15 benefits and perks of the Chase Sapphire Preferred (including its new best-ever bonus)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It’s been six years since I opened my first miles and points credit card, the Chase Sapphire Preferred® Card. It’s reputed as one of the best travel credit cards ever — and it absolutely is.

The card is especially a no-brainer for the first year. With it, you’ll earn 100,000 Chase Ultimate Rewards points after meeting minimum spending requirements. That’s worth at least $1,000 in travel when redeemed through Chase Ultimate Rewards (though it can be worth a lot more). The card also comes with a $95 annual fee. Most of us do, because of its above-average benefits and perks. You can read our full Chase Sapphire Preferred review for all the details.

Chase Sapphire Preferred Card benefits and perks

Welcome bonus

Let’s start with the juiciest part of this card. The Chase Sapphire Preferred comes with a welcome bonus of 100,000 Chase Ultimate Rewards points when you spend $4,000 on purchases within the first three months of opening the account.

100,000 points are worth at least $1,000 in travel when redeemed through Chase Ultimate Rewards travel portal (though it can be worth a lot more when transferred to the right airline or hotel partner).

This is the best offer we’ve ever seen for this card.

Ongoing bonus points

The Chase Sapphire Preferred gives you bonus points for the following purchases. As one of the best rewards credit cards, you can earn:

- 5x total points on all travel purchased through Chase Ultimate Rewards

- 3x points on dining, including eligible delivery services, takeout and dining out

- 3x points on select streaming services

- 3x points on online grocery purchases (excluding Target, Walmart and wholesale clubs)

- 2x points on all other travel

- 1x point on all other purchases

Travel purchases include things like airfare, hotels, car rentals, Airbnb, Uber, etc.

Transfer partners

You can transfer Chase points to extremely useful airlines and hotels to receive hundreds and hundreds of dollars in free travel. It’s the best way to use Chase points. For example, you could transfer 80,000 points to Southwest and receive ~$1,200 in flights (based on our valuation of Southwest points). Or you could transfer 68,000 points to Iberia and book two one-way business class tickets to Spain in lie-flat seats.

Chase Travel Portal redemptions

As a Sapphire Preferred cardholder, the value of your Ultimate Rewards points earned with other Chase cards become more valuable. That’s because if you have the Chase Sapphire Preferred® Card you get a 25% bonus when redeeming your points for travel through the Chase Ultimate Rewards Travel Portal (meaning your 20,000 point bonus is worth $250).

Chase Pay Yourself Back

Through Sept. 30, 2021, Chase Sapphire Preferred cardmembers can redeem points to offset purchases at grocery stores, home improvement stores, and dining at a rate of 1.25 cents each. You’ll be reimbursed in the form of a statement credit.

Using Chase Pay Yourself Back will net a much higher return than simply cashing your points out, which gives you a value of 1 cent per point. You have 90 days from the time each eligible transaction posts to erase it with your Chase points.

Be sure to check out our full guide on Chase Pay Yourself Back to learn all about it.

Combine Ultimate Rewards points from other cards

If you have a no-annual-fee Chase card like the Chase Freedom Flex℠, you can combine your points from the Flex card to the Sapphire Preferred card and then transfer them to Chase’s travel partners. Transferring to partners like Hyatt, United Airlines, British Airways, Virgin Atlantic and more can potentially get you much more value.

Peloton credits

Through December 31, 2021, the Sapphire Preferred card will get you $60 in statement credits for eligible Digital and All-Access Peloton memberships. That’s a nice little perk, especially given that lots of us are spending time at home these days!

Primary rental car insurance

When you pay for your rental car with the Chase Sapphire Preferred, you’ll automatically receive coverage for damage due to theft or collision to your rental car (you must waive the rental car agency’s CDW). This means you won’t have to pay $10+ per day for the in-house insurance provided by the rental company. If you rent cars for even a few days each year, this could save you a considerable amount of money.

In the event that you do actually damage your rental car, filing a claim is easy. During a trip to Ireland, I scraped my rental car against a cement pole. The rental agency charged my card $2,300 for the damage. I submitted a claim to Chase, and within weeks I received a check for $2,300. It was almost too good to be true.

The point is, the card will save you money when you decline the rental car insurance — and it’ll save you money when you actually wreck. You can read about how Chase solved my rental car wreck here.

