How (and why) to pay your taxes with a credit card in 2021

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It’s that time of year again. This tax season, you might be wondering if you can earn miles, points or cash back for paying taxes with one of the best travel credit cards. If you owe money, it’s a good time to consider a strategy for earning the most rewards for spending you’ll have to make anyway. Paying taxes is a great way to meet credit card minimum spending requirements or hit a spending threshold to earn elite status or other perks.

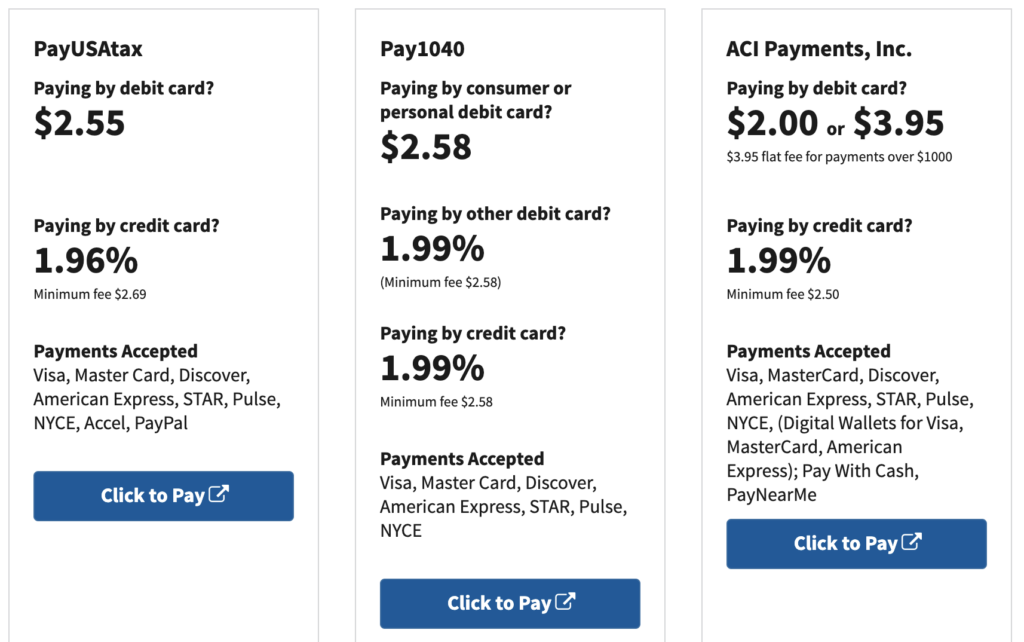

It’s not free to pay taxes with a credit card. At a minimum, you’ll pay a convenience charge of 1.96% through one of the IRS’s approved payment processors. But this can be worth it if it means unlocking a big welcome bonus or racking up points worth more than the fees you’ll pay.

Paying taxes with a credit card doesn’t always make sense. I’ll show you how to do it and whether or not it’s a good idea for you.

Can you pay taxes with a credit card

The IRS lets you pay taxes with a credit card, but you can’t pay them directly. Instead, you’ll have to go through a 3rd-party payment processor.

Unfortunately, the IRS has slightly raised card processing fees in 2021. The cheapest credit card processor is PayUSAtax, which works for personal and business taxes. They charge a 1.96% fee and allow payments with Visa, Mastercard, American Express and Discover.

Don’t worry, you will not be charged cash advance fees when you pay with a rewards credit card. It’s even in the payment processor FAQs:

Will I be charged a cash advance fee?

No, your tax payment will be treated like a retail purchase and not a cash advance.

I’ve paid taxes using Pay1040 several times and have never been charged a cash advance fee. Each time, the process was easy and painless.

When should you pay taxes with a credit card for points?

If you can’t pay your credit card balance in full and on time, paying taxes with a credit card usually does not make sense. You’ll pay interest that will negate any rewards you earn, on top of the payment processing fee.

However, it’s a good strategy to use a credit card in some situations. For example, if you:

- Want a fast and convenient way to meet minimum spending requirements for a new card welcome bonus

- Need to meet a spending threshold to earn elite status, elite qualifying miles or other big spender perks like free hotel night certificates

- Can earn more miles and points than the fees you’ll pay with certain rewards credit cards cards

But if you have certain cards or card combinations, you can actually earn travel rewards from your tax payments that can be worth double what you pay in fees.

Paying taxes to earn a welcome bonus

For most, paying taxes to meet a minimum spending requirement is the most logical option if you have to stomach a 2% fee.

Let’s say you owe $5,000 in taxes and use PayUSATax — you’d have to pay $98 in fees for a $5,000 credit card payment. But this could easily help knock out a credit card welcome bonus’ minimum spending requirement. For example, the bonus may be 75,000 Amex points after spending $5,000 in the first three months of card membership.

