Chase Southwest Plus card review: Biggest ever bonus worth more than $1,100

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Southwest is a Chase transfer partner, so you can earn points with cards like the Chase Sapphire Preferred® Card, then move them directly to your Southwest frequent flyer account.

However, transferring points will not count toward earning the Southwest Companion Pass, which we consider to be the best deal in travel. That’s why many choose to apply for Chase Southwest credit cards, like the Southwest Rapid Rewards® Plus Credit Card, which currently has an increased bonus worth up to 75,000 Southwest points after meeting the card’s tiered minimum spending requirements. That’s worth ~$1,125 in travel on Southwest. The card also has the lowest annual fee among any of the available Southwest credit cards.

Here’s our full Southwest Plus card review.

Who is this card for?

Whether you fly Southwest with any regularity or not, this card provides an excellent way to rack up Southwest points with an unusually low annual fee of $69. It’s the cheapest Southwest card to hold, so it’s very low risk if you decide the card doesn’t fit your lifestyle. If your travel goals include domestic flights, flights to Hawaii, the Caribbean, Mexico, or Central America, pay attention to this card.

However, we don’t recommend anyone apply for travel credit cards unless they’ve got a credit score above 700. If that’s not an issue for you, there are some other rules you should know:

- The Chase Southwest Plus card is subject to the Chase 5/24 rule. If you’ve applied for five or more credit cards from any bank (excluding certain business credit cards) in the past 24 months, Chase won’t approve you for this card

- It’s no longer possible to have more than one personal Southwest card at the same time. If you have a Southwest personal card, you’ll need to cancel it before you open this one (you can still get one or more business cards and a personal card)

- If you previously had the Chase Southwest Plus card, you should be able to earn the bonus again as long as it has been at least 24 months since you previously earned it

Current bonus

You’re going to want to sit down for this. When you open the Chase Southwest Plus card, you’ll earn up to 75,000 Southwest points after meeting tiered minimum spending requirements:

- 40,000 points after spending $1,000 on purchases within the first three months of account opening

- 35,000 more points after spending $5,000 on purchases within the first six months of account opening

You’ll find that Southwest points value hovers around 1.5 cents each for Southwest flights. That makes this highest-ever 75,000 point offer worth ~$1,125 in Southwest flights. Unbelievable value for a card with such a small annual fee.

Benefits and perks of the Southwest Plus card

The Southwest Plus card benefits include valuable travel and shopping protections and perks, and can make the annual fee worth paying year after year.

Southwest Companion Pass

The Southwest Companion Pass is the best deal in travel — it allows you to bring along a travel buddy for just the cost of taxes and fees, every single time you fly Southwest. The Chase Southwest Plus bonus can get you more than halfway to earning it.

To qualify for the Southwest Companion Pass, you’ll need to earn 125,000 qualifying Southwest points in a calendar year. The easiest way to earn the Companion Pass is by opening one personal and one business Southwest card and meeting minimum spending requirements.

Once you’ve earned the Companion Pass, a friend or family member can travel with you on paid and award flights for nearly free (just the cost of taxes and fees). Some of us on the Million Mile Secrets team have saved thousands of dollars with the Companion Pass.

3,000 Southwest points every year

Each year on your cardmember anniversary, you’ll receive 3,000 bonus Southwest points. At a value of 1.5 cents per point, that’s worth ~$45 in airfare and knocks out most of the annual fee cost.

Rental car insurance

When you decline a car rental company’s collision insurance and charge the entire rental to your Southwest Plus card, you’ll be covered for theft and collision damage on most rental cars. In the U.S., this coverage is secondary to your personal insurance.

Baggage delay insurance

If you use your Southwest Plus card to pay for your flight, you can get reimbursed for essentials like toiletries and clothing if your bags are delayed for more than six hours. Coverage is up to $100 per day for three days.

Lost luggage reimbursement

If you or an immediate family member’s checked or carry-on bags are damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

Purchase protection

The Chase Southwest Plus protects your eligible new purchases for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

Extended warranty

The Chase Southwest Plus extends the time period of a U.S. manufacturer’s warranty by an additional year on eligible warranties of three years or less.

Travel accident insurance

When you use your card to purchase an eligible trip, you’ll receive travel accident insurance for yourself and immediate family. This includes accidental death, dismemberment and loss of speech, sight and hearing. Coverage extends up to $500,000.

Travel and emergency assistance services (Visa Signature only)

If you’re traveling and need help with relaying an emergency message back home or need a medical or legal referral, you can call the Benefits Administrator for help 24 hours a day. You will be responsible for the cost of any goods or services obtained.

