For rates and fees of the Marriott Bonvoy Business American Express® Card, please click here.

4 Marriott Bonvoy Business Approval Tips for a Successful Application

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: Qualifying for a small business credit card might not be as difficult as you may think because you don’t need a full-time operation to qualify. I’ve qualified for small business cards with a part-time freelance business.

The Marriott Bonvoy Business™ American Express® Card currently has a Limited Time Offer: Earn 100,000 Marriott Bonvoy points after you use your new Card to make $5,000 in purchases within your first 3 months of Card Membership. Earn up to $150 in statement credits within your first 6 mont hs of Card Membership for all eligible purchases on your Card on U.S. Advertising in select Media. Plus receive complimentary Marriott Bonvoy Platinum Elite status for one year (February 1, 2021-January 31, 2022). Offer ends 1/13/21

Because of the Marriott-Starwood merger both Chase and Amex issue Marriott credit cards, but the Amex Marriott Bonvoy Business card is the only Marriott small business credit card that is still open for new applications. If you’d like a Marriott business card, these Marriott Bonvoy Business approval tips will help increase your odds of getting approved.

Marriott Bonvoy Business Approval Tips

The Marriott Bonvoy Business card is an excellent hotel credit card to consider because not only are Marriott points useful for booking free nights, but also you can transfer Marriott points to 40+ airlines.

1. Are You Eligible for the Bonus?

To qualify for a small business credit card you will need to operate some sort of profitable venture, but this doesn’t need to be a full-time gig. I’ve qualified for business cards as a freelance writer and my wife is eligible because of her freelance art business. Other side hustles like driving for Lyft or Uber, renting out your home on Airbnb or selling on Amazon or eBay can also qualify you for this card.

One of the quirks of American Express cards is that you’re only eligible to earn the intro bonus on a specific card once per lifetime. So if you have or have ever had the Marriott Bonvoy Business card (or it’s predecessor, The Starwood Preferred Guest® Business Credit Card from American Express) you won’t qualify for the welcome offer again.

You also won’t be eligible for the bonus if you:

- Are a current cardmember, or were a previous cardmember within the last 30 days, of the Marriott Bonvoy Business from Chase, or the Marriott Bonvoy Premier Plus Business from Chase

- Are a current or previous cardmember of either the Marriott Bonvoy Boundless Credit Card or Marriott Bonvoy Premier from Chase and received a new cardmember bonus or upgrade bonus in the last 24 months

- Applied and were approved for either Marriott Bonvoy Boundless Credit Card or Marriott Bonvoy Premier from Chase within the last 90 days

These requirements can be confusing, but if you aren’t eligible for the card due to one of these reasons, you’ll get a pop-up window informing you of this during the application process but before your credit is pulled.

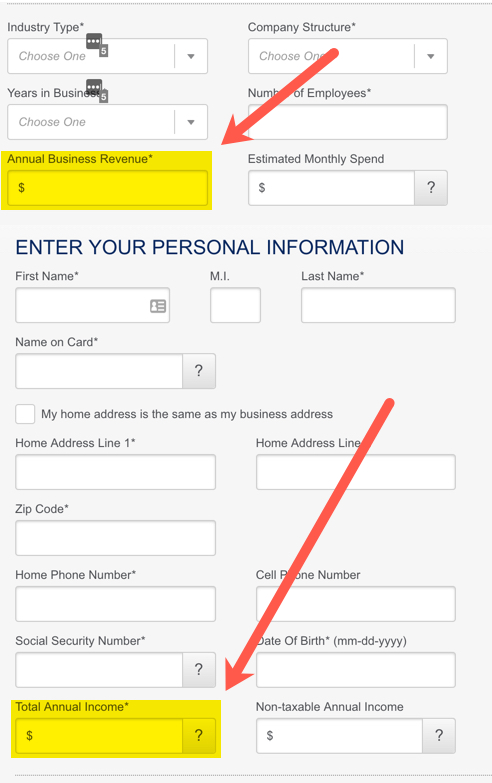

2. Claim All Your Eligible Income

When you’re filling out a business card application you need to provide your:

- Total annual income

- Annual business revenue

For every business card application I’ve submitted, my “total annual income” has always been much higher than my “annual business revenue” because I’ve only had part-time businesses. The same is likely to be true for you, unless your business is your full-time job or your only source of income.

