Southwest Priority Credit Card review

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Southwest Rapid Rewards® Priority Credit Card is the highest-qualify member of the Southwest family of credit cards offered by Chase. With the card, you’ll earn around $1,125 in Southwest travel after meeting the card’s tiered minimum spending requirements. The Chase Southwest Priority also comes with a slew of terrific benefits, including a $75 travel credit and 7,500 Southwest points on your card anniversary.

You can apply for the Southwest Rapid Rewards® Priority Credit Card here.

Here’s our Southwest Priority card review.

Who is this card for?

If you fly Southwest often or have a Southwest hub nearby, this is one of the best airline credit cards for you. You can receive $1,500+ in value from the card in the first year. I’ll show you how in just a minute.

First note that the Southwest Priority card is subject to Chase’s strict application policy, known as the Chase 5/24 rule. Chase won’t approve you for most of their cards if you’ve opened five or more cards from any bank (not counting Chase business cards and certain other business cards) in the past 24 months.

Also, if you’ve already got a Southwest personal credit card, you’re not eligible to open this one. And we recommend that you don’t apply for travel credit cards if your credit score is below 700.

Current bonus

The best way to earn Southwest points is by opening a Southwest credit card.

You’ll earn up to 75,000 Southwest points after meeting tiered spending requirements:

- 40,000 points after spending $1,000 on purchases within the first three months of account opening

- 35,000 more points after spending $5,000 on purchases within the first six months of account opening

This is the highest we’ve ever seen this card’s bonus. A Southwest point’s value is ~1.5 cents (and sometimes more), so it’ll be easy to get at least $1,125 worth of travel from the 75,000-point bonus.

A Southwest award chart doesn’t exist — the price you’ll pay in points is based on the cash price of the ticket. This means you’ll never have blackout dates when redeeming your hard-earned points. Plus, everyone gets two free checked bags and there are never any change or cancellation fees on Southwest.

Benefits and perks

Southwest Companion Pass

The Southwest Companion Pass is one of the best deals in travel. The Southwest Priority Card’s welcome bonus and the points you earn from spending on the card both count toward earning the pass. To earn a Companion Pass you need to complete one of the following tasks in a calendar year:

- Fly 100 qualifying one-way flights

- Earn 125,000 qualifying Southwest points

Once you earn the Companion Pass, a friend or family member can travel with you on paid and award flights for just the cost of taxes and fees. This can easily save you hundreds of dollars per flight. I use this for flights with my fiancé and we saved $1,000+ last year alone.

$75 in Southwest travel credits every year

Each year, you’ll receive $75 in statement credits after making eligible Southwest purchases. Basically, any Southwest purchases except for upgraded boarding and inflight purchases qualify. You can use this credit to purchase a ticket and effectively cut your annual fee in half.

7,500 anniversary points

Every year on your account anniversary, you’ll receive 7,500 Southwest points (worth ~$113 in airfare). That’s a nice way to offset most of the annual fee.

Four upgraded boardings

On your day of travel, when available, you can purchase an upgraded boarding. My last flight to Chicago was offering these upgrades for $50. Just use your card to purchase the upgrade and you’ll receive a statement credit up to four times per cardmember year. That’s worth up to $200.

20% back on inflight purchases

When you purchase inflight drinks, entertainment and Wi-Fi, you’ll receive 20% back in statement credits with no maximum. Wi-Fi is available for $8 per device, per flight. So you can save ~$2 when you purchase Wi-Fi.

Earn tier qualifying points

You earn 1,500 tier qualifying points (TQP) for each $10,000 you spend with your card on up to $100,000 in purchases every calendar year (15,000 TQP). These points count toward earning Southwest status.

How to use points with the Southwest Priority Card

It’s easy to earn points with the Southwest Priority Card. You can earn points in three ways:

- 2 Southwest points per dollar on Southwest Airlines purchases, including airfare

- 1 Southwest point per dollar on every other purchase

- 7,500 Southwest points each year on your card anniversary

Southwest award prices are based on the cash price of the ticket. This means no blackout dates as along as a paid ticket is available, but it also means no defined-award pricing. In general, Southwest points are worth ~1.5 cents each, but I’ve seen them go up to 1.8 cents each, and occasionally higher.

You can only redeem Southwest points for Southwest flights. In addition to award flights, you can also donate your points to charities or gift your points to another Southwest frequent flyer program member.

It’s really easy to redeem your Southwest points using their website or mobile app. In fact, they have a really fancy map that shows you all the routes they fly. I use this for inspiration when I want to see where I can travel.

