Chase Marriott Bonvoy Bold card review – Earn 30,000 points without the annual fee

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Marriott Bonvoy Bold™ Credit Card is the newest member of Marriott credit card family and right now you can earn 30,000 Marriott points after spending $1,000 in the first three months from opening the account. That’s a solid hotel credit card offer when you consider that you won’t be on the hook for an annual fee.

Apply for the Marriott Bonvoy Bold card here.

If you like staying at Marriott hotels, but don’t want to commit to paying an annual fee, then this is an excellent card to consider.

Here’s our Chase Marriott Bonvoy Bold review.

Who is this card for?

This card doesn’t have the same variety of perks as the rest of the Marriott credit cards or other top hotel credit cards. So it’s not the best choice for the typical road warrior. But you don’t need to pay a fee to keep the card, it can help you keep your Marriott points from expiring and fast-track your way to the next tier of Marriott Bonvoy Elite status.

So it’s a solid choice for those that travel with Marriott only occasionally. To get the best chance of being approved you’ll want a credit score of 690 or higher and this card is subject to the Chase 5/24 rule. And because both Amex and Chase issue Marriott Bonvoy credit cards, there are some convoluted application rules. You’re not eligible for the Marriott Bonvoy Bold card if you’re:

- Current card members of the Marriott Bonvoy™ Premier credit card (also known as Marriott Rewards® Premier), Marriott Bonvoy Boundless Credit Card (also known as Marriott Rewards® Premier Plus), Marriott Bonvoy Bold™ credit card, or

- If you’ve earned a new card member bonus in the previous 24 months from the Marriott Bonvoy™ Premier credit card (also known as Marriott Rewards® Premier), Marriott Bonvoy Boundless Credit Card (also known as Marriott Rewards® Premier Plus), or Marriott Bonvoy Bold™ credit card.

And you’re not eligible for the bonus if you:

- Are a current cardmember, or were a previous cardmember within the last 30 days, of Marriott BonvoyTM American Express® Card (previously, The Starwood Preferred Guest® Credit Card from American Express);

- Received a new card member bonus or upgrade bonus in the last 24 months with either the Marriott Bonvoy Business™ American Express® Card (previously, The Starwood Preferred Guest® Business Credit Card from American Express) or Marriott Bonvoy Brilliant™ American Express® Card (previously the Starwood Preferred Guest® American Express Luxury Card), or

- Applied and were approved for Marriott Bonvoy Business™ American Express® Card (previously, The Starwood Preferred Guest® Business Credit Card from American Express) or Marriott Bonvoy Brilliant™ American Express® Card (previously, the Starwood Preferred Guest® American Express Luxury Card) within the last 90 days.

Current bonus

The Marriott Bonvoy Bold comes with 30,000 Marriott points after spending $1,000 on purchases in the first three months from account opening.

Benefits and perks

With the Marriott Bonvoy Bold you’ll earn 3x points at participating Marriott hotels, 2x points on travel purchases and one point per dollar spent on all other purchases.

Marriott Bonvoy Silver elite status

You’ll get automatic Silver Marriott Bonvoy elite status (10% bonus points on paid stays, late checkout when available) as long as you have the card.

15 elite night credits per year

If you’re looking to reach the next status level, the Bonvoy Bold get you 15 elite night credits each year. That’s only 10 extra nights from Gold status or 35 nights from Platinum.

No foreign transaction fees

When you’re traveling abroad you won’t have to worry about foreign transaction fees because the Bonvoy Bold doesn’t have any.

Extended warranty

Eligible U.S. manufacturer’s warranties of three years or less are extended for an additional year when you use your card to make the purchase.

Lost luggage coverage

For travel paid for with your card eligible travelers are insured for up to $3,000 per passenger each trip for lost or damaged luggage.

Purchase protection

Covers new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.

Trip delay reimbursement

If your trip is delayed for more than 12 hours or requires an overnight stay, you could be reimbursed for up to $500 per ticket for reasonable expenses (meals, lodging, toiletries, medication and other personal use items).

Rental car insurance

When you pay for your entire car rental with your card you’ll be covered for damage and theft at no extra charge. This insurance in secondary if you’re renting in the U.S. and primary outside of the U.S.

