How to combine Citi ThankYou points: A clever, yet simple, strategy

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Citi is an MMS advertising partner.

If you’ve been at the travel hobby for a while, you’ve probably got a few cards in your wallet that earn the same type of rewards. Being able to combine them in one spot is important if you don’t have enough miles or points in a single account to book an award flight, hotel stay, or other travel.

Last year, I combined points from my Citi Premier® Card and Citi Prestige® Card to book five round-trip flights to Hawaii with my family, because I didn’t have enough points in either individual account to book the trip.

Calling Citi ThankYou at 800-842-6596 or the number on the back of your card is the easiest way to do this, but it’s also possible through your online account.

Here’s how to combine your Citi ThankYou accounts online so all your points are in one place:

Why combine your Citi ThankYou accounts?

The redemption value you get for your Citi ThankYou points depends on with which credit card your Citi ThankYou points are linked.

There are several credit cards that earn Citi ThankYou points. Here are the most popular:

- Citi Rewards+® Card – 2 points per dollar spent at gas stations and supermarkets (on up to $6,000 per year, then 1 point per dollar spent), 1 point per dollar spent on everything else. Read our review of the Citi Rewards+ Card

- Citi Premier® Card – 3 points per dollar spent on air travel, hotels, restaurants, supermarkets, gas stations and 1 point per dollar spent on everything else. Read our Citi Premier review for all the details

- Citi Prestige – 5 points per dollar spent on airfare and dining; 3 points per dollar spent on hotels and cruises, and 1 point per dollar spent on everything else

- Citi® Double Cash Card (can be converted to Citi ThankYou points if you have an eligible card) – 1 point per dollar when a purchase is made, and 1 point per dollar when your balance is paid, for an effective 2 points per dollar (or 2% cash back). Read our Citi Double Cash review

The information for the Citi Prestige and the Citi Double Cash Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

If you have the Citi Prestige, you’ll get the fourth night free on hotel stays of 4+ nights booked through the Citi portal; with the Premier, you do not.

Or say you have the Citi Prestige, which allows you to transfer points to airline partners, and the Citi Rewards+® Card, which does not. But the Citi Rewards+ offers a 10% rebate on the first 100,000 ThankYou points you redeem each year. If your accounts are combined, you’ll be able to stack the 10% rebate with a ThankYou points transfer to Qantas.

By combining your accounts you’ll be able to access the very best redemption rates and perks with all your Citi ThankYou points, regardless of the linked card.

It’s also a lot easier to manage your points balances when they’re pooled in one spot.

How to combine your Citi ThankYou accounts

If you want to combine your Citi ThankYou accounts online, here are the steps:

Note that some folks have reported errors if the names on the accounts don’t match exactly. In that case, it’s best to call Citi at 800-842-6596.

