Chase Southwest Premier credit card review

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you fly Southwest often, or if Southwest serves your home airport, you’ll get huge amounts of travel from the Southwest Rapid Rewards® Premier Credit Card. It’s got a solid sign-up bonus, and even comes with solid ongoing benefits like 6,000 points every cardmember anniversary, travel insurance and more. It’s certainly one of the best Southwest credit cards available.

Most importantly, the Chase Southwest Premier is a big boost if you’re trying to earn the best deal in travel, the Southwest Companion Pass. I’ll show you why.

Who is this card for?

First, we recommend you don’t apply for travel cards unless your credit score is 700 or above.

The Chase Southwest Premier card is also subject to Chase’s strict application policy, known as the Chase 5/24 rule. Chase won’t approve you for most of their cards if you’ve opened five or more cards from any bank (not counting Chase business cards and certain other business cards) in the past 24 months. If this is you, wait until you fall below five cards in 24 months.

Another important note is that it’s no longer possible to have more than one personal Southwest card at the same time.

Current bonus

With the Chase Southwest Premier, you can earn 40,000 Southwest points after spending $1,000 on purchases within your first three months of account opening.

Southwest points value is around 1.5 cents each (based on our valuations), so this 40,000 point bonus is worth ~$600 in Southwest travel. And those points will count toward the points needed to earn the holy grail of travel, the Southwest Companion Pass.

With the Companion Pass, you can bring a companion with you on any Southwest flight for nearly free (you’ll only be charged taxes, which is usually ~$11 for round-trip flights in the U.S.). This is a great way to enjoy more travel with your family and friends.

You’ll need to earn 125,000 Southwest points in a calendar year to earn a Companion Pass, which equates to a lot of flying (or spending). But one of the best perks of the Chase Southwest Premier card is that all points earned with this card count toward your Companion Pass, including the sign-up bonus. This makes it one of the easiest methods for earning the Companion Pass.

After you earn it, you can enjoy the Companion Pass for the remainder of the calendar year that you earn it in, plus the next year. So if you earned it tomorrow, you could bring a travel buddy for free through December 2021.

Benefits and perks of the Chase Southwest Premier

Bonus 6,000 Southwest points each year

Chase Southwest Premier cardholders earn 6,000 bonus points each year on their cardmember anniversary. These points have no minimum spending requirement; you simply get them each year you renew your card (i.e., pay the annual fee).

With an average value of ~1.5 cents per Southwest point, this bonus is worth ~$90 per year in travel on Southwest.

Car rental insurance

Since this card is designed for folks who like to travel, it is great to see a whole host of different travel benefits also offered through the Chase Southwest Premier.

When you book a rental car with this credit card, you will have the protection of car rental insurance against damage due to collision and theft. This coverage is secondary to your primary insurance. In other words, if you have auto insurance, this will only cover what your personal insurance doesn’t.

Baggage delay insurance

If your bags arrive at your destination six or more hours after you, then you and your immediate family are eligible for baggage delay compensation. You can receive up to $100 per day (maximum three days), but you must charge at least part of your airfare to your Chase Southwest Premier to be covered.

Lost luggage insurance

If your luggage is lost by the airline, you and your immediate family are covered for up to $3,000 per passenger. This coverage protects both your checked luggage and carry-on luggage that is damaged as a result of carrier negligence.

Travel accident insurance

When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive up to $500,000 in travel accident insurance. Examples of covered tragedies are:

- Loss of speech and hearing

- Loss of sight

- Loss of hands or feet

Extended warranty protection

It can be smart to use this card for everyday purchases. Not only will you earn Southwest points on all purchases but you can also enjoy purchase-protection benefits. This is especially useful when buying electronics and appliances.

With extended warranty protection, you’ll receive an additional year on eligible U.S. manufacturer’s warranties of three years or less. And you’re covered for a maximum of $10,000 per claim and $50,000 per account. So if you use your Chase Southwest Premier to purchase a TV that comes with a one-year warranty, the card will extend your warranty to a total of two years. That’s a pretty good deal, and it doesn’t cost you anything extra. Just make sure you use this card for your purchase.

This is especially cool since many things now are coming with manufacturer warranties of only 90 days.

Insurance against damage and theft

As an additional purchase protection, any eligible new purchases with your card are protected for 120 days against damage and theft. This applies up to $500 per claim and $50,000 per account.

You can read our post dedicated to Chase Southwest Premier benefits and perks for full details.

How to earn points with the Chase Southwest Premier

Here’s how to earn Southwest points with this card:

- 2 Southwest points per dollar on Southwest Airlines purchases

- 1 Southwest point per dollar on every other purchase

Southwest award prices are based on the cash price of the ticket. That means no blackout dates; you can reserve an award flight as long as there’s a seat for purchase.

