How to apply for a credit card (and when to do it)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

I remember being in the hunt for my first credit card as a young adult — craving symbolism that I was a functioning member of society. I didn’t even know about the immense power of travel credit cards back then.

I had never used credit. I thought I’d march into a bank, demand a credit card, and they’d be so impressed that I’d spent my entire life responsibly paying for things with cash that they’d give me the pick of the litter.

The opposite happened.

I couldn’t convince anyone to approve me for a credit card. I had no track record of trustworthiness with credit. How can I show a record of credit responsibility if nobody will give me a card in the first place??

Applying for a credit card can be a little intimidating if you have little experience with it. I’ll show you how to get a credit card, what you should keep in mind before applying for the best rewards credit cards, and some tips to being approved.

How can I get a credit card for the first time?

There are actually a couple ways to go about building credit for the first time. One super easy way is by being added as an authorized user on your friend or family member’s credit card (check out our post on the best credit cards for authorized users). You can actually ride the coattails of someone with good credit, and you’ll build a credit history yourself.

Alternately, you can open a secured credit card quite easily. Your bank can offer a credit card with a credit line for the amount you have in the bank (to help reassure them you won’t default). Other credit cards for students are often easier to open with little or poor credit history.

Does it matter when you apply for a credit card?

There’s this urban legend that you’ll have more luck being approved for a credit card during certain times of the day or week. This in no way affects your chances of approval.

However, sometimes the department you need to talk to won’t be open on the weekends. If your application was initially rejected, you’ll need to call the credit card reconsideration line, most likely open during normal business hours only.

The only time you need to be aware of the timing of your application is when an offer is changing. As long as you apply before the offer expiration date, you will earn the current bonus, even if your application isn’t approved until after the expiration date. You should take a screenshot of the offer you applied for just in case you need run into trouble later.

Know the credit card issuer’s application rules

Banks sometimes adjust their rules, especially when it comes to travel cards with lucrative bonuses. There are several bank rules — some unwritten, though we find they’re a truism nevertheless.

Here are a few important rules to remember:

- If you’ve been approved for five or more credit cards in the past 24 months from any bank (not including some small business cards), Chase will not approve you for its valuable travel credit cards. This is called the “Chase 5/24 rule”

- You can only earn the welcome bonus from each American Express card once per lifetime

- Once you earn a Chase Sapphire credit card bonus, you’re not eligible to earn another Sapphire bonus for 48 months

- Once you earn a Citi American Airlines credit card bonus, you’re not eligible for that particular card bonus for 48 months

- Once you earn a Citi ThankYou points earning credit card bonus, you’re not eligible for that particular card bonus for 24 months

- Barclays does not easily approve you for a credit card if you’ve already got a card with them and you rarely use it

- Capital One seems to only approve one card per six months

You can also read our full post on getting the same credit card bonus more than once. Knowing whether or not to apply is the first step.

Double check your credit score

Your credit score is the main thing banks consider when reviewing your application (though note it’s not the only thing — banks can approve or reject your application based on whatever grounds they want).