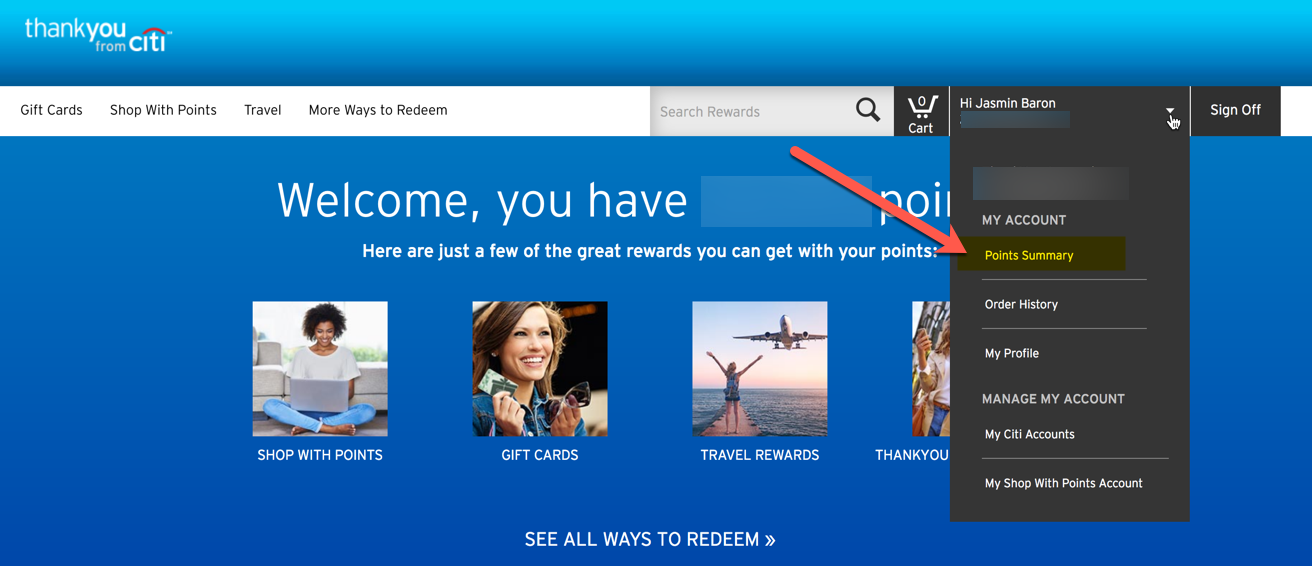

Step 1: Sign in to your Citi Account

Log into your Citi ThankYou account at thankyou.com. Then, navigate to “Points Summary” on the drop-down menu in the top right corner.

