How to fix errors on your credit report

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

There’s nothing as important as good credit to fuel success in the miles and points hobby. Even if you’re new to earning rewards through credit cards, staying on top of your credit score is critical.

That’s why it is important to monitor your credit report for errors that could negatively impact your credit score, and correct any errors to make sure you have the best possible credit score.

We’ll show you how to dispute credit report errors so you can keep a healthy credit score and continue to earn travel rewards from the best credit cards for travel.

Fixing errors on your credit report

Why is it so important to keep tabs on your credit, especially in the miles and points hobby? If you have poor credit, banks will deny your application for new cards, which means you’ll miss out on free travel. Don’t worry, there are ways to boost your credit score, including disputing potential errors on your credit reports.

Under the Fair Credit Reporting Act, financial institutions like banks and credit bureaus are responsible for providing the correct information about financial records, and, if you report any errors, these institutions must correct them. All you have to do is contact the credit bureau, point out the error to them, and show them why the information is incorrect.

Order your annual credit report for free

You can view your credit report from Experian, Equifax, and TransUnion by visiting one website. You can request reports from all three bureaus, or choose the ones you want.

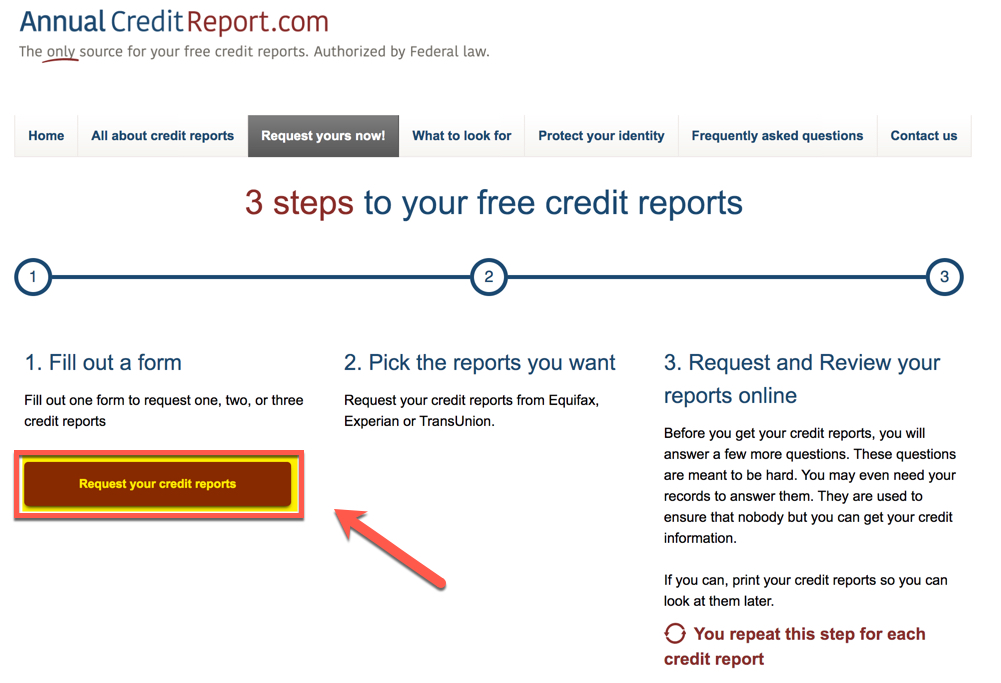

Step 1. Click the “Request your credit reports” button

Navigate to AnnualCreditReport.com and click on “Request your credit reports.”

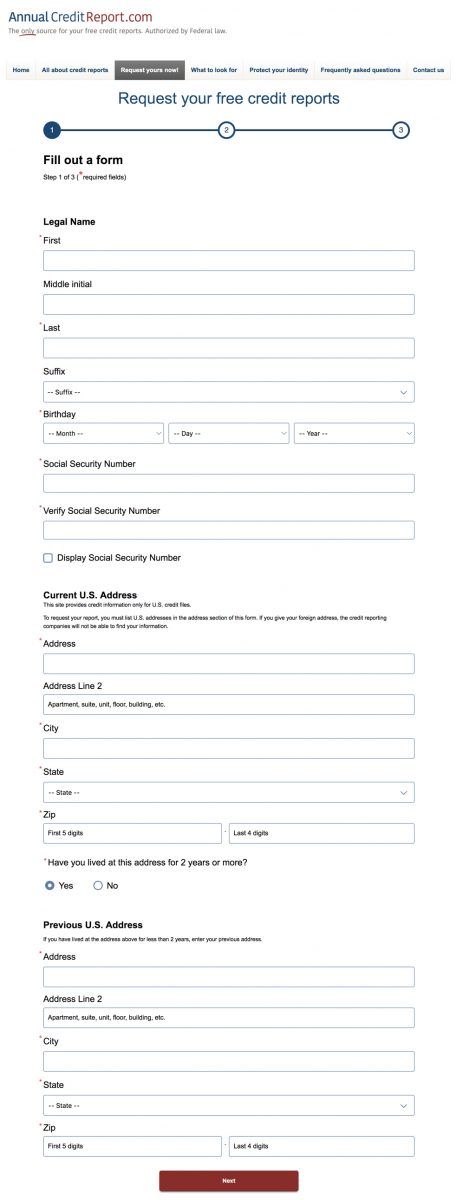

Step 2. Input your personal information

Help Annual Credit Report find your file by giving them your personal information, like your name, Social Security Number, and addresses for the past two years.