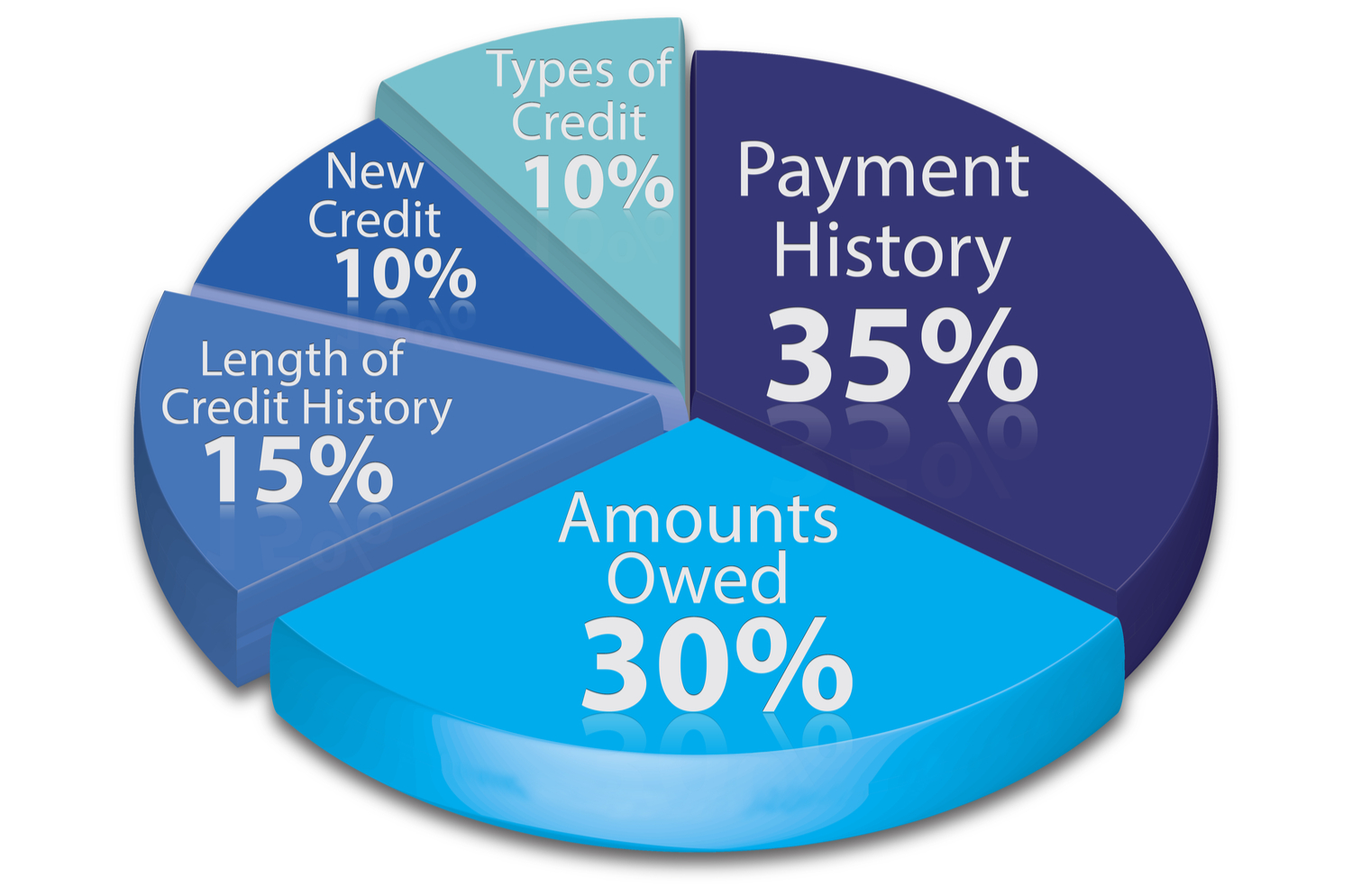

A credit score is made up of several factors, including payment history, debt owed, and the age of your overall accounts. We always recommend to readers to achieve a credit score of 700+ before opening travel credit cards. That’s when you’ll have the greatest odds of being approved for the best travel cards. Read our post on what score you need to qualify for the best credit cards. If you’re not there yet, that’s okay! There are plenty of ways to boost your credit score over time.

If you don’t know your credit score, there are many free online credit monitoring services that will give you an idea of your credit score. It’s worth stating that these services ONLY GIVE YOU AN IDEA, and can egregiously over or under-estimate your true score. In the past, these sites have been an astonishing 90 points off my actual score.