Baggage delay insurance

If your checked bags are delayed for six hours or more, you’ll receive up to $100 per day (for up to five days), so long as you’ve paid for at least part of your fare with your Chase Sapphire Preferred. If you don’t travel often and an airline has never lost your bag, you might not appreciate the value of this benefit, as the situation seems highly unlikely. IT’S COMING FOR YOU. Everyone loses a bag.

During a trip to Europe, my bag was delayed (lost) for forty days. That’s an extreme case and probably won’t happen to you. But Chase cut me a check for $500 to reimburse me for the clothes, toiletries, etc. that I had to buy for my trip. Huge pain. But hey, free clothes.

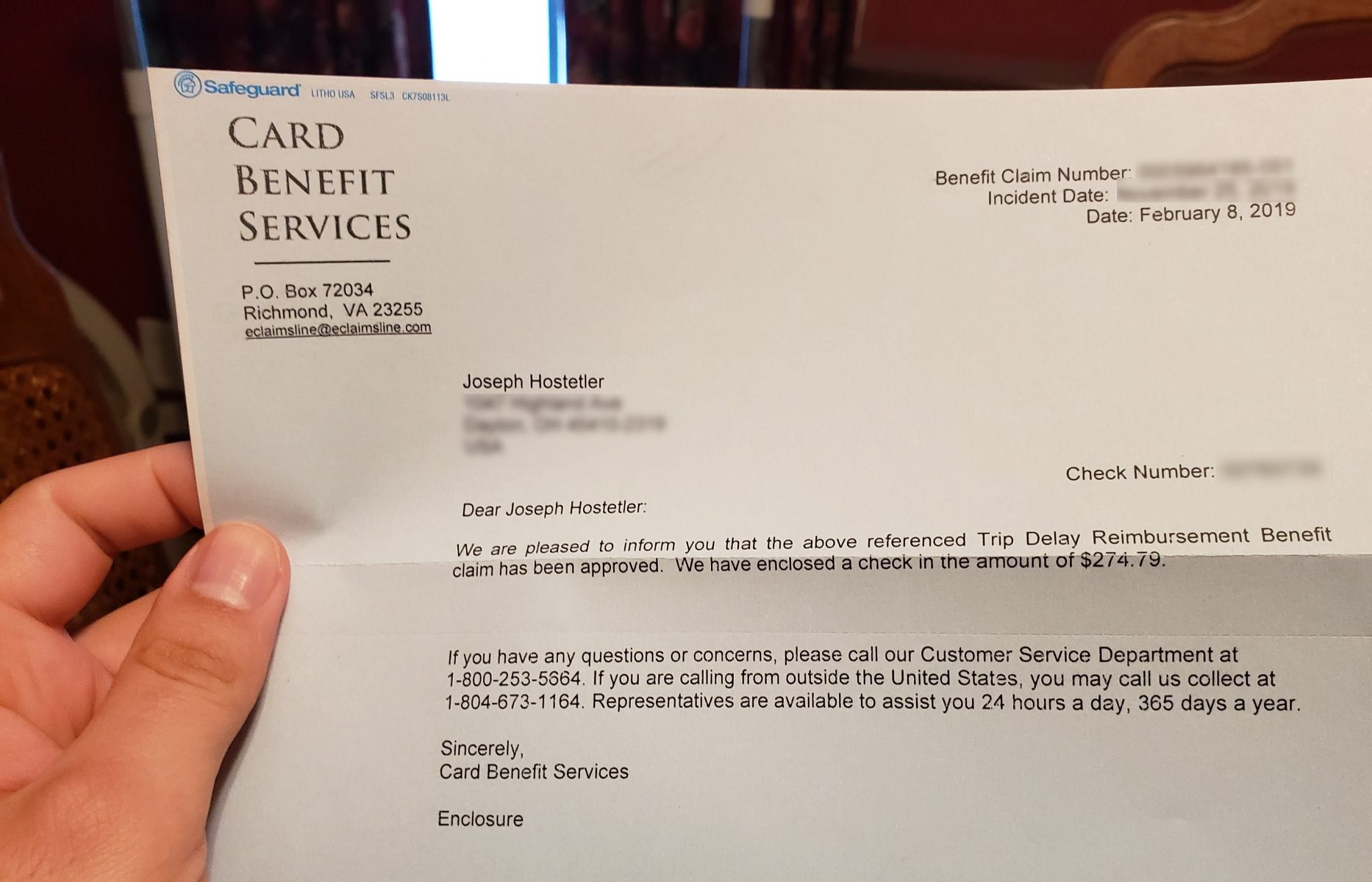

Trip delay reimbursement

When you pay for at least a portion of your travel with your Chase Sapphire Preferred, you can receive up to $500 back per ticket when your trip is delayed more than 12 hours or requires an overnight stay. You’ll be reimbursed for things like:

