Guide to the Capital One Purchase Eraser tool (erase restaurant and streaming expenses through April 30, 2021)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

You’ve heard us profess that Capital One miles are the easiest rewards to redeem and that Capital one cards are some of the best rewards credit cards. If you’re new to miles and points, earning Capital One miles is a great way to taste free travel with no effort.

Seriously, there’s no effort involved. Here are the steps:

- Open an eligible Capital One card like the Capital One Venture Rewards Credit Card

- Spend at least $3,000 on purchases within the first three months of account opening. (read this post to learn how you can do this without spending more money than normal).

- You’ll then earn 60,000 Capital One miles, which are worth at least $600 in travel. Then return to this post.

In this post, I’ll show you how easy it is to use those Capital One miles for a vacation with the famous Capital One Purchase Eraser.

What is the Capital One Purchase Eraser?

The Capital One Purchase Eraser lives in your Capital One online account. It is a platform that allows you to literally erase transactions you’ve made with your eligible Capital One card. You can swipe your eligible Capital One card at the car rental agency, and once the purchase posts in your transaction history, you can simply delete it, as though it never happened.

While you may be able to get more value by transferring to one of Capital One’s many airline transfer partners, with this method, you won’t have to worry about searching for available airline award seats, hotel award nights or blackout dates. You won’t have to negotiate complicated award charts or redeem your miles for certain airlines and alliances. You don’t need to know any of that stuff.

What purchases can be erased?

You can use your miles to pay for nearly any travel purchase, including:

- Airfare

- Hotels

- Rental cars

- Cruises

- Tolls

- Airbnb

- Timeshares

- Uber

- Limousines

- Trains

There’s really only one important thing to know: When you redeem through the Purchase Eraser, Capital One miles are worth 1 cent each. For example, if you book a $240 hotel room, you’ll need 24,000 miles to get it for free. If you don’t have enough miles, you have the option to use both cash and miles to pay for the purchase. So if you only have 18,000 miles, the room will cost 18,000 miles and $60.

How do I use the Capital One Purchase Eraser?

Step 1. Book travel

Make your travel purchases as you would with any credit card. Even if you haven’t yet earned a welcome bonus and you have zero miles, you can still go ahead and book your travel. You then have 90 days to sign into your online account, find the travel purchase, and “erase” it with miles.

Be sure you earn miles within that 90 day window, or you’ll have to pay for the travel out of your own pocket!

