7 tricks to upgrade your travel experience before you even get to your destination

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

This post has nothing to do with booking free flights or free hotels or free rental cars. We tell you how to do that stuff all the time.

Vacation for most people begins once they step foot off the plane at their destination. But for a miles and points hobbyist, the adventure begins much earlier. If you use the below techniques, you can enjoy the commute — not just the destination.

These are some things miles and points enthusiasts do every trip — but we hardly think about them being anything special anymore. But vacation with someone who isn’t in the points world, and you’ll revolutionize their travel experience. I remember my wide-eyed boyish wonder when I discovered there was a way for me to skip the long TSA lines with an exclusive security lane. Or when I first learned how to gain access to those fancy airport lounges with sliding automatic glass doors.

Below is a list of various tips we write about often — but here’s what they look like when you put them all together during a trip. Some are by taking advantage of travel credit card perks, and some are not. Comment if I’m missing a “hack,” you use, and I’ll add it to the post!

Planning your trip like a miles and points enthusiast

Insure your luggage

Our packing master list offers guidance on how to plan for your travel day, with suggestions like choosing identifiable luggage, making digital and physical copies of all your important documents, and wearing elasticated clothing. You can check out her helpful checklist below, and download it here.

Another practice that anyone who’s experienced delayed checked luggage regularly executes is cross-packing — it’s a way of ensuring you’ve got at least some necessities when you get to your destination. If you’re traveling with a buddy, you can put some of your clothes in their bag, and some of their clothes in your bag. If one bag gets lost, you’ve both still got enough clothing that you don’t have to walk around naked until your bag shows up.

One of the biggest perks in the travel credit card game (to me, at least, as my bags have been lost/delayed three times), is delayed baggage insurance. I’ve received close to $1,000 in reimbursements from Chase over the years for my baggage being delayed — once for a full 40 days during a trip to Ireland.

As long as you pay for your trip (even just the taxes and fees if you’ve booked an award flight) with a credit card that offers baggage insurance, you’ve got nothing to worry about. You’ll be reimbursed for toiletries, new clothes, and various other necessities.

How to do it: Book with one of the following cards:

- Chase Sapphire Preferred® Card: Triggered after 6+ hour delay, $100 per day for up to five days

- Chase Sapphire Reserve®: Triggered after 6+ hour delay, $100 per day for up to five days

- World of Hyatt Credit Card: Triggered after 6+ hour delay, $100 per day for up to five days

- United℠ Explorer Card: Triggered after 6+ hour delay, $100 per day for up to three days

All these cards give you a maximum of $500 per family member with a delayed bag.

Free checked bags

U.S. airlines typically charge $30 each way for bags when flying domestically. That’s an absolute ripoff (though Southwest still shines as a beacon of light with their free checked baggage policies).

If you’re not flying Southwest, you need a game plan for your checked bags — or you’ll receive a large bill on your credit card, despite using points and miles to reserve free flights. This is especially the case for large families traveling together.

If you’re in the miles and points game, you’re not paying for checked bags. It’s against your moral and ethical code.

How to avoid checked baggage fees: The best credit cards for checked baggage fees tend to have sub-$100 annual fees. That means if you flew just two domestic round-trips per year, you’d have completely offset the annual fee. And if you’re traveling with a partner, you’d save well over $100. The best cards for avoiding checked bags are:

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®: Best credit card for free American Airlines bags

- United℠ Explorer Card: Best credit card for free United Airlines bags

- Delta SkyMiles® Gold American Express Card: Best credit card for free Delta bags

- Barclaycard JetBlue Plus Card: Best credit card for free JetBlue bags

- Alaska Airlines Visa Signature® credit card: Best credit card for free Alaska Airlines bags

The information for the Citi AAdvantage Platinum Select, Barclaycard JetBlue Plus, and Alaska Airlines Visa Signature has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

