9 common mistakes people make with American Airlines cards and miles

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Citi is an MMS advertising partner.

American Airlines miles are excellent frequent flyer miles to earn. They’ve got a lot of domestic hubs and international flights you can book with miles, as well as plenty of cards that earn American Airlines miles.

You can rack up a tons of miles using cards like the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, CitiBusiness® / AAdvantage® Platinum Select® Mastercard®, American Airlines AAdvantage MileUp℠ Card and the Citi® / AAdvantage® Executive World Elite Mastercard®. These cards come with sign-up bonuses that let you stock up on American Airlines miles easily.

The information for the Citi AAdvantage Platinum and CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

You can even transfer points from Marriott to American Airlines, so if you have cards that earn those points you can pool them with the miles you earn using Citi American Airlines cards. However, there are common mistakes anyone can make with American Airlines credit cards that can keep them from realizing their full potential.

Let’s have a look at these common errors people make with American Airlines miles and cards so you can avoid the same fate.

Not knowing the Citi American Airlines card application rules

There are four Citibank credit cards that earn American Airlines miles, but they have a strict set of rules that govern how often you can earn sign-up bonuses. Citi won’t allow you to earn a sign-up bonus if you’ve opened or closed that specific AAdvantage card in the past 48 months. But if you earn the bonus on one card, that doesn’t restrict you from earning a welcome offer on the others.

Keep your American Airlines miles from expiring

American Airlines miles expire after 18 months of inactivity. However, you can keep your American Airlines miles from expiring by earning or redeeming miles. So you could take a flight on American Airlines (or a partner airline), book an award flight, earn miles with a hotel partner, make a purchase through the AAdvantage eShopping portal or the AAdvantage dining program. But the easiest solution is to simply make a purchase with any American Airlines card that is linked to your American Airlines account.

Not crediting partner (oneworld) flights to American Airlines

Often, when you book flights on an airline you don’t frequently fly, you can credit your miles to a partner airline. This is also the case when booking flights with American Airlines partners, like any of the oneworld alliance airlines such as Japan Airlines or British Airways. Instead of earning Japan Airlines miles, you can chose to earn American Airlines miles.

One thing to keep in mind is you will not necessarily earn 100% of the miles you would have earned on the partner as American Airlines miles. It depends on the fare class of the ticket purchased. You can visit the American Airlines website to see how many miles you can earn on partner airline flights.

Forgetting about the ability to book flights on partner airlines

It’s important to remember that you can redeem your American Airlines miles for travel not only on American Airlines but also on oneworld and other (non-oneworld) partner airlines.

The oneworld alliance is a group of 13 full member airlines and American has also partnered with other airlines including Air Tahiti Nui, Alaska Airlines, Etihad Airways, Fiji Airways and Hawaiian Airlines. You can also redeem your American Airlines miles for travel on these partner airlines. Read through our comprehensive guide to using American Airlines miles where we break down how to book flights on American Airlines’ partners and the best way to find award flights.

Not knowing how to earn American Airlines miles quickly

With four different Citi American Airlines cards to choose from and two Barclays American Airlines cards, there are plenty of ways to rack up American Airlines miles. And there is an American cobranded airline credit card to meet your travel needs. For example, the Citi® / AAdvantage® Executive World Elite Mastercard® gets you Admirals Club airport lounge access just for having the card. And the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® is a good choice for small business owners.

You can learn more about all of the different options with our guide to the best American Airlines cards.