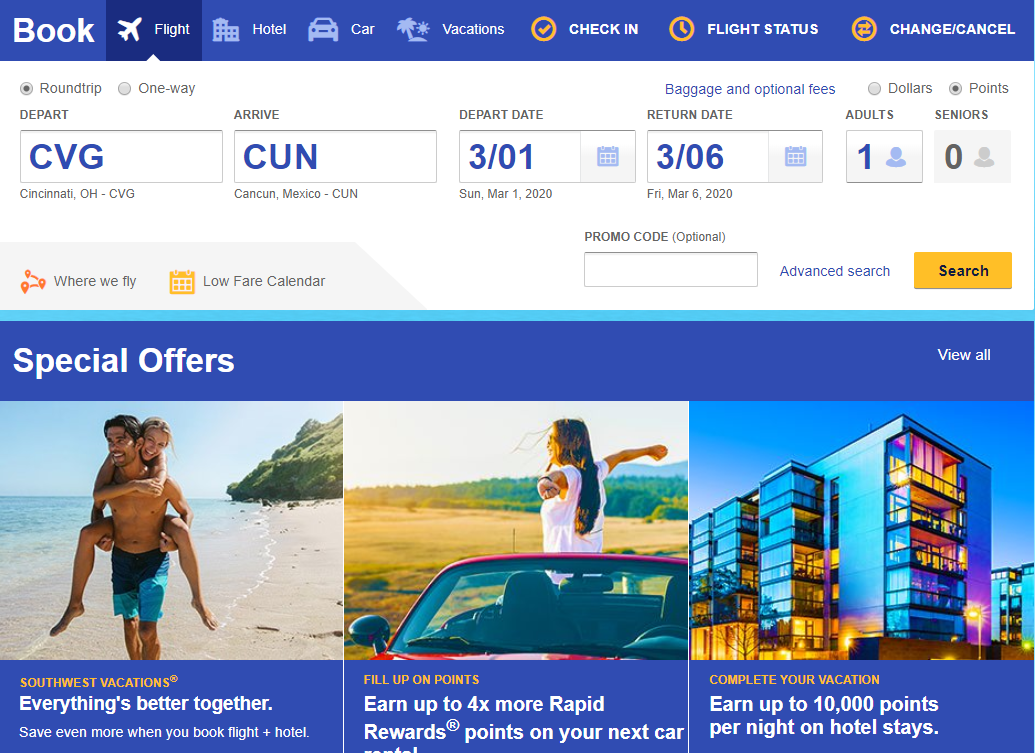

Again, Southwest points value is an average of ~1.5 cents each (it can be higher or lower) — so with the 40,000 Southwest points you’ll earn from this card’s sign-up bonus, you can expect to receive a value of ~$600. To use your points, make sure you’ve selected the “Points” box in the top right of the Southwest website. “Wanna Get Away” fares are the biggest bang for your points.

Southwest has an insanely generous cancellation policy. If you need to change a Southwest flight you reserved with either points or money, you can modify it for zero fees with Southwest, and if you need to cancel, the points or money you spent on the flight will be deposited into your Southwest account for future use.

You’ll always get two free checked bags and free cancellations and changes with any fare.

Is the annual fee worth it?

The card’s annual fee is $99 and is applied during your first billing statement.

This card doesn’t offer many super-helpful benefits compared to many of the best credit cards for travel. Even if you fly Southwest a lot and would get a great value from the two Southwest points per dollar on paid tickets, you can accomplish the same earning rate from the Chase Sapphire Preferred® Card (which everyone should have). That’s because you can transfer Chase Ultimate Rewards points from cards like the Chase Sapphire Preferred to Southwest at a 1:1 ratio.

Because you’ll receive 6,000 points every cardmember anniversary (worth about $90 in value for Southwest flights), you’re offsetting nearly all of the annual fee. If you’ll use any of the other benefits, the Chase Southwest Premier is worth the annual fee.

Insider secret

It’s true that you cannot have more than one personal Southwest card at once. However, you can hold a business and a personal card at once. In fact, earning both card bonuses would nearly qualify you for a Southwest Companion Pass! You need to earn 125,000 qualifying Southwest points in a calendar year to receive it. If you’re in the market for a Companion Pass, this is one of the best airline credit cards for you.

Bottom line

The Chase Southwest Premier comes with a welcome bonus of 40,000 Southwest points after meeting the minimum spending requirements. If you fly Southwest, you’ll have no trouble getting great value from this card. With the Southwest Companion Pass, a friend or family member flies with you for nearly free on paid and award tickets. If you make the most of it you could save hundreds (if not thousands) of dollars in airfare.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!