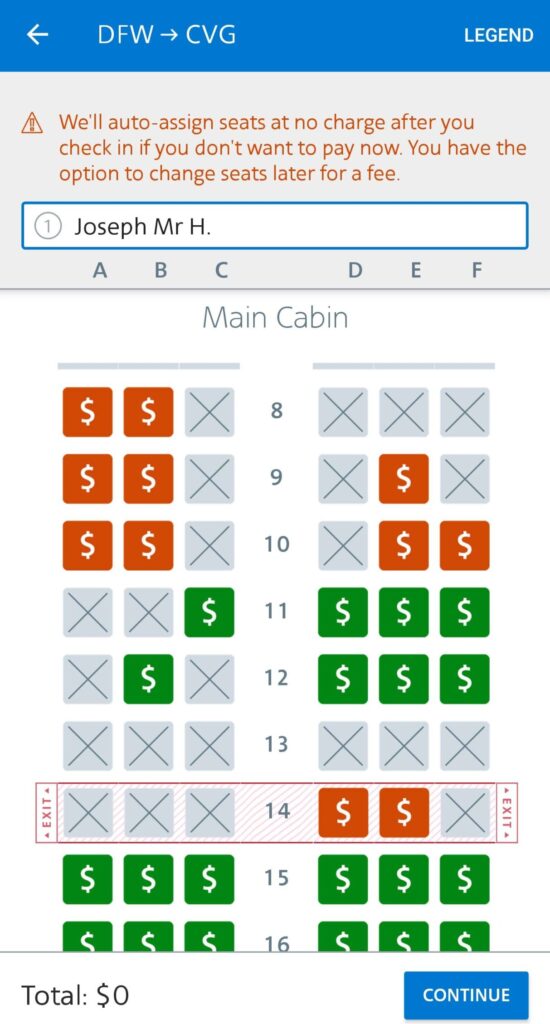

Let the airline choose my seats

This is kind of a gamble, but more often than not it pays off. If I look at my seat map a few days before my flight and I see very few empty seats, I will skip picking my own seat. Nobody wants to pay extra for Main Cabin Extra or Preferred Seating (those ones near the front of the plane), so those are pretty well guaranteed to be vacant.

While most other passengers view the seat map and quickly choose the best free seats that are still available, some of us wait in hopes that all other free seats will be snatched up. At that point, the airline has no choice but to assign you to a seat that they’d have otherwise charged for. It doesn’t always work, but it’s fun knowing you’re getting something for free that the airline wanted you to pay for.

TSA PreCheck

TSA PreCheck is a program that puts you on a special flyer list. You get a higher security clearance than tens of millions of U.S. travelers, and you don’t have to waste time in those demoralizingly long TSA lines.

Maybe I’m making it sound cooler than it is. TSA PreCheck allows you to zoom through airport security in a special lane. You don’t have to take off your shoes, belt, or jacket. You don’t have to remove your laptop or toiletries from your bag. Basically, TSA considers you trustworthy enough to skip all that jazz. Sometimes you can get through security practically without adjusting your gait.

How to get TSA PreCheck: You can pay $85 for a TSA PreCheck application. Or, you can use one of the top credit cards for TSA PreCheck, which comes with a trusted traveler statement credit that reimburses your application fee (worth up to $100), such as:

- United℠ Explorer Card

- Capital One Venture Rewards Credit Card

- Chase Sapphire Reserve®

- The Platinum Card® from American Express

Note: The trusted traveler statement credit that comes with these cards can instead be used for Global Entry, a program that allows you to skip the immigration lines when returning to the U.S. from another country (a $100 value). Global Entry comes with TSA PreCheck, so this is the better option.

Airport lounges

Once inside airport security, you’re not going to want to await your flight in the terminal with the thousands of commoners who just don’t know better.

Airport lounges vary dramatically in quality, but you’ll almost always find light snacks, free alcohol, free Wi-Fi and plenty of electrical outlets. Gone are the days of huddling next to a wall on the cold porcelain tiles of a concourse thoroughfare to keep your phone from dying.

Some facilities — like Amex Centurion lounges — offer full-on hot meals with premium alcoholic beverages.

How to get airport lounge access: Many credit cards offer airport lounge access with varying privileges. Lounge memberships that come with unlimited visits are offered by cards that have $450+ annual fees. A few less-premium cards offer access with a limited number of visits each year. Here are the best cards with airport lounge access:

- The Platinum Card® from American Express: Most comprehensive lounge access of any card (read here); up to two complimentary guests for most lounges (enrollment required)

- The Ritz-Carlton™ Credit Card (card no longer available for new applicants): Unlimited Priority Pass lounge access; unlimited guests

- Chase Sapphire Reserve®: Unlimited Priority Pass lounge access; up to two complimentary guests

- Hilton Honors American Express Surpass® Card: 10 complimentary visits annually; each guest counts as one visit (enrollment required)

- United℠ Explorer Card: two, one-time passes to United Clubs per year

The information for the Hilton Surpass has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