Travel accident insurance

When you pay for your travel with your Bonvoy Bold card, you are eligible for accidental death or dismemberment coverage of up to $500,000.

How to redeem points

There are 29 Marriott brands where you can use Marriott points to book award nights:

- AC Hotels by Marriott

- Aloft

- Autograph Collection Hotels

- Courtyard by Marriott

- Delta

- Design

- EDITION

- Element

- Fairfield Inn & Suites by Marriott

- Four Points by Sheraton

- Gaylord Hotels

- JW Marriott

- Le Meridien

- Marriott Executive Apartments

- Marriott Hotels

- Marriott Vacation Club

- Moxy Hotels

- Protea Hotels

- Renaissance Hotels

- Residence Inn by Marriott

- Ritz-Carlton

- Sheraton

- Springhill Suites by Marriott

- St. Regis

- The Luxury Collection

- TownePlace Suites by Marriott

- Tribute

- Westin

- W

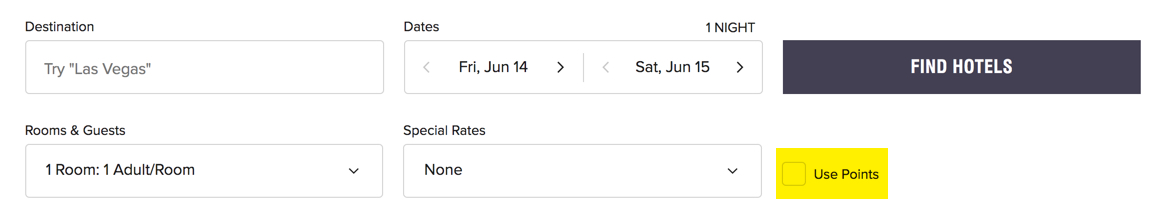

Redeeming points for award stays is easy. You just search your desired destination and dates on Marriott’s site and be sure to check the “use points” box to see which hotels are available for points bookings.

Marriott points are also great for transferring to airlines because there are 40+ Marriott transfer partners. The transfer ratio for the vast majority of these partners is 3:1, so every three Marriott points converts into one airline mile. But for every 60,000 Marriott points you transfer, you’ll get an extra 15,000 Marriott points added to your transfer. In most cases, that’s an extra 5,000 airline miles.

Marriott points also transfer to a lot of airlines that don’t participate in other major transferrable-points programs, that’s why I think they are the best hotel points to earn for free flights.

Pairing the Marriott Bonvoy Bold with other credit cards

If you want to earn more Marriott points, you could consider applying for a Marriott credit card that has a bigger intro bonus, like one of these cards:

- Marriott Bonvoy Boundless Credit Card – Earn three free nights (each night valued up to 50,000 points) after spending $3,000 on purchases in your first three months from account opening.

- Marriott Bonvoy Business™ American Express® Card – Limited Time Offer: Earn 100,000 Bonus Marriott Bonvoy Points after you use your new card to make $5,000 in purchases within the first three months of account opening. Offer ends 5/18/22.

- Marriott Bonvoy Brilliant™ American Express® Card – Earn 75,000 bonus points after you spend $3,000 in purchases within the first three months of card membership. Plus, earn up to $200 in statement credits for eligible purchases made on your new card at U.S. restaurants within the first six months of card membership.

But because of the application restrictions I mentioned earlier, you’d have to wait a long time before you could pick-up a second Marriott card. Instead, you could earn Chase Ultimate Rewards points or Amex Membership Rewards points — both transfer to Marriott at a 1:1 ratio.

You can earn transferrable Chase Ultimate Rewards points with the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® or Ink Business Preferred Credit Card. One problem is, that these are Chase credit cards, so they are limited by the 5/24 rule as well.

If you’re over the 5/24 limit and still want to earn Marriott points, then you should apply for an American Express card that earns Amex Membership Rewards points.

Bottom line

With the Marriott Bonvoy Bold card, you’ll earn 30,000 Marriott points after spending $1,000 on purchases in the first three months from account opening.

That’s a nice bonus you earn from a no-annual-fee travel credit card. Plus, the card has other ongoing perks like 15 elite night credits every year, which gets you Marriott Silver status and puts you only 10 nights away from earning Gold status.

You can apply for the Marriott Bonvoy Bold Credit Card here.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!