Chase Sapphire Preferred or Citi ThankYou Premier? Which Is the Better Card for You?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Now that the sign-up bonus on the Chase Sapphire Preferred has increased to 50,000 Chase Ultimate Rewards points after meeting minimum spending requirements, it’s a good time to look at how this card stacks up against cards with a similar bonus.

The Citi ThankYou Premier also has a 50,000 point sign-up bonus, and both cards have a lot in common.

So which card is better for you? As always, it depends on your travel goals and how you like to use your points!

Let’s compare the cards and see how both can get you Big Travel with Small Money!

Two Cards With Terrific Big Travel Options!

Link: Chase Sapphire Preferred

Link: My Review of the Chase Sapphire Preferred

Link: Citi ThankYou Premier

Link: My Review of the Citi ThankYou Premier

With the Chase Sapphire Preferred and Citi ThankYou Premier, you’ll earn 50,000 flexible points after meeting minimum spending requirements.

The $95 annual fee on both cards is waived for the 1st year. And neither charge foreign transaction fees, so they’re good to use when you’re abroad.

Note that the minimum spending requirement on the Chase Sapphire Preferred is $1,000 higher ($4,000 on purchases in the 1st 3 months of opening your account) than the Citi ThankYou Premier

Each card has terrific (but slightly different) bonus categories, like travel and dining.

Both cards let you redeem your points towards paid travel at the same rate. Or transfer points to airline and hotel partners for an even better deal.

You’ve also got the option to redeem the points you earn from both cards for gift cards, merchandise, or cash back. But this isn’t the best way to use your points!

1. Bonus Categories

These cards are excellent for folks like me who like to travel (and eat!). Both earn bonus points on travel and dining, but the earning is slightly different.

a. Chase Sapphire Preferred

With the Chase Sapphire Preferred, you’ll earn 2 Chase Ultimate Rewards points per $1 you spend on travel, which includes:

Airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges, and highways, and parking lots and garages.

And you’ll also earn 2 Chase Ultimate Rewards points per $1 you spend on dining, including sit-down restaurants, fast-food joints, and some bars or nightclubs that serve food.

b. Citi ThankYou Premier

The Citi ThankYou Premier also earns bonus points on travel and dining, but it works differently.

You’ll earn 3 Citi ThankYou points per $1 you spend on travel, and their travel category is much more broad, including:

Airlines, hotels, car rental agencies, travel agencies, gas stations, commuter transportation, taxi/limousines, passenger railways, cruise lines, bridge and road tolls, parking lots/garages, campgrounds and trailer parks, time shares, bus lines, motor home/RV Rental and boat rentals.

So you’ll earn more points with the Citi ThankYou Premier in the travel category. And the biggest bonus – the 3X travel category includes gas stations! That’s a huge expense for many folks and an easy way to rack up points quickly.

You’ll also earn 2 Citi ThankYou points per $1 you spend on dining AND entertainment. Entertainment includes:

Sports promoters, theatrical promoters, movie theaters, amusement parks, tourist attractions, record stores and video rental stores.

This is the better card for earning bonus category points! But, while all people are created equal, points are NOT! That’s why you might consider…

2. Transfer to Travel Partners

You’ll usually get the most value from your Chase Sapphire Preferred or Citi ThankYou points when you transfer them to airline and hotel partners for Big Travel.

You can transfer Chase Sapphire Preferred points to the following airlines and hotels:

| Chase Ultimate Rewards Airline Transfer Partners | ||

|---|---|---|

| Aer Lingus | British Airways | Flying Blue (Air France/KLM) |

| Iberia | JetBlue | Singapore Airlines |

| Southwest | United Airlines | Virgin Atlantic |

| Chase Ultimate Rewards Hotel Transfer Partners | ||

|---|---|---|

| Hyatt | IHG | Marriott |

| Ritz-Carlton |

With the Citi ThankYou Premier, you can move points to these airlines, plus Hilton hotels:

| Citi ThankYou Points Airline Transfer Partners | ||

|---|---|---|

| Avianca | Asia Miles (Cathay Pacific) | EVA Air |

| Etihad | Flying Blue (Air France/KLM) | Garuda Indonesia |

| Jet Airways | JetBlue | Malaysia Airlines |

| Qantas | Qatar Airways | Singapore Airlines |

| Thai Airways | Turkish Airlines | Virgin Atlantic |

You’ll notice the list of transfer partners for each program is very different. Only Singapore Airlines and Virgin Atlantic are partners with both programs.

