The Benefits of Business Credit Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer is no longer available, but check the Hot Deals for the latest offers! Update: The Chase Ink Bold card and AMEX SimplyCash cards are no longer available for new sign-ups.Are you looking for ways to earn more Big Travel with Small Money?

I wrote about the recently increased sign-up bonuses on the Chase Ink Bold, Chase Ink Plus, and Chase Ink Business Cash Credit Card.

For a limited time, you’ll get 60,000 Chase Ultimate Rewards points after spending $5,000 in the 1st 3 months on the Chase Ink Bold and Chase Ink Plus cards. And you’ll get 30,000 points ($300 cash back) after spending $3,000 in the 1st 3 months on the Chase Ink Cash card.

So if you’ve been thinking about applying for a business card, now is a good time!

Applying for business cards, especially if you already have a lot of personal cards, can be a good way to increase your miles and points balances and get extra perks!

Why Apply for Business Cards?

Link: How to Apply for a Business Credit Card

Link: How to Fill Out a Chase Business Card Application

Link: How to Fill Out an AMEX Business Card Application

Link: 3 Ways You May Qualify for a Business Credit Card

Business cards often have big sign-up bonuses, bonus miles and points in certain categories, and extra perks and discounts that don’t always come with personal cards.

For example, the Chase Ink cards earn 5X points at office supply stores, and on phone, internet, and cable TV. And you get a Lounge Club membership which gives you 2 free airport lounge visits per year. Not to mention certain discounts like the Visa Savings Edge program!

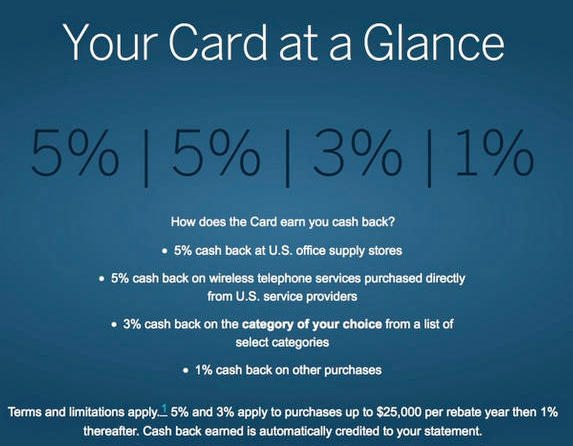

Or, if you have the AMEX SimplyCash business card, you can earn 5% cash back at office supply stores and on wireless services. You’ll also earn 3% cash back on a category you choose!

Applying for business cards can be a good way to earn another sign-up bonus if you already have the personal version of a card. For example, if you have the Starwood Preferred Guest® Credit Card from American Express, you can get the bonus again if you sign-up for the Starwood Preferred Guest® Business Credit Card from American Express.

This is especially useful now that AMEX has changed their rules to limit folks to 1 sign-up bonus per card in their lifetime.

Some folks may think they can’t apply for a business credit card because they don’t have a business. But read my post about how you could qualify for a business card.

What About Your Credit Score?

Link: Why Business Cards Impact Your Personal Credit Score Less Than Personal Cards

Some folks may worry that applying for business credit cards will affect their credit score.

You will get a hard credit inquiry when you apply for a business credit card, so your score might decrease a few points in the short term.

But the credit line, amounts owed, and length of credit history on business cards are NOT reported to credit bureaus. So apart from the initial credit inquiry when you apply, having a business credit card should have no effect on your credit score! In fact, it could be an advantage because your spending doesn’t impact your credit score.

Note: If you default on a business credit card debt, it WILL be reported to credit bureaus and your score will most definitely decrease!As always, you should read my post about the dangers of applying for credit cards. Only do what you’re comfortable with!

Bottom Line

Applying for business credit cards can be a good way to increase your miles and points balances. Many business cards have very good sign-up bonuses, bonus earning categories, and extra perks and discounts.

You may qualify for a business card even if you don’t think you have a business! And if you have the personal version of a card (say the Starwood Preferred Guest® Credit Card from American Express), you can get the sign-up bonus on the business version, Starwood Preferred Guest® Business Credit Card from American Express as well.

Which business credit card is your favorite and why?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!