Amex Business Platinum approval tips (Earn 100,000 points with this increased offer!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Applying for Amex small business cards can be a great way to boost your rewards balances. And with the current increased offer on The Business Platinum Card® from American Express, you can earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership.

That’s one of the top small business card bonuses being offered right now, and you can improve your chances of earning this bonus by following these Amex Business Platinum approval tips.

Amex Business Platinum approval tips

If you’re considering applying for The Business Platinum Card® from American Express, the good news is, Amex small business cards aren’t impossible to get. There is no magic bullet for getting your application approved, but these strategies can help improve your odds.

Determine your eligibility

As long as you’re operating a for-profit business (even if you have very low income), you can qualify for an Amex small business card. This can include part-time gigs as well, like driving for Uber or Lyft. My wife qualifies for small business cards as a part-time freelance artist and I’ve qualified in the past as a freelance writer. And if you’re a sole proprietor, it’s likely you’ll be able to use your own name as the business name and your social security number as the business tax ID. I do this for all of my small business card applications because I don’t have a separate business tax ID or fictitious name for the business. For more help, read our guide on how to complete an Amex business card application.

Just remember, Amex only allows you to earn a welcome bonus once per card per lifetime. So if you have or have ever had this card in the past, you won’t qualify for the bonus. But if an Amex card has a personal version and business version they both count as different products. So you can qualify for the Amex Business Platinum card’s intro bonus even if you’ve had The Platinum Card® from American Express.

Amex will also consider the number of American Express cards you’ve opened or closed, in addition to other factors, when reviewing your application. But one nice thing about Amex applications is if you’re not eligible for a card you’ll get a pop-up window letting you know that you don’t qualify before Amex pulls your credit.

For more information about this, check out our article on how to qualify for a small business credit card (and why you should get one).

Include all eligible income

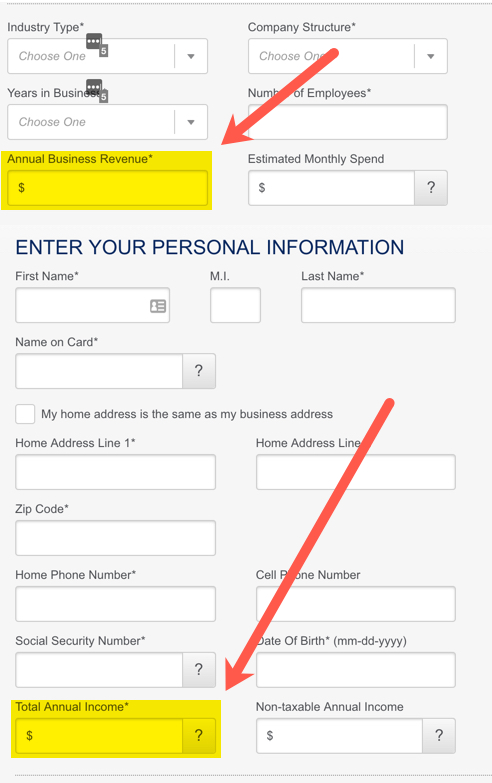

Besides your credit score, the total income you report on your credit card application can be an important factor in receiving approval and the amount of your credit limit. When you’re filling out a business card application you’ll enter your business revenue and your total income.

This distinction is important because you’ll want to make sure you’re 100% accurate and also not short-changing yourself. Your “annual business revenue” is straightforward, as it’s all the money your business makes before any expenses. But your “total annual income” is different. It’s easiest to think of it as the combined income you have access to for paying your bills. So when my wife applies for a small business credit card, her “total annual income” is always much higher than her “annual business revenue” because she can include my salary as part of her “total annual income.”

Keep in mind, you must be 21 or older to include household income as part of your “total annual income.”

Fill out the application correctly

The Amex Business Platinum card application is very straightforward. However, you’ll need to answer more questions than you would on a personal card application. If you’re an existing American Express customer, you can login to your account to have the application automatically enter your existing personal information.