After you made your payment you’d have 80,000 Amex points: 75,000 points from the welcome bonus and 5,000 points from the $5,000 payment (since the card would earn 1x points on the payment itself). 80,000 Amex points are worth $1,440, which far outweighs the $98 in fees you’d have to pay.

With that example in mind, it might make sense to open up a card for the sole purpose of earning a welcome bonus in one fell swoop. Check out our BonusTracker for credit card welcome bonuses that are worth $1,000 or more. Current large offers include:

- The Platinum Card® from American Express — You’ll earn 100,000 Membership Rewards® Points after you spend $6,000 on purchases on the Card in your first 6 months of Card Membership.

- Both the Ink Business Cash® Credit Card and the Ink Business Unlimited® Credit Card are offering a welcome bonus where you can earn $750 (or 75,000 Chase points) after spending $7,500 in the first three months of account opening.

Best credit cards for paying taxes

The best card for paying your taxes is usually any card you’re trying to meet the minimum spending requirement with. The extra fees you pay often pale in comparison to earning a bonus worth hundreds. But once you’ve met your spending requirement, you’ll want to crunch the numbers before you pay your taxes with a card.

As a rule of thumb, you’ll want to earn at least 2% back in rewards for it to make sense to pay the extra fees. That can easily be done with certain credit cards that earn cash back. The Citi® Double Cash Card earns 2% cash back (1% when you buy and 1% as you pay) on every purchase.

But, with cash-back cards you’re earning a minuscule .04% in profit. In order to really knock it out of the park you need to earn transferable rewards. When you have the ability to move points to airlines and hotels you can turn your tax payments into business-class flights or luxury hotel stays. Below I’ve highlighted the best options for each of the major flexible points programs.

The information for the Citi Double Cash Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Amex Membership Rewards

Earning Amex Membership Rewards points when you pay taxes is easy with The Blue Business® Plus Credit Card from American Express because it earns 2x Amex points on the first $50,000 in purchases you make each calendar year, then 1x. We value Amex points at 1.8 each, so you’ll be getting 3.6% back in rewards and this card has no annual fee. (see rates and fees)

Capital One Rewards

The Capital One Venture Rewards Credit Card and Capital One Spark Miles for Business both earn a straightforward unlimited 2x miles on every purchase. You can redeem Capital One miles toward eligible travel purchases at a rate of one cent per point, but you can also transfer Capital One miles to airline and hotel partners.

The transfer ratio for Capital One miles is varies depending on the partner, which means that not every transfer partner is a good deal. Read our complete guide to the Capital One transfer partners and the best ways to use Capital One miles for more details.

Citi ThankYou

If you have the Citi Double Cash card and another card that earns Citi ThankYou points you can convert the cash back you earn into Citi ThankYou points at a rate of one cent to one point. In order to be able to transfer ThankYou points you need to have either the Citi Premier® Card or Citi Prestige® Card.

With the Double Cash and Premier/Prestige combo, you’re effectively earning 2% (2x ThankYou points) per dollar on all purchases (1%/1x when you pay, plus 1%/1x as you pay your bill). We value ThankYou points at 1.7 cents each, meaning you’re earning 3.4% back in rewards when paying your taxes with the Citi® Double Cash Card.

The information for the Capital One Spark Miles and Citi Prestige has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Chase Ultimate Rewards

Most Chase credit cards will only earn 1x Chase Ultimate Rewards points when paying your taxes with those cards. However, you can earn 1.5% back if you pay with the Chase Freedom Unlimited® or Ink Business Unlimited Credit Card. This can be a good option only if you have another Chase Ultimate Rewards card that enables transfers, like the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® or Ink Business Preferred Credit Card, then you’ll be able to pool your points onto that card and transfer them to Chase’s travel partners.

The Freedom Unlimited or Ink Business Unlimited are particularly good options if you have the Chase Sapphire Reserve. The reason for this is because with the Sapphire Reserve your points are worth 1.5 cents each when you book through the Ultimate Rewards travel portal. So you’re earning 2.25% back with either version of the Unlimited card.

When transferring points to partners, you can expect to get 1.7 cents in value per Chase point. So when paying with one of the Unlimited cards, you can expect a return of at least 3.4%.

Bottom line

Before you write a check to pay your taxes, consider using a rewards credit card to earn valuable miles or points. It’s not free – there’s a convenience fee when you pay your taxes through IRS-approved 3rd-party payment processors, like Pay 1040. It can be worth paying a fee if the rewards you earn get you more value, especially if you use the payment to meet the minimum spending and earn a welcome bonus on a new credit card.

With the right card or card combination, you can actually come out ahead with travel rewards, for example, The Blue Business® Plus Credit Card from American Express or Citi® Double Cash Card are great no-annual-fee options.

For more credit card news, deals and analysis sign-up for our newsletter here.

For the rates and fees of The Blue Business Plus Card from American Express, please click here.

Featured photo by Africa Studio/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!