So which has the better set of airline and hotel partners?

a. Chase Ultimate Rewards

For many folks, Chase Ultimate Rewards points allow the most flexibility in booking award travel. That’s because they have more useful partners for both domestic and international travel. This includes 4 hotel chains, compared to only Hilton hotels with Citi ThankYou.

Points transfers are always at a 1:1 ratio and are usually instant. That makes Chase Ultimate Rewards points good to have as a backup-points fund if you need to book an award quickly, like in the event of a family emergency.

And Chase Ultimate Rewards airline partners allow you to book award flights on airlines in all 3 major alliances:

- British Airways – use points for travel on British Airways and oneworld alliance partners like American Airlines (plus other partners like Aer Lingus and Alaska Airlines)

- Korean Air – use miles to book flights on Korean Air and SkyTeam alliance airlines

- Singapore Airlines & United Airlines – use miles for travel on Singapore Airlines, United Airlines, or Star Alliance partners

Plus, you can transfer Chase Ultimate Rewards points to Southwest, which is an even sweeter deal if you have the Southwest Companion Pass! That’s because a with the companion pass, a friend flies with you for almost free on both paid and award tickets. It’s the best deal in domestic travel!

I prefer Chase Ultimate Rewards points because their partners include 2 of my favorite award programs, Hyatt and United Airlines.

b. Citi ThankYou

While Citi ThankYou has more airline transfer partners, most of them are NOT US-based (Virgin America is the exception).

And not all transfers are at a 1:1 ratio. For example, when you move points to Virgin America, you’ll only get 500 Virgin America points for every 1,000 Citi ThankYou points you transfer.

And transfers to Hilton are at a 2:3 ratio. Plus, Citi says it can take up to 14 days for transfers to complete, although in practice it normally takes a few days.

All 3 major alliances are also represented. But some of the programs, like Thai Airways (Star Alliance), Malaysia Airlines & Qatar (oneworld alliance), and Garuda Indonesia (SkyTeam alliance), aren’t very practical for US flyers.

That’s because there aren’t lots of other easy ways to earn points in those programs, like through airline credit cards. And it can be more difficult to book award flights with foreign airline programs.

That said, there are some sweet spots with Citi ThankYou airline transfer partners. Singapore Airlines is a good choice for Singapore Airlines award flights, as well as Star Alliance partner flights.

And I’ve shown you how it can make more sense to book United Airlines award flights using Singapore Airlines miles within the US (including Hawaii) and to the Caribbean. You’ll pay fewer miles in some cases than if you booked the flights using United Airlines miles.

You can also get a good deal transferring Citi ThankYou points to Flying Blue (the award program for Air France and KLM).

Each month, they publish discounted Promo Award flights between certain cities and Europe (including some cities in the Middle East, North Africa, and near Asia). You can sometimes save 50% of the miles required!

But to book these flights, you must use Flying Blue miles (and not SkyTeam partner airline miles).

Consider your future plans before you decide which program has better transfer partners for your travel goals!

3. Book Paid Travel

With both the Chase Sapphire Preferred and Citi ThankYou Premier, you can use points to pay for travel through the Chase Ultimate Rewards or Citi ThankYou travel portals.

With either card, your points are worth 1.25 cents each towards flights, hotels, car rentals, cruises, and activities. So with both cards, the 50,000 point sign-up bonus is worth $625 in paid travel.

So in this regard, the cards are equal.

This can be a terrific deal! I’ve shown you how you’ll often save points by booking flights with Chase Ultimate Rewards points instead of transferring to airline partners for award tickets.

Using points for paid travel gives you more flexibility. That’s because:

- There are no blackout dates! You can buy a ticket even if award seats aren’t available on the flights you want – handy for last-minute travel or during holidays

- You’ll earn airline miles or hotel points for the ticket or stay

- If you don’t have enough points to pay for a ticket or hotel (either an award or paid), you can combine your points with cash.

Plus, you can use your points for activities or cruises, which can’t normally be booked with miles & points.

Out of curiosity, I searched for a round-trip flight between New York and Chicago around Christmas at both the Chase Ultimate Rewards and Citi ThankYou travel portals to see if I’d get the same flights and prices.

