“My Experience Helping a Friend Plan a Credit Card Strategy for Her Small Business”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Meghan: My friend Dolly and her husband are rockstar entrepreneurs and run a few different operations.

She’s a real estate agent and he’s a builder. And they also own a window coverings business. In the past, they have taken on projects like flipping houses, building new homes, interior designing, and more!

And because they’re so successful at what they do, they have lots of monthly business expenses.

After hearing me rave about miles & points for so long, Dolly decided she wanted to get in the game. So we got together to strategize.

Here’s more about what Dolly and I discussed. Including which cards she decided to get to meet her family’s travel goals!

Putting Businesses Expenses on the Right Credit Card

Link: Top Small Business Credit Cards

Link: How to Qualify for a Small Business Credit Card (And Why You Should Get One!)

Dolly and Jack’s situation is a great case study in how to maximize small business expenses, because they regularly charge thousands of dollars to credit cards each month. Mostly from having to pay the materials suppliers of their blinds and shades business.

Between the two of them, she and her husband already have a few rewards cards, including 2 Capital One cards, the Chase Ink Business Cash Credit Card, the Chase Hyatt card (no longer available to new applicants), and United Explorer Card. But they put most of their charges on their Capital One Spark Miles for Business card and their Chase Ink Business Cash Credit Card, because they like the simple earnings and redemption structure of both.

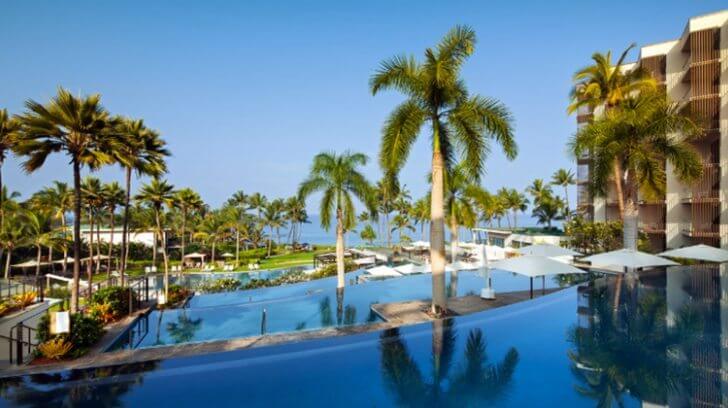

They want to take at least 3 international trips to spots like Europe, Ecuador, and South Africa. But she had concerns about getting into the miles & points hobby, like:

- Managing multiple cards (tracking intro bonuses, annual fee dates, etc.)

- Earning the best rate for their most common purchases

- Keeping business expenses separate from personal expenses

- Being able to easily track expenses

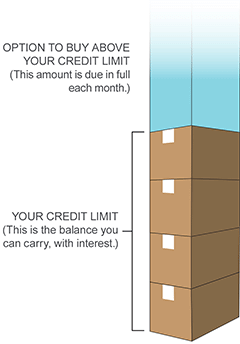

- Having a large credit line to pay big bills

- Keeping good credit scores

But I think I convinced her that when you’re making big expenditures for a business, you might as well earn miles & points for travel!

The Cards I Recommended and Why

I recommended they get the following cards:

- Chase Ink Business Preferred

- Chase Freedom Unlimited

- SimplyCash® Plus Business Credit Card from American Express

1. Chase Ink Business Preferred

To me, getting the Ink Business Preferred was a no-brainer given their situation.

It comes with an 80,000 Chase Ultimate Rewards points welcome bonus after meeting minimum spending requirements.

The sign-up bonus alone is worth at least $800. So even if you’re not sure you’ll travel, you can get cash back.

Plus, they fly United Airlines a lot and have the United Explorer Card. And you can transfer Chase Ultimate Rewards points to United Airlines miles at a 1:1 ratio.

Here’s our full review of the Chase Ink Business Preferred card.

Note: With Chase’s 5/24 rule, it’s unlikely you’ll be approved for most of their cards if you’ve opened 5+ cards from any bank (NOT counting Chase business cards and these other business cards) in the past 24 months.

2. Chase Freedom Unlimited

I also suggested the Chase Freedom Unlimited, primarily because of how easy it is to earn and redeem points (or cash back). And for paying their window coverings suppliers.

Bills like those don’t fall into the regular bonus categories cards offer, like travel, dining, or office supplies, for example. So earning 1.5X Chase Ultimate Rewards points (1.5% cash back) per $1 spent on all of those purchases with NO limit is a great option for them. Especially because lots of other cards put a cap on the number of rewards you can earn.

Here’s more about why this no-annual-fee card is great for lots of folks.

3. SimplyCash® Plus Business Credit Card from American Express

Lastly, I recommended the AMEX Simply Cash Plus small business card, because Dolly mentioned needing a large credit limit and the ability to pay big bills (like $10,000+). And it offers to ability to “buy above your credit limit.” Meaning they’d be able to spend above their credit limit without any over-the-limit fees. Which could be helpful for growing their business!

Plus, AMEX small business cards to NOT count against Chase’s 5/24 rule. So Dolly and Zach will have a better chance of getting other great Chase travel rewards cards in the future.

Dolly’s Other Options

In addition to these 3 cards, I mentioned The Business Platinum® Card from American Express and the Barclaycard Arrival Plus World Elite Mastercard cards, too. Because they both come with valuable welcome bonuses.

But she’s not sure the high annual fee on the AMEX Business Platinum card would be worth it for them. And although she likes how simple it is to redeem Barclaycard Arrival Plus miles for travel, she doesn’t want to manage too many cards at once.

That said, she plans to regularly update her credit card strategy to make sure the cards they’re using still make sense. And will definitely consider those cards in the future!

Bottom Line

My friend asked me for advice on which cards she should get for her successful small business. Because she wanted to get more involved in the miles & points hobby, to take her family on amazing vacations!

After considering her concerns and personal travel goals, I recommended the Chase Ink Business Preferred, Chase Freedom Unlimited, and the AMEX Simply Cash Plus Business card. Because with these cards, they’ll be able to make the most of their business expenses by earning points, miles, and cash back.

Are there any other cards you’d recommend for Dolly?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!