Capital One Spark Cash approval tips – $500 bonus and 2% back everywhere

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

With the Capital One® Spark® Cash for Business card, you can earn a $500 cash bonus after spending $4,500 in the first three months from opening the account. The card’s $95 annual fee is waived the first year and you’ll earn a straight 2% cash back on every purchases with no limit. This simplicity and value make it both one of the best Capital One cards and the best business cash-back credit cards.

Anytime you can earn a $500 bonus without paying an annual fee the first year, it’s a win. So let’s take a look at whether or not the Capital One Spark Cash small business credit card is right for you and share tips for getting approved for the card.

Information for the Capital One Spark Cash card has been collected independently by Million Mile Secrets and has not been reviewed by the card issuer.

Capital One Spark Cash approval tips

If you’re trying to get, or stay, under Chase’s 5/24 rule applying for the Capital One Spark Cash isn’t a good idea because it will count toward your card limit with Chase. That’s because Capital One business card accounts will appear on your personal credit report, which isn’t the case with most other banks.

That said, if you’re well over Chase’s 5/24 limit and don’t want to apply for more Chase credit cards soon, consider the Capital One Spark Cash is a solid credit card that earns cash back. It has an excellent welcome offer, earns 2% cash back on every purchase and the rewards are easy to redeem. If you’re looking for a straightforward cash back card, this is a good pick.

Here are five tips for getting approved.

Know if you’re eligible

Lots of people don’t think they’re eligible to apply for the Capital One Spark Cash card because it’s a business card. But you should check out this post about how you can qualify for a business card. As long as you’re operating a for-profit business (even if you have a small amount of business income), it’s possible to get approved for a small business credit card. That’s great because they can be a terrific way to really help your miles, points and cash-back balances grow.

If you’re a freelancer or independent contractor (Uber, Lyft, delivery driver) you could qualify for business cards as a sole proprietor. I’ve opened business cards as a freelance writer and my wife has done the same as a freelance artist.

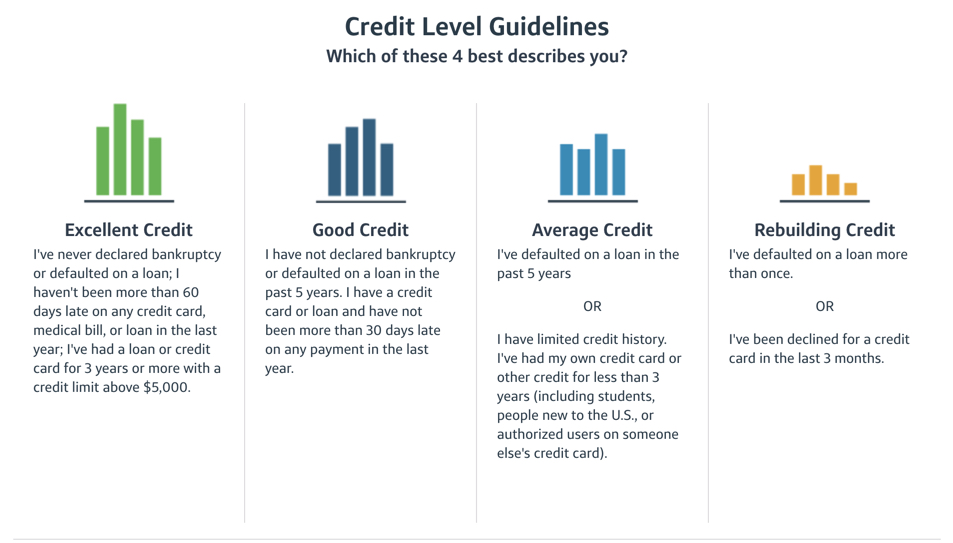

Maintain an excellent credit score

Capital One suggests you only apply for the Capital One Spark Cash card if you have “excellent credit.” Capital One describes this as anyone who has:

- Never declared bankruptcy or defaulted on a loan

- Has not been more than 60 days late on a loan in the past year

- Has had a loan or credit card for 3+ years with a credit limit of $5,000+

If this describes you, you have a good chance at being approved. Just remember, regardless of your credit, Capital One always has the final say.

Fill out the application correctly

The Capital One Spark Cash card application is fairly straightforward, but there are more questions than you would see on a personal card application.

One thing that trips people up is the business tax ID box on the application. But, if you’re a sole proprietor, you can apply using just your social security number if you don’t have an EIN (Employer Identification Number). Many Million Mile Secrets team members enter their social security number when applying as a sole proprietor for small business cards. If you’re applying as a sole proprietor (meaning you’re not in any type of partnership), you can use your name as the legal business name.

For step-by-step tips, read our guide to completing a Capital One business card application.

Include any and all income you earn

Besides your credit score, the total income you report on your credit card application can be an important factor in receiving approval and the amount of your credit limit. In most cases you can include income beyond traditional salaries and wages, as long as you’ll have access to those funds to pay your card off, like:

- Investment income

- Social security

- Retirement benefits

- Military allowances

- Shared income from a partner

Just remember to always tell the truth in your application and be prepared to explain any income sources to the bank.

Call Capital One if you don’t receive an instant approval

If you’re declined for a card, it’s worth a call to the bank to speak to a credit representative to find out what’s going on. When calling, remember to always be friendly. If you call and aren’t getting the answers you’re looking for, you could always politely hang up and try again.

Be prepared to provide documentation regarding your business, such as a copy of a business card, proof of mailing address, invoices, etc. And be able to explain why you’re applying for the card (beyond the sign-up bonus).

Here are tips to make your credit card reconsideration telephone call a success.

Bottom Line

If you decide to apply for the Capital One Spark Cash for Business card, be sure you meet requirements like:

- Having excellent credit

- Qualifying for a small business card

- Reporting all the income you earn, including from sources other than a traditional W-2 jobs

Capital One does pull from all three main credit bureaus when they process your application and they report small business cards to your personal credit reports. So if you’re new to miles and points or want to apply for more valuable Chase travel credit cards, applying for this card might not be worth it.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!