Chase Sapphire Preferred vs Capital One Venture: Comparing two incredible elevated offers

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Among our readers, two credit cards top the list of favorites: Chase Sapphire Preferred® Card and the Capital One Venture Rewards Credit Card. That’s even more so the case now that both cards are offering incredibly lucrative increased welcome offers.

The Chase Sapphire Preferred is the best card for beginners and the Capital One Venture card is popular with those who want a simple rewards program.

Both are rewards credit cards with fantastic sign-up bonuses and enough earning capability to make our list of the best travel credit cards. Today we’ll take a deep dive into both cards to help you figure out which card is best for you.

Chase Sapphire Preferred versus Capital One Venture

| Card Name | Welcome Bonus |

|---|---|

| Chase Sapphire Preferred® Card | 100,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening |

| Capital One Venture Rewards Credit Card | Earn 100,000 Capital One miles after spending $20,000 on purchases within the first 12 months of account opening Or you still earn 50,000 miles after spending $3,000 on purchases in the first three months |

Chase Sapphire Preferred or Capital One Venture

Best sign-up bonus

Earning a sign-up bonus when you open a new card is one of the fastest and easiest ways to earn miles and points for free travel. And right now, both of these cards are offering increased welcome offers.

The Chase Sapphire Preferred card offers 100,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first three months from account opening. This sign-up bonus is worth $1,250 in travel (1.25 cents per point) when you redeem your points through the Chase Ultimate Rewards travel portal — and potentially more if you transfer points to travel partners like United Airlines, Hyatt or Singapore Airlines.

In comparison, with the Capital One Venture, you can earn up to 100,000 Capital One miles. You’ll earn 100,000 bonus miles after spending $20,000 on purchases within the first 12 months of account opening. Or still earn 50,000 bonus miles after spending $3,000 on purchases in the first three months.

You can redeem your Venture miles at a rate of one cent per mile toward travel. So the sign-up bonus is worth at least $1,000. But, you can also transfer Venture miles to airline partners, which can increase your return.

When deciding which has the better sign up bonus, you might be quick to think that it’s the Capital One Venture. But it’s important to note the extra minimum spending requirement needed to earn the bonus.

I’d much rather spend $4,000 to earn 100,000 Chase Ultimate Rewards points (worth at least $1,250 in travel when redeemed through Chase Ultimate Rewards) than five times that — $20,000 — to earn 100,000 Venture miles (also worth $1,000 in travel). For this reason, the Chase Sapphire Preferred beats out the Venture card in this category.

Winner: Chase Sapphire Preferred

Best earning rate

Once you get your new card, it’s time to start spending and earning points. Each card earns points in different ways.

With the Chase Sapphire Preferred, you’ll earn:

- 2x Chase points on travel and dining worldwide

- 5x Chase points on Lyft rides (through March 2022)

- One Chase point per dollar spent on everything else

With the Capital One Venture, you’ll earn

- 2x Venture miles on purchases

At first glance, the Capital One Venture appears to have an overall higher earning rate, because it earns 2x on all purchases. But you also have to consider what these points and miles are worth when you redeem them for travel.

Chase Ultimate Rewards points earned from the Chase Sapphire Preferred are worth 1.25 cents each when you book travel through the Chase Ultimate Rewards travel portal. So you can get a return of 2.5 cents for every dollar spent on travel and dining, 6.25 cents on Lyft rides (through March 2022) and 1.25 cents per dollar on everything else.

Capital One Venture miles are worth at least one cent each toward paid travel. So you get a return of at least two cents per dollar spent. If you don’t spend a lot on travel and dining, the Capital One Venture is the better deal for ongoing spending.

Let’s say you spend $10,000 per year on a card. If $6,000 of your purchases are on dining and travel (60% of total spending) and $4,000 is non-bonus spending, then you’ll earn:

- 16,000 Chase Ultimate Rewards points with the Chase Sapphire Preferred ($6,000 x 2x points on travel and dining + $4,000 x 1 point on everything else), or

- 20,000 Venture miles with the Capital One Venture card ($10,000 x 2x miles on all spending)

That would give you $200 in travel with Chase Sapphire Preferred (16,000 Chase Ultimate Rewards points x 1.25 cents per point) or $200 in travel with the Capital One Venture card (20,000 Venture miles x 1 cent per mile).

