HUGE news: Capital One adds amazing new partners, transfers 1:1 with select programs

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Capital One just became a big part of your miles and points strategy. This is some of the best news we’ve seen in a long time.

It’s been nearly three years since Capital One airline and hotel transfer partners were unveiled. That was a monumental step forward for Capital One, but two things restrained the points currency from being an actual competitor with the likes of Chase Ultimate Rewards and Amex Membership Rewards:

- Capital One miles have always had a poor transfer ratio

- There were very few truly useful airline and hotel partners

From April 20, 2021, these two achilles heels are significantly diminished. Capital One is improving transfer rates and adding fantastic new partners! This makes Capital One credit cards exponentially more enticing than ever before. It could turn your points strategy upside down.

Capital One miles receive huge improvements

The majority of us in the miles and points community use Capital One miles for one thing: Offsetting recent travel purchases, like airfare, hotels, rental cars, Uber, etc. The program has a feature that allows you to turn your miles into a statement credit towards any travel you’ve purchased on your card in the last 90 days.

For most travelers, this has been the best use of Capital One miles — until now. Let’s first summarize these changes in a fun and digestible way.

The Capital One Venture Rewards Credit Card comes with a choose-your-own-adventure kind of welcome bonus. You can either earn:

- 100,000 bonus miles when you spend $20,000 on purchases in the first 12 months of account opening, or

- 50,000 bonus miles after spending $3,000 on purchases in the first three months of account opening

If you were to just go for the 50,000-mile bonus, you’d have enough miles for:

- Five one-way flights (or 2.5 round-trips) to Hawaii (potentially worth $1,500+)

- Up to six nights in a pricey hotel in Europe (potentially worth $1,000+)

- A one-way business class flight to Europe on American Airlines (potentially worth $2,500+)

- Two nights at a super fancy 1-bedroom Vacasa home (potentially worth several hundred dollars)

And if you go for the full 100,000-mile bonus, you’ll have 140,000 miles after meeting minimum spending requirements. That means you’d have enough miles to nearly triple the above values! Let’s examine the two big Capital One miles developments so you can see what I mean.

Improved transfer rates

You’ll now be able to transfer Capital One miles to the following travel partners at a 1:1 ratio (previously 2:1.5, so a 25% boost):

- Avianca (good for cheap Star Alliance flights)

- Etihad (good for inexpensive award prices on American Airlines)

- Cathay Pacific (good for amazing business class on Cathay Pacific or American Airlines)

- AeroMexico

- Finnair

- Qantas (good for domestic flights on American Airlines)

- Wyndham

A card like the Capital One Venture earns 2 miles per dollar — which translates to 2 miles/points per dollar in the above loyalty programs. I’ve included a note beside the programs that pop as great deals (Avianca, Etihad, Cathay Pacific, Qantas), but even Wyndham can provide big value.

Etihad and Cathay Pacific both allow you to book business class flights on American Airlines starting at just 50,000 miles one-way. Those seats can cost thousands of dollars! By earning the full 100,000-point bonus with the Capital One Venture, you could nearly book three one-way flights to Europe (you’d have 140,000 points after meeting minimum spending).

New transfer partners

Capital One has muscled four new loyalty programs into their long list of transfer partners:

- British Airways (1:1 transfer ratio)

- Turkish Airlines (1:1 transfer ratio)

- Choice Hotels (1:1 transfer ratio)

- TAP Portugal (1:1 transfer ratio)

While it’s always exciting when we’ve got new ways to redeem our miles and points, two or three of these new partners are extra exciting. I’m looking at Turkish Airlines and Choice.

For example, Turkish allows you to fly anywhere in the U.S. on their partner United Airlines (including Hawaii and Alaska) for just 7,500 miles each way in coach, or 12,500 miles each way in business class. That’s right, you can fly from Newark to Honolulu in a lie-flat seat for 12,500 miles (if you can find availability).

Previously, the only way to efficiently earn Turkish miles was by transferring:

- Citi ThankYou points (transfers at a 1:1 ratio)

- Marriott points (transfers at a 3:1 ratio)