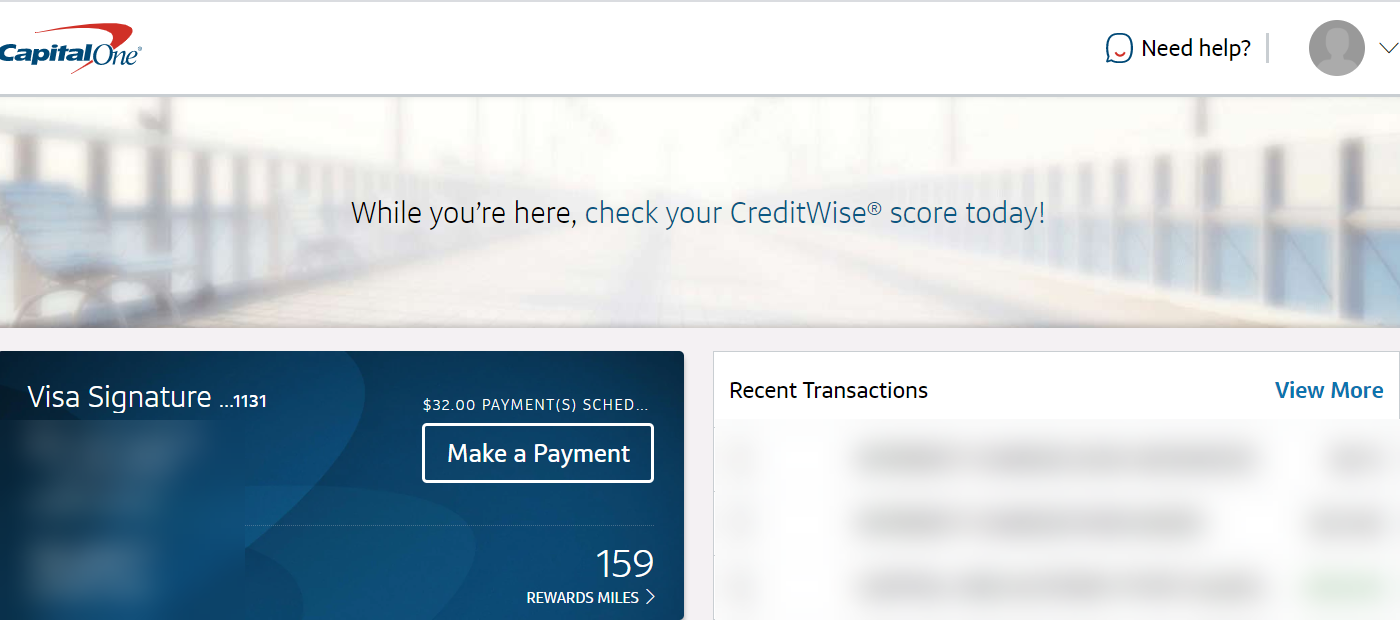

Step 2. Log-in to your Capital One account and click “Rewards”

Your account will show your balance of miles next to your card

You’ll see the number of miles you have next to your card. Click that number to begin redeeming your miles.

