having a large outstanding balance appear on your credit report. Making early payments can be an easy way to boost your credit score!

Lots of credit cards don’t equal poor credit

It’s contrary to common belief, but having several open credit cards can actually help improve your credit score. The key is to utilize only a small portion of the credit limit on all of your cards. Opening a new credit line will reduce your credit utilization ratio as long as you doesn’t use a large portion of the limit on the new card.

The Chase Sapphire Preferred® Card is number one on our list of the best credit cards for beginners. If you’re new to miles and points, that’s the go-to card for you. It’s still one of my favorite cards, and I’ve been in this hobby for a long time. We don’t recommend anyone sign up for a travel credit card unless they have a credit score of at least 700. If you’re not quite there yet, it’s no problem! Just nurse your credit until you’re there (and investigate the relatively new ultraFICO credit score to see if that can boost). If you’re a student, check out our post on tips for college students to build their credit.

After you’ve been in the credit game for a while, you can check out our guide to the best credit cards for excellent credit and begin earning lots of valuable welcome offers to save on airfare, hotels, rental cars and more.

I have 18 open credit card accounts and they’ve never caused me to drop below 700. They only bolster my number! If you can achieve excellent payment history and a low credit utilization, the world of travel can be practically free for you.

This doesn’t mean you should apply for 10 new credit cards today. Each time you apply for a credit card, the banks look at your credit report. This is known as a hard credit inquiry. Hard inquiries can have a minor impact on your credit score, but in my experience, the temporary impact of applying for one or two new cards is usually offset by the long-term benefit of maintaining a low credit utilization ratio. It recovers in no time.

It’s also worth noting that if you see your credit score plummet, check out our post on how to dispute errors on your credit report and win.

Bottom line

Paying your credit card bills in full and on time is just part of the equation used to calculate your credit score. An important factor (30% of your credit score) is your credit utilization ratio. That’s the total balance reported to the credit bureaus divided by the total available credit limit across your credit card accounts.

To avoid this, you can pay your bill off multiple times per month, before your bill is due. You can also take the fun route and open more cards! You’ll earn valuable welcome bonuses, and the extra available credit will mean you can make larger purchases without your credit score taking a hit.

Let us know if you’ve had a similar experience with a sudden credit score drop. And subscribe to our newsletter for more credit card tips and tricks.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!