Roadside Dispatch

For a flat fee per call, you can get roadside dispatch for common mishaps like:

- Towing – up to five miles included

- Tire changing – must have good, inflated spare

- Jump-starting – battery boost

- Lockout service (no key replacement)

- Fuel delivery – up to five gallons (cost of fuel not included)

- Winching (within 100 feet of paved or county-maintained road only)

To access roadside dispatch, call 800-847-2869. It’s not free (~$60 per call), but it’s helpful if you don’t have your own roadside coverage.

How to redeem points

With the Chase Southwest Plus, you’ll earn Southwest points in three ways:

- 2 Southwest points per dollar on Southwest purchases, including airfare

- 1 Southwest point per dollar on everything else

- 3,000 Southwest points after your cardmember anniversary

The number of points you’ll pay for a Southwest award flight is based on the cash price of the ticket. What makes Southwest points so valuable is that there are never any blackout dates. If there’s a seat for sale on the airplane, you can use Southwest points to book it. Check out our post on the best ways to use Southwest points.

Again, Southwest points value are ~1.5 apiece. The 75,000 Southwest point welcome bonus is worth about $1,125 in flights.

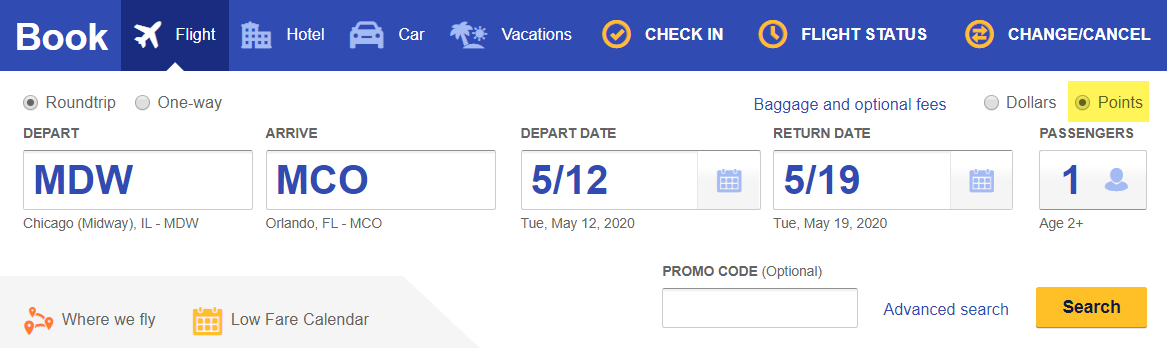

Redeeming your points is a very straightforward process. Head over to the Southwest website and search for flights as you normally would, including departure and destination airport, dates of travel and number of passengers. Be sure to check the “Points” box in the top right corner of the page. Look for Wanna Get Away fares because these are the cheapest and cost the fewest number of points.

You’ll then get a list of flight options with their corresponding points cost. When there’s a fare sale, you’ll pay fewer points, but expensive last-minute flights cost a lot more.

Another reason we love using Southwest points is the airline’s generous change and cancellation policy. If you need to modify a Southwest flight (whether paid with cash or points), you won’t pay any fees, unlike other airlines. And if you need to cancel, the points or cash you spent on the flight are deposited into your Southwest account for future use.

Plus, you’ll always get two free checked bags on Southwest. Most other airlines charge $30 for a first bag and even more for the second, so this can translate into tremendous savings.

Is the annual fee worth it?

The Chase Southwest Plus annual fee is $69 and is applied during your first billing statement. It’s absolutely worth the fee to earn 75,000 Southwest points after meeting the card’s tiered minimum spending requirements.

As for the long term, you’ll earn 3,000 points every cardmember anniversary. Because Southwest points are worth ~1.5 cents each toward Southwest flights, you can get a value of $45 from your anniversary points (1.5 cents per point x 3,000 points).

With this perk alone, you’ll cover most of the cost of the annual fee, and if you make use of any of the other benefits, you come out way ahead.

Insider secrets

This card’s bonus in positively unignorable. It’s a jaw-dropping deal, and I’m not just saying that. However, even if you fly Southwest regularly, you’ll often do better to reserve your flights with a non-Southwest credit card, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®. You’ll earn an equal (or greater) number of Chase points for your purchase than you would Southwest points — and Chase points transfer to Southwest at a 1:1 ratio. Plus, you’ll get improved travel insurance, such as baggage delay insurance and trip delay insurance.

Read our Chase Sapphire Preferred review for more details.

Bottom line

Currently, when you sign up for the Chase Southwest Plus card, you’ll earn an all-time high 75,000 Southwest points after meeting the tiered minimum spending requirements.

The sign-up bonus and the points you earn from making purchases with the Chase Southwest Plus card count toward earning the Southwest Companion Pass, the top deal in travel. With the Companion Pass, you can add a designated friend or loved one to your paid or award reservation for just the cost of taxes and fees, which is typically ~$11 for round-trip flights within the U.S.

You can apply for the Chase Southwest Plus card here.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!