New Offer for the Chase British Airways Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Did you know that a family of 4 can visit Europe for practically free with just a single credit card offer?

And if you know how to use it, you can get potentially thousands of dollars in value from it!

The British Airways Visa Signature® Card is offering 3 Avios points per $1 spent in the first year of account opening on up to $20,000 in purchases. That’s 100,000 British Airways Avios points! But you’ll have to put quite a lot of spending on your card to earn all those points. If you can manage it, though, prepare for a whole slew of Big Travel with Small Money.

I’ll show you what I mean!

The information for the British Airways Visa Signature Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Here’s my comprehensive British Airways credit card review. I’ll help you decide if it’s worth applying for!

British Airways Credit Card Review

- Earn 3 Avios points per $1 on up to $20,000 in the first year

- Book 4 (nearly free) round-trip flights to Europe or Hawaii

- Earn a Travel Together Ticket to bring a friend with you for the price of taxes & fees after meeting a spending requirement

- Get valuable travel perks

- Get extended warranty protection

British Airways Credit Card Offer

Link: British Airways Visa Signature® Card

Link: How to Use British Airways Avios Points

This is an offer we haven’t seen before for this card. It not a normal credit card bonus with a minimum spending requirement, instead you’ll earn points as you spend. Like I said before, you’ll earn 3 Avios per $1 spent on up to $20,000 within the first year of having the card.

So you’ll need to put $20,000 in spending on your card during the first year to earn the full 100,000 British Airways Avios points.

After the first year or first $20,000 spent in that year, the card also comes with:

- 3 British Airways Avios points per $1 you spend on British Airways purchases

- 1 British Airways Avios point per $1 you spend on everything else

It also doesn’t have any foreign transaction fees. And when you make $30,000 in purchases within a calendar year you’ll get a Travel Together Ticket (your companion flies with you on a British Airways award flight from the US for just the cost of taxes and fees).

The $95 annual fee is NOT waived for the first year. But it’s worth it for 100,000 British Airways Avios points!

Is the British Airways Card Good Deal?

Link: How to Use British Airways Avios Points Like a Pro

As you can see, the Chase British Airways card incentivizes big spenders! But you can get a Travel Together Ticket after you spend a total of $30,000 in a calendar year.

And the nice thing is that you’ll be earning 3X Avios points per $1 even if you don’t hit the $30,000 spending mark.

Here are ways you can get fantastic value from British Airways Avios points!

1. Round-Trip to Europe for 26,000 British Airways Avios Points

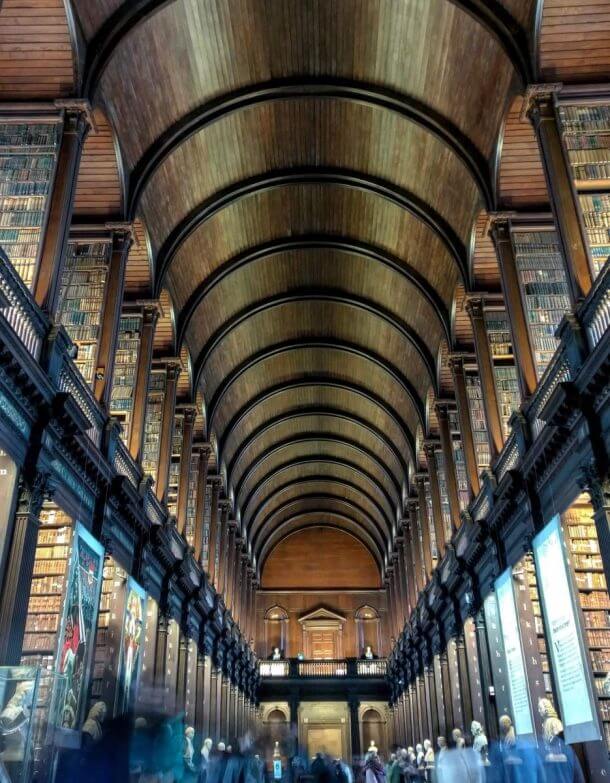

Link: Use British Airways Avios Points to Get to Ireland for Cheap

One of the cheapest ways to get to Europe from the US is by using British Airways Avios points to reach Ireland.