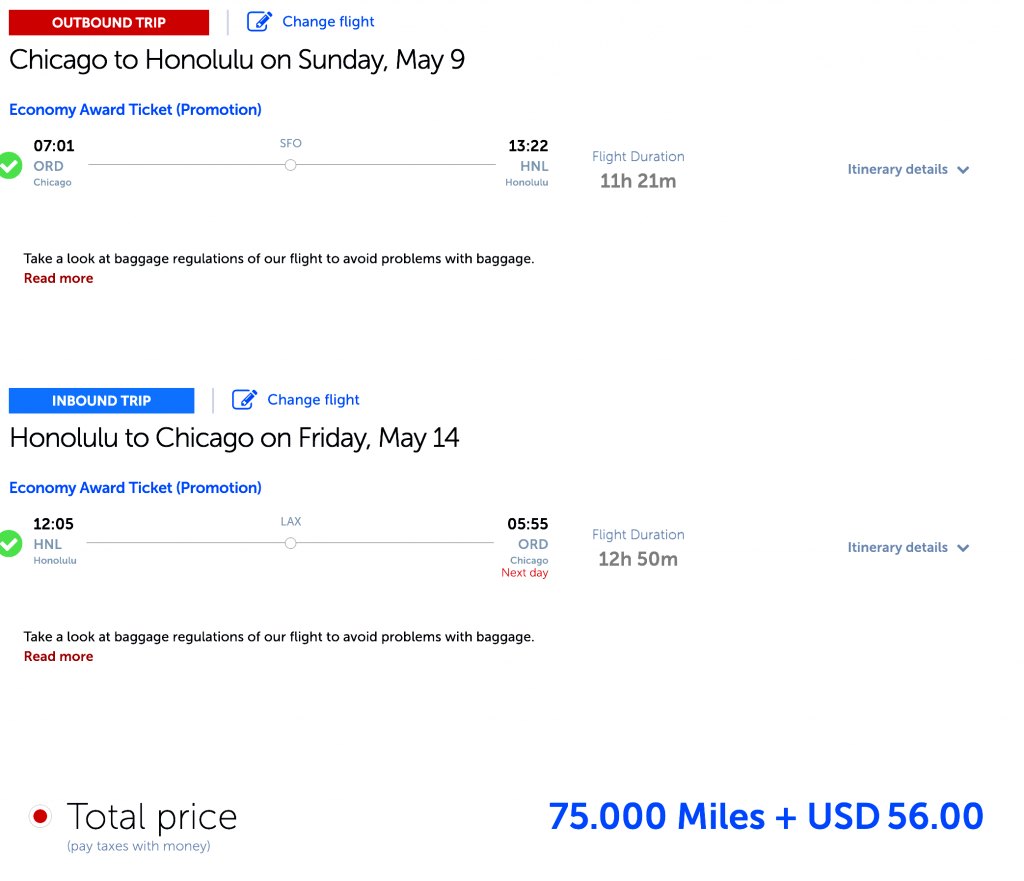

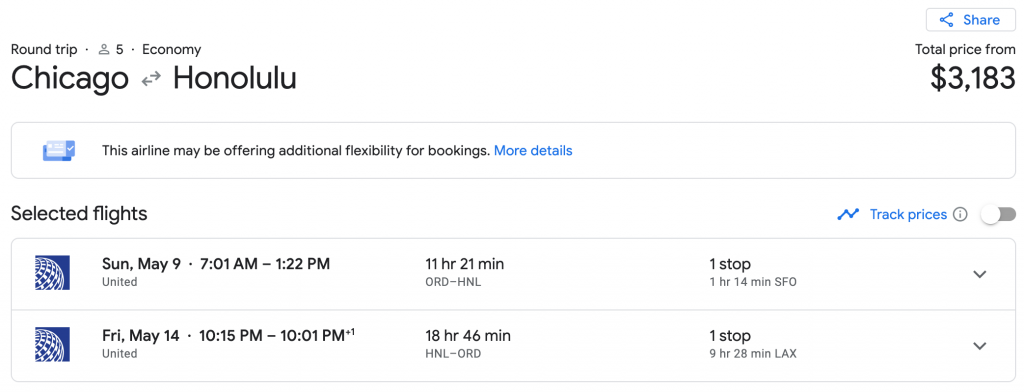

This addition by Capital One means we can now transfer the giant welcome bonuses that come with cards like the Capital One Venture to Turkish for literally thousands and thousands of dollars in value. I plugged some random dates into the Turkish Airlines website for round-trip flights between Chicago and Honolulu for five people, and here’s what I got.

The total cost came to 75,000 miles and $56.

I quickly found the same exact itinerary on Google Flights, and the cost for a family of five came to $3,183. In other words, you’re getting 4.17 cents per mile in value!

You can transfer Capital One miles to Turkish at a rate of 1:1.

Note: If your sole intention is to collect Turkish miles through regular spending, you should still use the Citi® Double Cash Card to achieve your goal. It’s a no annual fee card that earns 2% cash back (1% back when you make a purchase, and 1% back when you pay your bill). If you also have a card like the Citi Premier® Card, you can convert that cash back into Citi ThankYou points, and transfer them to Turkish at a 1:1 ratio (which is better than Capital One’s 2:1.5 ratio).

Choice hotels can also be a good transfer partner, particularly if you’ve planned travel to Scandinavia. Hotels can cost hundreds of dollars up there, while only pricing out at 8,000 points per night.

The information for the Citi Double Cash Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Capital One miles have catapulted from relative obsolescence to one of the hottest loyalty programs on the market. I can honestly say I had no intention of collecting Capital One miles before today, and I’m now mapping my new strategy around collecting as many as I can (earning Capital One miles is easy, as well).

With Capital One’s improved transfer ratios and fantastic new partners, it’s now quite effortless to get outsized value for your miles. Let me know what you think of this development! And subscribe to our newsletter to make sure you don’t miss important miles and points news like this.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!