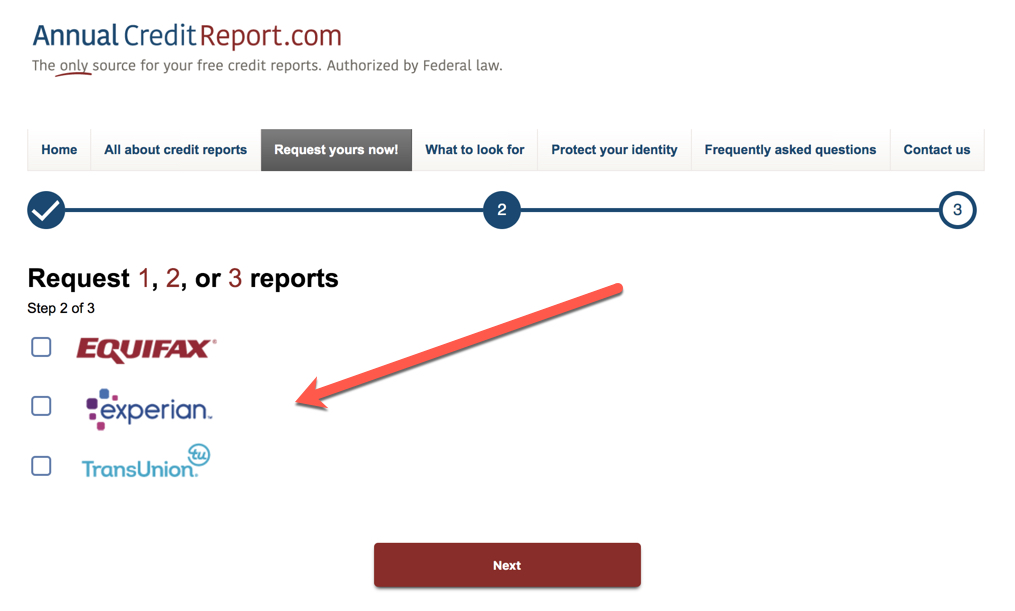

Step 3. Choose the credit bureaus you want to view

You can choose one, two or all three credit bureaus to view. Just keep in mind that pulling reports from all three bureaus will mean you can’t pull any of them for free for another year.

Step 4. Verify your identity

You’ll be asked just a few more questions in order for the system to verify your identity. These questions will include things like confirming past addresses or car loan payment amounts.