When you fly on British Airways’ partner airline, Aer Lingus, you can visit Ireland for as little as 26,000 British Airways Avios points round-trip! Aer Lingus flies non-stop to Ireland (either Dublin or Shannon) from:

- Boston

- Chicago

- Hartford

- Minneapolis (starting in 2019)

- Newark

- New York – JFK

- Philadelphia

- Washington, DC

So if you depart from any of these cities, it’s possible to book 4 round-trip tickets (104,000 British Airways Avios points total) with the card’s full bonus.

This price only applies to off-peak travel dates. But typically Aer Lingus defines off-peak as ~8 months out of the year.

Million Mile Secrets contributor Lyn recently used this strategy for her family. Read how she did it here!

2. Round-Trip to Hawaii for 25,000 British Airways Avios Points

Link: How to Fly to Hawaii With British Airways Avios Points

You can use British Airways Avios points to book flights to Hawaii on American Airlines or Alaska Airlines. And if you depart from the West Coast, you’ll pay as little as 25,000 British Airways Avios points round-trip!

For example, you can fly to Hawaii for as little as 12,500 points one-way in coach when you fly from:

- Anchorage

- Bellingham

- Los Angeles

- Oakland

- Phoenix

- Portland

- Sacramento

- San Diego

- San Jose

- Seattle

So you’ll have enough points for 4 round-trip flights if you spend only $25,000 in the first year of account opening!

3. Short-Haul Award Flights

Link: Wandering Aramean’s British Airways Avios Points Tool

Whether you’re traveling within the US or internationally, British Airways Avios points are just about the best way to make short hops for cheap.

For short-haul (under 1,151 miles) coach award flights in North America, you’ll pay 7,500 British Airways Avios points one-way. Outside of North America, short-haul (under 651 miles) coach flights cost just 4,500 British Airways Avios points one-way.

So you can use 4,500 British Airways Avios points to hop from Trinidad to Saint Lucia. That ticket normally costs ~$150. So you’d get a value of ~3.33 cents per point ($150 ticket / 4,500 points)!

4. Transfer Points to Partner Airline Iberia

Link: How to Transfer Points Between British Airways and Iberia

British Airways charges a minimum of 15,000 Avios points for a short round-trip flight within North America. That’s better than most other airlines. But in some circumstances, you can do even better by transferring your points to British Airways partner Iberia!

That’s because:

- Iberia has a different award chart, and charges as little as 11,000 points round-trip for flights of 600 miles or less

- Iberia saves you points when you’re booking a flight with a connection. British Airways charges you at least 7,500 points for each segment on your trip, but Iberia calculates the award price based on the total number of miles you fly

Iberia can also help you save on hefty fuel surcharges. British Airways likes to tack on super expensive fees when you book transatlantic award flights. Booking with Iberia Avios points instead of British Airways Avios points could save you hundreds and hundreds of dollars (though this isn’t always the case).

Transferring points takes just a couple minutes, and could save you tons of points and money. Check out our comprehensive post for how to transfer British Airways Avios points to Iberia!

Is the British Airways Card Worth Keeping?

The card has several perks that could definitely make the card worth keeping year after year.

1. Travel Together Ticket

Each calendar year you spend $30,000 in purchases on your card, you’ll get a Travel Together Ticket, which is valid for 2 years.

So when you redeem British Airways Avios points for a flight for yourself on a British Airways mainline flight, you can bring someone else with you for just the cost of taxes & fees! That effectively doubles the value of your points during that flight. The ticket is only valid for flights that originate and return to the US.

You can even use the Travel Together Ticket if you book a First Class seat! Though I wouldn’t normally recommend this, because the taxes & fees are so astronomical on British Airways.

