Can You Transfer Citi ThankYou Points to a Spouse’s Airline Account?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Cathy, commented:

Can my husband transfer Citi ThankYou points to my frequent flyer account?

Great question, Cathy!

Your husband can NOT transfer Citi ThankYou points directly to your frequent flyer account.

But, if you both have a ThankYou account, he can transfer points to you for free.

Then, transfer the points from your ThankYou account to a Citi airline transfer partner as long as you have certain cards. It’s called Citi Points Sharing.

Or, he can transfer ThankYou points to his airline account and book a flight for you.

I’ll explain how you can share Citi ThankYou points!

Citi Points Sharing

Link: Citi Points Sharing

Link: Citi ThankYou Rewards

Link: How to Transfer Citi ThankYou Points to Airlines

For Cathy to get her husband’s Citi ThankYou points into her airline account, she’ll first need to have her own ThankYou account.

You can transfer Citi ThankYou points to airline and hotel partners if you have these cards:

- Citi Chairman (no longer available for new applicants)

- Citi Prestige Card

- Citi ThankYou Premier Card

Then, she can use Points Sharing to transfer points from her husband’s account to her ThankYou account.

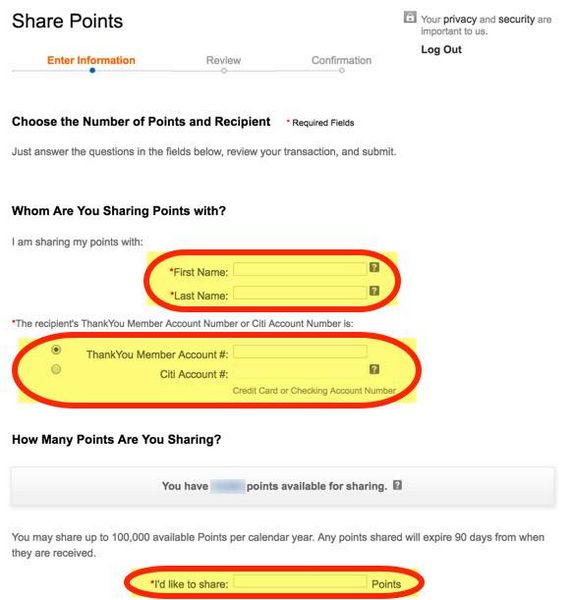

To share points, first log-in to Citi ThankYou Rewards.

Then, scroll through until you see the points sharing option.

Finally, enter the name, account number, and the number of points you’d like to share.

In just 3 simple steps, the ThankYou points will instantly be deducted from your account and appear in the other person’s account. Now he or she can use the miles to book airline award tickets on the following Citi airline transfer partners.

| Citi ThankYou Points Airline Transfer Partners | ||

|---|---|---|

| Avianca | Asia Miles (Cathay Pacific) | EVA Air |

| Etihad | Flying Blue (Air France/KLM) | Garuda Indonesia |

| Jet Airways | JetBlue | Malaysia Airlines |

| Qantas | Qatar Airways | Singapore Airlines |

| Thai Airways | Turkish Airlines | Virgin Atlantic |

Why Use Points Sharing?

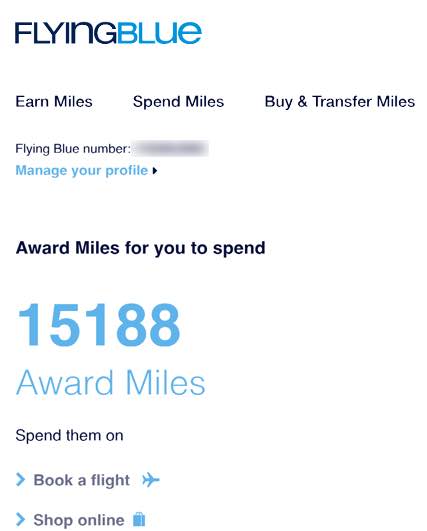

Points Sharing is an excellent way to increase your points balances to book an award flight. For example, let’s assume you have ~15,000 Flying Blue miles saved in your account and don’t have any points in your ThankYou account.

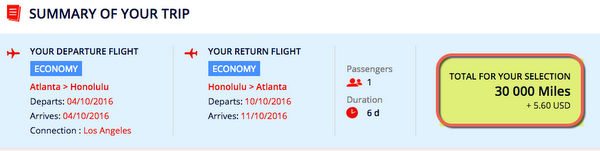

But, you’d like to book a round-trip award flight from Atlanta to Honolulu, which costs 30,000 Flying Blue miles.

Because you can’t have someone transfer Citi ThankYou points directly to your Flying Blue account, you can use Points Sharing. A partner, friend, or family member can send you 15,000 ThankYou points, which you can then transfer to your Flying Blue account.

Remember that transfers to Citi airline partners don’t happen instantly. It can take up to 14 days. But, it usually only takes couple of days in my experience.

Earn More Citi ThankYou Points

Link: Citi Prestige Card

Link: Citi ThankYou Premier Card

Citi Prestige

In addition to the sign-up bonus for the Citi Prestige, you can earn perks like:

- 3 Citi ThankYou points per $1 you spend at airlines, hotels, and travel agencies

- 2 Citi ThankYou points per $1 you spend at restaurants and select entertainment (includes movie theaters, amusement parks, tourist attractions)

Citi ThankYou Premier Card

Currently, there’s no sign-up bonus available on the Citi ThankYou Premier card. If you already have it, remember you earn:

- 3 Citi ThankYou points per $1 spent on travel (ex. airfare, gas stations, taxis, tolls)

- 2 Citi ThankYou points per $1 spent on dining and entertainment (amusement parks, sporting events, movies)

I like that the travel category includes a wide range of purchases such as:

- Airfare

- Cruises

- Car Rental Agencies

- Gas Stations

- Hotels

- Parking Garages

- Public Transportation

- Taxis

- Tolls

Using the bonus spending categories to earn 2X or 3X ThankYou points can help increase your point balances. Then, use the points to share with others or transfer to Citi’s travel partners. Or you can book travel directly through the Citi ThankYou Portal.

Bottom Line

You can NOT transfer Citi ThankYou points directly to someone else’s airline account. Instead, use Citi Points Sharing to transfer Citi ThankYou points to your partner, family member, or friend’s ThankYou account. Then, he or she can transfer the points to Citi’s transfer partners.

To earn ThankYou points, you can get the sign-up bonus on the Citi Prestige. Or use the Citi Prestige and Citi ThankYou Premier card to earn 2X or 3X ThankYou points on certain bonus spending categories.

Have you used Points Sharing? I’d like to hear about your experience!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!