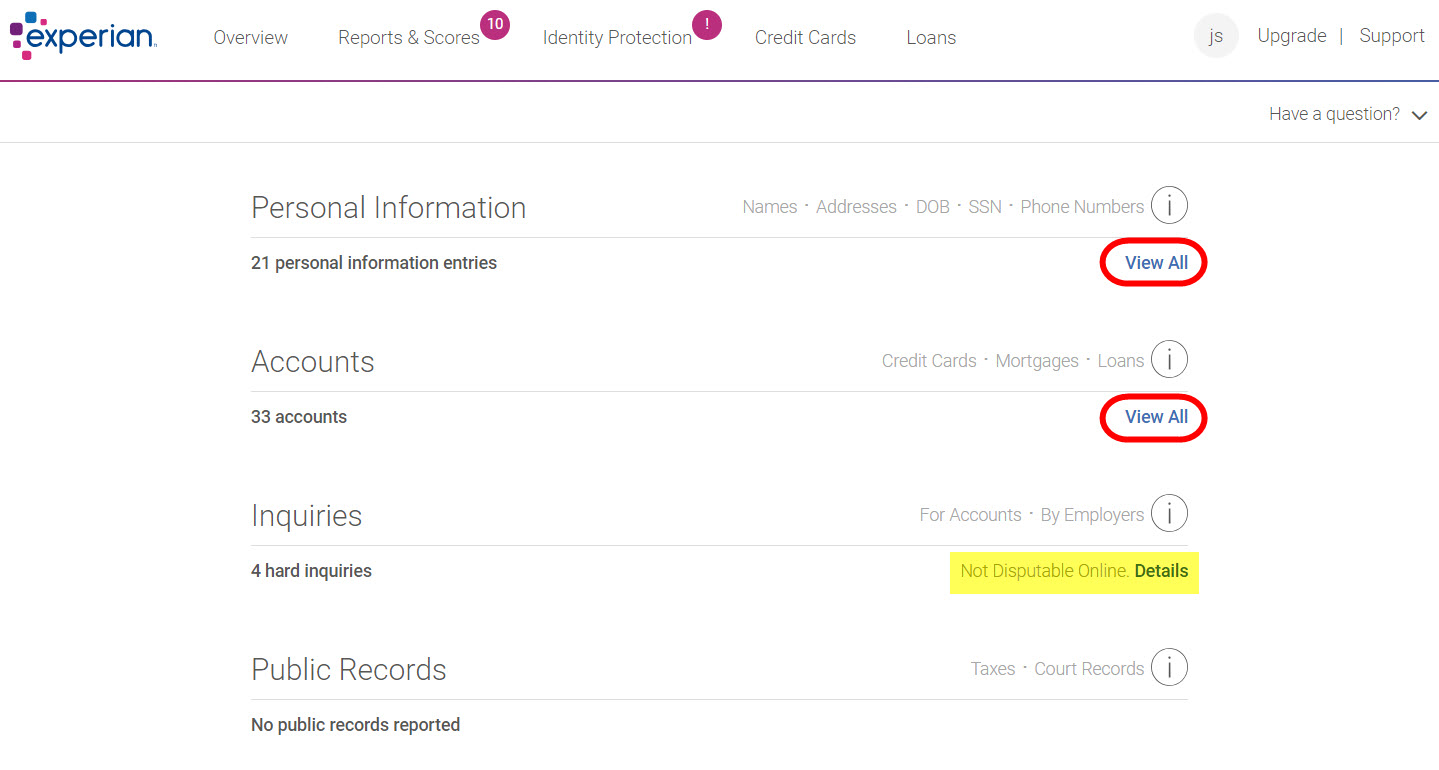

Step 5. Examine your credit report for items you want to dispute

After verifying your identity, your credit report will be generated. Then you’ll be able to scroll through the report and identify any potentially negative items.

How to dispute credit report errors

If you’ve examined your credit report and would like to dispute an item, the process is simple. And all of the three major credit bureaus allow you to file disputes online:

- Experian dispute instructions

- Experian online dispute

- Equifax dispute form

- Equifax online dispute

- TransUnion dispute form

- TransUnion online dispute

You can also file a dispute by mail. If you decide to mail your dispute with documentation, we recommend doing it by certified mail with a return receipt. You’ll still be able to retrieve the results of your dispute online.

Step 1. Fill Out a Dispute Form

Download a dispute form (or access it online) for the credit bureau that has the negative mark and fill it out with the personal information it requests.

Step 2. Add your credit report (with notes!)

Print your credit report and draw attention to all the areas you’d like to dispute. Circle and highlight the negative items.

(Note: Not all disputes can be filed online. For example, Experian wouldn’t let me dispute inquiries online.)

Step 3. Find documents that support your dispute

If you want to fix your credit report, you’ll have to convince the credit bureaus your argument is valid. Find documents that support your claim and attach them to your credit report. For example, if your credit report shows you’ve missed two payments on a credit card, print those statements showing your payment.

Step 4. Write a letter explaining your disputes

Write a letter identifying each item you’re disputing, and explaining why you feel it should be changed.

Here is a good sample dispute letter to help you get started. It should look something like this:

Hello,I am writing to dispute the following information in my file. I have circled the items I dispute on the attached copy of the report I received.

The following Citi credit card account is displaying inaccurate information. My file shows I have made two late payments, but I have never missed a payment. I am requesting that the item be removed to correct the information.

Enclosed are copies of my account statements on the corresponding dates to support my position. Please re-investigate these matters and correct the disputed items as soon as possible.

Thank you!

Your Name

Enclosures: Account statements from May 2019 and July 2019

Remember to include your name, address, city, state, zip code and date.

Step 5. Send your letter by certified mail with a return receipt

Send your letter by certified mail with a return receipt request. That way you’ll know the credit bureau received your documents,

The credit bureau will then investigate your dispute, usually within 30 days.

Note: Make sure any documents you send the credit bureaus are not the only available copies. Send duplicates, and keep the original documents for yourself. You might need them later.These steps should resolve any problems you have on your credit report. There are agencies available to help you, like the Consumer Financial Protection Bureau, which enforces federal consumer financial laws and helps protect you as a consumer.

Bottom line

If you haven’t looked at your credit score in a while, it’s worth the time and effort. There could be errors on your credit report that are affecting your credit score, and you must have a good credit score to be successful in the miles and points hobby.

In order to submit a dispute, you’ll need to:

- Fill out a credit bureau dispute form

- Print your credit report and circle the errors

- Attach documents that support your dispute

- Write a letter to the credit bureau explaining the errors

- Send your documents by certified mail with a return receipt, so you know they received your letter

That’s it — the credit bureau will investigate your claim, usually within 30 days.

Have you had success removing errors from your credit report? Let us know in the comments.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!