- Meals

- Lodging

- Ground transportation

- Toiletries

Over Thanksgiving week, my flight was delayed and I missed my connection. I booked a room at the Grand Hyatt, ate breakfast in their fabulous restaurant, and received a check for $275 from Chase which covered every penny. You can read about my trip delay and interaction with Chase here.

No foreign transaction fees

If you’re traveling abroad, you’re throwing money away if you don’t use a card that waives foreign transaction fees.

Some cards will charge you a 3% fee for making purchases outside the country (that sometimes even includes reserving foreign hotels on the internet while inside the U.S.). The Chase Sapphire Preferred doesn’t charge foreign transaction fees, so you can contract tennis elbow from furiously swiping and you won’t be charged a penny of dumb fees.

Trip cancellation/interruption

Stool happens. If your vacation is interrupted by things like inclement weather, sickness, death, a call to jury duty, etc., you may be eligible for reimbursement up to $10,000 per person ($20,000 per trip) for things like airfare and hotels. You and your immediate family traveling with you are covered.

There are plenty of conditions that aren’t covered, such as injury due to negligence, sickness due to a preexisting condition, and a declared or undeclared war.

Extended warranty protection

I’ve personally never used this benefit, but it’s a cool one to have. When you buy certain products with a US manufacturer’s warranty, you’ll get an additional year of warranty (only eligible for warranties of three years or less).

Purchase protection

If something you buy with your Chase Sapphire Preferred is ever the victim of theft or damage within 120 days of purchase, you can have it repaired or replaced (up to $500). That’s a great benefit, though there are quite a few exclusions for which Chase won’t reimburse, such as motorized vehicles, pets, and used items.

Roadside dispatch

This feature gives you various services when your vehicle breaks down. Simply call 800-847-2869, and you’ll get the following services for a flat fee:

- Towing – Up to 5 miles included

- Tire Changing – must have good, inflated spare

- Jump Starting – battery boost

- Lockout Service (no key replacement)

- Fuel Delivery – up to 5 gallons (cost of fuel not included)

- Winching (within 100 feet of paved or county maintained road only)

It’s not AAA, but it’s excellent when you’re in a pinch.

Overall value

Let’s ignore the giant welcome bonus that comes with this card when examining the value of this card. Is the Chase Sapphire Preferred annual fee still worth paying? It’s $95, and it’s not waived the first year.

Nearly all of this card’s benefits are insurance-related; you’re covered from every common travel inconvenience if you book your travel with this card.

Because of this, you first need to estimate your travel frequency. If you book flights and rental cars even a few times each year, if you swipe your card overseas, this card is your companion. If you rarely ever travel, there are other credit cards that may better serve your lifestyle while offering similar extended warranty and purchase protection benefits.

After crunching some quick numbers on the amount this card has saved me from these preventative benefits, I estimate I’ve saved an average of $608 per year. My travel is relatively frequent, though — and I’ve had a couple big disasters. Because of this, I’ll continue to pay the card’s annual fee each year.

Bottom line

The Chase Sapphire Preferred comes with an increased 100,000 bonus points. That is the best bonus we’ve ever seen with this card.

The Sapphire Preferred also happens to be the best Chase credit card for beginners. But it’s by no means just a “beginner” card. I’m no beginner, and the Chase Sapphire Preferred still has my fingerprints all over it. Its benefits alone (not points) have saved me thousands over the years. And because of this card’s combined perks of earning bonus points on common purchases and the ability to transfer points to airlines, this could be considered one of the best airline credit cards.

Let me know if you think the Chase Sapphire Preferred is worth the annual fee! (It is, trust me).

Featured image by Jenny Sturm/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!