Find a credit card that meets your goals

There are lots and lots of credit cards out there. Don’t be overcome with analysis paralysis. Finding your next card is actually really simple as long as you’ve got a travel or financial goal in mind (read our beginner’s guide if you don’t know your goals yet). Read our breakdowns of the best credit cards, and in minutes you’ll know exactly which card is for you. For example:

- If you’re specifically interested in free hotel stays, read about the best hotel credit cards

- If you’re specifically interest in free airfare, read about the best airline credit cards

- If you’re interested in all things free travel, read about the best credit cards for travel

- If your primary objective is earning cash, read about the best cashback credit cards

- If you want to stay away from annual fees, read about the best no annual fee credit cards

If you have any particular questions, leave them in the comments and we’ll do our best to help you pinpoint your goal.

Check CardMatch to ensure you’re getting the best offer

CardMatch is a magical tool that reveals to you if credit card issuers have specifically targeted you for better offers than everyone else. For example, the public offer for a credit card may be 60,000 points after meeting minimum spending requirements. But by typing in a few personal details into CardMatch, you may find that you’ve got a special 100,000-point offer instead!CardMatch will help you ensure you’re getting the biggest bonus for every credit card approval. Check out my post on finding increased credit card offers with CardMatch.

If you’re not immediately approved, DON’T call the reconsideration line

Immediately after submitting your credit card application, you’ll probably receive one of two landing pages:

- You’re instantly approved

- The bank couldn’t provide an automated verdict, so you’ll have to wait for an answer (usually takes a week or two)

When receiving this news, many choose to immediately phone the credit card issuer to talk with a reconsideration specialist — to try and talk them into pushing the application through. While there’s nothing wrong with calling reconsideration (you should, in fact), the best time is after you’ve received your formal rejection letter in the mail.

Remember, you may still actually get approved for the card. You won’t know until you get your letter (or you call your card issuer’s automated application status phone number). If you wait until you receive that answer, you’re effectively giving yourself two shots at being approved. You can then call reconsideration and plead your case. Here are five tips to make your reconsideration call a success. Don’t be afraid to ask. The worst that can happen is they’ll say no.

Remember, banks are businesses. At the end of the day, they want you to be their customer. Sometimes the reconsideration department representatives only need to ask a few simple questions to get approval. Other times, you might need to offer to cancel another card with the bank, or move around your current lines of credit.

How many credit cards should you apply for and how often?

First let me say that, despite what you’ve heard, opening credit cards will not hurt your credit score. You will see a slight drop after opening a new account, — each time you apply for a credit card, the bank pulls your credit score. And when a bank makes a credit inquiry, your score can temporarily be lowered by three to five points, but this effect drops off after three to six months. In no time, your score will likely be stronger than ever — provided you pay off all your bills on time and don’t carry large balances month to month.

I’ve got 19 active credit cards and my credit score is nearly 800. It’s never been higher than it is right now. However, each bank determines how much credit to give you based on factors such as your income, history of repaying debts, and the number of new credit card accounts you’ve opened recently. Too many accounts opened in a short time is a red flag. Banks don’t like to see a lot of credit inquiries on your credit report because it means you could be less likely to pay back your debt.

Apply for a few cards each quarter

Because the effect of credit inquiries drops off after three to six months, some people like to apply for three or four cards every quarter. Some apply for these cards at the same time from different banks because they believe that banks won’t see the inquiries from other banks on the same day.

Wait for the big welcome bonuses

Another way to time your applications is to apply for the increased welcome bonuses when they are available, or simply when you feel comfortable meeting the minimum spending. You could apply for one card now, and another one in a month or two.

Bottom line

There are many things to keep in mind when applying for credit cards — especially if you’ve been in the miles and points hobby for a while. Just remember to keep your end goal in mind. If you want free hotel stays, open hotel cards that have minimum spending requirements you can achieve. Keep track of your credit score and only apply if you’re 700 or above. And always check CardMatch before applying for a credit card, as you may be targeted for an extra generous welcome offer.

Let me know your credit card application tips! And subscribe to our newsletter for more posts like this delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!