Ink Plus or Ink Cash: Which Is a Better Fit for You?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Folks looking for a small business credit card might consider the Chase Ink Cash now that the sign-up bonus has increased.

But Chase small business also offers a different card, the Ink Plus, which has a bigger sign-up bonus!

Depending on your spending habits and travel goals, each of the small business cards has its own perks and benefits. Of course you could get both cards because they’re considered different card products.

Let’s compare the Ink Plus and Ink Cash small business cards!

Which Chase Small Business Card Earns You More?

Link: Chase Ink Business Cash Credit Card

Link: My Review of the Chase Ink Cash

Link: Chase Ink Plus

Link: My Review of the Chase Ink Plus

Sign-up Bonus

With the increased sign-up bonus on the Chase Ink Cash card, you can earn $300 cash back bonus (30,000 Chase Ultimate Rewards points) after you spend $3,000 on purchases in the first 3 months from account opening.

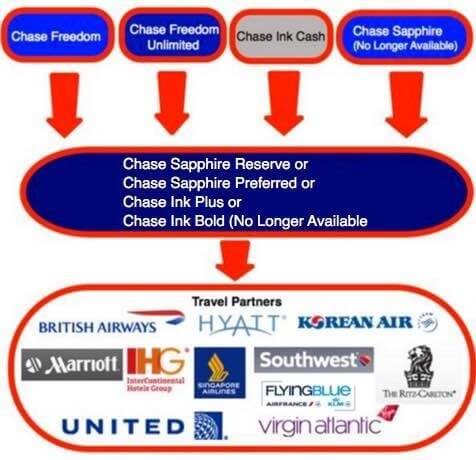

But to transfer Chase Ultimate Rewards points earned on the Ink Cash to airline and hotel partners like Hyatt and United Airlines, you’ll need to have either the Chase Sapphire Preferred, Chase Sapphire Reserve, Chase Ink Plus, or Chase Ink Bold (no longer available).

If you don’t have one of these cards, you can only redeem points for cash back or paid travel through the Chase Travel Portal at a rate of 1 cent per point. So the 30,000 point sign-up bonus is worth $300 in cash back.

The sign-up bonus on the Ink Plus card is 60,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the first 3 months of opening your account.

So you’ll earn double the sign-up bonus on the Ink Plus card. But you’ll also have a higher minimum spending requirement.

Regular Spending

The Ink Cash cards have slightly different bonus spending categories. With the Ink Cash, you’ll earn:

- 5% cash back at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year and

- 2% cash back at gas stations and restaurants each account anniversary year

- Up to $50,000 a year then 1%

And on the Ink Plus, you’ll get 5X Chase Ultimate Rewards points in the same categories as the Ink Cash. But instead of gas stations AND restaurants, you’ll earn:

- 2X Chase Ultimate Rewards points at gas stations and on rooms booked directly with hotels

There’s also a difference between the cards in terms of the maximum spending cap on bonus spending.

On the Ink Cash, you’ll earn bonus points on up to $25,000 in combined purchases for each bonus category during a calendar year.

With the Ink Plus, you’ll get bonus points on up to $50,000 in spending for each category every year.

If you’re a big spender and spend a lot in the bonus categories, you’ll earn more points with the Ink Plus.

Looking for No Fees?

The Ink Cash is a terrific card to keep in your wallet because there’s no annual fee. Meanwhile, the Ink Plus comes with a $95 annual fee that’s NOT waived the first year.

But I wouldn’t mind paying a $95 annual fee to get double sign-up bonus.

And the Ink Plus is better to use overseas because there are no foreign transaction fees. The Ink Cash card charges 3% on foreign transactions.

How to Qualify for Either Chase Small Business Card

Link: How to Qualify for a Small Business Credit Card

Many folks qualify for small business cards without realizing it! You don’t need to be earning millions of dollars to qualify for a small business card.

If you sell items online for a profit, provide paid childcare, or do freelance work, you could be eligible.

You can apply as a sole proprietor using your Social Security Number. You’re NOT required to have a business EIN (Employer Identification Number) to qualify for the card.Remember, if it’s been more than 24 months since you last received the sign-up bonus on the Ink Plus or Ink Cash cards, you can get the bonus again.

Get Both Cards

It’s possible to get both Chase small business cards because they’re considered different card products. With the current sign-up bonuses on both cards, you’d earn 90,000 Chase Ultimate Rewards points after meeting minimum spending requirements.

But it’s unlikely you’ll get approved for both cards on the same day. So you could wait until you’re finished with the minimum spending requirements on one card before applying for the second card.

Million Mile Secrets team member Scott has both cards. He likes the Ink Cash card because there’s no annual fee. And he earns 2X Chase Ultimate Rewards points at restaurants for business expenses.

But he also wanted to earn the lucrative sign-up bonus on the Ink Plus card, so he got that card too! He uses the Ink Plus instead of Ink Cash overseas because there are no foreign transaction fees.

Remember, Chase has tightened their application rules, making it harder to get lots of new Chase cards. If you’ve opened ~5 or more credit cards (from any bank) in the past 24 months, (excluding certain business cards) it will be difficult to be approved for either Chase small business card.

Bottom Line

The Chase Ink Cash card has an increased sign-up bonus of 30,000 Chase Ultimate Rewards points. This small business card is good for folks looking to earn cash back and have no annual fees. Or use it for Big Travel when you transfer points to a different Chase Ultimate Rewards card like the Sapphire Reserve.

The Ink Plus card offers double the sign-up bonus. And you can transfer points directly to airline and hotel partners. Plus, folks who spend a lot in the bonus categories can earn more points because it has a higher spending cap compared to the Ink Cash card.

It’s possible to get both cards because they are different card products. But be mindful of Chase’s stricter application rules.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!