United Gateway card: No annual fee with a big bonus

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

We love when banks issue new credit cards — namely because it gives us the opportunity to earn more sign-up bonuses!

The United Gateway℠ Card is a no-annual-fee United credit card. It comes with 15,000 United Airlines miles after spending $1,000 on purchases within the first three months of account opening. Plus, earn 3x on grocery store purchases up to $15,000 for the first year account is open. We estimate United miles to be worth around 1.3 cents each. That makes this bonus worth ~$260, though you can get significantly more value if you know how to use United Airlines miles. Not bad for a no-annual-fee airline credit card!

This card’s earning rates are also above average for a no-annual-fee-product. You’ll earn:

- 2 miles per dollar on United Airlines purchases, at gas stations, and on local transit and commuting

- 1 mile per dollar on all other purchases

This card also waives foreign transaction fees, unusual for a no-annual-fee card, so it’s good to swipe abroad. You’ll also get 25% back on United inflight purchases.

Should you get this card?

The card replaced the United TravelBank card, and the legacy United MileagePlus credit card. If you’ve got one of these cards, you should have received your new card by October 31, 2020. Your account number, credit line, and other details will remain the same.

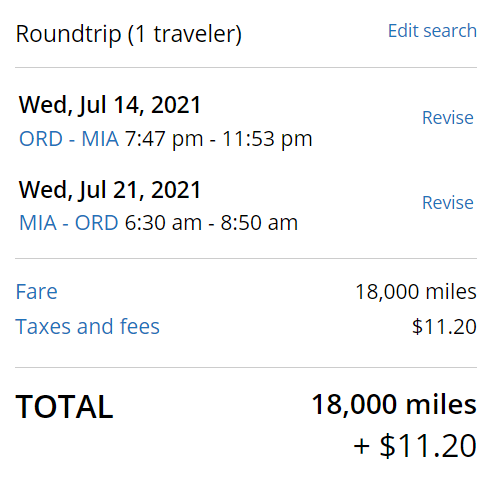

United aptly names this card the United Gateway℠ Card. It’s a great starter card if you’re new to the miles and points hobby. Because it’s a no-annual-fee card, there’s zero risk in opening it and giving it a try. It comes with a sign-up bonus that’s large enough to book a free round-trip domestic flight, such as Chicago to Miami. Once you get the taste of free airfare, you won’t go back.

The 2x miles for spending at gas stations and commuting is a good deal, as these are not bonus categories on other United credit cards. If you’re a United miles fanatic, it’s not a bad card to have. Just note that the card won’t have benefits like Priority Boarding, free checked bags, and exclusive award access like with the United℠ Explorer Card or the United Club℠ Infinite Card.

There is one giant reason you may NOT want to apply for this card, however. There are much faster ways to earn United miles, and it’s got nothing to do with United credit cards.

Both the Chase Freedom Flex℠ and the Chase Freedom Unlimited® earn rewards that instantly transfer to United Airlines. The only catch is that you must also hold one of the following cards:

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card

- Chase Sapphire Reserve®

With these cards, you can convert Chase points into United miles at a 1:1 ratio. These cards have a significantly better earning rate than any United credit card and neither have an annual fee. Both cards come with the following benefits:

- $200 cash back (20,000 Chase points) after spending $500 on purchases within the first three months of account opening

- 5% back (5x Chase points) on travel purchased through the Chase Travel Portal

- 3% back (3x Chase points) on dining, including takeout and delivery

- 3% back (3x Chase points) on drugstores

Plus, the Chase Freedom Flex℠ comes with 5% back (5x Chase points) on rotating bonus categories on up to $1,500 per quarter after activating the bonus, and 1% back on all other purchases. The Chase Freedom Unlimited® provides 1.5% cash back on all non-bonus purchases.

You can rack up United miles way faster by using these cards. However, if you’re looking for a quick 15,000 United miles, the United Gateway is an easy option.

Very important note: All cards above are subject to the Chase “5/24 rule.” If you’ve opened five or more cards from any bank (not counting certain business credit cards) in the past 24 months, Chase will not approve you for any of these cards.

Bottom line

The United Gateway℠ Card is a great addition to United’s credit card portfolio. It’s lack of foreign transaction fees, solid welcome bonus and mileage-earning rate means it could definitely find a place in United flyers wallets’. Just remember that there are better ways to earn United miles, namely through a combination of the Chase Sapphire and Freedom cards.

[ Apply here for the United Gateway℠ Card ]

Let us know what you think of the latest addition to the United credit card family! And subscribe to our newsletter to be sure you don’t miss any new credit card debut. We’ll even show you step-by-step how to get the best use of your miles and points.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!