If you’re a big spender, this could be a reason to continue paying the card’s $95 annual fee each year.

2. NO Foreign Transaction Fees

Many credit cards charge an additional ~3% to your bill when you use your card outside the US. That can really add up quickly if you’re swiping your card a lot during your vacation!

The Chase British Airways card doesn’t add foreign transaction fees, so it’s a good card to take with you during your trip.

3. Travel & Purchase Coverage

The Chase British Airways card has plenty of helpful benefits for both travel and everyday purchases. You’ll get:

- Auto Rental Coverage – When you decline the rental car agency’s collision insurance and charge the rental to your car, you’ll be covered for collision damage and theft for most rental cars (coverage is secondary)

- Baggage Delay Insurance – Receive up to $100 per day when your baggage is delayed 6+ hours. Eligible purchases for reimbursement include things like clothing and toiletries.

- Lost Luggage Reimbursement – If bags are damaged or lost by the airline, you will be reimbursed up to $3,000

- Purchase Protection – Your purchases are covered for 120 days against damage or theft ($500 per claim, $50,000 per account)

- Extended Warranty Protection – If you use your card to purchase an item that has a warranty of 3 years or less, the card will extend your warranty by 1 year

Do You Qualify for This Card?

There are a few questions to ask yourself before applying for this card.

1. Do You Have a Good Credit Score?

I usually recommend NOT applying for credit cards in this hobby unless your credit score is above 700. Based on data points from Million Mile Secrets team members and readers, most folks who are approved for travel cards like this have a credit score of at least 700.

Just remember, no matter how stellar your credit score is, Chase has the final say. And they look at lots of factors other than your credit score, and can decline you for any reason. For example:

- If you have lots of Chase credit cards, you may have more difficulty being approved for new cards. Chase might not want to extend any additional credit!

- Chase might not like if you already carry large balances on your credit cards

- If you’ve recently opened 5+ credit cards (from any bank), Chase will automatically decline your application

2. Have You Had the Chase British Airways Card Before?

If you’ve had this card in the past, Chase allows folks to earn the sign-up bonus again as long as you don’t have the card currently open and it’s been at least 24 months since you last received the bonus.

3. Do You Have All the Other Chase Cards You Want?

The Chase British Airways is affected by the Chase “5/24” rule! So if you’ve opened 5 or more credit cards (from any bank) in the past 24 months (excluding Chase business cards and certain other business cards) you won’t qualify.

And if you’re under the Chase 5/24 limit, this card CAN prevent you from getting other valuable Chase credit cards in the future. If you’re a miles & points beginner, it’s better if you sign-up for a card that earns Chase Ultimate Rewards points now, and open this card later. I recommend beginning with cards like:

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Ink Business Preferred Credit Card

With these cards, you can transfer the points you earn to British Airways at a 1:1 ratio. Or you can transfer them to other valuable partners, like Southwest, Hyatt, and United Airlines. You can even use the points to purchase travel through the Chase Ultimate Rewards travel portal. So you have more flexibility to redeem your points with these cards than with the Chase British Airways card.

Note: If you aren’t sure how many cards you’ve opened in the last 24 months, you can read our post for how to easily check your Chase “5/24” status.

Bottom Line

With the new offer on the Chase British Airways card, you can earn a total of 100,000 British Airways Avios points. But it’s not a sign-up bonus. Instead you’ll earn 3 Avios points per $1 spent in the first year on up to $20,000 in purchases.

With the Avios points you could earn, you’ll have more than enough for things like:

- 4 round-trip flights to Ireland (from select US cities)

- 4 round-trip flights to Hawaii (from the West Coast)

- 10+ round-trip international flights (650 miles or less)

However, I do NOT recommend this card if you’re new to miles & points. Because there are credit cards with more valuable sign-up bonuses and benefits that you should open first.

Let me know what you think of this card!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!