How to Earn Lucrative Sign-Up Bonuses Without Paying Annual Fees Out-of-Pocket

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.I’ve written why even thrifty folks like me should consider annual fee cards. Because these cards often come with big sign-up bonuses and great perks that can help you achieve your travel goals!

That said, I understand folks new to our hobby might not be comfortable paying an annual fee expense. Team members Keith and Scott remember feeling this way when they first started out. And now they each have 8+ cards with annual fees.

But there’s a strategy you can use to earn valuable sign-up bonuses on certain annual fee cards without paying the fee out-of-pocket.

I’ll explain how you can offset annual fees with certain credit cards!

Why Get an Annual Fee Card?

Link: Why Even Thrifty Folks (Like Me) Should Consider Annual Fee Cards

No annual fee credit cards are a great place to get started in the miles & points hobby. Because you can keep these cards forever, which is a great way to build a relationship with the banks and increase your credit score.But once you get your feet wet, annual fee cards offer an opportunity to earn lucrative sign-up bonuses quickly.

Then, you can redeem miles or points from the sign-up bonus for unforgettable adventures, like Emily’s mother-daughter trip to Paris.

Sometimes banks waive the annual fee on certain cards for the first year as an incentive to try the card to see if you like the perks. For example, the $95 annual fee on the Chase Sapphire Preferred® Card is waived the first year. This is one of the reasons it’s my favorite card for beginners.

There are also several annual fee hotel credit cards with free nights on your card anniversary. As long as the value of the free night is worth more than annual fee expense, you’re ahead of the game!

Offset Credit Card Annual Fees

Link: Beginner’s Guide to Using Flexible Points for Big Travel With Small Money

It’s possible to wipe out the annual fee on certain cards that earn flexible points by redeeming the points for cash back or a statement credit.

For example, the Chase Ink Business Preferred currently has an 80,000 Chase Ultimate Rewards point sign-up bonus after you spend $5,000 on purchases in the first 3 months of opening your account.

The card has a $95 annual fee, which is NOT waived the first year.

To get the most value from the bonus, I normally recommend transferring Chase Ultimate Rewards points to travel partners like Hyatt, Southwest, or United Airlines. But if you’re looking to keep extra cash in your pocket by NOT having an annual fee expense, you can redeem Chase Ultimate Rewards points for cash back.

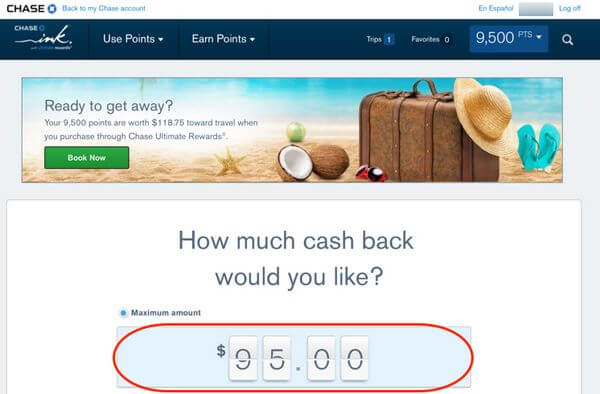

Your points are worth 1 cent each toward cash back. This means you can redeem 9,500 Chase Ultimate Rewards points for $95 cash back, which is the amount of the Ink Preferred annual fee.

If you’re a new cardholder and use this method after earning the sign-up bonus, you’ll still have 70,500 Chase Ultimate Rewards points left over (80,000 point sign-up bonus – 9,500 points to offset annual fee). Remember, you’ll also earn points from the spending you did to unlock the sign-up bonus.

Keep in mind, this strategy is best for folks who meet minimum spending requirements before the end of the first billing cycle. Because the annual fee usually shows up on your first statement. So you’ll want to have the sign-up bonus points in your account already to avoid paying the annual fee out-of-pocket.

Otherwise, you’ll have to pay the annual fee and redeem points for cash back later on to offset the expense.

The remaining ~70,500 Chase Ultimate Rewards points are more than enough for 2 free award nights at top Hyatt hotels, like the Park Hyatt New York where team member Jasmin recently stayed. An award night costs 30,000 Hyatt points per night.

Remember, the Ink Preferred is a small business card, which means you must have a for-profit venture to qualify.

That said, you can use this trick with other Chase Ultimate Rewards cards with annual fees like the Chase Sapphire Preferred and Chase Sapphire Reserve.

And this method works the same for Citi ThankYou point cards like the Citi Premier Card. Because these flexible points are also worth 1 cent each toward cash back.

But I would NOT recommend this strategy for AMEX Membership Rewards cards. Because you do NOT get a favorable ratio when you redeem these points for cash back.

Bottom Line

There are many reasons to consider credit cards with annual fees, including the ability to earn lucrative sign-up bonuses, which you can use toward Big Travel!

If you’re looking to avoid annual fee expenses, you might consider certain annual fee cards that earn flexible points. Because you can redeem points from these cards toward cash back, which can offset the annual fee.

For example, the Ink Business Preferred comes with an 80,000 Chase Ultimate Rewards point sign-up bonus after meeting spending requirements. This card has a $95 annual fee. But you can redeem 9,500 Chase Ultimate Rewards points from the sign-up bonus for $95 cash back, which completely wipes out the annual fee. And you’ll still have at least 70,500 points remaining to transfer to Chase airline and hotel travel partners.

Keep in mind this strategy is best for folks who make a large purchase in the first billing cycle to meet minimum spending requirements. Because the annual fee appears on your first statement. So you’ll want to have the sign-up bonus points in your account already to avoid paying the annual fee out-of-pocket.

Do you ever redeem flexible points for cash back to avoid paying a card’s annual fee out-of-pocket?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!