What are Citi ThankYou points worth? Here’s how to get the most out of them

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Citi is an MMS advertising partner.

Citi ThankYou points are super flexible, so they offer plenty of opportunities for great travel and rewards. Like many other reward programs, you can redeem Citi ThankYou points in different ways, including transferring to travel partners like JetBlue and Singapore Airlines, booking travel through the Citi travel site or for cash back and gift cards. You can earn transferable Citi ThankYou points with travel credit cards like the Citi Premier® Card or Citi Prestige® Card.

How much are Citi points worth? It depends on which Citibank credit card or cards you have. In general, you’ll get an average value of 1.7 cents per point, but with certain redemptions, you’ll get a value as low as 0.5 cents a point and with the right transfer partner, it’s possible to get 5+ cents per point in value.

Here’s what you need to know about how much Citi ThankYou points are worth.

The information for the Citi Prestige cards has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Citi ThankYou points value

One way to instantly increase the value of your Citi ThankYou points is to have the Citi Rewards+® Card. When you have it, you’ll get a 10% points rebate on the first 100,000 points you redeem each year. This includes travel redemptions booked through the Citi ThankYou site, cash-back redemptions and gift cards. And it also applies to points transfers with Citi’s travel partners, you just need to have your Citi Rewards+ account combined with either a Citi Premier or Citi Prestige account.

What value can you get when you redeem Citi ThankYou points for cash back?

Quick answer: Between 0.5 cents and one cent each

The easiest (but least valuable) way to use your Citi ThankYou points is for cash back. You can redeem your points for a statement credit at a value of 0.5 cents per point. So 10,000 ThankYou points are worth $50 of a statement credit. You can also choose to use points for a charitable donation at the same value. Both of these have a $50 (10,000 ThankYou points) minimum redemption requirement.

Gift cards have a higher value of one cent per point. This means that you can redeem 10,000 ThankYou points for $100 worth of gift cards. There is a $25 (2,500 ThankYou points) minimum redemption. If you use points as a payment toward a mortgage, student loan or charitable donation you’ll get a value of one cent per point. And if you have the Citi Prestige card, you can also redeem points for cash back at one cent per point.

This is not the best way to use Citi ThankYou points because you can typically squeeze more value from them redeeming them for travel. If you’re looking for a cash back card to use frequently, check out our guide to the best cash-back credit cards – these can be a better option for earning cash back than redeeming Citi ThankYou points.

What value can you get when you redeem Citi ThankYou points for travel through the Citi portal?

Quick answer: One cent each for travel

You can book travel through the Citi ThankYou site and pay with your points. This portal works similar to any other online travel agency you might use already such as Expedia, Priceline and others, but allows you to pay for the reservation by redeeming Citi ThankYou points. The portal offers redemptions for airfare, hotels, car rentals, activities and cruises.

ThankYou points redeemed through the Citi ThankYou travel site are worth one cent per point toward travel.

What value can you get when you transfer Citi ThankYou points to travel partners?

Quick answer: Between one and five cents each

One of the biggest benefits of having points in a flexible points rewards program, like Citi ThankYou, is that you often redeem points for more value by transferring them to travel partners.

Each airline’s miles will have slightly different values depending on how you redeem them. But receiving 1.7 cents per point is fairly common as an average across most of these partners, with some partners like Singapore Airlines or Turkish Airlines yielding an average value of over two cents per point. You’ll typically get the highest value by waiting for transfer bonuses, taking advantage of award sales or booking international business or first-class awards.

Citi ThankYou transfer partners

| Transfer partner | Transfer ratio | Transfer time |

|---|---|---|

| Aeromexico | 1:1 | Instant |

| Avianca | 1:1 | Instant |

| Cathay Pacific (Asia Miles) | 1:1 | 24 hours |

| Etihad | 1:1 | 3-6 days |

| EVA Air | 1:1 | 1 -2 days |

| Flying Blue (Air France/ KLM) | 1:1 | Instant |

| JetPrivilege | 1:1 | 1-2 days |

| JetBlue | 1:1 | Instant |

| Malaysia Airlines | 1:1 | 1-2 days |

| Qantas | 1:1 | 1-2 days |

| Qatar Airways | 1:1 | 1-2 days |

| Singapore Airlines | 1:1 | Up to 24 hours |

| Thai Airways | 1:1 | Up to one week |

| Turkish Airlines | 1:1 | 1-2 days |

| Emirates | 1:1 | |

| Virgin Atlantic | 1:1 | Instant |

Points transfers to Citi ThankYou partners can be slower than other flexible reward programs, like Chase Ultimate Rewards. A few of these partners (Etihad and Thai Airways) can take up to a week. Most average a few days. This is worth remembering if you are looking to take advantage of one-day fare sales or last-minute tickets.

You might notice that Citi ThankYou doesn’t have any hotel transfer partners. Anyone looking to redeem their points for hotel stays can redeem their points through the Citi ThankYou portal, which offers many hotel options including boutique and non-chain hotels. For example, Jasmin redeemed points from her Citi Premier card for a luxury stay at the Conrad Tokyo.

