Yes! Just Got Approved for My First Personal Chase Credit Card in Nearly 3 Years – Southwest Companion Pass Here I Come!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Squee! I’m so excited – after holding off on applying for personal Chase cards for almost 3 years, I finally pulled the trigger on what’s shaping up to be the best Chase credit card offer this year. Instant approval!

For a limited time until February 11, 2019, all 3 Chase Southwest personal credit cards are offering a promotional Southwest Companion Pass (valid until December 31, 2019) AND 30,000 Southwest points after spending $4,000 on purchases in the first 3 months of account opening:

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

While the points are great and all (they’re worth ~$450 in travel and double that if you use your Companion Pass), earning a Southwest Companion Pass from just one Chase credit card is an incredible deal. With the Southwest Companion Pass, a friend or family member flies with you for nearly free on paid and award tickets (just pay taxes and fees, usually ~$6 one-way on domestic flights). It’s a massive savings.

So which Southwest Chase credit card did I get? Let’s just say it’s not the one I originally planned. 🙂

Approved! One Chase Credit Card = Unlimited Southwest Companion Pass Travel Until the End of 2019

Apply Here: Southwest Rapid Rewards® Premier Credit Card

Read our review of the Chase Southwest Premier card

Apply Here: Southwest Rapid Rewards® Plus Credit Card

Read our review of the Chase Southwest Plus card

Apply Here: Southwest Rapid Rewards® Priority Credit Card

Read our review of the Chase Southwest Priority card

The Southwest Companion Pass is, hands down, the best deal in travel. Having a friend or family member fly with you for nearly free an unlimited number of times while your pass is active is an incredible opportunity.

All 3 Southwest personal cards – the Southwest Rapid Rewards Plus Credit Card, Southwest Rapid Rewards Premier Credit Card, and Southwest Rapid Rewards Priority Credit Card currently come with 30,000 Southwest points AND a promotional Southwest Companion Pass (valid until December 31, 2019) after spending $4,000 on purchases in the first 3 months of account opening. But only until February 11, 2019 (just 2 weeks away).

Normally, to qualify for the Southwest Companion Pass, you’d need to earn 110,000 Southwest points in a calendar year. This deal is an absolute fast track!

Note: These cards are subject to the Chase 5/24 rule, so if you’re opened 5+ cards from any bank (not including certain small business cards) in the past 24 months, you won’t be approved. You’re also not eligible if you already have a personal Southwest card open, or received the bonus on one in the past 24 months. However, you are eligible if you have or have had the Southwest Rapid Rewards® Premier Business Credit Card, which has a different offer.