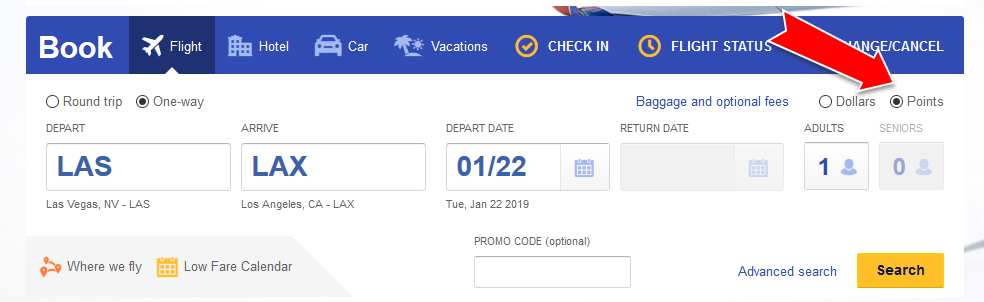

To use your points, click on the “Points” button in the top right when searching for flights. On the next screen, you’ll see three columns showing you Business Select, Anytime and Wanna Get Away fares. The latter will offer the best value for your points. You’ll always get two free checked bags and free cancellations and changes with any fare. Select the flight you want and hit continue.

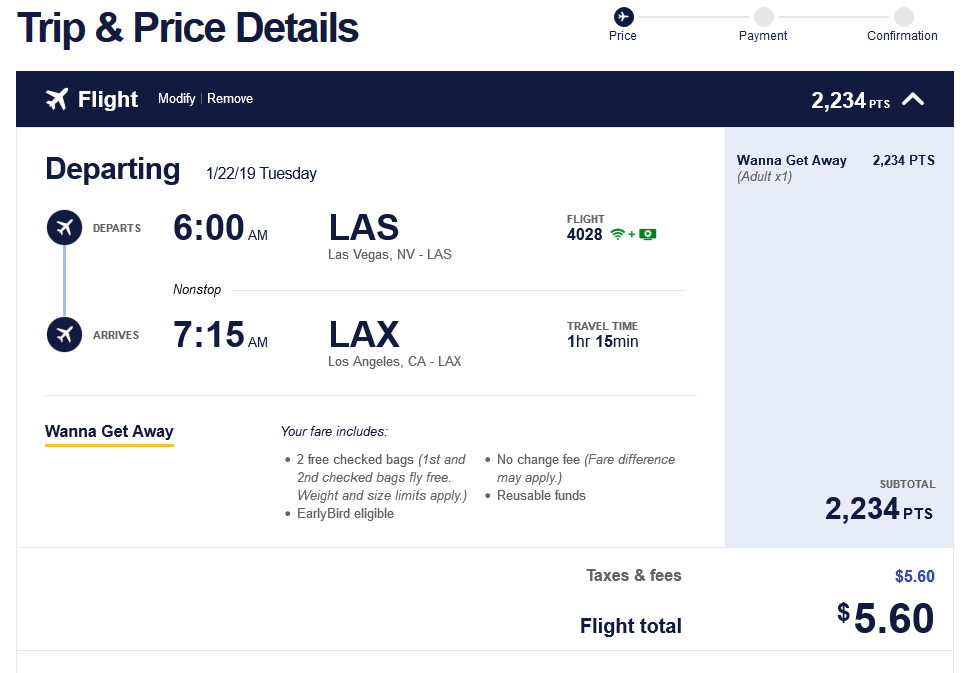

The next page shows you your specific itinerary, your points cost, and the taxes and fees (usually ~$6 for a one-way domestic flight).

If you ever need to cancel or change your flight, just head to your account page. You can see your future flights and choose the “Cancel/Change” button to see your options. If you don’t like any of the alternatives, you can cancel your flight. Your points will return to your account and your ~$6 will be refunded to your credit card or can be held on your account for future use — your choice.

Is the annual fee worth it?

True, the card’s annual fee is $149. But you can receive $1,500+ in value from the card in the first year:

- At least 80,000 points after earning the intro bonus and including the points earned by meeting spending requirements (worth $1,200 based on our Southwest points value estimation)

- $75 statement credit annually

- $113 in points (based on our Southwest points value estimation) annually

- Up to $200 in upgraded boardings annually

This is hands down one of the best Southwest credit cards.

Insider secret

This card may have the highest annual fee of all the Southwest personal cards, but it’s the only one that can entirely negate the annual fee every single year with no effort on your part. So long as you fly Southwest a couple times each year, you’ll receive ~$188 in free airfare thanks to a $75 Southwest statement credit and 7,500 Southwest points for renewing your card each year.

Those perks makes it the least expensive Southwest personal card — and one of the best credit cards for travel.

Bottom line

The Southwest Priority Card is the top dog among all the Chase Southwest personal cards. You’ll earn 75,000 Southwest points (worth ~$1,125 in travel) after meeting minimum spending requirements. The card offers a recurring value of nearly $400 for only a $149 annual fee (not including the value from the highest-ever welcome bonus).

If you fly Southwest often, you’ll get great use of this card. You can apply for the Chase Southwest Priority card here.

Subscribe to our newsletter for more in-depth analysis of the best credit cards for travel like this in the future.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!