Forgetting about the American Airlines shopping portal and dining program

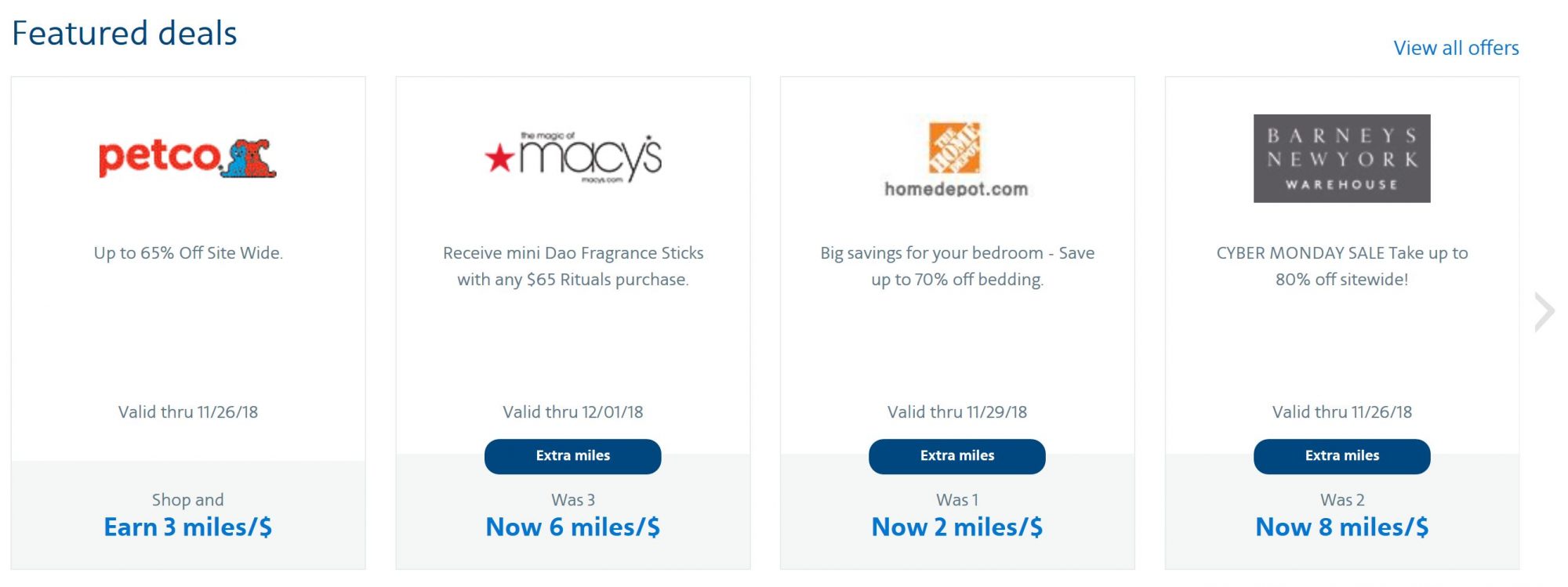

One easy way to earn extra American Airlines miles is to use the American Airlines shopping portal and the American Airlines dining program. The American Airlines AAdvantage eShopping Portal lets you earn bonus American Airlines miles for purchases you were already going to make at over 900 stores. You just find the website you were going to shop at, like Macy’s or Home Depot, click the link on the AAdvantage eShopping Portal to bring you to that particular site and start shopping. Read up on everything to know about using online shopping portals here.

The American Airlines AAdvantage dining program is a set it and forget it way to earn extra miles. Log in to the website using your American Airlines credentials and link any travel credit card or rewards credit card you typically use (you do not only need to use an American Airlines branded card). You’ll then be able to earn bonus AA miles when you use your card at thousands of participating restaurants, bars or clubs. It’s a hands-off, easy way to earn miles.

Not being flexible with travel dates

When booking flights you might know exactly where you need to go during a specified time period or you could be exploring possible destinations with more flexible dates. To make the most of your American Airlines miles, the latter is a better situation to be in because American Airlines awards can be cheaper during less popular travel times and on certain days of the week when you are more likely to find cheaper awards.

But these cheap awards aren’t without their downsides, for example, Economy Web Specials cannot be changed. And the other side of this coin is that sometimes you’ll be charged exorbitant rates during peak season or on days with high demand. But this is the world we have to live in as American has moved toward dynamic pricing.

Not taking advantage of reduced mileage awards

One of the lesser-known deals American Airlines offers is the reduced mileage awards promotion that is available to certain American Airlines credit card holders. If you’re looking to save on your next award flight, check out which airports have American Airlines’ reduced mileage awards.

The way it works is, every fews months American Airlines releases a set of cities with discounted award flights over the coming months. For award flights of 500 miles or less you will get a 2,000-mile discount on a round-trip flight or 1,000 miles off a one-way flight. That means you can book a one way flight for only 6,500 American Airlines miles. And on longer flights (500 miles or more), you’ll receive a 7,500-mile discount on round-trip awards. Keep in mind that the discount only applies to saver-level awards.

You can read more about this promotion and which cards are eligible here.

Not having card that earns bonus miles for American Airlines purchases or offers free checked bags

The great thing about most of the American Airlines cards is that they come with extra benefits in addition to sign-up bonuses. Cards like the Citi AAdvantage Platinum Select, CitiBusiness AAdvantage and the Citi AAdvantage Executive, all come with priority boarding and free checked bag perks. And those cards all earn 2x AA miles on eligible purchases made with American Airlines.

American Airlines miles are useful miles to have. There are plenty of partners you can book award flights with and the great deals for American Airlines’ own flights. Cards like the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® are great not only because of the intro bonuses, but because they come with value benefits, like free checked bags and priority boarding. Plus, any purchase you make with an American Airlines credit card (that is linked to your account) will keep your AA miles from expiring.

If you want to earn a chunk of miles, the Citi AA Platinum card’s welcome offer is currently 50,000 American Airlines miles after making $2,500 on purchases in the first three months of account opening. If you are looking for a personal credit card, this is a great way to build up your American Airlines miles balance.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!