If more than 60% of your purchases are on dining and travel, then the Chase Sapphire Preferred is the better choice.

Winner: Capital One Venture, (unless you spend more than 60% of your purchases on travel and dining)

Best redemption value

Capital One Venture miles are simple and straightforward to earn and redeem.

You can use your miles for nearly any travel purchase at a value of one cent per mile, like taxi rides, hotels, room service and flights. You can also redeem Capital One miles for cash back, but you’ll only get .5 cents per point, so it’s not a good deal.

Capital One miles also transfer to airline partners like Singapore Airlines or Emirates. However the Capital One miles’ transfer ratios aren’t that great, you can transfer miles at a 2:1.5 ratio to most of the Capital One transfer partners, but three only have a transfer ratio of 2:1.

To redeem your miles for travel, make eligible travel purchases with your card. You have 90 days to sign in to your online account, find the travel purchase, and erase it with your miles. There’s no minimum redemption increment when redeeming miles unless you’re using miles to partially pay for a travel purchase. In that case, the minimum is 2,500 miles ($25).

With the Chase Sapphire Preferred card, you can redeem your Chase Ultimate Rewards points for cash back (one cent per point) or paid travel through the Chase Ultimate Rewards travel portal (1.25 cents per point). And there’s another option.

Chase Sapphire Preferred cardholders have the ability to transfer Chase Ultimate Rewards points at a 1:1 ratio to the following airline and hotel partners:

- Aer Lingus

- British Airways

- Flying Blue (Air France / KLM)

- Hyatt

- Iberia

- IHG

- JetBlue

- Marriott

- Singapore Airlines

- Southwest

- United Airlines

- Virgin Atlantic

These options open up many opportunities for travel and potentially get you much more value for your points.

