ZERO Out-of-Pocket Expense for a Disney World Hotel Stay (and You Can Do It Too!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Keith: Holiday travel can be stressful, especially because airfare and hotel cash prices tend to be expensive. But with the right miles & points strategy, you can reduce your out-of-pocket travel expenses significantly, even during peak travel times.

For example, my wife and I recently celebrated New Year’s Eve with my parents at Epcot in Disney World. Planning ahead allowed us to use credit card points to book 2 rooms just outside Disney World for free.

Staying on-site at Disney World the week after Christmas required a 2-night minimum at most hotels. And I saw room rates of $1,000+ per night at hotels with available rooms (most were sold out), which I found to be outrageous.

I realize families traveling with young children might prefer to book an on-site hotel to take advantage of meal plan discounts. You can check out this guide to using points to stay at on-site Disney World hotels.

But if you don’t mind staying just outside of Disney and want to avoid out-of-pocket expenses, this strategy might work for you!

Transferring Chase Points to Hyatt to Stay Free at the Hyatt Regency Grand Cypress

My wife and I love to keep a stash of Chase Ultimate Rewards points for potential hotel bookings if we’re visiting an area during a busy travel time. Because we can transfer points to Hyatt, which has a no “blackout date” policy. As long as a standard room is available for sale, you can book it using points!

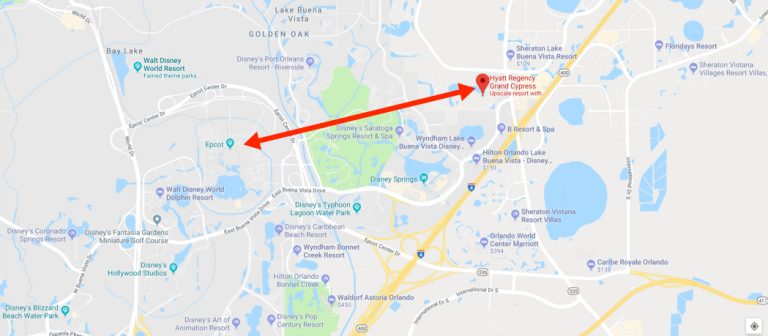

During our holiday travel planning, I found open award rooms at the Hyatt Regency Grand Cypress, which is just a ~15 minute ride from the Disney World Theme Parks. The hotel provides a free shuttle, which was a fantastic perk during our stay.

We decided on this hotel based on the overwhelming amount of positive TripAdvisor reviews. It gets better ratings than some of the on-site Disney World hotels.

And you don’t pay resort fees when you book a Hyatt award stay. The Hyatt Regency Grand Cypress has a $30 per night resort fee, so we avoided $60 in fees by booking 2 rooms with points.

Many other hotel chains don’t waive resort fees on award stays. For example, even with Starwood Platinum status, I still pay resort fees at certain hotels, which is extremely frustrating.

The Hyatt Regency Grand Cypress is a Category 4 Hyatt hotel, which means an award night costs 15,000 points. So I transferred 30,000 Chase Ultimate Rewards points to my Hyatt account to cover the cost of 2 rooms. The same rooms would have cost ~$700 total if we paid cash. This means we got ~2.3 cents per point worth of value ($700 cash cost of stay / 30,000 points).

Unfortunately, we didn’t get to spend much time at the hotel because we were enjoying the New Year’s Eve festivities at Epcot. But the location and our room were ideal for a quick one-night stay. I’d definitely go back!

The lobby was decorated for the holidays. And there was a parrot on security duty. Perhaps checking to make sure folks with low-level Hyatt Discoverist status weren’t trying to get free breakfast. 😉

The rooms were modern and spacious with a balcony overlooking the private lake.

The full stand-up shower was modern and water pressure was just right.

We took advantage of the free hotel shuttle to get to Disney World. The bus dropped us near the monorail, which we then took to Epcot.

Earn Chase Ultimate Rewards Points So You Can Save, Too!

Besides earning the valuable sign-up bonuses, we like to use the card that gets us the most bonus points for purchases we make everyday.

For example, I use the Chase Sapphire Reserve to earn 3X Chase Ultimate Rewards points on travel & dining purchases. And my wife uses the no annual fee Chase Freedom to earn 5X points on purchases in rotating quarterly bonus categories each quarter you activate (on up to $1,500 in spending).

Just remember you can only transfer points directly to Chase’s travel partners (like Hyatt) if you have certain cards. But folks with no annual fee Chase Ultimate Rewards points earning credit cards can combine points (including with a spouse) and then transfer them.

Note: Chase Ink Plus and Chase Ink Bold cardholders can also transfer points directly to airline and hotel partners. But these cards are no longer available to new applicants.

Bottom Line

Even during peak holiday travel, you can use points to avoid out-of-pocket hotel expenses.

My wife and I recently transferred 30,000 Chase Ultimate Rewards points to Hyatt. Then, booked 2 rooms at the Hyatt Regency Grand Cypress. The hotel was just a ~15 minute shuttle ride away from theme parks at Disney World, like Epcot! And using points saved us ~$700, which was the total cash cost of 2 rooms at the hotel on New Year’s Eve.

Hyatt is a fantastic Chase travel partner because the hotel chain does NOT have blackout dates. And you don’t pay resort fees when you book an award stay!

Have you used points to save money on a trip to Disney World?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!