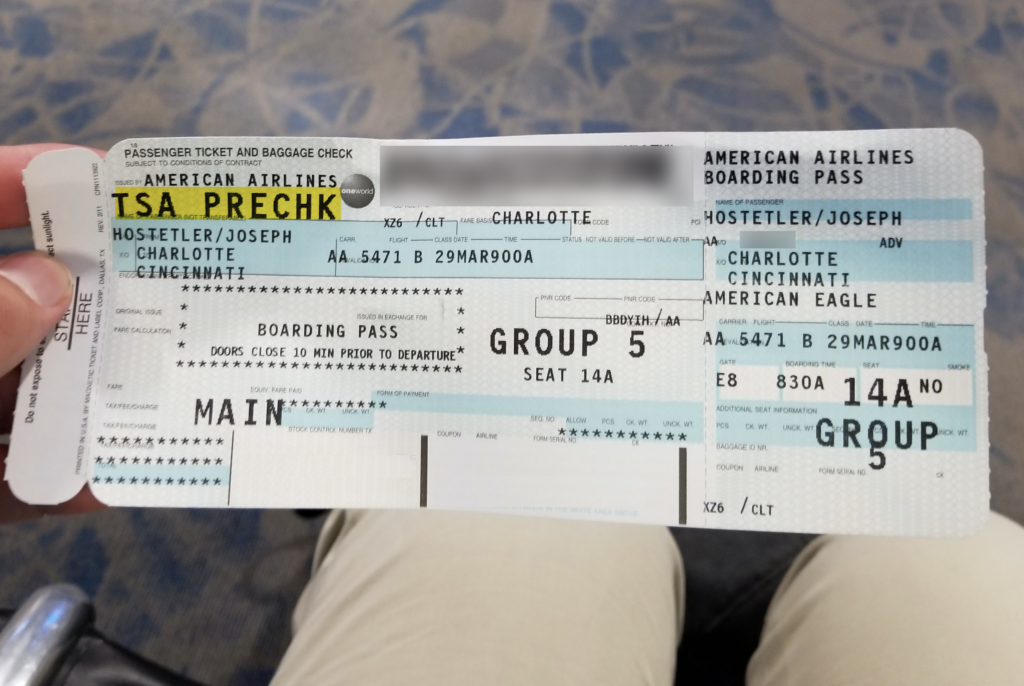

Preferred boarding

Do you notice how when an airline’s boarding process begins, all travelers, even the ones that are in the dead-last boarding group, begin unpacking starting blocks from their carry-on? Getting on the plane as quickly as possible is bafflingly important to people.

However, if you’re in the last couple of boarding groups, it does become a bit worrying if you’ve got carry-on luggage. Overhead bin space is a precious commodity on a full flight. I’ve been the one walking up and down the aisle analyzing whether or not I can manipulate other travelers’ bags. You don’t have to be the first one on the plane, but you do not want to be the last.

How to get on the plane sooner: Most airline credit cards come with some kind of preferred boarding perk. Some even come with Priority Boarding, which means you’re lumped into the group with those who have airline elite status or anyone who paid for Premium Economy.

You won’t make the first footprint on the plane, but you’ll have plenty of overhead bin space to choose from — guaranteed. The best cards for this are:

- Citi® / AAdvantage® Executive World Elite Mastercard®: Priority (group 4)

- Delta SkyMiles® Gold American Express Card: Main Cabin 1 (group 5)

- United℠ Explorer Card: Group 2 (group 5ish)

Note that you may not want to rush onto a plane while it’s still boarding due to COVID-19 concerns.

Free inflight Wi-Fi

Not a miles and points tip, but T-Mobile gives you inflight Wi-Fi for free on:

- Alaska Airlines

- American Airlines (not all flights)

- Delta

Depending on which plan you have, you may get an hour for free — or unlimited access for all flights (Magenta Plus, ONE Plus or ONE Plus International). Inflight Wi-Fi costs can be exorbitant, so this can save a lot if you’ve got things to do.

You don’t even have to be a T-Mobile customer yourself — you can just input a friend or family member’s number who has T-mobile and you should be good to go.

Bottom line

Booking your trip with points and miles saves you loads of money on airfare and accomadation, but there are plenty of ways to save cash and upgrade your travel experience before you even reach your destination. Subscribe to our newsletter for tricks to getting free travel with minimal effort.

And let me know if there’s a tip you use at the airport that’s not on this list!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!