Here’s Why 3 of Our Team Members Are Seriously Considering Getting the Marriott Bonvoy Business Credit Card — and Why Our Senior Editor Already Has It!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

INSIDER SECRET: This card has the potential to give you an upgraded experience at Marriott hotels.The Marriott Bonvoy Business™ American Express® Card comes with 75,000 bonus Marriott Bonvoy points after spending $3,000 on purchases in the first 3 months of account opening. That’s a significant amount of points, which can upgrade your travels in an impactful way!

But that big bonus is only where this card begins to shine. Two of my teammates and I are seriously considering this card (I need 70,000 more points for my upcoming stay in the Maldives), and our senior editor, Jasmin, already has the card. That’s because the card comes with enough ongoing benefits that it’s worth paying the card’s $125 annual fee (See Rates & Fees).

So, is the Marriott Bonvoy Business Credit Card worth it? I’ll help you decide!

Is the Marriott Bonvoy Business Credit Card Worth It?

Apply Here: Marriott Bonvoy Business™ American Express® Card

Read our Marriott Bonvoy Business Review

Credit card annual fees are a FANTASTIC way to scare people away from a card.

But the golden rule at MMS is to do the math. Take a look at the benefits that come with the card, and if you can save more money than the annual fee (relatively effortlessly), it’s a good deal.

The Marriott Bonvoy Business Credit Card is a small business card, which means you’ll need a small business to qualify. If you’ve got a for-profit venture, even things like selling on eBay, tutoring, and freelance writing, you’re good to go!

Here are the top reasons this card is worth keeping.

Free Night Award

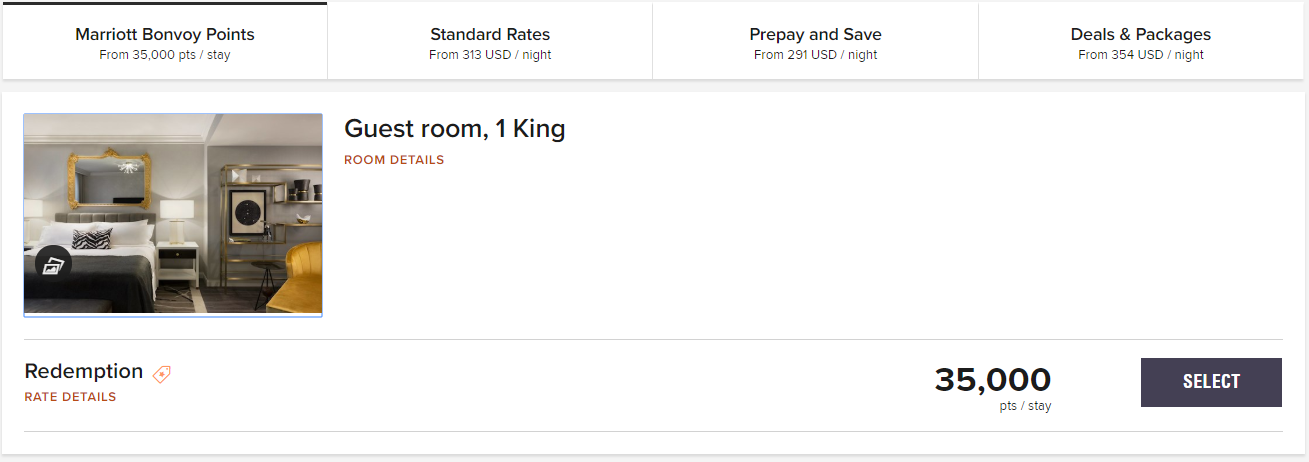

Every year when you renew your credit card, you’ll receive a free night at Marriott hotels that cost 35,000 points or less.

I have hotel credit cards that come with similar perks to this, and I never plan on canceling them. I recently used my 35,000 point Marriott free night at Hotel LeVeque in Columbus, which can cost $350+ per night.

You can easily receive more from this single benefit than you’ll pay in the card’s annual fee. Most hotels cost more than $125 per night, after all! If you know you’re going to stay in a Marriott hotel at least once per year, this card is worth it.

I stay several nights in hotels each year, so I’ll pick up as many cards with annual free nights as I can! They’ll save me money in the long run, even after paying the annual fees.

Note: If you’re a big spender, this card will give you ANOTHER free night (up to 35,000 points) when you spend $60,000 in a calendar year. Easy to do with many small business expenses!A Better Hotel Experience

The below perks don’t justify the annual fee alone, but they help to make the case for it.

With the Marriott Bonvoy Business Credit Card, you’ll receive automatic Silver Marriott Bonvoy elite status. That means whenever you stay at a Marriott hotel, you’ll get benefits like:

- 10% bonus points for paid stays

- Priority late checkout (when available)

- Free Wi-Fi

- Dedicated Elite Reservation Line

Plus, if you spend $35,000 on purchases in a calendar year with the Marriott Bonvoy Business Credit Card, you’ll be bumped up to Gold Marriott Bonvoy elite status through the end of the following calendar year. That’s much better than Silver, because you’ll get 25% bonus points on paid stays, 2:00 pm late check-out (when available), and room upgrades (when available).

The card even gives you “premium” internet at Marriott hotels. That’s a notch above the regular Wi-Fi you receive as a Silver elite status member, and something you’d have to pay for otherwise (unless you have Gold elite status or above).

Elite Night Credits

The Marriott Bonvoy Business Credit Card comes with 15 elite night credits each year. That means Marriott is basically reducing the number of nights you need to stay to achieve elite status by 15 nights.

For example, you’ll need to stay 25 nights to earn Gold elite status. But if you have this card, you’ll only need to stay 10 nights (25 night requirement – 15 nights for having the Marriott Bonvoy Business Credit Card).

Pretty cool! If you’re trying to reach higher level elite status, this card is a huge help.

Bottom Line

The Marriott Bonvoy Business Credit Card comes with a $125 annual fee. But don’t rule it out just yet! It’s quite effortless to save much more than that with the card every single year.

Three of us on the team plan to apply for the card. We all stay in a Marriott hotel at least ONCE per year, and hotels are often more expensive than $125 per night. So we’ll ALWAYS come out ahead by using our annual free night at Marriott.

In fact, you can use the free night at certain hotels that cost HUNDREDS more than you’ll pay in annual fees.

Add to this the 75,000 point welcome bonus after meeting minimum spending requirements, and this card is a no-brainer. Just remember this is a small business card, so you’ll need to have a for-profit venture to qualify for the Marriott Bonvoy Business Credit Card.

You can check out Devon’s article to read more about if the Marriott Bonvoy Business is worth it, and see if you’re eligible. And you can learn about all things Marriott by reading the following:

- Marriott Bonvoy Review

- Marriott Points Value

- Marriott Bonvoy Elite Status Review

- Best Way to Use Marriott Points

- How to Transfer Marriott Points to Airlines

- How to Earn Marriott Points

- How to Setup a Marriott Account

- How to Use Marriott Points

- Marriott Award Chart

- Do Marriott Points Expire?

Check out the current Marriott promotions here. And enroll in our newsletter for more credit card evaluations like this!

[gravityform id=”3″ title=”false” description=”false”] ForEditorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!