Both portals returned similar results. The cheapest flight, on Spirit Airlines, was the same price through both programs. You’d pay ~$436, or 34,894 points, using either Chase Ultimate Rewards or Citi ThankYou points.

There were some minor differences in the other flights they had available. So if you have points in both programs, it’s worth checking both portals to be sure you’re getting the best flights!

4. Cash Back, Gift Cards, and Merchandise

You’ll get the least value from your Chase Ultimate Rewards and Citi ThankYou points when you redeem them for cash back / statement credits, gift cards, or merchandise.

a. Cash Back and Statement Credits

Chase Ultimate Rewards points are worth 1 cent each when redeemed for cash back or a statement credit. So the 50,000 point Chase Sapphire Preferred sign-up bonus is worth $500.

That’s not bad, but you’ll usually get much more value redeeming them for travel or transferring to airline and hotel partners.

Redeeming Citi ThankYou points for cash back is a BAD deal. That’s because they’re only worth 0.5 cents each for cash back or a statement credit. So the 50,000 point Citi ThankYou Premier sign-up bonus is only worth $250.

b. Gift Cards & Merchandise

If you prefer gift cards, you’ll also usually get a value of 1 cent per point in both programs.

Gift card options include hotels, cruises, car rentals, department stores, restaurants, and more.

Using points for merchandise is also generally a poor value. You can use Chase Ultimate Rewards points for Amazon purchases at a rate of 1 cent per point.

And through Citi, you can buy merchandise directly with points. This is another bad deal.

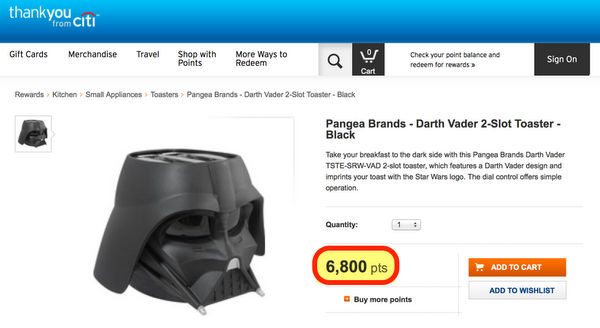

For example, this Darth Vader toaster costs 6,800 Citi ThankYou points.

This might be a cute gift for the Star Wars fan in your life, but it can be bought for ~$50 (or less, with promotions and discounts) at many department stores, like Kohl’s. In this case, you’re getting a value of ~0.7 cents per point.

I’d rather pay by credit card and earn points for my Dark Lord toaster than redeem flexible bank points that can be used in so many other awesome ways!

So Which Card Wins?

For me, the Chase Sapphire Preferred is the superior card. I use Chase Ultimate Rewards points for Big Travel by transferring to airline and hotel partners almost exclusively. And their transfer partners are more in-line with my travel goals.

But that doesn’t mean that the Citi ThankYou Premier isn’t a good card for your travel plans. It truly depends on how you like to use your points!

If you’d rather use points towards paid travel, both cards are equally good.

But for cash back, the Chase Sapphire Preferred is far better.

Are you having trouble deciding? Because the cards are from different banks, you could always get both.

Keep in mind that Chase has changed their application rules, so it might be harder to get approved for a Chase Ultimate Rewards earning card if you’ve had lots of recent credit applications (although there are exceptions).

So if you plan on getting 1 card before the other, apply for the Chase Sapphire Preferred first.

Bottom Line

The Chase Sapphire Preferred and Citi ThankYou Premier cards have lots of similarities, including a 50,000 point sign-up bonus after completing minimum spending.

The $95 annual fee on both cards is waived for the 1st year. And each card allows you to transfer points to airline and hotel partners, use points toward paid travel, and redeem points for cash back, gift cards, and merchandise.

The Citi ThankYou Premier is the better card for earning in bonus categories, like travel (which includes gas stations), dining, and entertainment.

Your points are worth 1.25 cents each with either card when you redeem them for paid airline tickets, hotels, car rentals, cruises, and activities.

But for most folks, Chase Sapphire Preferred has far better transfer partners. But consider your travel goals, because the Citi ThankYou Premier might also work for you!

And if cash back is your thing, you’ll also do better with the Chase Sapphire Preferred.

These are both excellent cards, though my favorite is still the Chase Sapphire Preferred. If you’re having a hard time deciding, you could always get both!

Which card do you prefer and why? Please share in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!