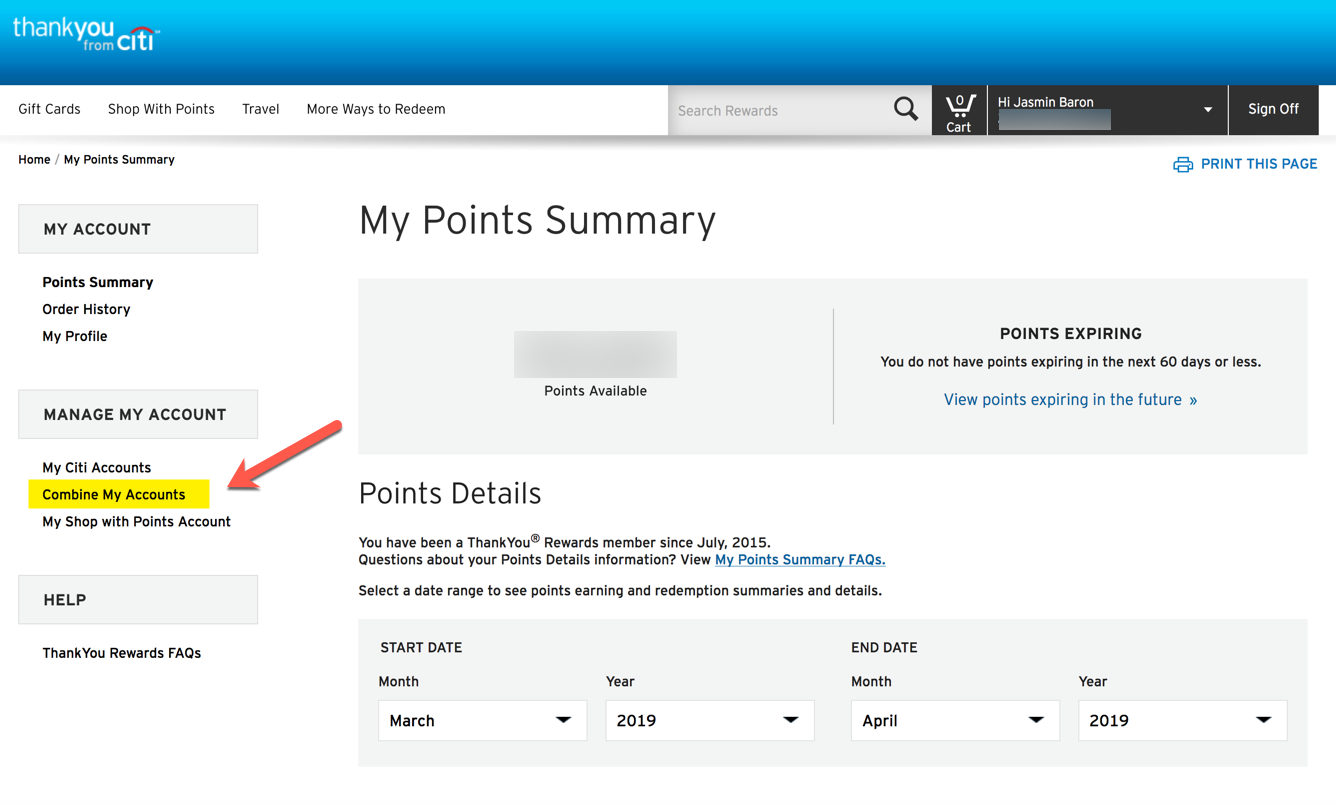

Step 2: Select “Combine My Accounts”

On the left sidebar under “Manage My Account” click on “Combine My Accounts.”

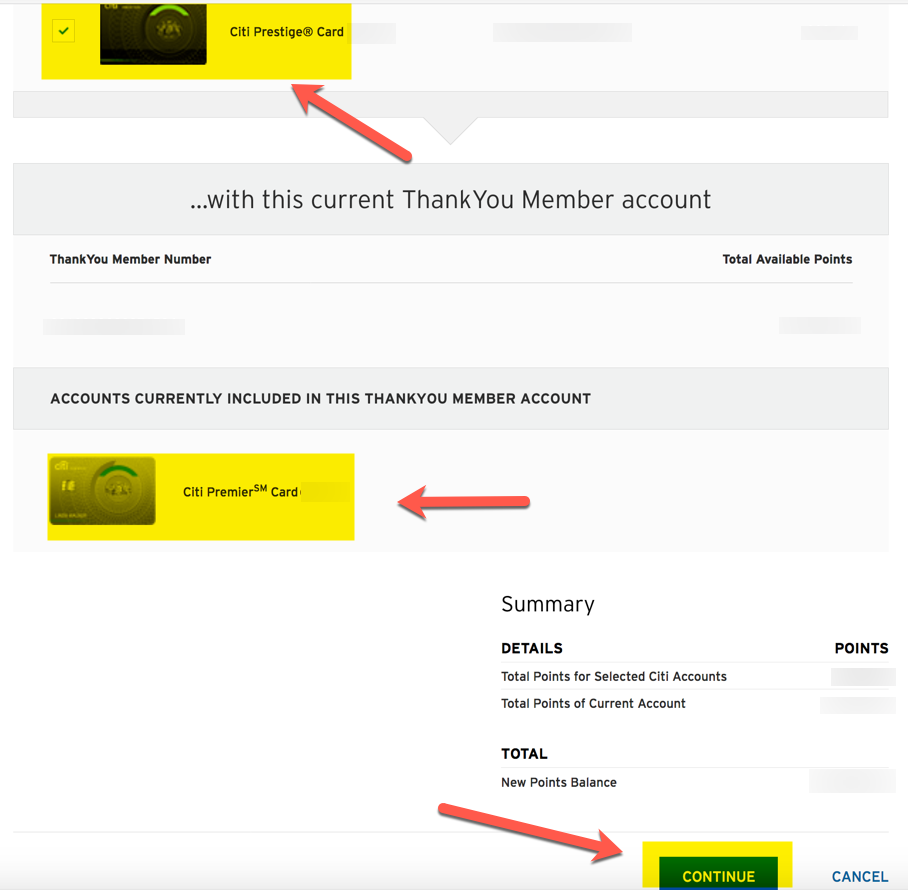

Step 3: Choose the accounts you wish to combine

In this example, I’ve combined my Citi Prestige account and my Citi Premier account by selecting the checkbox next to the Prestige. Then click “Continue” to confirm.

