Why I used an airline card to book a hotel — and vice versa

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

When determining your next travel credit card, closely examining your travel goals will help guide your decision. But that’s only half the battle — the best card for you may not be as simple as you think.

For example, just because you frequently fly on Southwest doesn’t mean the Southwest Rapid Rewards® Plus Credit Card is right for you. In fact, the best card for your situation may not be a Southwest credit card at all.

As an example, I’ll show you why I paid for airfare with a hotel credit card — and why I paid for my hotel with an airline credit card. Sounds like a mistake, doesn’t it?

The best credit card for your upcoming travel isn’t always what it seems

Booking American Airlines flights with a Marriott credit card

American Airlines credit cards don’t have many bonus categories, so when a bunch of your spending falls into a category that earns bonus miles, it’d seem like the smart thing to use your American Airlines card.

Most AA cards will earn 2 American miles per dollar on American Airlines purchases. That’s their attempt to convince you to pay for their flights with their card. It’s not enough.

I recently contacted Chase to request that they upgrade my Marriott Bonvoy credit card into a fancier (and more expensive) Chase Ritz-Carlton card. The card isn’t available to new applicants, but you can tell Chase you’d like to change your current Marriott card to a Ritz-Carlton card (Ritz-Carlton is a luxury brand under the Marriott umbrella).

There are three reasons the Chase Ritz-Carlton is better for AA flights than an American Airlines card.

Travel insurance

Citi American Airlines credit cards have zero travel insurance. They don’t offer Trip Delay insurance, they don’t offer baggage delay insurance, they don’t offer travel accident insurance, they don’t offer rental car insurance, they don’t offer anything. If something goes wrong during your trip, Citi does not have your back.

Chase, on the other hand, will follow you around with medicine in case you get a bit of a tummy ache. The Chase Ritz-Carlton card has the best travel insurance (along with the Chase Sapphire Reserve®), offering perks like:

- Delayed baggage insurance – If your bag doesn’t show up within six hours of your arrival, Chase will pay you $100 per day per person, for up to five days

- Trip Delay insurance – If your trip is delayed by six hours or more, Chase will pay you up to $500 per person, per trip

Seat upgrades

The Chase Ritz-Carlton card comes with a $300 annual travel credit which you can redeem for “airline purchases,” like checked bag fees, lounge access, and seat upgrades.

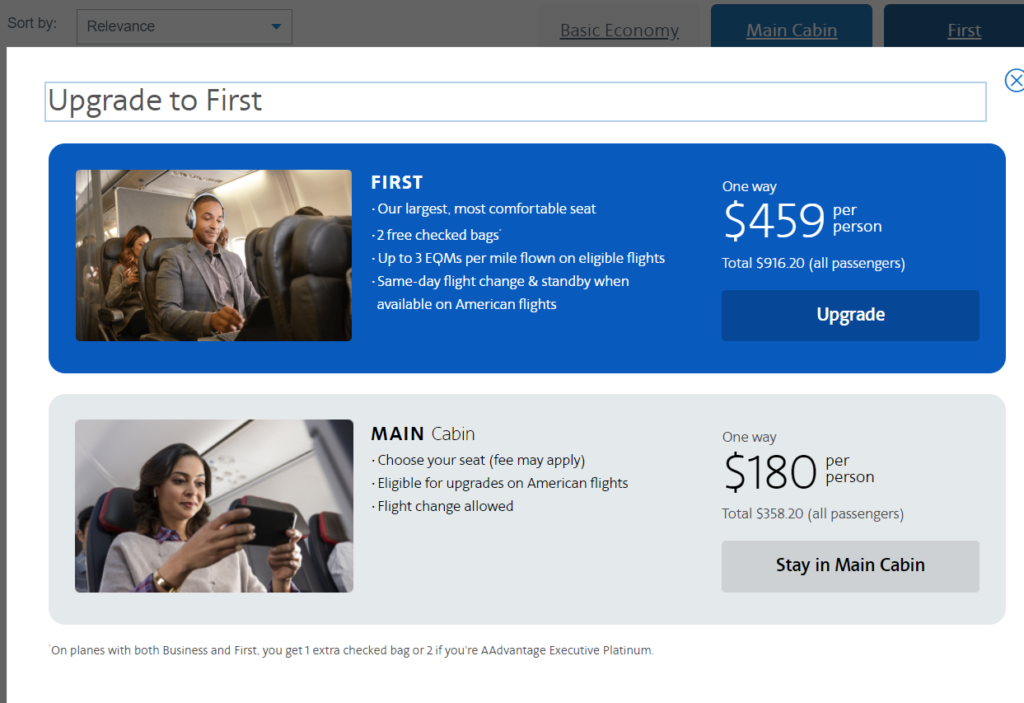

Last month, I booked what I considered to be super cheap transcontinental business class flights — $459 one-way for lie-flat seats on American Airlines (though looking now, you can book them for just $409!).

I decided to redeem my Ritz travel credit toward two business class flights. Because the Ritz-Carlton card reimburses for upgrades, I first selected a coach seat. Then as I progressed toward checkout, the American Airlines upgrade popup appeared right on schedule.

I simply took a screenshot of the popup, and after the purchase posted in my transaction history, I sent Chase a secure message asking them to trigger my $300 credit. I want to say the credit appeared the next day.

By using the Ritz-Carlton card instead of my AA credit card, I scored two lie-flat business class flights for about $308 each.

Yes, the Ritz-Carlton card does come with a hefty $450 annual fee, but its got a ton of other benefits on top of the $300 travel credit that help offset that cost. Perks include an annual free night certificate for properties up to 50,000 points, Marriott Gold elite status, a Priority Pass membership and three upgrades to the Ritz-Carlton Club Level on paid stays

Note: Due to COVID-19, the Ritz-Carlton credit card allows you to redeem your $300 statement credit toward grocery store and restaurant purchases through December 31, 2020.

Booking a Marriott hotel with my American Airlines card

Earning a huge welcome bonus

The reasoning here is much simpler — I’m in the process of meeting the minimum spending requirement on my new CitiBusiness® / AAdvantage® Platinum Select® Mastercard® , and the price of my Marriott stay is helping me get there.

The information for the CitiBusiness AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Yeah, I forfeited a few thousand Marriott points by not using my Ritz Carlton card to pay for my stay. But it’s worth it to more quickly earn my credit card welcome bonus. I don’t have a lot of big purchases coming up, so every extra dollar counts.

We always say, the best card to use is the one with which you’re trying to earn a big fat welcome bonus. In my mind, the only time this rule doesn’t apply is with airfare. Use a card that gives you travel insurance so you don’t have to worry about cancellations, delayed bags, etc. Read my post about how Chase Trip Delay Insurance has saved me literally thousands over the years I’ve had my Chase Sapphire Preferred® Card.

Bottom line

Just because you’ve got a card that’s co-branded with a specific travel brand with which you’re about to spend doesn’t mean it’s the best card for the job. There are plenty of scenarios where it’s better to use a completely unrelated card. For another example, read our post on why Delta credit cards are not the best for Delta flyers.

Subscribe to our newsletter for more travel tips and advice delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!