You can apply using just your social security number if you’re a sole proprietor and don’t have an EIN (Employer Identification Number). Plus, Amex doesn’t have strict income requirements for small business cards.

Many Million Mile Secrets team members have always used their social security numbers to apply as sole proprietors for small business cards. And if you’re applying as a sole proprietor (meaning you’re not in any type of partnership), you can use your name as the legal business name.

Here’s a complete guide to filling out an Amex business card application.

Call the reconsideration line if you’re not approved

When you apply for a rewards credit card, you’ll see one of the following results: approved, declined or pending. If you’re not automatically approved for the card, I recommend not calling the reconsideration line, but instead waiting until you get a message from Amex telling you their decision (or you see the result through your online application status).

That said, if you’re declined in the end, it’s worth a call to the bank’s reconsideration line to speak to a credit representative to find out what’s going on.

A few tips to remember when calling the reconsideration line:

- Be friendly. Customer service representatives will appreciate kindness because they put up with a lot.

- Know why you are applying for this card, other than the bonus. Know key features of the card that you’ll use. Do not say you just want the welcome bonus.

- Be prepared to provide documentation regarding your business, such as a copy of a business card, proof of mailing address, invoices, etc.

This post details ways to make your credit card reconsideration telephone call a success.

Amex Business Platinum Card

The Amex Business Platinum card is currently offering a welcome bonus of 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership. The card also comes with perks like (terms apply):

- 1.5x Amex Membership Rewards points on single purchases of $5,000+ (on up to $2 million of these purchases per calendar year) and on eligible purchases in key business categories.

- 5x Amex Membership Rewards points when you book airfare or prepaid hotels through the Amex travel portal

- 35% of your points back for all first class or business-class flights booked through the Amex travel portal using Pay With Points (see rates & fees)

- 35% of your points back for all flights, including coach tickets, booked with your selected airline through the Amex travel portal using Pay With Points (up to 1 million points back per calendar year).

- Up to $200 in statement credits per calendar year for airline incidentals with your selected airline (luggage fees, in-flight food & drink, etc.)*

- Up to $400 in Dell credits for U.S. purchases each calendar year*

- Access to airport lounges (Delta, Priority Pass, Airspace, Escape and American Express Centurion Lounges)* (enrollment required).

- Elite car rental status with Avis, Executive status with National Car Rental, and Gold Plus Rewards with Hertz*

- Hilton Honors Gold elite status (free breakfast and upgrades when available)*

- Marriott Bonvoy Gold elite status* (enrollment required).

- Statement credit for Global Entry or TSA PreCheck

*Enrollment required for select benefits.

Although the $595 annual fee ($695 if application is received on or after 01/13/2022) is not waived the first year (see rates & fees), you can get lots of travel with the welcome bonus alone.

Amex Membership Rewards points are popular transferable points to collect, because you get flexibility to redeem points for award travel with any of the Amex airline or hotel partners. You can also use points to buy gift cards to popular stores and restaurants.

Amex Business cards don’t impact future Chase card applications

Another great aspect of the Amex Business Platinum card is that it doesn’t count toward Chase’s 5/24 rule, because Amex business cards will not show up on your personal credit report. So getting this card won’t hurt your chances of being approved for Chase credit cards in the future.

Bottom line

The Amex Business Platinum card has one of the best bonuses of any travel credit card right now. You’ll earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership.

To improve your odds of being approved for the Amex Business Platinum card, make sure you meet requirements like:

- Have a credit score of 700+

- Report all eligible income on your application

- Be prepared to call the Amex reconsideration line

Ultimately, American Express has the final say on whether you’ll be approved.

If your application isn’t immediately approved, you should wait for the automated system to make a decision. If you’re declined, you should call Amex to be reconsidered.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

For rates and fees of the Amex Business Platinum card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!