Don’t get denied! Common reasons people don’t get approved for Chase credit cards (besides the Chase 5-24 rule)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Avoid these common mistakes when applying for Chase credit cards. I have five Chase credit cards and I’ve learned a lot along the way in addition to the Chase 5/24 rule. Use our Chase approval tips when you apply for the best Chase credit cards, such as:

- Ink Business Preferred Credit Card

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Southwest® Rapid Rewards® Performance Business Credit Card

- Southwest Rapid Rewards® Plus Credit Card

- World of Hyatt Credit Card

- Ink Business Unlimited Credit Card

Approval tips for Chase credit cards

Chase 5/24 rule

Chase won’t approve you for most of their credit cards if you’ve opened five or more credit cards from ANY bank within the past 24 months. This is known in the miles and points community as the Chase “5/24 rule”. There are exceptions, however: Business credit cards from American Express, Bank of America, Chase, Citi and Wells Fargo don’t count towards your five credit card total. You can open as many of these cards as you want and you’ll still be eligible for valuable Chase credit cards.

Another notable quirk is that while Chase business cards don’t count against your 5/24 status, you will be ineligible for them once you have opened five personal credit cards from any bank. Open the ones you want before looking at your fifth personal credit card.

Here is a solid application strategy regarding the 5/24 rule:

- Evaluate your travel goals – If you’re saving miles & points for a specific trip, this might be your cue to apply for the airline or hotel card that best fits your goals

- Go for the big bonuses – Increased sign-up bonuses come and go, so it’s important to ensure that when you open a card, you’re getting the top offer. You can bookmark our page with the travel credit cards with the best bonus to stay in the know. For example, the Chase Sapphire Preferred currently comes with 80,000 bonus points after you spend $4,000 on purchases in the first 3 months.

- Go for the Southwest Companion Pass – With a Companion Pass, you can bring along a friend or family member whenever you fly Southwest for just the cost of taxes and fees. You need to earn 125,000 qualifying Southwest points in a calendar year to earn the Southwest Companion Pass. Fortunately, Southwest credit card bonuses count toward this requirement! Read our Southwest Companion Pass post to see how easy it is to earn.

Credit score requirement

In general, the fancier cards with top perks require a higher credit score. Credit score isn’t the only factor, though. We generally recommend for Chase credit cards a minimum credit score of 700 — if you’re below that, you should wait until you’ve breached 700 before you dive into miles and points.

For example, Chase Sapphire Preferred® Card applicants should usually have a credit score of 720 or above. There are plenty of reports of cardmembers who were approved with a lower score, but this’ll give you the highest approval odds. Check out this post for more details.

Age of your credit file

If you’re brand new to credit such as you’ve never had a credit card before or you just got a social security number, you might need to wait a little bit. Again, Chase has the final say. A work-around is to get added as an authorized user to someone’s credit card. This will start to build your credit. You could also start with a secured credit card.

If you think you were denied for this reason, you can call Chase and say you can submit proof of income which may make them feel more comfortable about approving your application.

Lots of inquiries in recent months

When you apply for credit and authorize a lender to check your credit report, they perform a “credit inquiry,” which posts on your credit report. No big deal. However, if there are a ton of those in a short period of time, Chase might think you’re suffering financially and are desperate to borrow money. They just want to know you won’t run up a bill on them and not pay.

Nobody knows exactly how many credit inquiries Chase considers a red flag. If you’re denied for this reason, call Chase to explain.

You already have a lot of credit with Chase

Chase has a number they calculate as to the total amount of credit they want to trust you with. If you’re already at that limit, they might hesitate to give you a new credit card with even more of a credit line. Several of us have had this happen to us. Just call Chase and explain why you want this new card (and don’t say you just want a sign-up bonus!). You can offer to reduce the credit line with one of your current Chase cards and basically move it to the new card.

Open a Chase bank account

If you live near a Chase branch, you might want to consider establishing a banking relationship. Data points indicate that this has made the difference in card application approvals. Remember, this isn’t necessary, but keeping a chunk of money in your Chase account won’t hurt. Also keep in mind that certain bank accounts have fees. You don’t want to open an account unless you think you’ll benefit.

Fix Chase credit problems

If you owe Chase money, figure that out before you apply for another card. If you’ve recently been late with paying Chase, that won’t be good for your application. Using points for travel is awesome — but credit card debt is not worth it. Please only apply for these cards if you’ll be paying on-time and avoiding interest charges and fees.

Keys to filling out a Chase credit card application

A wrong address, incorrect social security number, etc., can confuse Chase and cause a denial. So if you do get denied, definitely contact Chase to see if they had a question about your identity.

Income requirements for Chase personal credit cards

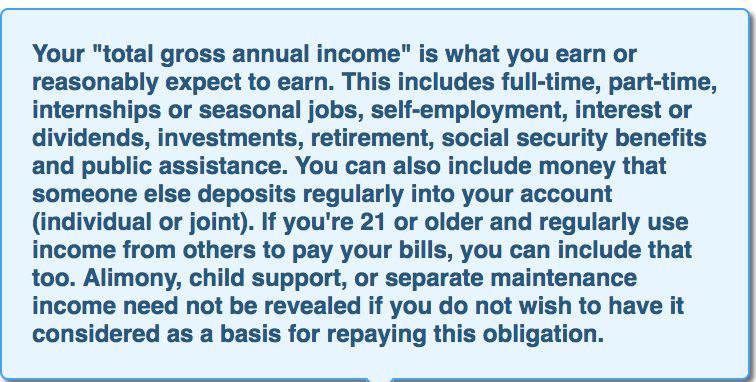

You’ll need to show Chase you can afford to pay the bill each month. They’ll factor this in. But Chase realizes that some folks are retired and have plenty of savings, while others are young and have financial support from close family members. For example, when you apply for the Chase Sapphire Preferred, this is how the site explains what number is fair to enter into the income box.

Income requirements for Chase business credit cards

On the application for the Ink Business Preferred, Chase asks you to enter annual business revenue/sales. Remember, revenue is not profit. If your business made $17,000 and incurred $6,000 of expenses, you’d enter $17,000.

Be honest on the application. These cards are meant for small businesses who want to use Chase credit cards to grow the business. Also, the application asks about your personal income in the same way described above. Chase is looking at both your business and your ability to pay the bill regardless of how your business performs.

How to get approved through the reconsideration line

Whenever I’ve been denied or my application went to “pending,” I called Chase and had a nice conversation. The two things I always have in my favor are:

- I’m a good Chase customer. I pay all bills on-time and in full. I have a Chase bank account. This seems to build trust as it’s been active for years and they see money in it

- I have a reason for wanting the new credit card besides the fat sign-up bonus. I’m honest and say yes you got my attention with the bonus but I also plan to keep spending on the card because of the ongoing points I’ll earn and to use the card perks

Bottom line

It’s normal to feel apprehensive or nervous when applying for credit card. Hopefully learning more about the approval process here for Chase credit cards makes you feel more at ease. If you’ve got an excellent credit score, don’t let it go to waste! Get the cards and points so you can travel for free.

A “denied” application isn’t the end of the world. It happens very rarely once you know what Chase is looking for — and now you do!

Lead image courtesy of Jeramey Lende/Shutterstock

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!