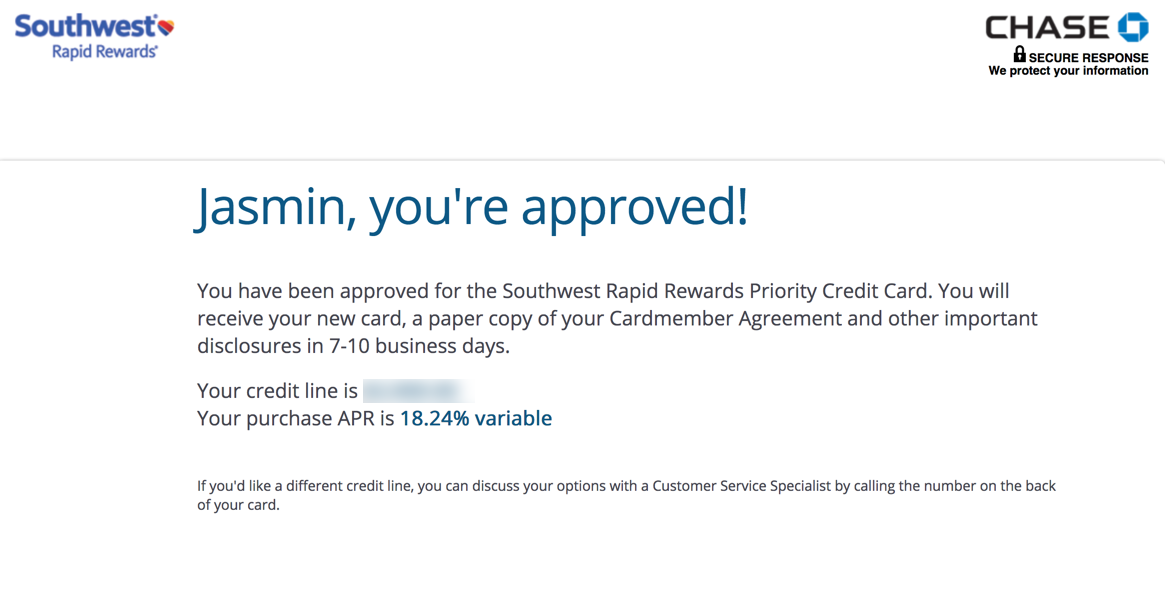

I ended up applying for the Southwest Rapid Rewards Priority Credit Card – and was instantly approved (despite being a little nervous given that I already have 6 Chase credit cards).

Originally, I’d intended to apply for the Southwest Rapid Rewards Plus Credit Card, because it has the lowest annual fee ($69) of the Chase Southwest personal cards. The Southwest Rapid Rewards Premier Credit Card clocks in at $99 per year, and the Southwest Rapid Rewards Priority Credit Card costs $149 per year.

So why’d I choose the Southwest Rapid Rewards Priority Credit Card, with the highest annual fee, over the others?

When I wrote about my new credit card strategy now that I’m well below 5/24, Million Mile Secrets reader Paul B commented with an excellent point:

Instead of the Southwest Rapid Rewards Plus, why not get the Southwest Rapid Rewards Priority? The annual fee is $149, instead of $69. However, the Priority card gives you a $75 travel credit, making the real difference only $5 ($149 – $75 = $74). For that $5 you get 7,500 points instead of 3,000 points on your account anniversary, and 4 free upgrades for early boarding.

Paul is totally right. The Southwest Rapid Rewards Priority Credit Card comes with additional perks the other 2 cards don’t have, like up to $75 in statement credits for eligible Southwest purchases and 4 upgraded boardings (position A1 to A15) each account anniversary year. When you take the $75 in statement credits into account, the net annual fee cost of the Priority card compared to the Plus card is only $5 more.

And on your account anniversary the Southwest Rapid Rewards Priority Credit Card gives you 7,500 Southwest points (worth ~$113 in Southwest airfare), while the Southwest Rapid Rewards Plus Credit Card only comes with 3,000 anniversary points (worth ~$45 in Southwest airfare).

So between the $75 in statement credits for Southwest purchases, upgraded boardings, and 7,500 anniversary points, you can actually come out ahead with the Southwest Rapid Rewards Priority Credit Card. It’s a keeper!

Bottom Line

I was instantly approved for the Southwest Rapid Rewards Priority Credit Card – the first personal Chase credit card I’ve opened in almost 3 years. And now I’m busy figuring out how the kids and I will make the most of the promotional Southwest Companion Pass (valid through the end of 2019) and 30,000 Southwest points it comes with after spending $4,000 on purchases in the first 3 months of account opening.

Actually, all 3 Southwest personal Chase credit cards have a similar offer, but only until February 11, 2019:

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

Earning the Southwest Companion Pass from a single Chase credit card is an outstanding (and unprecedented!) deal. With the Southwest Companion Pass, a pal (or a child, or partner, or parent – anyone you designate) can fly with you on paid and award tickets for nearly free – just the cost of taxes and fees. It’s gonna translate into big savings for my family and we can’t wait.

So where should we go first? I’m thinking we’ll use the Companion Pass on the Hawaii trip I’m planning once they start flying to the Aloha State. And maybe a few weekend trips up and down the East Coast to spots like Florida, the Caribbean, or Washington, DC.

Are you tempted by these personal Southwest Chase credit card offers? How would you use a Southwest Companion Pass?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!