My South American Excursion: How I’ll Use the 15,000 Point Chase Freedom Unlimited Bonus

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Like many travelers, Machu Picchu ranks high on my bucket list. But if you’ve seen the price of airfare between the US and Peru, you’ll understand why people save up for this experience.

Fortunately, South America is ripe with opportunities for Big Travel with Small Money. By earning welcome bonuses from top travel rewards cards, like the Chase Freedom Unlimited®, you could be well on your way to a dream trip without breaking the bank!

The information for the Chase Freedom® has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

If you want to score (almost) free flights to South America but aren’t sure where to start, I recommend earning Chase Ultimate Rewards points because of their value and flexibility. And whether you’re an experienced Million Mile Secret Agent or just looking to dip your toes into the miles and points hobby, the Chase Freedom Unlimited card is an excellent choice.

Earn 15,000 Points With the Chase Freedom Unlimited

Apply Here: Chase Freedom Unlimited®

Our Review of the Chase Freedom Unlimited

The Chase Freedom Unlimited® card offers a $150 bonus (15,000 Chase Ultimate Rewards points) after spending $500 on purchases in the first 3 months of account opening.

In addition to the bonus, you’ll earn unlimited 1.5% cash back (1.5 Chase Ultimate Rewards points per $1) on all purchases, making this an ideal everyday card for newbies and experienced travelers alike. With such a low spending requirement, no annual fee, and a generous return on everyday purchases, the card is definitely next on my list to apply for.

But to squeeze the most value out of your Chase Ultimate Rewards points, you will want to pair this card with an annual-fee Chase card like the Chase Sapphire Preferred Card, Chase Sapphire Reserve, or Chase Ink Business Preferred Credit Card. When you have one of these premium cards, you can combine your points from the Chase Freedom Unlimited and unlock the ability to transfer points to Chase’s airline and hotel partners, like United Airlines, Hyatt, or British Airways.

But before you start earning points, it’s best to have a travel goal. Here’s the trip I have in mind:

My South American Excursion

My initial travel goal was to book round-trip award flights in Business Class between Boston and Lima. But, after learning about the United Airlines Excursionist Perk, I couldn’t resist adding Bogotá, Colombia to my itinerary.

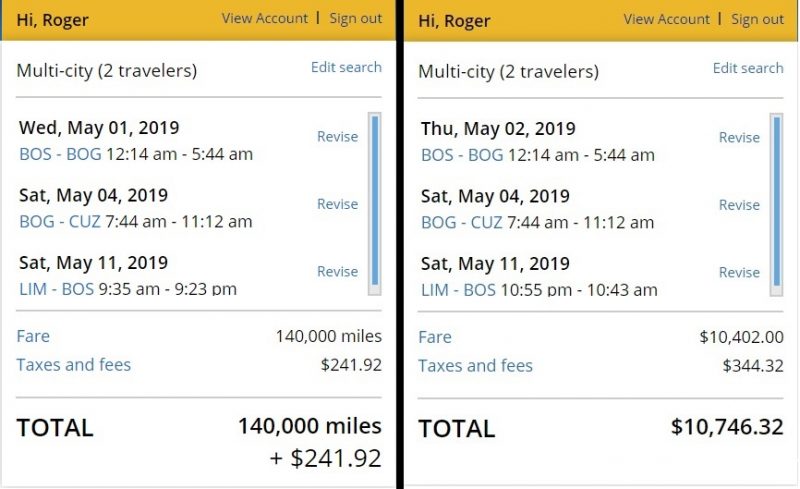

Each round-trip costs 70,000 United Airlines miles (140,000 miles total for 2 people) and, thanks to the Excursionist Perk, I was able to tack-on a one-way from Bogotá to Cusco for zero additional miles.

How I’ll Use the 15,000 Point Chase Freedom Unlimited Bonus

After earning the 80,000 point sign-up bonus from the Chase Ink Business Preferred and taking advantage of the 5% quarterly bonus categories on my Chase Freedom card, I’ve accumulated a total of 127,500 Ultimate Rewards points. The 15,000 point bonus from the Chase Freedom Unlimited will put me well over the 140,000 points I need to book my flights!

I’ll start by transferring 140,000 Chase Ultimate Rewards points to my United Airlines account. You can convert Chase Ultimate Rewards points to United Airlines miles at a 1:1 ratio, and the points transfer almost immediately!

After completing the transfer, I can log into my United Airlines account and book a multi-city flight from Boston to Bogota, Bogota to Cuzco, and Lima to Boston. Using my newly acquired United Airlines miles, I’ll pay ~$242 in taxes and fees for flights with a cash price of ~$10,746. That’s a redemption value of ~7.5 cents per mile (~$10,746 paid ticket price – ~$242 taxes and fees / 140,000 miles), which is superb!

Other Ideas

So you don’t already have a stash of points like I do? No worries! As long as you also have Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred, there are plenty of ways you can make the most of the 15,000 point bonus from Chase Freedom Unlimited. Here are just a couple:

- Transfer your bonus at a 1:1 ratio to 15,000 British Airways Avios points to book a round trip domestic flight 1,150 miles or less

- Transfer your bonus to your Hyatt account to earn a free night at any category 4 hotel, including the luxurious Andaz Peninsula Papagayo Resort in Costa Rica

- Explore the Chase Ultimate Rewards travel portal to book flights, hotels, rental cars, and other activities. You can redeem your 15,000 points at a rate of 1.25 cents apiece with the Chase Sapphire Preferred or Chase Ink Business Preferred. Better yet, redeem at 1.5 cents per point with the Chase Sapphire Reserve

Bottom Line

Whether you’re new to miles & points or are looking for an inexpensive way to top-off your Chase Ultimate Rewards account, the Chase Freedom Unlimited deserves a space in your wallet. And with no annual fee, it’s free to keep forever!

You’ll earn a $150 bonus (15,000 Chase Ultimate Rewards points) after spending $500 on purchases in the first 3 months of account opening.

To get the most value from the bonus, pair your Chase Freedom Unlimited card with an annual-fee card like the Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred. Then, you’ll have the ability to transfer points to travel partners like Hyatt or United Airlines. And you’ll be able to book travel through the Chase Ultimate Rewards travel portal at a better rate!

However you decide to spend your points, be sure to check out destinations in South America where there are lucrative point redemptions with many options for award booking and plenty of available award seats. You could scratch Machu Picchu off your bucket list!

How would you use 15,000 point Chase Freedom Unlimited bonus?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!