Which Has Better Discounts, AMEX OPEN or Visa SavingsEdge?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Update: The Chase Ink Plus 70,000 point offer is no longer available, but check Hot Deals for the latest offers!Beyond the sign-up bonuses for the Ink Plus card (70,000 Chase Ultimate Rewards points) and AMEX SimplyCash ($250), both cards give you access to business savings programs.

Ink Plus gets you discounts with Visa SavingsEdge while AMEX SimplyCash entitles you to save at the merchants participating in AMEX OPEN.

But which is better for your situation?

Here’s a look at where you can earn points for travel or save money with each program.

Where You’ll Save Money or Earn Points With AMEX OPEN

Link: My full review of AMEX OPEN

You can choose to earn discounts or American Express Membership Rewards points when you shop at the participating merchants using your American Express business card.

Note: You only have the option to earn American Express Membership Rewards points if you have a Membership Rewards card. The AMEX SimplyCash and Starwood Preferred Guest Business from American Express are NOT such cards. Instead you’ll earn cash back.You can see my full review of AMEX OPEN to get all the details on where you’ll save money. But for most folks with small businesses, you’ll probably get the best deals with FedEx and Hyatt.

You’ll also save between 3% and 10% at Hertz depending on how much you spend per year. But I prefer other ways to save money on rental cars.

And I’d use a card such as the Ink Plus or Ink Bold to get primary rental car insurance.

1. FedEx

When you enroll your American Express business card in the AMEX OPEN program, you’ll automatically get a 5% discount on your statement or 2 additional Membership Rewards points (if your card earns them).

You get the discount on up to $20,000 per year per card on your combined purchases with FedEx Express and FedEx Ground.

You get the same discount on up to $20,000 of spending with each card with FedEx Freight.

And you get the 5% automatic rebate or 2 additional Membership Rewards points on up to $20,000 of spending at FedEx Office.

The FedEx Office discount can be a great deal for real estate agents making signs and sending out postcards. It can also make sense for small businesses handing out flyers and brochures.

You can also use FedEx Office to create invitations and banners announcing grand openings or sales.

For travelers like us, FedEx Office can be a convenient place to get a new passport photo.

The Chase Ink Plus, Ink Bold, and Ink Business Cash Credit Card get you 5X Chase Ultimate Rewards points (or 5% cash back) at office supply stores. And your American Express business card can get you the same discount at FedEx Office when you enroll in AMEN OPEN.

2. Hyatt

When book a paid stay at Hyatt, Park Hyatt, Hyatt Regency, Andaz, or Grand Hyatt hotel, the AMEX OPEN program reduces your bill by 5% with a statement credit. Or you can choose 2 additional Membership Rewards points per $1 spent.

This applies on up to $10,000 of spending per card per year.

And remember, AMEX SimplyCash gives you another 3% back when you choose hotels as your 3% savings category.

The Chase Ink Plus and Ink Bold earn 2X Chase Ultimate Rewards points (or 2% cash back) when you purchase rooms directly from the hotel. And those cards are eligible for more hotel discounts with the Visa SavingsEdge program.

Where You’ll Save Money With Visa SavingsEdge

Link: My full review of Visa SavingsEdge

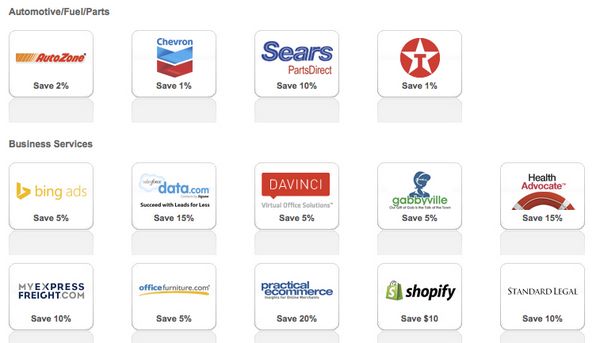

Visa SavingsEdge has many more merchants participating than AMEX OPEN. I’ll highlight the ones you’ll probably use the most. But check their full list to see where else you can save!

For instance, you’ll get discounts at Alamo and National, but I prefer better ways to save money on rental cars.

1. Hotels

You’ll save 5% when you book directly with a participating hotel. This includes:

- Days Inn

- Hawthorn

- Howard Johnson

- La Quinta

- Ramada

- Super 8

- Travelodge

- Wyndham

So when you book directly with these hotels using your Chase Ink Plus or Ink Bold, you’ll save a total of 7%. That’s because Ink Plus and Ink Bold save you 2% when booking rooms directly with the hotel.

The 2% savings is on the 1st $50,000 you spend at hotels and gas stations combined per card year.

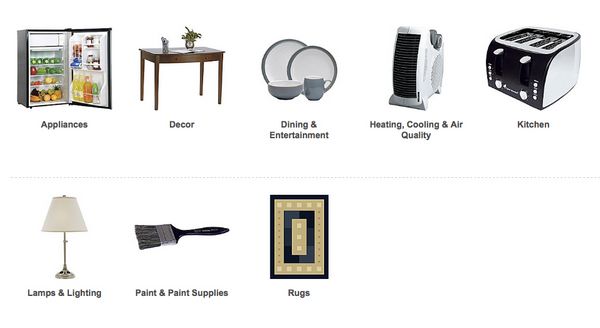

2. Staples

When you spend at least $200 at Staples in the US or online, you get 1% back. You might find that useful if you’re buying Visa gift cards, the new iPhone, a computer, or bulk purchases of granola bars for your wife.

And remember you get 5% back (or 5X Chase Ultimate Rewards points) when you use your Chase Ink card at Staples or other office supply stores.

See my full review of Visa SavingEdge for other ideas. But keep in mind the list of stores changes periodically.

Which Program Is Better for You?

For folks who already have an American Express business card or Visa business card, it makes sense to enroll in AMEX OPEN or Visa SavingsEdge because they’re free. However they may use your purchasing data to better market those granola bars.

If you’re trying to decide between applying for an AMEX business card such as the AMEX SimplyCash or Chase business card such as the Ink Plus, the other merits of each card will probably outweigh the benefits of their savings programs.

That said, if you spend A LOT at 1 of these merchants, it could be a big enough savings to influence your decision.

For instance, businesses who do lots of FedEx shipping could do very well with AMEX Open! And businesses who book lots of paid stays at budget hotels could be very happy with Visa SavingsEdge.

Bottom Line

It makes sense to enroll your American Express business card in the AMEX OPEN program. Here are all the discounts but some folks will especially like the savings at FedEx and Hyatt.

And you can save money by linking your Visa business card, such as the Chase Ink Plus or Ink Bold, to the Visa SavingsEdge program. You’ll save at over 30 places but Staples and participating budget hotels might be the most interesting.

Unless you spend a huge amount at a participating merchant, neither program will likely influence you to get 1 card over another.

But AMEX OPEN and Visa SavingsEdge are certainly great ways to save extra cash on purchases you’ll be making anyway!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!