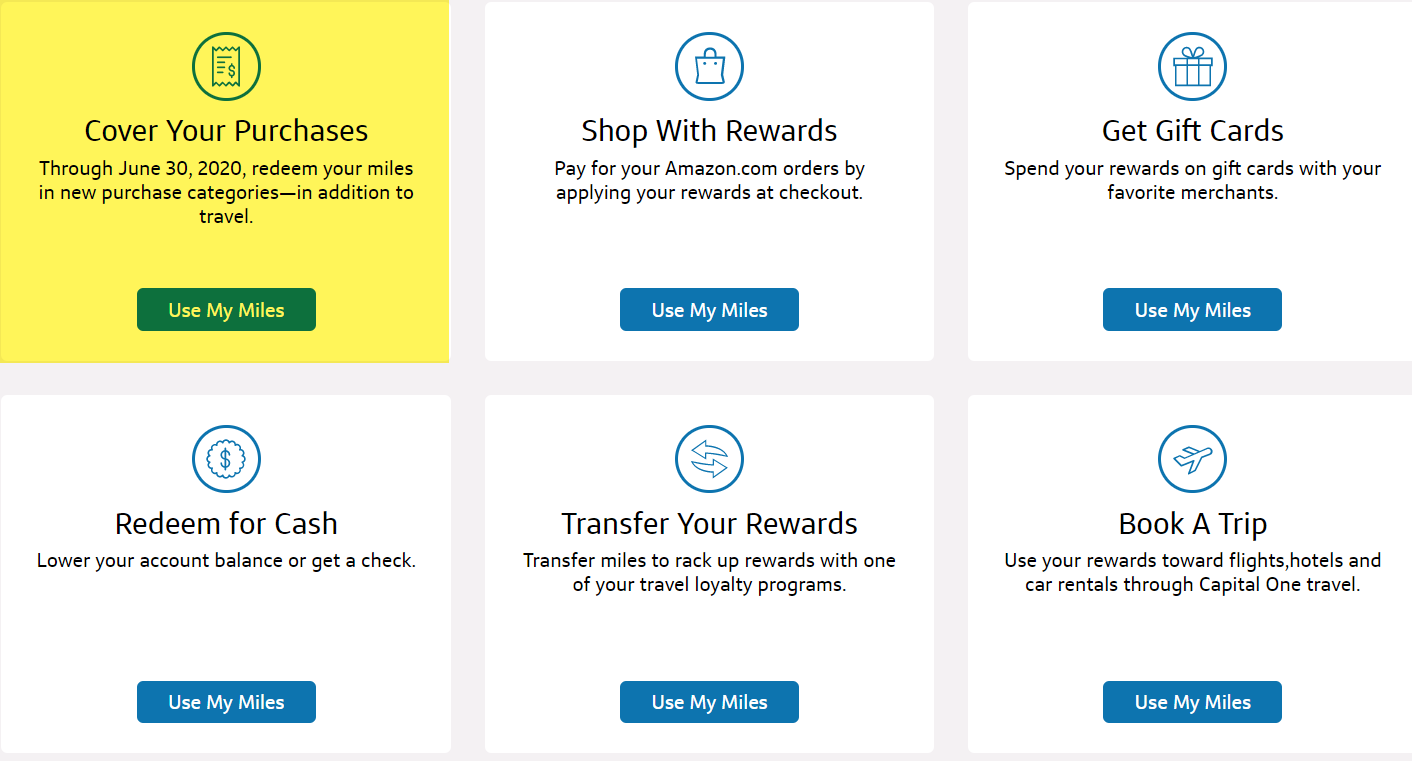

Step 3. Click “Cover Your Purchases”

There are a handful of ways you can choose to use Capital One miles, but you’ll get the best value by using them for travel. For example, you can redeem for gift cards or a statement credit at 0.5 cents per point — that’s only half the rate you’ll receive if using your miles towards travel.

Plus, you can use Capital One miles for eligible restaurant delivery, takeout and streaming service purchases. This option was set to expire at the end of September but has since been extended through April 30, 2021. Since nobody’s traveling right now, that’s a great temporary addition!

Step 4. Choose the purchases you want to erase

Capital One will then take you to a page with a list of all travel transactions that have been put on your card in the past 90 days (also restaurant and streaming purchases through June 30, 2020). Eligible transactions are the ones that code as a travel purchase (your credit card issuer acknowledges that it’s travel-related). For example, you can use Capital One miles for airfare but not for cantaloupe at your local supermarket.

Sometimes it can be difficult to know for sure if something will code as a travel purchase. When I was in Dubai, for example, I used my card to pay for Afternoon Tea at the Burj Al Arab, which is a hotel. The transaction coded as a travel purchase because the restaurant was inside a hotel. All Capital One knew was that I used my card at a hotel, so they allowed me to redeem my miles to get this purchase.

However, I tried the same thing at a restaurant in the Drake Hotel in Chicago, and the transaction coded as a regular restaurant purchase. I couldn’t erase that meal with miles.

Step 5. Redeem your miles

You don’t have to redeem all your miles for a travel purchase — you can instead use a combination of cash and miles. Select “Edit Miles Using” before you confirm your redemption. There’s no minimum redemption amount when you redeem miles. If you hailed a $4.52 Uber, you could simply wipe the charge off your transaction history with 452 Capital One miles.

However, if you’re using miles to partially pay for a travel purchase, the minimum is 2,500 miles ($25). In other words, If you want to use a combination of money and miles to pay for your $85 rental car, your bill will be at least 25,000 miles and $60 cash.

That’s all there is to it. Look for a confirmation number and a message below the transaction explaining that you’ve successfully redeemed your miles. You’ll also get an email confirmation.

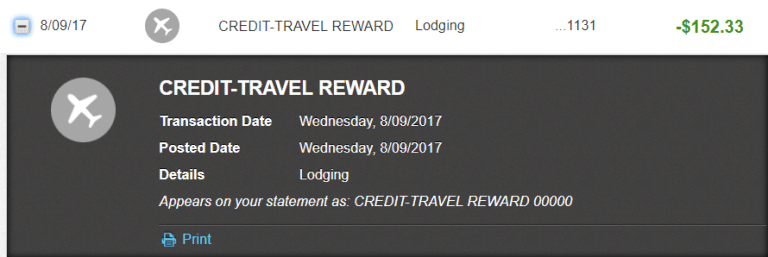

I’ve found that I receive the statement credit by the next day. The redeemed miles will show up on your transaction history as “CREDIT-TRAVEL REWARD.”

Bottom line

The Capital One Purchase Eraser is what you want if you aren’t in the frame of mind to research award charts and miles and points sweet spots. There is a LOT to know to get the best value for your rewards (though you can learn the tricks and tips in a uniquely digestible way if you subscribe to our newsletter). You simply swipe your card and erase the purchase from your statement — you’ll never have to pay it!

Let us know if you have questions about this method of redeeming your Capital One miles.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!