An Unforgettable Trip to … Minnesota (for Cheap With Southwest and IHG Points!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I’ll never forget my first trip to Minnesota.

Visiting candy stores and casinos in the middle of nowhere, avoiding a heat wave by swimming, and meeting family members I hope to see again soon – it was something special. And I was able to do it using miles and points earned from top travel credit cards for pennies on the dollar!

Miles and points doesn’t have to be about bucket list destinations or fancy First Class cabins (but that’s fun, too!). This trip was exciting to me and my fiancee, because we got to visit her family she hadn’t seen in quite some time and whom I’ve never met.

When I heard we would need to head out to Minnesota on short notice, I knew I could take advantage of my miles and points to get us there and back without breaking the bank.

Overall, I used 38,800 points and spent ~$248 for ~$1,185 in travel!

How I Earned the Points, Booked the Travel, and Maximized My Value

My Itinerary

| Segments | Points | Cash | Value |

|---|---|---|---|

| 2 Round-Trip Southwest Flights Boston to Minneapolis | 18,794 | ~$22 | ~$617 |

| 2 Nights at Bloomington W MSP Holiday Inn | 20,000 | $0 | ~$224 |

| 4 Day National Car Rental w/ Executive Status | Earned 1 reward point | ~$226 | ~$344 |

| Totals | 38,794 | ~$248 | ~$1,185 |

Southwest Companion Pass

Late last year, I heard about how to qualify for the Southwest Companion Pass by earning 110,000 Southwest points or more in a single calendar year (Note: This has increased to 125,000 Southwest points in a calendar year as of Jan. 1, 2020). The companion pass is good for the year you earn it until the end of the following year. Meaning, you could hold the companion pass for almost 2 years if you time it right.

The easiest way to earn the Companion Pass is to open up Southwest credit cards, like the Southwest Rapid Rewards Premier Business Credit Card and the Southwest Rapid Rewards Priority Credit Card after meeting minimum spending requirements.

Note: You can only have 1 personal Southwest credit card at a time.

After you’ve earned the Companion Pass, you can add your companion to your paid or award flights for just the cost of taxes and fees (~$11 round-trip for domestic flights)!

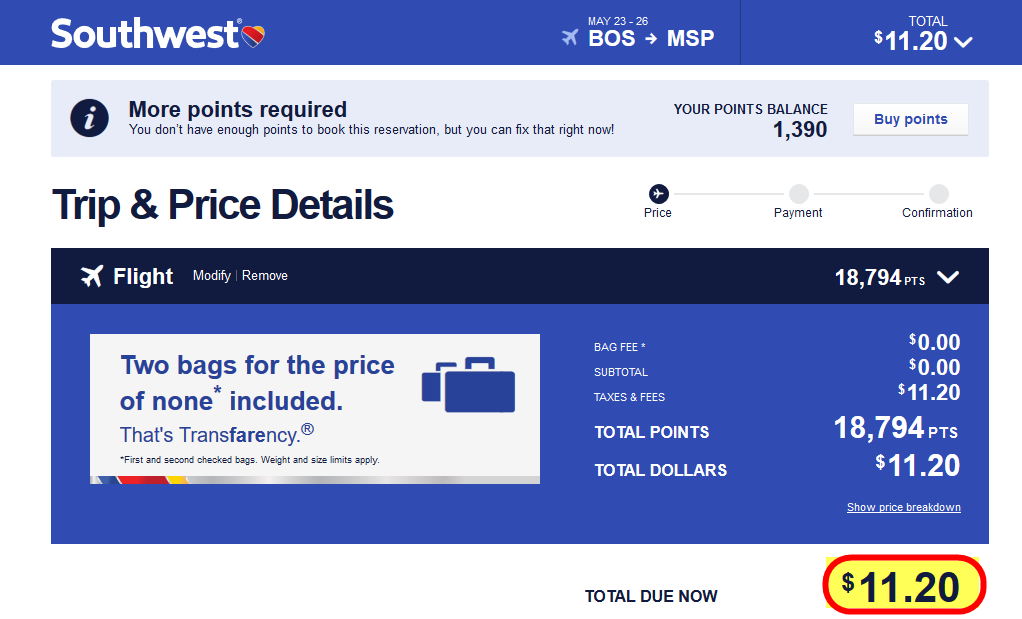

Now, I couldn’t replicate my exact trip from last year but I found a very comparable trip for Memorial Day 2019. For 1 round-trip ticket, it’ll cost $309 or 18,794 Southwest points. That’s ~1.58 cents per point ($309 fare -$11 tax / 18,794 points), a little over the average of ~1.5 cents per Southwest point. Because I have the Companion Pass, I can add my fiancee to my itinerary for only ~$11. That’s a steal!

