How to upgrade to the Chase Sapphire Reserve – and what you’ll want to know before trying

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Recently, the Chase Sapphire Reserve® has gotten a bit of a makeover and its annual fee has increased to $550. We’ve already talked about how to downgrade your card if the annual fee doesn’t make sense for you anymore. But with the Sapphire Reserve’s new benefits, like perks with Lyft and DoorDash, you also might want to go the opposite direction and upgrade another Chase credit card to a Sapphire Reserve.

Upgrading is a great option if you can’t get approved for the Reserve card otherwise because of the Chase 5/24 rule or because you’ve earned a welcome bonus on any version of a Sapphire card in the past 48 months. You won’t earn the card’s intro bonus, but you’ll still get the card’s other great perks, which can make upgrading to the Sapphire Reserve worth it.

Upgrading to the Chase Sapphire Reserve

When you upgrade to the Sapphire Reserve, you’ll earn Chase Ultimate Rewards at the following rates:

- 3x Chase Ultimate Rewards points per dollar on travel and dining

- 10x Chase Ultimate Rewards points per dollar on Lyft rides (through March 2022)

- One Chase Ultimate Rewards point per dollar on all other purchases

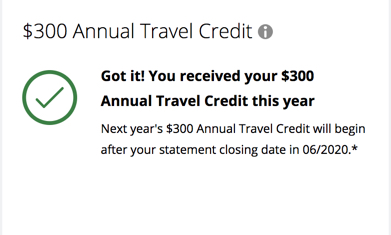

The best perk that comes with the card is the up to $300 in annual travel credits, which is super easy to earn. You’ll also get a Global Entry/TSA PreCheck application fee credit (worth up to $100). And cardholders can enroll in a complimentary Priority Pass Select membership, which gets you and up to two guests access to Priority Pass airport lounges.

Sapphire Reserve cardmembers are also eligible for a free year of Lyft Pink, which normally costs $19.99/month and gets you 15% off Lyft rides and other perks. You just need to activate this membership by adding your Sapphire Reserve to your updated Lyft app by March 31, 2022. You’ll also get $60 in DoorDash credit in 2020, and another $60 in credit in 2021. That’s on top of at least one year of complimentary DashPass, which gets you waived delivery fees on orders of $12 or more at participating restaurants. You will need to register for DashPass (with your card) no later than Dec. 31, 2021.

Of course, you’ll also have to pay the card’s $550 annual fee, which is not waived for the first year. But the card’s perks can easily offset the annual fee. And your Chase points will be worth more (1.5 cents each) for travel booked through the Chase Ultimate Rewards Travel Portal. That means you can combine points from other cards like the Chase Freedom® and those points instantly become more valuable.

Card you can upgrade to the Sapphire Reserve from

Only certain Chase cards can be upgraded to the Sapphire Reserve, including:

- Chase Freedom®

- Chase Freedom Unlimited®

- Chase Sapphire (no longer available to new applicants)

- Chase Sapphire Preferred® Card

You can’t upgrade from other Chase cards, including airline credit cards, hotel credit cards and small business credit cards issued by Chase, and you must have had the eligible card open for one year to upgrade.

You’ll also need to qualify for a $10,000 credit limit with Chase because the Sapphire Reserve is a Visa Infinite card. For example, if your Chase Freedom Unlimited has a $5,000 credit limit, Chase will need to review your info to make sure you’re creditworthy for the higher limit; you may be able to move credit from other Chase cards.

How to complete a Sapphire Reserve upgrade

If you want to upgrade to the Chase Sapphire Reserve, you can contact Chase at the phone number on the back of your current credit card. Because you’re upgrading, the process may be similar to applying for a new credit card. The Chase representative may ask you about your income, for example, to make sure you qualify for the credit limit on the Chase Sapphire Reserve.

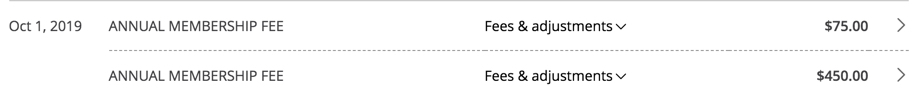

When you upgrade you’ll want to be aware of your current account’s anniversary date, because that is when your new $550 annual fee will be due each year. (You’ll pay a prorated fee if you upgrade in the middle of a cardmember year.) For example, I upgraded my Freedom card to the Sapphire Reserve in June and paid a prorated annual fee because the account renewal date is in October. When October rolled around I paid the full annual fee and an additional $75 for having my wife as an authorized user.

When I upgraded I was able to earn the full $300 in travel credits right away, but once my account renewed in September (and I paid the full annual fee) I didn’t get access to the $300 in travel credits again…and I won’t be able to earn the $300 in travel credit again until nine months after I paid my annual fee (one year from the initial upgrade).

That means that if I want to close or downgrade my Reserve card before the annual fee is due in October I’ll want to use the full travel credit before then.

Also, if you upgrade from the Chase Sapphire Preferred, you can get a prorated refund of your annual fee you paid on that card. For example, if you paid your annual fee six months ago, you’ll get 50% of the annual fee refunded when you upgrade to the Sapphire Reserve.

Bottom line

Some people might consider upgrading to the Sapphire Reserve if they are impacted by Chase’s 5/24 rules and can’t get new cards from Chase. By upgrading, you’ll get instant access to perks like 3x Chase points on travel and dining, plus the $300 in annual travel credits. But a Sapphire Reserve upgrade won’t earn you any welcome bonus offer.

You are eligible to upgrade if you’ve had the Chase Freedom, Chase Freedom Unlimited, Chase Sapphire (no longer available for new sign-ups) or Chase Sapphire Preferred open for more than one year. Just call the Chase number on the back of your current credit card to upgrade.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Featured photo by Wyatt Smith.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!