Your “total annual income” is defined by Amex as:

Include all income available to you. If under age 21, include only your own income. Income includes wages, retirement, investments, rental properties, etc. Alimony, child support, or separate maintenance need not be revealed if you do not wish to rely upon it.

Basically, think of it as all of the sources of income you have access to for paying your bills. So my wife can add my yearly salary to her “total annual income.” Your “annual business revenue” is simply all the money your business makes before expenses.

3. Don’t Let the Business Card Application Trip You Up

An American Express small business card application isn’t too complicated, but there are a couple of questions that can trip you up if it’s your first application. So check out our Amex business card application guide for step-by-step instructions.

Two of the most common questions we get are:

- What if I don’t have a business tax ID?

- What should I enter as my business name?

Luckily, there is a simple solution to both of these questions. For the first, if you’re a sole proprietor you can use your Social Security number as your business tax ID. Most part-time businesses are classified as sole proprietors, which means you don’t have a business partner or partners and you haven’t taken the extra step of setting up a separate legal business structure, like an LLC.

As a sole proprietor, you’re also likely to be able to just use your name as the business name as long as you haven’t registered a separate name for your business.

I use my own social security number for my business tax ID and my name as my business name on all of my business credit card applications these days.

4. If at First You Don’t Succeed – Call Again

Once you hit the submit button on your application you’ll either get an instant approval, a rejection or a pending review notification. You can check your Amex application status here.

If your application goes into pending, the general consensus is to wait until Amex give you a decision, but sometimes you can call their reconsideration line and answer a few questions to expedite the process.

If you’re denied, then you’ll definitely want to call the reconsideration line (877-399-3083) to see if there is anything you can do to turn the denial into an approval. Go into the call prepared to answer specifics about your business and why you want the card (other than just the welcome bonus). Maybe you travel a lot for business and highly value the Amex Marriott Bonvoy Business card’s 6X Marriott points on eligible Marriott purchases, or the card’s annual free night certificate (at hotels costing up to 35,000 points) interests you.

There is no right or wrong answer, but just be aware that the final decision is in the hands of the phone representative, so being friendly can go a long way. If you don’t have success on your first call, it doesn’t hurt to hang up and call again.

Amex also has unofficial limits on how many credit cards they’ll let you have at one time. The limit seems to be right around 5 credit cards (not including charge cards), so when you call the reconsideration department you might be able to get your application approved if you’re willing to close one of your existing Amex cards.

Marriott Bonvoy Business 100,000-Point Offer

Apply Here: Marriott Bonvoy Business™ American Express® Card

Read our Marriott Bonvoy Business review

The Marriott Bonvoy Business™ American Express® Card comes with a Limited Time Offer: Earn 100,000 Marriott Bonvoy points after you use your new Card to make $5,000 in purchases within your first 3 months of Card Membership.

The card also comes with these other benefits:

- 6 Marriott points per $1 spent on eligible Marriott purchases

- 4 Marriott points per $1 spent at US gas stations, at US restaurants, on wireless telephone services purchased directly from US service providers and on US purchases for shipping

- 2 Marriott points per $1 spent on all other purchases

- Free Silver elite status

- Free employee cards (see rates & fees)

- Free Boingo Wi-Fi

- Gold status after you make $35,000 in purchases with the card in a calendar year

- 15 elite night credits every year

- Terms Apply

The card does have a $125 annual fee (see rates & fees), but its perks still can make the Marriott Bonvoy Business worth it. For example, every year after your account anniversary you’ll get a free night award valid at participating Marriott hotels that cost up to 35,000 points, and if you spend $60,000+ in purchases on your card in a calendar year, you’ll get a second free night award.

If you want to learn more about Marriott and how to make the most of your Marriott points, check out these guides:

- Marriott points value

- Best way to use Marriott points

- Marriott transfer partners

- How to earn Marriott points

- How to setup a Marriott account

- Marriott award chart

- Do Marriott points expire?

- Marriott Bonvoy elite status

- Marriott Bonvoy review

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!