If you need top off your Southwest points balance, you can always open our favorite beginner’s travel card, the Chase Sapphire Preferred Card, and transfer some of your welcome bonus to your Southwest account. Even if you aren’t hurting for Southwest points, you can read our review of the Chase Sapphire Preferred to learn how to get $1,000+ worth of travel from the sign-up bonus.

Note: Points transferred to Southwest from Chase Ultimate Rewards do NOT count towards earning the Companion Pass.

IHG PointBreaks

Every quarter, IHG releases a list of PointBreaks hotels at a reduced award price of 5,000, 10,000, or 15,000 IHG points. I have the old Chase IHG Select card (no longer available to new applicants) so I have a fair number of IHG points in my account. You can earn a welcome bonus of 80,000 IHG points after spending $2,000 on purchases within the first 3 months of account opening, with the new IHG® Rewards Club Premier Credit Card.

That’s enough for 16 free nights at 5,000-point locations, or 8 free nights at 10,000-point hotels though IHG PointBreaks!

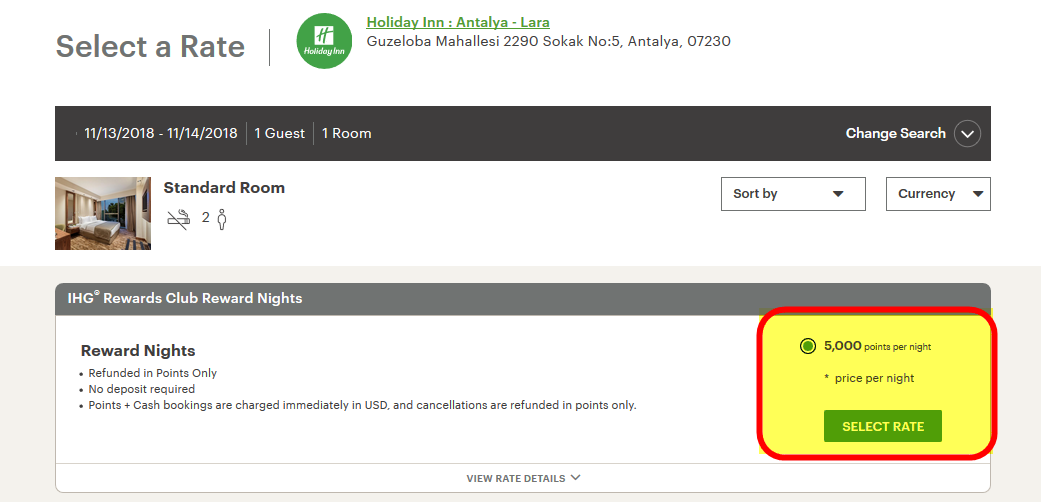

Booking PointBreaks stays is very easy. Head over the PointBreaks webpage and select a hotel. This will bring you to the hotel’s webpage where you’ll need to select “Reward Nights” under Rate Preference. Then select the option for a standard room at the reduced award rate.

Note: You may only book 2 nights maximum at any given PointBreaks hotel.

