The AMEX Answer to the Chase Sapphire Reserve?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.The Chase Sapphire Reserve is making a big impact on the miles & points world. It was Chase’s response, in part, to the terrific travel benefits offered by the refurbished Citi Prestige card.

Now, American Express MIGHT be preparing to release a card with benefits that compete with them both! And it could be as early as next week.

I love a good competition! 🙂 And more opportunities for folks in our hobby to get Big Travel with Small Money!

I’ll share the rumors I’ve heard so far, and tell you my hopes for a new AMEX card.

The American Express “Tier One” Rumor

Link: Doctor of Credit

Link: myFICO

Link: Monkey Miles

Link: One Mile at a Time

There are rumblings of another top-notch travel rewards credit card. And this time it’s coming from American Express!

1. “Tier One” Trademark

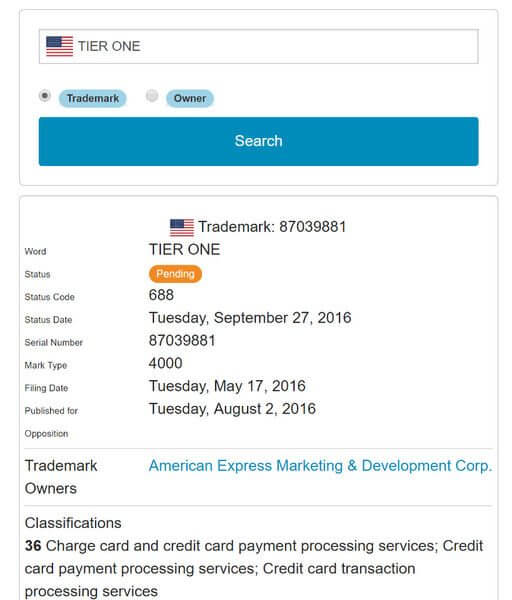

Folks on Reddit report a rumor of an AMEX credit card called “Tier One” which is intended to rival the Chase Sapphire Reserve and Citi Prestige. While nothing is for certain yet, there’s evidence that this could be real! As Monkey Miles points out, the Chase Sapphire Reserve was first leaked through Reddit, and then a registered trademark was spotted with the leaked name. And that’s exactly what has happened with the American Express Tier One! A Reddit leak, and a registered trademark.

2. New Card or Update to The Platinum Card® from American Express?

Link: The Platinum Card® from American Express

Link: American Express Mercedes-Benz Platinum

Link: The Business Platinum Card® from American Express OPEN

A reliable source tells us that there are definitely changes coming to the AMEX Platinum card. But whether these rumors are about an improved AMEX Platinum card or a brand new product, we don’t know.

It may just be an update to The Platinum Card® from American Express. Because a Reddit user says an AMEX customer service representative led him to believe it would be an upgrade to the AMEX Platinum Card.

And Million Mile Secrets team member Jasmin called American Express to ask about the rumored updates! While the customer service representative wouldn’t share much, he did say:

AMEX has always been the leader in credit cards for travelers. And we are well aware of the Chase Sapphire Reserve and its benefits. We intend to continue being the leader.

No real details, but it definitely sounds like they have something planned!

My Wish List for a New or Improved AMEX Card

If AMEX wants to compete with Chase and Citi, they should include:

- A higher sign-up bonus for the card

- A better incentive to use the card instead of the Chase Sapphire Reserve and Citi Prestige

So here is what I’m hoping to see offered by the new (or improved) American Express card.

1. Bonus Categories

Running with Miles makes a great point about AMEX Platinum bonus categories.The AMEX Platinum card used to have much better travel benefits than any other card, making it a stand-out card without category bonuses. But that’s not the case anymore!

Folks don’t spend as much with their AMEX Platinum because the rewards earning rate isn’t good. There are no bonus categories like there are with other cards that have similar benefits (like 3X points on airfare and hotels with the Citi Prestige and Chase Sapphire Reserve).

However, a reader from One Mile at a Time reports that an AMEX representative told him:

When you spend $5,000+ you get 1.5 AMEX Membership Rewards points and when you book travel with AMEX Membership Rewards points, you’ll get 50% back instead of 30%. No bonus spending categories.

The rumored AMEX card should have category bonuses similar to the Citi Prestige.

2. Improve Points Redemption Rate Through AMEX Portal

The Citi Prestige allows you to redeem your ThankYou points for 1.6 cents each when booking an American Airlines flight through the portal (soon to be 1.33 cents for all flights), and 1.25 cents for any other travel expense.

Chase Ultimate Rewards points with the Chase Sapphire Reserve are worth 1.5 cents per point when you book through the Ultimate Rewards portal.

The points you earn with the AMEX Platinum are worth 1 cent each when you use them for flights through the AMEX travel portal. That’s a bad redemption rate on a card that has no bonus categories.

I’d like to see AMEX match the Chase Sapphire Reserve‘s redemption rate of 1.5 cents per point.

3. Improve Annual Airline Credit

The AMEX Platinum‘s current airline credit isn’t as useful as the travel credits that come with the Citi Prestige and Chase Sapphire Reserve. With the AMEX Platinum credit, you will be reimbursed a total of $200 per calendar year for charges like:

- Phone reservation fees

- Checked baggage fees

- In-flight amenities (food, drinks, headphones)

- Airport lounge fees

In other words, things that can either be avoided (phone reservation fees), or things you might spend money on just because you know it will be reimbursed (in-flight food). And you have to pick ONE airline.

But the $300 travel credit that comes with the Chase Sapphire Reserve can be used for anything related to travel, like hotels, rental cars, even parking garages!

The travel credit that comes with a new (or improved) AMEX card should at least match the $250 credit offered by the Citi Prestige, and the categories should be more broad.

4. Sign-Up Bonus

AMEX is going to have to convince cardholders of the Citi Prestige and Chase Sapphire Reserve to cancel their card and switch to AMEX!

AMEX Membership Rewards points are not usually worth as much as Citi ThankYou Points or Chase Ultimate Rewards points for booking paid travel through each bank’s online travel portal.To compete with Chase, AMEX should offer a sign-up bonus of at least 100,000 AMEX Membership Rewards points. And if this is a refreshed AMEX Platinum card instead of a new product, AMEX should ignore their “once in a lifetime” rule to encourage customers to come back.

5. Surprise Feature

The AMEX Platinum can match the Citi Prestige and Chase Sapphire Reserve benefit-for-benefit, but that won’t necessarily make people switch. There will need to be a unique benefit to make this card a no-brainer, similar to the Citi Prestige’s 4th night free benefit, or the Chase Ritz-Carlton’s $100 airfare companion discount. Even a waived annual fee for the first year could encourage folks to try the card out.

Whether this will be a brand new credit card, or just an upgrade for the AMEX Platinum, one thing is for sure: this card should have everything that comes with the AMEX Platinum and more! More benefits added, and no benefits deleted.

Bottom Line

There is a rumor circulating about a new American Express credit card, dubbed “Tier One.”

The rumor suggests this card will have travel benefits that will compete with the Chase Sapphire Reserve and Citi Prestige. But we don’t know much at this point!

If you have the AMEX Platinum card, have you asked American Express about these rumors? What’s on your wish list for a new American Express card?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!