I Narrowly Avoided a Very Common Travel Credit Card Rip-Off Today — Here’s How

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Few things in the points & miles world can be as frustrating as not having enough miles in your account to redeem for anything meaningful.

There are lots of tricks for getting more miles into your account, like opening one of the best credit cards for travel. But is there any way to transfer the miles you have out of your account?

Million Mile Secret Agent Mst commented:

Can I transfer Delta miles to Starwood points at a 1:1 ratio?

Sorry, Mst, but transferable points can only be moved in one direction.

When you transfer flexible points to a partner, you can NOT transfer them back. And airline miles do NOT convert into transferable points.

This is one of the reasons why we value transferable points more than other points and miles. Let’s take a look at which points transfer to which airlines. And how to transfer points between accounts.

Which Points Transfer to Which Airlines?

The transfer ratios to all the major airlines are listed below. Also, it’s important to know that for every 20,000 Starwood points you transfer to an airline partner with a 1:1 transfer ratio, you’ll get a 5,000-mile bonus!

Note: Starwood points are living on borrowed time, as it will soon merge loyalty accounts with Marriott.

| Airline | American Express Membership Rewards points | Chase Ultimate Rewards points | Citi ThankYou points | Capital One miles | Marriott points |

|---|---|---|---|---|---|

| Aegean Airlines | 3:1 | ||||

| Aer Lingus | 1:1 | 1:1 | 3:1 | ||

| Aeroflot | 3:1 | ||||

| Aeromexico | 1:1.6 | 1:1 | 2:1.5 | 3:1 | |

| Air Canada Aeroplan | 1:1 | 2:1.5 | 3:1 | ||

| Air China | 3:1 | ||||

| Air New Zealand | 200:1 | ||||

| Alaska Airlines | 3:1 | ||||

| Alitalia | 1:1 | 2:1.5 | 3:1 | ||

| Al Nippon Airways (ANA) | 1:1 | 3:1 | |||

| American Airlines | 3:1 | ||||

| Asiana Airlines | 3:1 | ||||

| Avianca | 1:1 | 1:1 | 2:1.5 | 3:1 | |

| British Airways | 1:1 | 1:1 | 3:1 | ||

| Cathay Pacific | 1:1 | 1:1 | 2:1.5 | 3:1 | |

| China Eastern | 3:1 | ||||

| China Southern | 3:1 | ||||

| Copa | 3:1 | ||||

| Delta | 1:1 | 3:1 | |||

| El Al | 1,000:20 | ||||

| Emirates | 1:1 | 1:1 | 1:1 | 2:1 | 3:1 |

| Etihad | 1:1 | 1:1 | 2:1.5 | 3:1 | |

| Flying Blue (Air France & KLM) | 1:1 | 1:1 | 1:1 | 2:1.5 | 3:1 |

| EVA Air | 1:1 | 2:1.5 | |||

| Finnair | 2:1.5 | ||||

| Frontier | 3:1 | ||||

| Hainan Airlines | 2:1.5 | 3:1 | |||

| Hawaiian Airlines | 1:1 | 3:1 | |||

| Iberia | 1:1 | 1:1 | 3:1 | ||

| Japan Airlines (JAL) | 3:1 | ||||

| Jet Airways | 1:1 | 3:1 | |||

| JetBlue | 5:4 | 1:1 | 1:1 | 2:1.5 | 6:1 |

| Korean Air | 3:1 | ||||

| LATAM | 3:1 | ||||

| Lufthansa | |||||

| Malaysia Airlines | 1:1 | ||||

| Qantas | 1:1 | 1:1 | 2:1.5 | 3:1 | |

| Qatar Airways | 1:1 | 2:1.5 | 3:1 | ||

| Saudia | 3:1 | ||||

| Singapore Airlines | 1:1 | 1:1 | 1:1 | 2:1 | 3:1 |

| Southwest | 1:1 | 3:1 | |||

| TAP Portugal | 3:1 | ||||

| Thai Airways | 1:1 | 3:1 | |||

| Turkish Airlines | 1:1 | 3:1 | |||

| United Airlines | 1:1 | 3:1.1 | |||

| Virgin Atlantic | 1:1 | 1:1 | 1:1 | 3:1 | |

| Virgin Australia | 3:1 |

How to Transfer Points Between Accounts Within the Same Program

Even though you can NOT transfer points into your Starwood (or other transferable points) account, you usually can transfer points between accounts within the same loyalty program.

But the rules vary depending on the program. Here are the transfer rules for the 4 major transferable points programs:

- AMEX Membership Rewards – You can not transfer AMEX Membership Rewards points to other AMEX Membership Rewards accounts. But you can transfer points directly into the loyalty accounts of authorized users

- Chase Ultimate Rewards – You can combine Chase Ultimate Rewards points with a member of the same household (or a joint business owner).

- Citi ThankYou – You can transfer points to another Citi ThankYou account. But they expire after 90 days. And you can not transfer Citi ThankYou points directly into someone else’s airline or hotel account

- Starwood – You can only transfer Starwood points into other Starwood accounts that have shared the same address for at least 30 days (but there is a workaround!)

Again, note that the Starwood loyalty program will soon no longer exist. Come August 2018, it will merge with Marriott. You’ll then be able to transfer Marriott points to many airlines at a ratio of 3:1. And for every 60,000 points you transfer, you’ll receive 5,000 bonus airline miles (60,000 Marriott points = 25,000 airline miles).

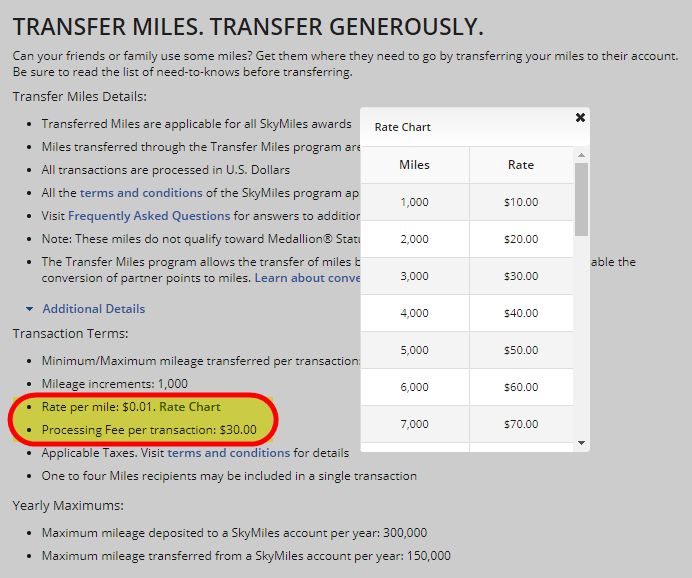

Most airlines allow you to transfer or “gift” miles to someone else’s account. But you’ll most likely pay a fee. And it’s usually NOT a good deal.

So unless you have miles that are expiring, or you’re just shy of having enough miles for an award, we would NOT suggest this option.

Bottom Line

Transferable points are great because you can transfer them to lots of different partners. But once you transfer them out of your account, you can’t get them back.

And if you earn airline miles, you can NOT transfer them to your transferable points account. But if you’re in a pinch, you can transfer miles between accounts within the same loyalty program.

Thanks for the question, Mst!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!