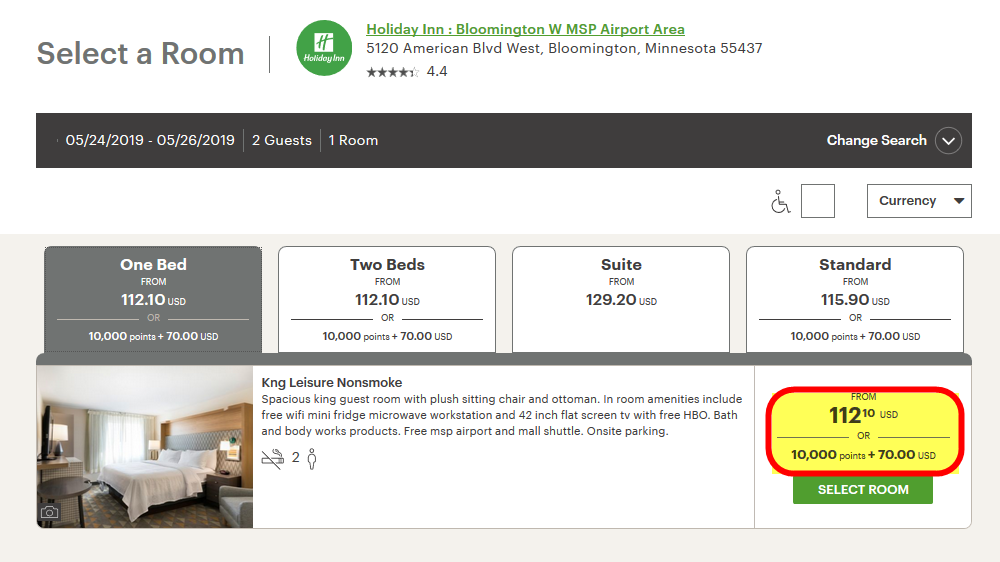

I was able to find availability at the Holiday Inn in Bloomington, Minnesota for 10,000 IHG points per night. Ecstatic, I booked for the maximum of 2 nights and we stayed with family the other 2 nights. The hotel rates during our stay were ~$224, so at 20,000 points, I got 1.1 cent per point, about 2X the going redemption value.

Tip: Sign-up for our newsletter to stay up to date on the PointBreaks release dates. Availability goes fast!

National Car Emerald and Executive Aisle

Like many Million Mile Secrets team members, I prefer National when renting a car. Why? Convenience and savings.

National has something called the Emerald Aisle and the Executive Aisle. By paying for a mid-size vehicle, you’ll unlock the ability to choose any car in the Emerald or Executive Aisle, depending on your status. This allows you to pay for a sedan but drive away in a Camaro or SUV, for the family. 😉

How do you get Emerald or Executive Elite Status? You’ll earn Emerald status is earned just by signing-up for their loyalty program. Executive Elite status is most easily earned with a status match through American Express. Cards like The Business Platinum® Card from American Express and the Hilton Honors American Express Ascend Card can earn you free Executive Elite status, for a limited time.

Once you have your status, just make a reservation for a mid-size vehicle as normal. For reference, it’s usually only $10 to $20 more for a mid-size rental over a compact car.

When I traveled to Minnesota, I knew I was flying in late and that Terminal 2 at MSP wouldn’t have any car rental staff on-duty after the terminal closed. However, since National had the Emerald and Executive Aisle, I went about my business as usual. I picked out my SUV, drove to the security gate, and hit the interstate. On top of the convenience, I only paid $225 for a $343 reservation because there was an SUV available in my aisle – that’s over $100 in savings!

Oh, and I always use my Chase Sapphire Preferred Card to purchase car reservations for its amazing primary rental car insurance. Team member Joseph was able to save over $2,600 using this invaluable card benefit when he visited Ireland.

Dining and Entertainment

Travel means spending money on dining and entertainment – it’s inevitable.

We visited many places including the famous Mall of America, SEA LIFE Aquarium, the World’s Largest Candy Store, and the Mystic Lake Casino. I generally use my Chase Sapphire Preferred when I dine out, but with the NEW Capital One Savor Cash Rewards Credit Card , I earn 4% cash back on all entertainment and dining purchases. So that cookie dough cup seems a little more justified now. 🙂

The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

So, if you know you’re going to spend money on these categories, you might as well earn competitive cash back.

Bottom Line

There are so many ways to earn points, miles, and cash back but actually redeeming your earnings can be a much different story.

On a recent trip to Minnesota, I took advantage of my Southwest Companion Pass, IHG Point Breaks, National Executive Elite status match, and top-tier dining and entertainment cash back.

I used my Chase Sapphire Preferred and Capital One Savor the most for their travel protections and cash back earning potential, respectively.

Remember, while award redemptions can get you huge value per point, you should focus on their specific value in your situation. For example, my mom needed a hotel stay with only 3 hours notice so I booked her a relatively mediocre redemption using my IHG points. But she was able to stay somewhere safe and that’ll always be more valuable than my points will ever be.

What about you? Have you redeemed miles and points for a seemingly ordinary trip that was extra special to you and your family?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!