One area where Citi struggles is with domestic flights. They don’t have major partners like American Airlines, Delta, United Airlines or Southwest. That said, you can transfer Citi ThankYou points to partners which are part of an airline alliance, then redeem miles for any airline within that alliance. For instance, you can transfer Citi points to Singapore Airlines, Avianca or Turkish Airlines to book United Airlines flights.

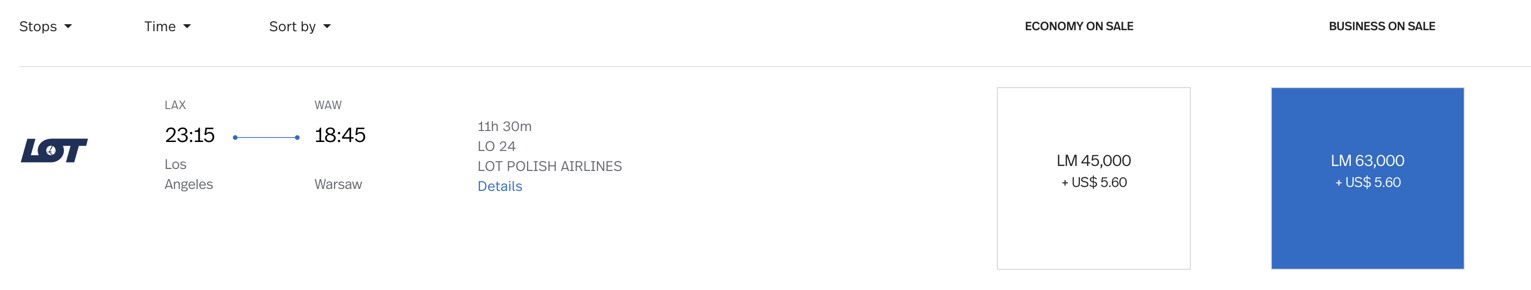

Example: Business-class awards with Avianca LifeMiles

To demonstrate how valuable Citi ThankYou points can be, check out this sample booking using Avianca LifeMiles to book a business-class award with LOT. You could fly from Los Angeles to Warsaw on LOT Polish in business class for~$3,500 one-way in this case. Or you could book that same ticket for only 63,000 Avianca LifeMiles.

That makes this redemption worth ~5.55 cents per ThankYou point. If you can consistently get that kind of value for your ThankYou points you’re doing extremely well for yourself.

Is Citi ThankYou the right program for you?

The most important thing to consider with any program is whether or not it fits into your travel habits. It’s slightly less flexible than other reward programs, meaning it won’t be a good pick for everyone. For example, it lacks a solid domestic airline transfer partner. While it does partner with JetBlue, they don’t have as many flights or serve as many airports as American Airlines, Delta or United Airlines. So if JetBlue doesn’t fly to your airport, that transfer partner will do you no good.

And they don’t offer hotel transfer partners. While it is true that hotel transfer partners usually offer lower value than airline transfer partners, it is still nice to have the option. None of this is to say that Citi ThankYou isn’t a good program. As stated earlier, some of these transfer partners, such as Singapore Airlines, Avianca, Turkish Airlines and Virgin Atlantic can easily get you up to 5+ cents per point in value.

And this is the underlying point. For people looking to fly where these airlines (or their partners) go, the Citi ThankYou rewards program offers incredible value. But if your travel habits fall outside of what can be offered by the transfer partners, then a different flexible rewards program might make more sense and offer more value for your spending.

Of course, you’re not obligated to lock yourself into one program either. Most of us on the MMS team collect points in the Citi ThankYou, Chase Ultimate Rewards, and Amex Membership Rewards programs simultaneously.

How should you use your Citi ThankYou points?

The travel portal is a decent option if you don’t want to worry about award charts or are booking last-minute flights. It is also your only option for booking hotels since Citi doesn’t offer any hotel transfer partners. But transfer partners will still be a better option when you are looking to get the most value on airfare because your average value across all the transfer partners is ~1.7+ cents per point – higher than what the portal would offer you.

Those with the Citi Prestige card are going to want to focus almost all of their effort on using Citi’s transfer partners. This card only offers one cent per point within the travel portal, making it a much bigger loss in value compared to what is possible with transfer partners.

Bottom line

Flexible Citi ThankYou points are worth 0.5 to ~5 cents each, depending on how you redeem them. The Citi Premier and Citi Prestige are currently the only two cards that allow you to fully utilize this rewards program by enabling transfers to Citi’s travel partners.

You can redeem Citi ThankYou points for:

- Cash back/statement credit: Worth 0.5-1 cent per point

- Gift cards: Worth one cent per point

- Travel portal: Worth 1 cent per point

- Transfer partners: Worth 1 – 5+ cents per point depending on the travel dates and airline

The value of your Citi points will completely depend on how you redeem your points. Let us know if you have a favorite Citi ThankYou points redemption.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!