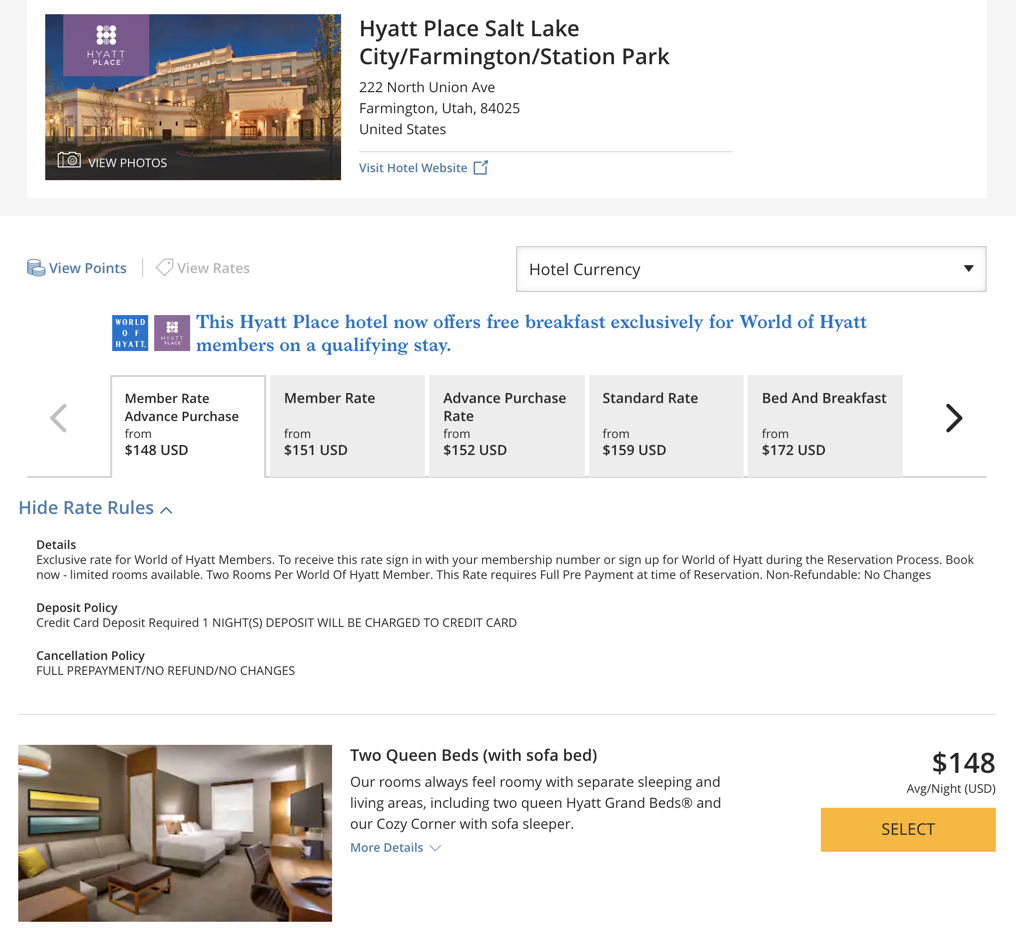

For example, Million Mile Secrets contributor Alex often travels between Salt Lake City and Seattle. He usually stays at the Hyatt Place Salt Lake City Farmington/Station Park. This is a beautiful Category 1 hotel which costs 5,000 Hyatt points per night.

A sample paid night at this hotel costs $148. But instead of paying cash, you could transfer 5,000 Chase Ultimate Rewards points to Hyatt for an award night. In this case, your Chase Ultimate Rewards points are worth ~3 cents each ($148 cost of a paid night/5,000 points per night). That’s much higher than the 1.25 cents-per-point value you’d get booking through the Chase Ultimate Rewards travel portal.

But if you used the Capital One Venture for this stay, you could erase the cost of the $148 room with 14,800 Venture miles. That’s more than 3x the number of Chase Ultimate Rewards points you’d need for the same stay.

Winner: Chase Sapphire Preferred

Best travel protection benefits

If you travel often, consider the insurance and protection benefits each card provides. Delays, cancellations and mishaps can occur.

The Chase Sapphire Preferred offers excellent travel protections, including:

- Primary car rental insurance – Covers damage due to theft or collision to your rental car, when you pay for the rental with your card

- Trip delay reimbursement – Reimbursement of up to $500 per ticket when your trip is delayed more than 12 hours

- Trip cancellation/interruption – Up to $10,000 per covered trip

- Baggage delay – Up to $100 per day for a maximum of five days when your bags are delayed for six hours or more

Many cards offer rental car insurance, but the Chase Sapphire Preferred is one of the few cards that offer primary rental car insurance, which means you do not need to report an accident to your car insurance provider or pay your policy’s deductible.

By comparison, the Capital One Venture card offers secondary car insurance, meaning it will only cover what’s left after you file a claim with your primary car insurance provider. You will be responsible for the deductible on your policy and you will need to report the accident, which might raise your premium.

The Capital One Venture does not offer coverage for trip or baggage delay or trip interruption or cancellation. But it comes with a Global Entry or TSA PreCheck credit (worth up to $100).

Winner: Chase Sapphire Preferred

Best annual fee

Both the Chase Sapphire Preferred and the Capital One Venture cards have the same $95 annual fee.

Best foreign transaction fee

Luckily, when deciding between the Chase Sapphire Preferred and the Capital One Venture card, you never have to worry about foreign transaction fees.

Winner: It’s a tie

Best worldwide acceptance

The Chase Sapphire Preferred and the Capital One Venture are both Visa cards. So they’ll both be equally accepted around the world.

Winner: It’s a tie

Bottom line

The Chase Sapphire Preferred and the Capital One Venture cards both have excellent sign-up bonuses and easy-to-earn rewards.

For most, the Chase Sapphire Preferred is a better deal.

It edges out the Capital One Venture card in most areas, and Chase Ultimate Rewards points are more valuable because of the better redemption rate through the Chase Ultimate Rewards portal and by transferring points to popular airline and hotel programs.

- Best sign-up bonus: Chase Sapphire Preferred offers $250+ more value

- Best points earning: Capital One Venture offers a straightforward 2x Venture miles on every day purchases

- Best redemption value: Chase Sapphire Preferred can get you significantly more value when you transfer points to travel partners

- Best travel protection benefits: Chase Sapphire Preferred offers primary rental car insurance, trip delay reimbursement, trip cancellation/interruption and baggage delay insurance

- Best annual fee: Both cards charge a $95 annual fee.

- Both cards tied in worldwide acceptance and no foreign transaction fees

You can’t go wrong with either card. In fact, if you don’t travel or dine out often, then the Capital One Venture card might be the better pick with its 2x earning rate on everything.

You’ll find our in-depth review of the Chase Sapphire Preferred and the review of the Capital One Venture here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!