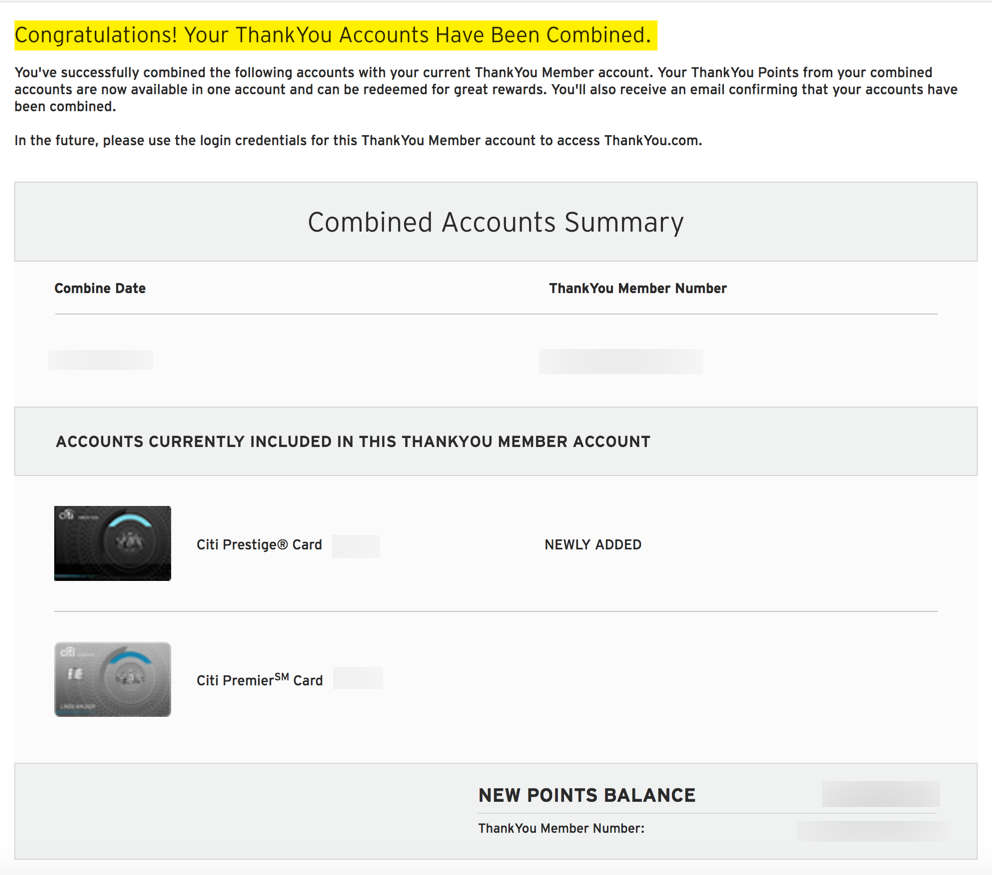

Step 4: Verify and receive confirmation

You’ll have one last opportunity to verify the change before you submit. Keep in mind that once your accounts are combined, Citi says it’s difficult to split them up again.

Finally, you’ll be brought to a screen congratulating you for combining your accounts.

Shortly after, expect an email with the same information. Going forward, you’ll see your points balances combined and earnings presented in one spot when you access your Citi account.

Bottom line

Combining your Citi ThankYou points accounts is a smart move if you have multiple Citi ThankYou points cards. By pooling your points in one spot, you’ll be able to access the best perks from your cards with all of your eligible points. That includes the 10% rebate on the first 100,000 points you redeem each year with the Citi Rewards+.

The easiest way to do this is by calling Citi ThankYou at 800-842-6596 or the number on the back of your card. This is especially important if the names on your different accounts don’t match exactly. But if you prefer to do it yourself online, it’s a fairly straightforward process.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!